Gold

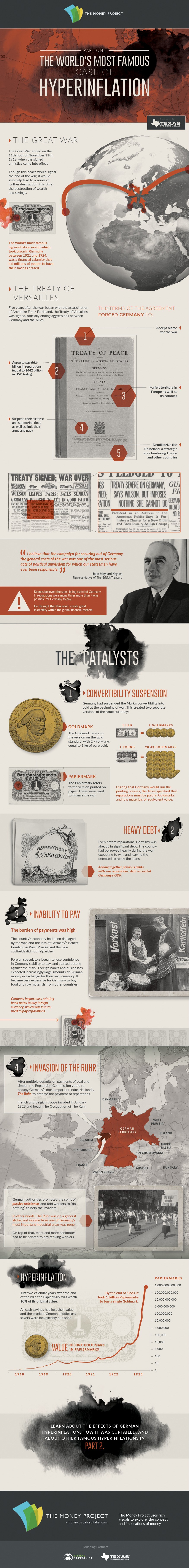

The World’s Most Famous Case of Hyperinflation

The World’s Most Famous Case of Hyperinflation (Part 1 of 2)

The Money Project is an ongoing collaboration between Visual Capitalist and Texas Precious Metals that seeks to use intuitive visualizations to explore the origins, nature, and use of money.

The Great War ended on the 11th hour of November 11th, 1918, when the signed armistice came into effect.

Though this peace would signal the end of the war, it would also help lead to a series of further destruction: this time the destruction of wealth and savings.

The world’s most famous hyperinflation event, which took place in Germany from 1921 and 1924, was a financial calamity that led millions of people to have their savings erased.

The Treaty of Versailles

Five years after the assassination of Archduke Franz Ferdinand, the Treaty of Versailles was signed, officially ending the state of war between Germany and the Allies.

The terms of the agreement, which were essentially forced upon Germany, made the country:

- Accept blame for the war

- Agree to pay £6.6 billion in reparations (equal to $442 billion in USD today)

- Forfeit territory in Europe as well as its colonies

- Forbid Germany to have submarines or an air force, as well as a limited army and navy

- Accept the Rhineland, a strategic area bordering France and other countries, to be fully demilitarized.

“I believe that the campaign for securing out of Germany the general costs of the war was one of the most serious acts of political unwisdom for which our statesmen have ever been responsible.”

– John Maynard Keynes, representative of the British Treasury

Keynes believed the sums being asked of Germany in reparations were many times more than it was possible for Germany to pay. He thought that this could create large amounts of instability with the global financial system.

The Catalysts

1. Germany had suspended the Mark’s convertibility into gold at the beginning of war.

This created two separate versions of the same currency:

Goldmark: The Goldmark refers to the version on the gold standard, with 2790 Mark equal to 1 kg of pure gold. This meant: 1 USD = 4 Goldmarks, £1 = 20.43 Goldmarks

Papiermark: The Papiermark refers to the version printed on paper. These were used to finance the war.

In fear that Germany would run the printing presses, the Allies specified that reparations must be paid in the Goldmarks and raw materials of equivalent value.

2. Heavy Debt

Even before reparations, Germany was already in significant debt. The country had borrowed heavily during the war with expectations that it would be won, leaving the losers repay the loans.

Adding together previous debts with the reparations, debt exceeded Germany’s GDP.

3. Inability to Pay

The burden of payments was high. The country’s economy had been damaged by the war, and the loss of Germany’s richest farmland (West Prussia) and the Saar coalfields did not help either.

Foreign speculators began to lose confidence in Germany’s ability to pay, and started betting against the Mark.

Foreign banks and businesses expected increasingly large amounts of German money in exchange for their own currency. It became very expensive for Germany to buy food and raw materials from other countries.

Germany began mass printing bank notes to buy foreign currency, which was in turn used to pay reparations.

4. Invasion of The Ruhr

After multiple defaults on payments of coal and timber, the Reparation Commission voted to occupy Germany’s most important industrial lands (The Ruhr) to enforce the payment of reparations.

French and Belgian troops invaded in January 1923 and began The Occupation of The Ruhr.

German authorities promoted the spirit of passive resistance, and told workers to “do nothing” to help the invaders. In other words, The Ruhr was in a general strike, and income from one of Germany’s most important industrial areas was gone.

On top of that, more and more banknotes had to be printed to pay striking workers.

Hyperinflation

Just two calendar years after the end of the war, the Papiermark was worth 10% of its original value. By the end of 1923, it took 1 trillion Papiermarks to buy a single Goldmark.

All cash savings had lost their value, and the prudent German middleclass savers were inexplicably punished.

Learn about the effects of German hyperinflation, how it was curtailed, and about other famous hyperinflations in Part 2 (released sometime the week of Jan 18-22, 2016).

About the Money Project

The Money Project aims to use intuitive visualizations to explore ideas around the very concept of money itself. Founded in 2015 by Visual Capitalist and Texas Precious Metals, the Money Project will look at the evolving nature of money, and will try to answer the difficult questions that prevent us from truly understanding the role that money plays in finance, investments, and accumulating wealth.

Mining

Gold vs. S&P 500: Which Has Grown More Over Five Years?

The price of gold has set record highs in 2024, but how has this precious metal performed relative to the S&P 500?

Gold vs. S&P 500: Which Has Grown More Over Five Years?

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Gold is considered a unique asset due to its enduring value, historical significance, and application in various technologies like computers, spacecraft, and communications equipment.

Commonly regarded as a “safe haven asset”, gold is something investors typically buy to protect themselves during periods of global uncertainty and economic decline.

It is for this reason that gold has performed rather strongly in recent years, and especially in 2024. Persistent inflation combined with multiple wars has driven up demand for gold, helping it set a new all-time high of over $2,400 per ounce.

To put this into perspective, we visualized the performance of gold alongside the S&P 500. See the table below for performance figures as of April 12, 2024.

| Asset/Index | 1 Yr (%) | 5 Yr (%) |

|---|---|---|

| 🏆 Gold | +16.35 | +81.65 |

| 💼 S&P 500 | +25.21 | +76.22 |

Over the five-year period, gold has climbed an impressive 81.65%, outpacing even the S&P 500.

Get Your Gold at Costco

Perhaps a sign of how high the demand for gold is becoming, wholesale giant Costco is reportedly selling up to $200 million worth of gold bars every month in the United States. The year prior, sales only amounted to $100 million per quarter.

Consumers aren’t the only ones buying gold, either. Central banks around the world have been accumulating gold in very large quantities, likely as a hedge against inflation.

According to the World Gold Council, these institutions bought 1,136 metric tons in 2022, marking the highest level since 1950. Figures for 2023 came in at 1,037 metric tons.

See More Graphics on Gold

If you’re fascinated by gold, be sure to check out more Visual Capitalist content including 200 Years of Global Gold Production, by Country or Ranked: The Largest Gold Reserves by Country.

-

Brands6 days ago

Brands6 days agoHow Tech Logos Have Evolved Over Time

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023

-

Green2 weeks ago

Green2 weeks agoRanking the Top 15 Countries by Carbon Tax Revenue