Technology

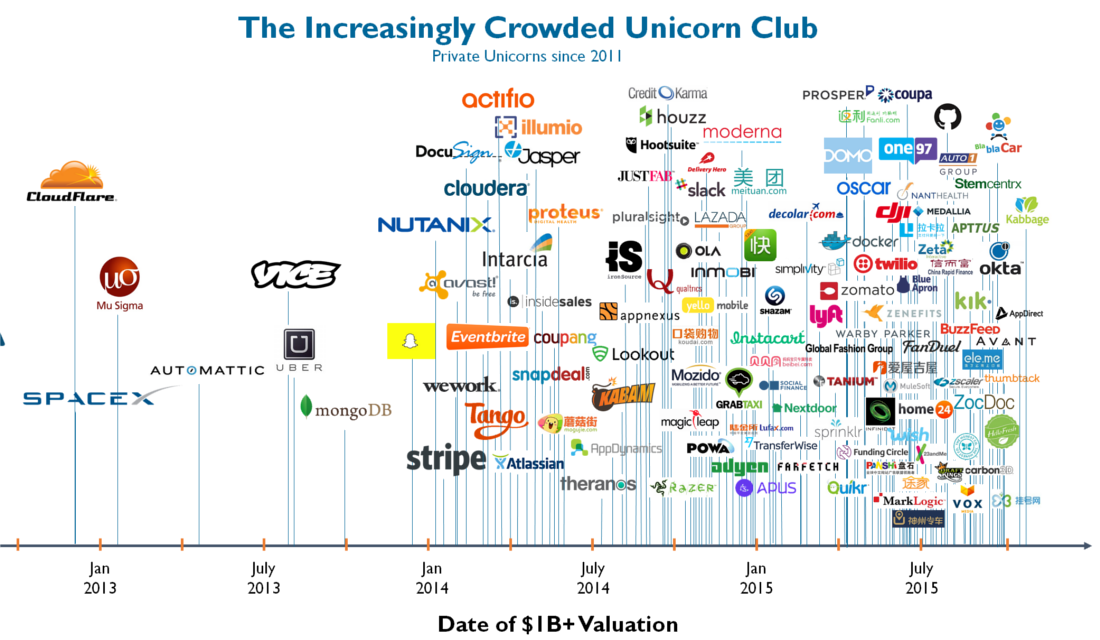

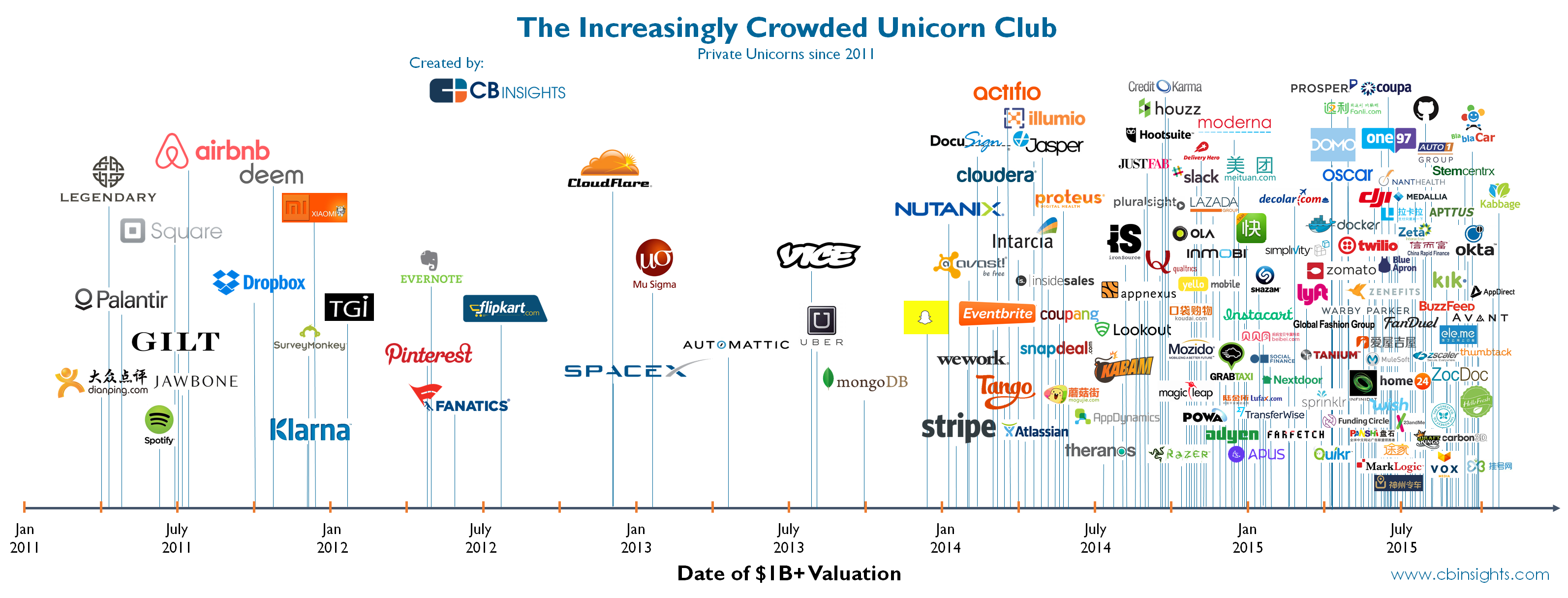

The Increasingly Crowded Unicorn Club

The Increasingly Crowded Unicorn Club

Unicorns, a moniker applied to private startups valued at over $1 billion or more, are supposed to be mythical in nature.

At best, there are supposed to be so few of them that venture capital firms would be absolutely elated to have a stake in any unicorn out there. (Or even their Canadian narwhal equivalents)

However, the truth is that unicorns are simply not rare or mythical anymore. According to the real-time list that CB Insights hosts, the number is now at 145 unicorns globally. In other words, the once exclusive Unicorn Club is becoming increasingly crowded.

That said, the odd member of the club does find the door.

Square, a prominent member of the club led by Twitter co-founder Jack Dorsey since mid-2011, finally IPO’d just a month ago with mixed results. It rose money from the public market at $9/share, which was a significant discount on the last private capital it raised at $15.46/share. Today it is trading closer to $12, which shows there is still optimism towards these kinds of technology companies.

Box’s IPO in January 2015 also sent mixed messages. It was privately valued at $2.4 billion, but then IPO’d at $1.7 billion. It soared on the first days of trading to $2.7 billion but then fell back down to a value below its IPO as lockups on insider traders expired during the summer.

Is the appetite for unicorns still frothy, or is it starting to sour?

We certainly agree that many of these companies have a great opportunity ahead of them. Many are growing at breakneck speed, and others are starting to find ways to monetize their offerings. However, is there really room for hundreds of them?

Today, the Australian software company Atlassian IPOs on the Nasdaq with a reported valuation of $4.4 billion. At time of publishing, it is up 33% on the day, and we will be continuing to watch the stock closely.

Technology

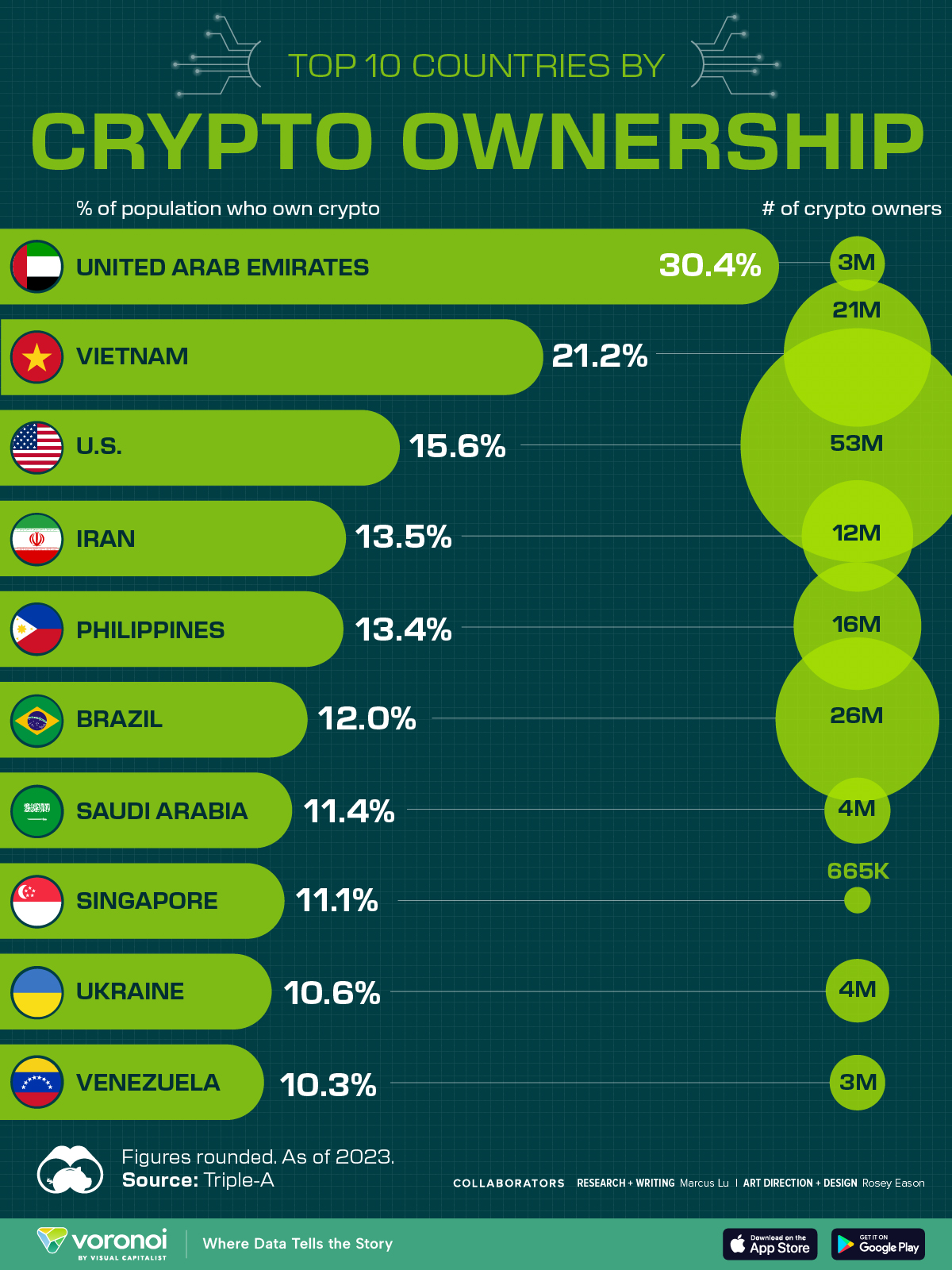

Countries With the Highest Rates of Crypto Ownership

While the U.S. is a major market for cryptocurrencies, two countries surpass it in terms of their rates of crypto ownership.

Countries With the Highest Rates of Crypto Ownership

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This graphic ranks the top 10 countries by their rate of cryptocurrency ownership, which is the percentage of the population that owns crypto. These figures come from crypto payment gateway, Triple-A, and are as of 2023.

Data and Highlights

The table below lists the rates of crypto ownership in the top 10 countries, as well as the number of people this amounts to.

| Country | % of Population Who Own Crypto | # of Crypto Owners |

|---|---|---|

| 🇦🇪 United Arab Emirates | 30.4 | 3M |

| 🇻🇳 Vietnam | 21.2 | 21M |

| 🇺🇸 U.S. | 15.6 | 53M |

| 🇮🇷 Iran | 13.5 | 12M |

| 🇵🇭 Philippines | 13.4 | 16M |

| 🇧🇷 Brazil | 12 | 26M |

| 🇸🇦 Saudi Arabia | 11.4 | 4M |

| 🇸🇬 Singapore | 11.1 | 665K |

| 🇺🇦 Ukraine | 10.6 | 4M |

| 🇻🇪 Venezuela | 10.3 | 3M |

Note that if we were to rank countries based on their actual number of crypto owners, India would rank first at 93 million people, China would rank second at 59 million people, and the U.S. would rank third at 52 million people.

The UAE Takes the Top Spot

The United Arab Emirates (UAE) boasts the highest rates of crypto ownership globally. The country’s government is considered to be very crypto friendly, as described in Henley & Partners’ Crypto Wealth Report 2023:

In the UAE, the Financial Services Regulatory Authority (FSRA-ADGM) was the first to provide rules and regulations regarding cryptocurrency purchasing and selling. The Emirates are generally very open to new technologies and have proposed zero taxes for crypto owners and businesses.

Vietnam leads Southeast Asia

According to the Crypto Council for Innovation, cryptocurrency holdings in Vietnam are also untaxed, making them an attractive asset.

Another reason for Vietnam’s high rates of ownership could be its large unbanked population (people without access to financial services). Cryptocurrencies may provide an alternative means of accessing these services without relying on traditional banks.

Learn More About Crypto From Visual Capitalist

If you enjoyed this post, be sure to check out The World’s Largest Corporate Holders of Bitcoin, which ranks the top 12 publicly traded companies by their Bitcoin holdings.

-

Markets5 days ago

Markets5 days agoVisualizing Global Inflation Forecasts (2024-2026)

-

Green2 weeks ago

Green2 weeks agoThe Carbon Footprint of Major Travel Methods

-

United States2 weeks ago

United States2 weeks agoVisualizing the Most Common Pets in the U.S.

-

Culture2 weeks ago

Culture2 weeks agoThe World’s Top Media Franchises by All-Time Revenue

-

voronoi1 week ago

voronoi1 week agoBest Visualizations of April on the Voronoi App

-

Wealth1 week ago

Wealth1 week agoCharted: Which Country Has the Most Billionaires in 2024?

-

Business1 week ago

Business1 week agoThe Top Private Equity Firms by Country

-

Markets1 week ago

Markets1 week agoThe Best U.S. Companies to Work for According to LinkedIn