Technology

How Startups Can Improve Their Odds of Becoming a Unicorn

In 2017, we showed that 57 startups were able to achieve unicorn status – a rare designation that is reserved only for privately-held startups valued at $1 billion or more.

While this number may seem high, unicorns are still quite the rarity.

In the U.S. alone, there are currently 19,550 venture-backed startups vying for those same massive valuations. At the same time, it’s been estimated that each new startup only has a 0.00006% chance of becoming a billion dollar company.

How to Improve Those Odds

No one ever said that joining the ranks of unicorns would be easy, but there is some good news for aspiring founders.

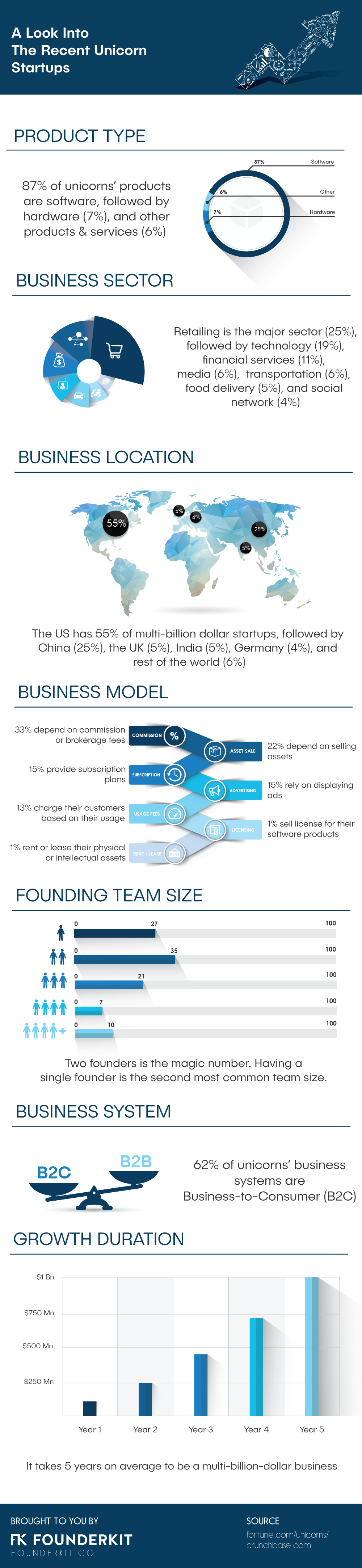

Today’s infographic, which comes to us from FounderKit, looks at traits of existing unicorns – and analyzing this wealth of data might help entrepreneurs in shaping their own companies for future success.

Put together with information from Fortune and Crunchbase, this infographic gives us some clues as to how game-changing unicorns have been built in the past.

While it’s certainly not a prescription for future success, it does provide a blueprint for what’s needed to improve your chances of beating the odds.

Playing the Red Team

If you’re an entrepreneur with billion dollar dreams, take a close look at the categories that best resemble your startup.

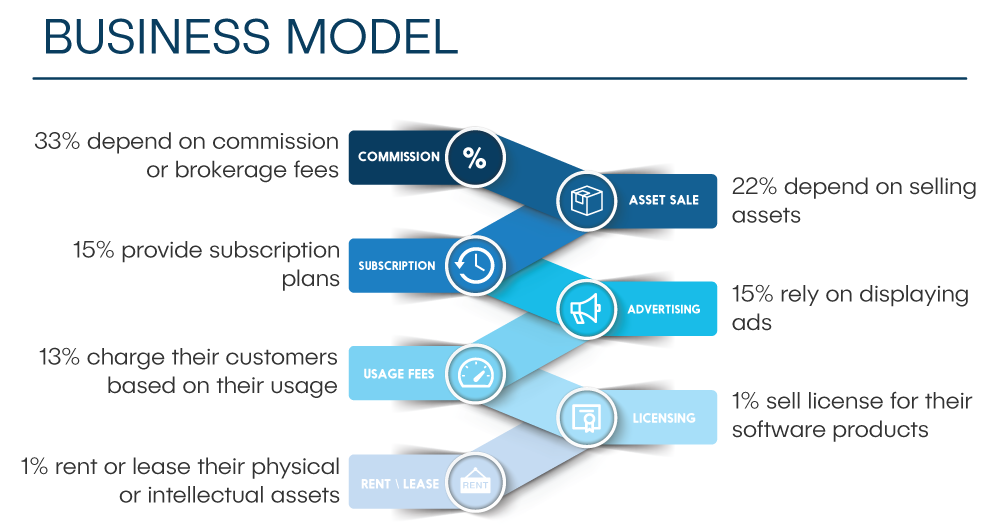

For example, if your model depends on leasing hardware to the energy sector as a major revenue source, you should note that the odds are mostly against you. For starters, only 7% of unicorns are hardware companies, and energy doesn’t register high as a major business sector that has seen many unicorns. Further, companies that rent or lease their physical or intellectual assets make up just 1% of recent unicorn companies, which makes this particular model look pretty disadvantageous.

It doesn’t mean that this idea is not feasible – maybe it’s an underappreciated sector, or the idea is completely groundbreaking. However, given the information above, it’s most likely that this will be a tough go, so it’s worth making adjustments accordingly.

Playing the Green Team

Based on the above information, what combination of startup traits could provide the most common recipe for unicorn status?

Let’s create a hypothetical new startup:

- It should be consumer focused, since the majority of companies are B2C (62%)

- It should provide software, since 87% of all unicorns focus there

- This startup should be retail/e-commerce marketplace focused, a category home to a whopping 25% of recent unicorns

- It should have a model based on commission or brokerage fees (33% of recent unicorns)

It’s not hard to see similarities with the above traits and recent unicorns like Shopify or Airbnb, which both serve as solid precedents for success.

Of course, it’s far from a guarantee of future unicorn status, but it does mean that you likely have better than a 0.00006% chance.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees