Technology

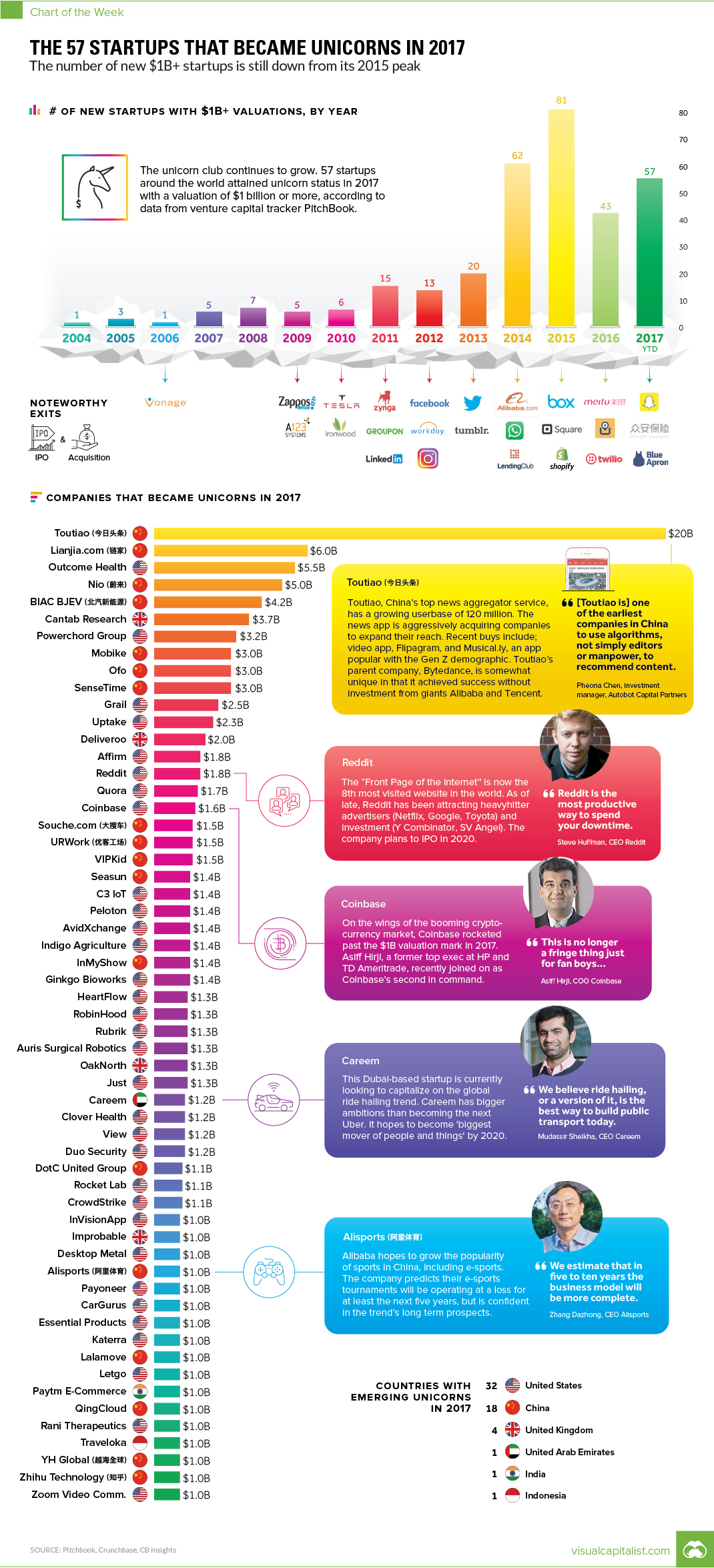

The 57 Startups That Became Unicorns in 2017

57 New Unicorns in 2017

Collectively, they’re now worth $116.5B

The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

For a startup, reaching the coveted $1 billion unicorn valuation is an important milestone – but as we’ve found out in recent years, it’s not necessarily a guarantee of future success.

In 2017, there were 57 startups that crossed the unicorn threshold, and they range from well-known companies, such as Reddit or Quora, to rapid-risers like China’s Toutiao (now valued at $20 billion), which has seemingly come out of nowhere.

Investors have conviction that these companies will provide the platforms and products of the future, and they are placing big bets on them to deliver.

Will they live up to the hype, or will they ultimately end up in the unicorn graveyard?

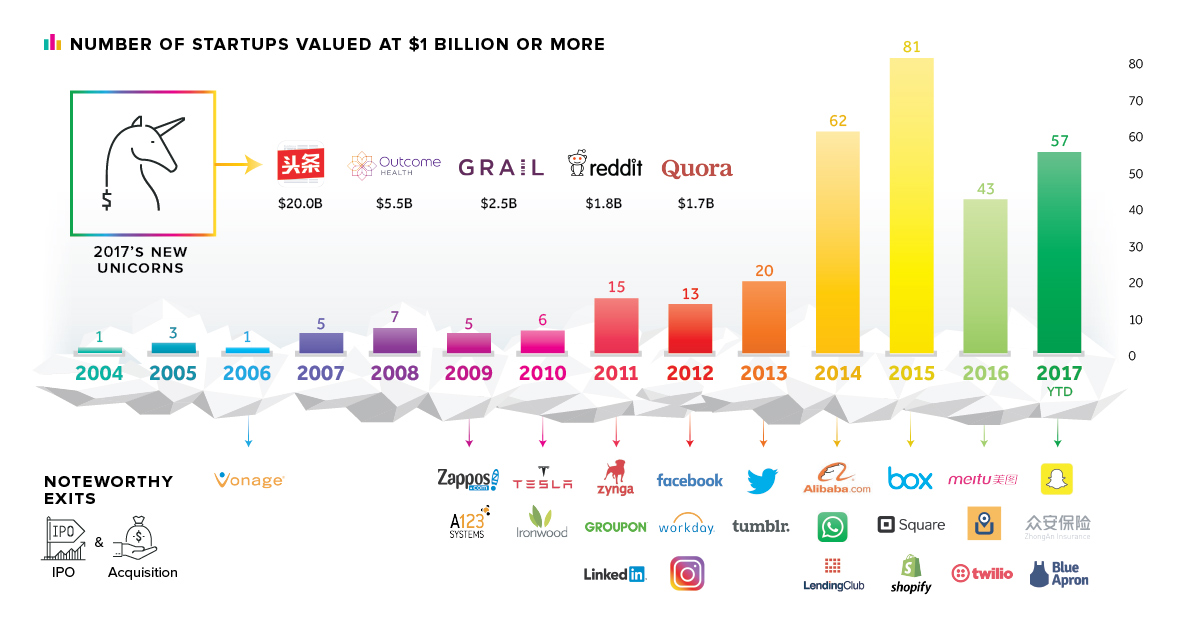

Unicorn Births by Year

With 57 new unicorns, this year ranks third overall in terms of births per year.

| Year | # of Unicorns | Notable Unicorn Birth |

|---|---|---|

| 2009 | 5 | BloomEnergy |

| 2010 | 6 | Groupon |

| 2011 | 15 | Airbnb |

| 2012 | 13 | |

| 2013 | 20 | Uber |

| 2014 | 62 | Slack |

| 2015 | 81 | Vox Media |

| 2016 | 43 | Compass |

| 2017 | 57 |

While 57 unicorns in 2017 is still a high number, it’s also clear that the froth has died down from the unicorn bonanza that occurred in 2015.

Venture capitalists have clearly dialed it down a notch, re-focusing on the selective quality of investments rather than the overall quantity of big bets.

Notable Unicorns in 2017

Based on data from PitchBook, we’ve included the full list of unicorns in the chart today.

However, here are some that caught our eye:

Toutiao (China)

Valuation: $20 billion

Founded in 2012, Toutiao is the behemoth on this year’s new unicorn list. Based in Beijing, Toutiao is a news and information platform that focuses on recommendations using AI technology. The company pushes content to users based on previous user interactions as well as the detailed analysis of new content. The platform has 120 million active users and has also gone on a recent buying spree, acquiring names like Flipagram and Musical.ly.

Coinbase (United States)

Valuation: $1.6 billion

The cryptocurrency sector is exploding with growth, and Coinbase has been along for the ride since 2012. The most important crypto platform in the U.S. has such a strong influence in the sector, that the “Coinbase Effect” is now a talking point for traders everywhere. Whenever Coinbase introduces a cryptocurrency to its base of 10 million users, the added visibility and liquidity can make the price go bananas. It’s happened with Litecoin and Bitcoin Cash so far, and now every move by Coinbase is closely tracked by crypto power users and influencers.

Alisports (China)

Valuation: $1.0 billion

Alibaba’s foray into sports isn’t going unnoticed. In conjunction with Sina Corp (a Chinese telecom) and Yunfeng Capital Co (venture capital), Alibaba hopes that Alisports will carve out a huge chunk of the RMB 5 Trillion Chinese sports market. It’s also worth noting that Alisports sees e-sports as having huge potential, and as a central piece of its platform.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees