Technology

China’s Digital Wallets Offer a Glimpse at the Future of Payments

Chinese consumers conduct 11 times more mobile payments than their counterparts in the United States, so as we look to the future of digital wallets, China is a natural place to start.

Forecasts for mobile payment adoption in the United States remain flat for now; however, two major brands – WeChat and AliPay – offer a glimpse of what the future may eventually hold for mobile payments in North America.

Digging Through WeChat’s Wallet

WeChat, a platform owned by Tencent, is a force to be reckoned with. It’s fast closing in on one billion monthly active users (MAUs), and the average user spends over an hour on the app each day.

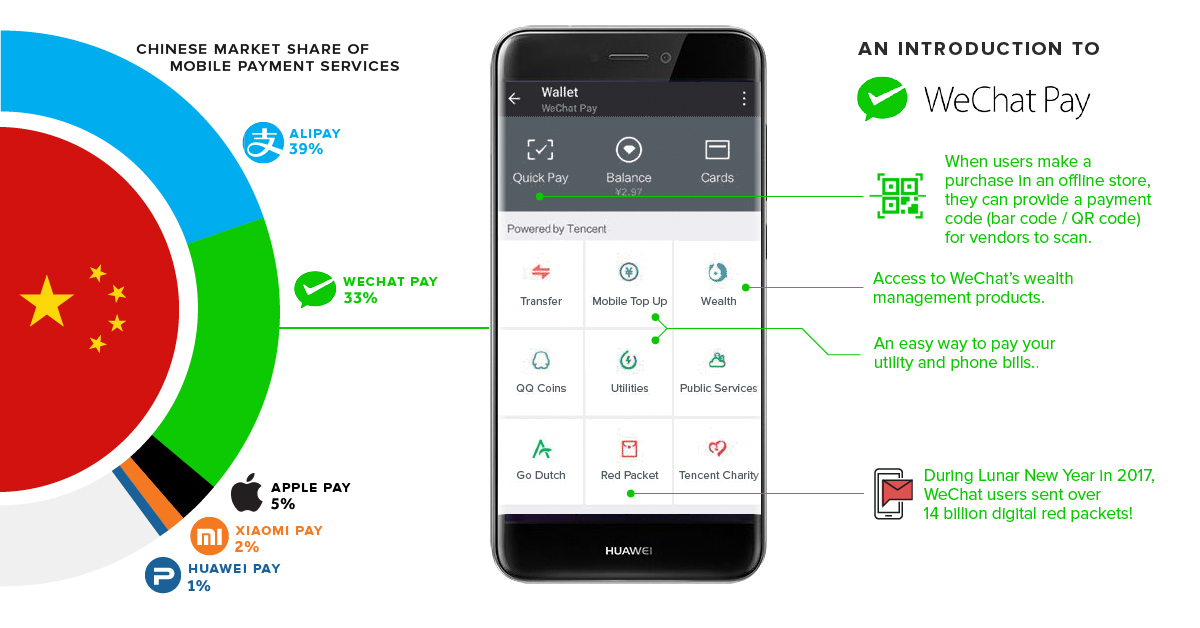

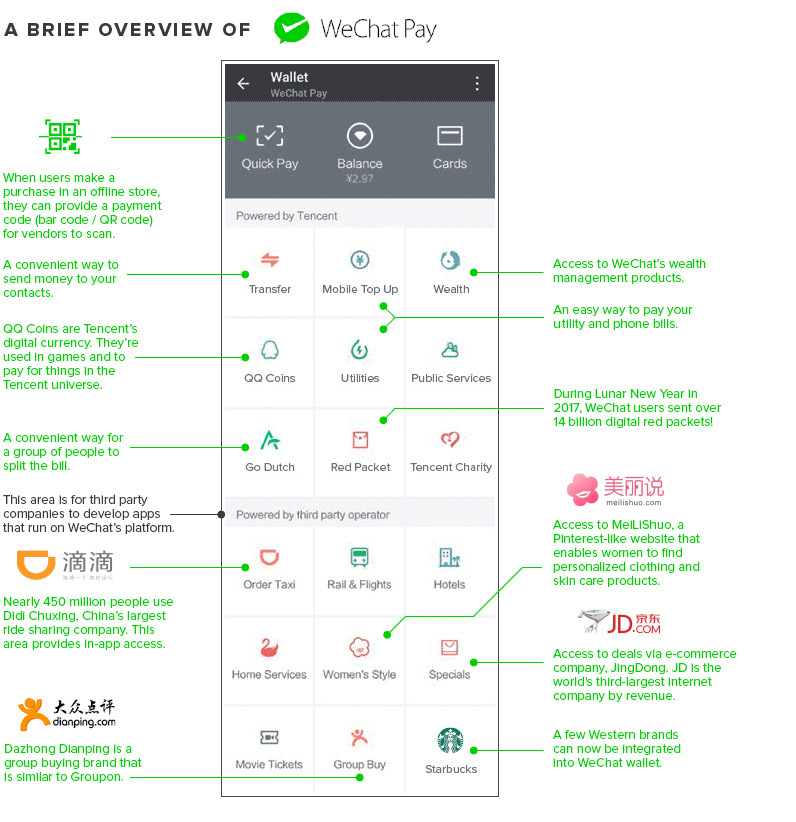

WeChat users aren’t just unusually chatty – there’s actually a high level of utility to the platform that North American apps have yet to match. WeChat’s wallet alone is packed with features ranging from mobile payments to ride hailing. Below is a look at just some of the features.

WeChat’s wallet is packed with features that are constantly evolving, but here are some current features worth noting:

Payments in the real world

“Scan-and-pay” is widely popular in China, particularly in big cities where it’s hard to find a product or a service that cannot be purchased with a mobile device. According to China Channel, over 90% of Chinese consumers have adopted WeChat as a method of payment in offline purchases. That compares with a 32% adoption rate for debit and credit cards.

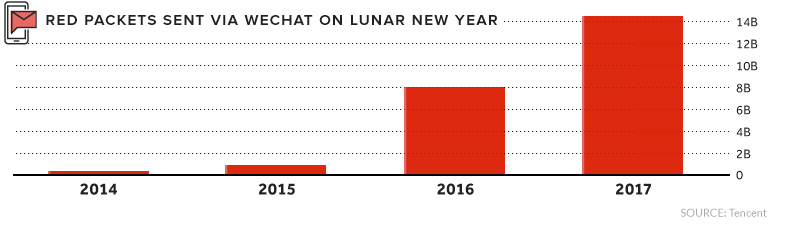

Red Packets

WeChat has seen tremendous growth of its wallet by capitalizing on China’s tradition of gifting cash-filled red envelopes (known as hongbao). In fact, the volume of digital red packets sent has skyrocketed from 16 million to 14.2 billion in only three years.

Digital Tip Jar

WeChat also offers a glimpse at a new avenue for content creators to monetize their hard work online. WeChat’s Tip Jar feature allows users to send micro-payments to writers, musicians, artists, and more.

Go Dutch

Splitting the bill in a busy restaurant or pub setting can be major hassle. “Go Dutch” is a feature that allows WeChat users to divvy up a bill and pay using the app. Features like Go Dutch make digital payments an appealing option because they solve a real world problem.

Third-Party Apps

WeChat has robust third-party integration within its wallet. Functionality is so deep that users can order anything from transportation to home cleaning services with the push of a button. China’s largest e-commerce, group buy, and ride hailing companies are already on these platforms, but Western brands like Starbucks are getting in on the action too.

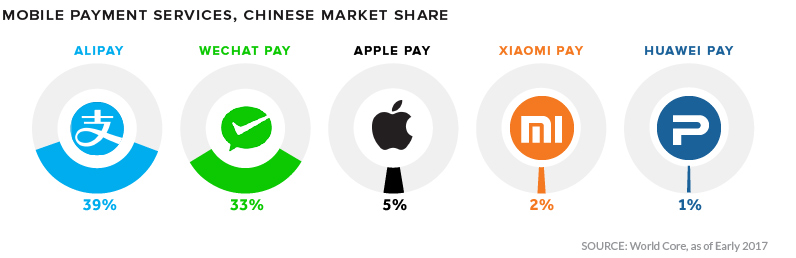

Going Head-To-Head

The mobile payments sector is becoming increasingly binary as WeChat and AliPay dogfight for market share. AliPay – Ant Financial’s payment brand – was once the undisputed leader in mobile payments, but the company has recently seen its market share eroded by an increasingly scrappy WeChat. WeChat has smartly leveraged its popularity and massive user base to get people using it as a payment tool as well.

ApplePay, which had high hopes for the Chinese market, continues to lag far behind domestic brands.

Growing Pains for Digital Wallets

China’s central bank recently imposed tougher rules regarding scan-and-go payments, a move that Ant Financial and Tencent are publicly praising, but that may dampen the meteoric growth trajectory of mobile payments. The new regulations take aim at aggressive tactics used to capture market share from competitors, and set limits on how much consumers can spend daily using barcode-based payments.

Despite growing pains, mobile payments and digital wallets will continue to be a dominant part of the Chinese economy. The only question is, when will the rest of the world follow suit?

Brands

How Tech Logos Have Evolved Over Time

From complete overhauls to more subtle tweaks, these tech logos have had quite a journey. Featuring: Google, Apple, and more.

How Tech Logos Have Evolved Over Time

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

One would be hard-pressed to find a company that has never changed its logo. Granted, some brands—like Rolex, IBM, and Coca-Cola—tend to just have more minimalistic updates. But other companies undergo an entire identity change, thus necessitating a full overhaul.

In this graphic, we visualized the evolution of prominent tech companies’ logos over time. All of these brands ranked highly in a Q1 2024 YouGov study of America’s most famous tech brands. The logo changes are sourced from 1000logos.net.

How Many Times Has Google Changed Its Logo?

Google and Facebook share a 98% fame rating according to YouGov. But while Facebook’s rise was captured in The Social Network (2010), Google’s history tends to be a little less lionized in popular culture.

For example, Google was initially called “Backrub” because it analyzed “back links” to understand how important a website was. Since its founding, Google has undergone eight logo changes, finally settling on its current one in 2015.

| Company | Number of Logo Changes |

|---|---|

| 8 | |

| HP | 8 |

| Amazon | 6 |

| Microsoft | 6 |

| Samsung | 6 |

| Apple | 5* |

Note: *Includes color changes. Source: 1000Logos.net

Another fun origin story is Microsoft, which started off as Traf-O-Data, a traffic counter reading company that generated reports for traffic engineers. By 1975, the company was renamed. But it wasn’t until 2012 that Microsoft put the iconic Windows logo—still the most popular desktop operating system—alongside its name.

And then there’s Samsung, which started as a grocery trading store in 1938. Its pivot to electronics started in the 1970s with black and white television sets. For 55 years, the company kept some form of stars from its first logo, until 1993, when the iconic encircled blue Samsung logo debuted.

Finally, Apple’s first logo in 1976 featured Isaac Newton reading under a tree—moments before an apple fell on his head. Two years later, the iconic bitten apple logo would be designed at Steve Jobs’ behest, and it would take another two decades for it to go monochrome.

-

Green1 week ago

Green1 week agoRanked: The Countries With the Most Air Pollution in 2023

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Travel2 weeks ago

Travel2 weeks agoRanked: The World’s Top Flight Routes, by Revenue