The Roller Coaster of Emotional Investing and Its Impact on Portfolios

The Roller Coaster of Emotional Investing

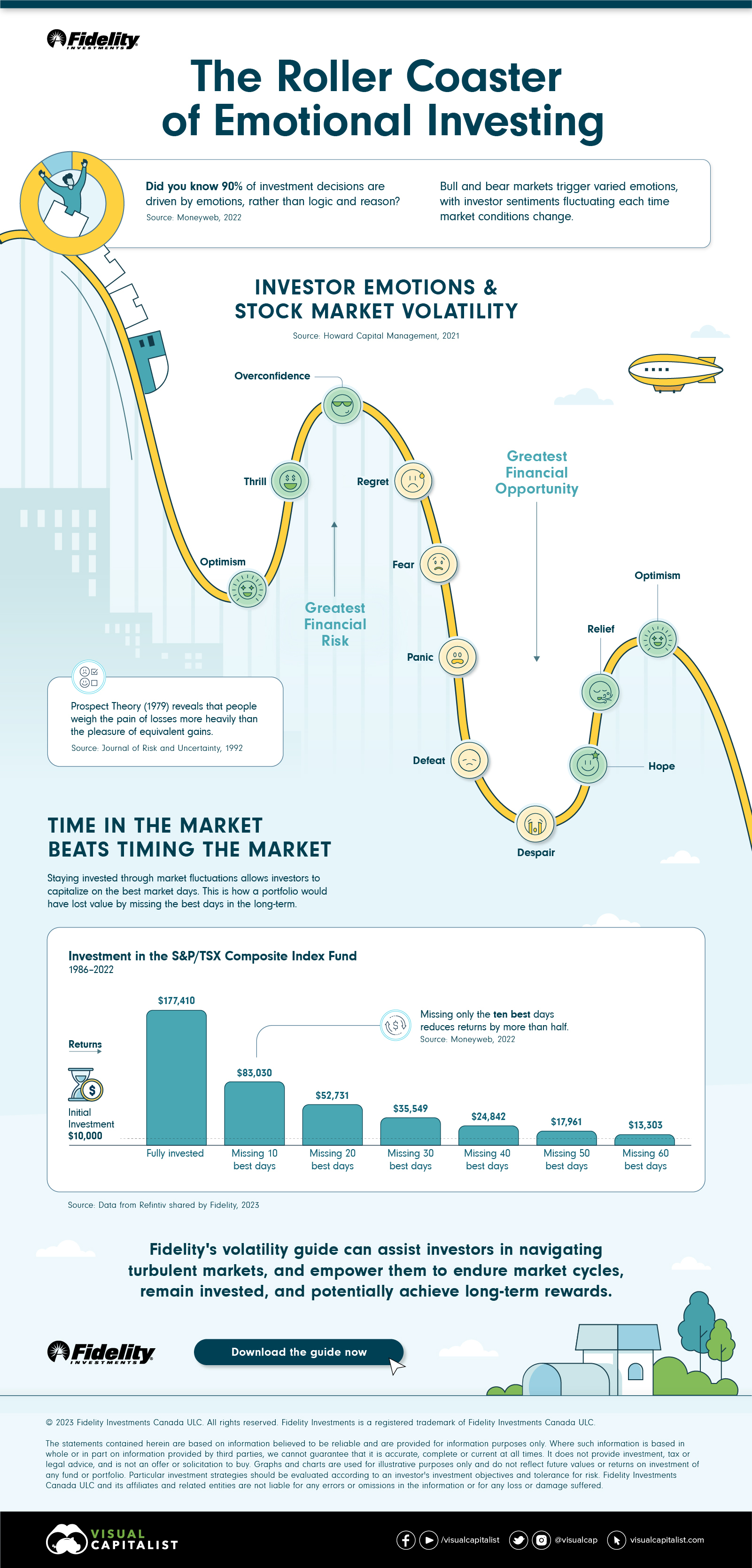

Did you know that 90% of investment decisions are influenced by emotions? And this is amplified during extreme bull and bear markets, putting investors’ impulses to test.

In this infographic sponsored by Fidelity Investments, we delve into behavioral finance to uncover the highs and lows of emotional investing and understand why time in the market beats timing the market.

The Emotional Investing Journey

According to the Prospect Theory (1979), losses have a higher emotional impact than equivalent gains. This means that the emotional toll of losing $100,000 outweighs the satisfaction of gaining the same amount. This, in turn, impacts how investors adjust their strategies.

For example, despite the common knowledge that when markets dip, it is a golden time for investors to enter, they respond with uncertainty, according to research by Howard Capital Management.

Then, as the market rebounds, surging investor optimism can often lead to overestimations of how high the next peak will be.

Time vs. Timing

Staying invested through market fluctuations allows investors to benefit from the best market days without having to make big buy or sell decisions.

Here, using Refinitiv’s research, we consider a $10,000 investment from 1986 to 2022 and compare its performance when consistently invested versus missing the top market days.

| Portfolio Value | Change in Value From Peak | |

|---|---|---|

| Stayed fully invested | $177,410 | - |

| Missed 10 best days | $83,030 | -$94,380 |

| Missed 20 best days | $52,731 | -$124,679 |

| Missed 30 best days | $35,549 | -$141,861 |

| Missed 40 best days | $24,842 | -$152,568 |

| Missed 50 best days | $17,961 | -$159,449 |

| Missed 60 best days | $13,303 | -$164,107 |

This shows that missing only the 10 best days reduces returns by more than half. Hence, staying invested amid market fluctuations enables investors to optimize their returns.

Fidelity’s volatility guide serves as a compass to help investors navigate turbulence and maintain a long-term perspective.

Download Fidelity’s volatility guide.

-

Investor Education6 months ago

Investor Education6 months agoThe 20 Most Common Investing Mistakes, in One Chart

Here are the most common investing mistakes to avoid, from emotionally-driven investing to paying too much in fees.

-

Stocks10 months ago

Stocks10 months agoVisualizing BlackRock’s Top Equity Holdings

BlackRock is the world’s largest asset manager, with over $9 trillion in holdings. Here are the company’s top equity holdings.

-

Investor Education11 months ago

Investor Education11 months ago10-Year Annualized Forecasts for Major Asset Classes

This infographic visualizes 10-year annualized forecasts for both equities and fixed income using data from Vanguard.

-

Investor Education1 year ago

Investor Education1 year agoVisualizing 90 Years of Stock and Bond Portfolio Performance

How have investment returns for different portfolio allocations of stocks and bonds compared over the last 90 years?

-

Debt2 years ago

Debt2 years agoCountries with the Highest Default Risk in 2022

In this infographic, we examine new data that ranks the top 25 countries by their default risk.

-

Markets2 years ago

Markets2 years agoThe Best Months for Stock Market Gains

This infographic analyzes over 30 years of stock market performance to identify the best and worst months for gains.