Countries

Ranked: Share of Global Arms Imports in 2022

Ranked: Share of Global Arms Imports in 2022

Countries spend an enormous amount on their militaries, both to secure national interests and maintain their sovereignties.

A huge part of that goes toward acquiring new arms and equipment, often from other nations, as weapons manufacturing becomes extremely sophisticated and specialized.

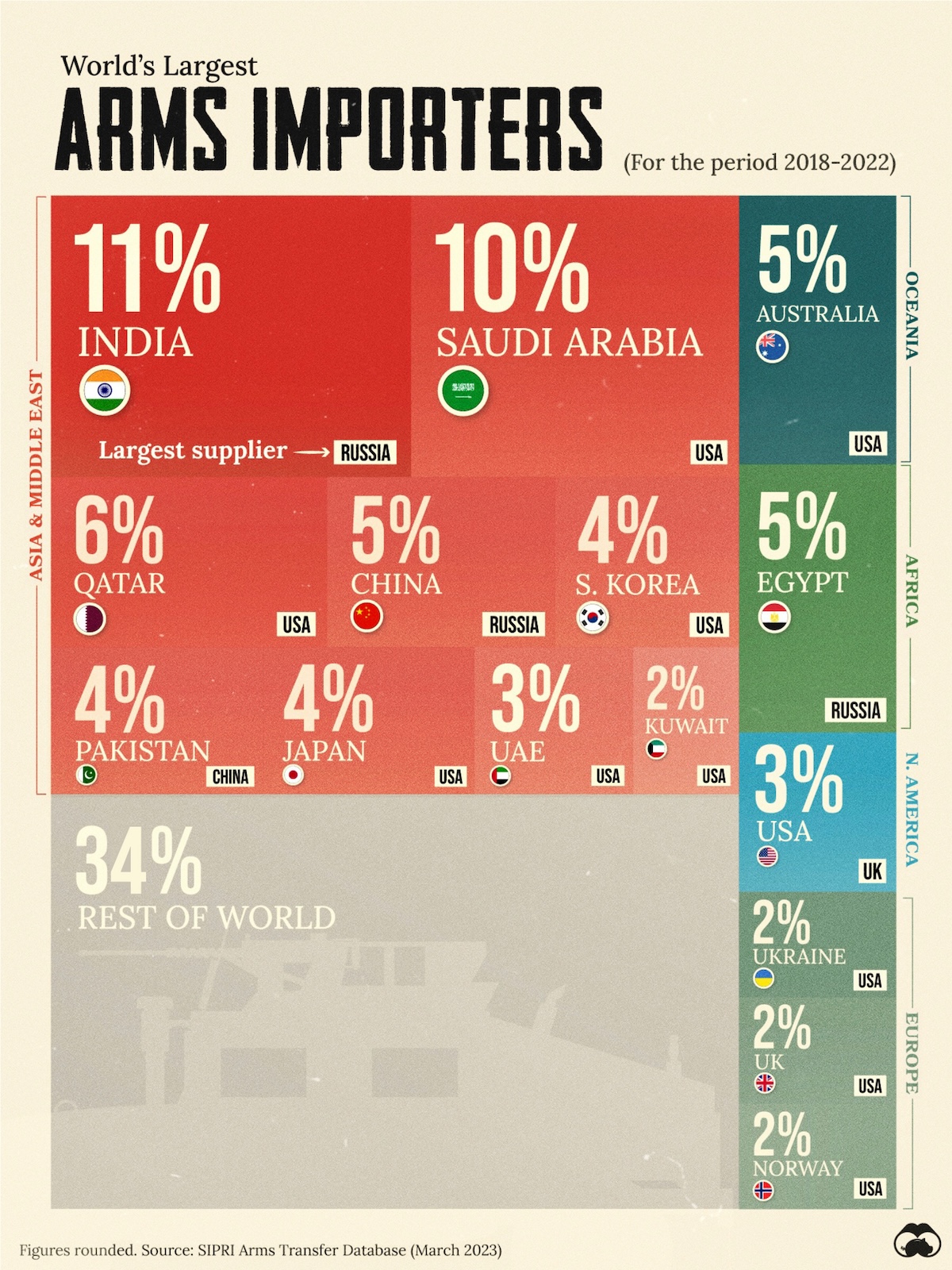

We highlight the countries with the biggest share of of global arms imports in 2018–2022, using data from the Stockholm International Peace Research Institute (SIPRI).

Which Country Imports the Most Weapons?

India ranks first in having the biggest share of global arms imports at 11% in the time period between 2018–2022. The world’s fifth biggest economy has the fourth-biggest military budget and relies on Russia to supply most of its foreign arms needs, followed by France and the U.S.

| Country | % Share of Global Arms Imports (2018-2022) | Largest Supplier |

|---|---|---|

| 🇮🇳 India | 11% | 🇷🇺 Russia |

| 🇸🇦 Saudi Arabia | 10% | 🇺🇸 U.S. |

| 🇶🇦 Qatar | 6% | 🇺🇸 U.S. |

| 🇦🇺 Australia | 5% | 🇺🇸 U.S. |

| 🇨🇳 China | 5% | 🇷🇺 Russia |

| 🇪🇬 Egypt | 5% | 🇷🇺 Russia |

| 🇰🇷 South Korea | 4% | 🇺🇸 U.S. |

| 🇵🇰 Pakistan | 4% | 🇨🇳 China |

| 🇯🇵 Japan | 4% | 🇺🇸 U.S. |

| 🇺🇸 U.S. | 3% | 🇬🇧 UK |

| 🇦🇪 UAE | 3% | 🇺🇸 U.S. |

| 🇰🇼 Kuwait | 2% | 🇺🇸 U.S. |

| 🇬🇧 UK | 2% | 🇺🇸 U.S. |

| 🇺🇦 Ukraine | 2% | 🇺🇸 U.S. |

| 🇳🇴 Norway | 2% | 🇺🇸 U.S. |

| 🌐 Rest of World | 34% | N/A |

From the Middle East, Saudi Arabia (10%) and Qatar (6%) rank as the second and third-largest importers of weapons, both benefiting from the U.S. as their biggest military trade partner.

Australia, China, and Egypt are all at 5%, with the former primarily supplied by the U.S. while the latter two by Russia. In fact, the U.S. and Russia are the primary sources of arms for 13 of the top 16 countries by share of global arms imports.

Naturally, the two countries are the world’s biggest exporters of military equipment, accounting for 56% of arms exports by volume.

How Arms Imports Align with Geopolitical Events and Alliances

The list of biggest arms importers is also a shorthand for geopolitical hotspots and tense border situations in the world. The India-China-Pakistan trifecta has three nuclear-powered nations in close proximity with each other, with border skirmishes between India and its western and eastern neighbour occurring semi-regularly in the last decade.

Four Middle Eastern nations—incidentally all supplied by the U.S.—speak to attempts to counter Iran’s influence in the region. Meanwhile Australia, Japan and South Korea are bolstering their forces amidst rising tensions with China and North Korea.

With the UK, Ukraine, and Norway rounding out the top 15, the spillover from the Russian invasion—in Ukraine’s case, being the target of the invasion—is also seen clearly.

Countries

Countries With the Largest Happiness Gains Since 2010

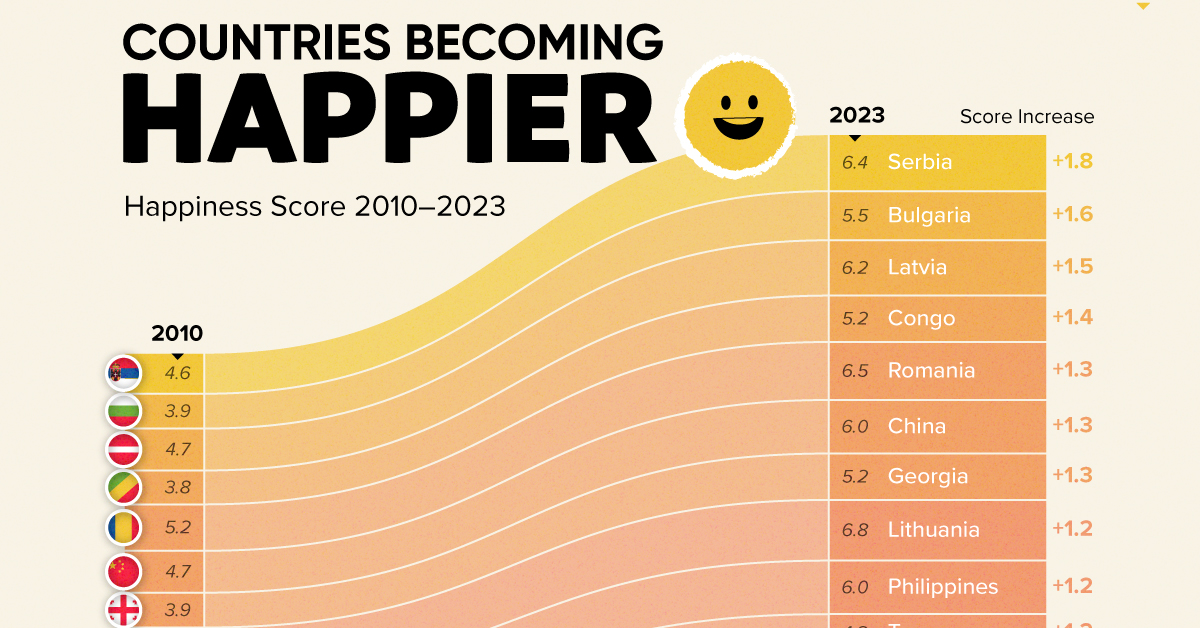

Tracking Gallup survey data for more than a decade reveals insights into the regions seeing happiness gains.

Countries With the Largest Happiness Gains Since 2010

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

In 2011, Bhutan sponsored a UN resolution that invited governments to prioritize happiness and well-being as a way to measure social and economic development.

And thus, the World Happiness Report was born.

In 2012, the first report released, examining Gallup poll data from 2006–2010 that asked respondents in nearly every country to evaluate their life on a 0–10 scale. From this they extrapolated a single “happiness score” out of 10 to compare how happy countries are.

More than a decade later, the 2024 World Happiness Report continues the mission to quantify, measure, and compare well-being. Its latest findings also include how countries have become happier in the intervening years.

We visualize these findings in the above chart, which shows the 20 countries that have seen their happiness scores grow the most since 2010.

Which Countries Have Become Happier Since 2010?

Serbia leads a list of 12 Eastern European nations whose average happiness score has improved more than 20% in the last decade.

In the same time period, the Serbian economy has doubled to $80 billion, and its per capita GDP has nearly doubled to $9,538 in current dollar terms.

| Rank | Country | Happiness Score Gains (2010–2024) | 2024 Happiness Score (out of 10) |

|---|---|---|---|

| 1 | 🇷🇸 Serbia | +1.8 | 6.4 |

| 2 | 🇧🇬 Bulgaria | +1.6 | 5.5 |

| 3 | 🇱🇻 Latvia | +1.5 | 6.2 |

| 4 | 🇨🇬 Congo | +1.4 | 5.2 |

| 5 | 🇷🇴 Romania | +1.3 | 6.5 |

| 6 | 🇨🇳 China | +1.3 | 6.0 |

| 7 | 🇬🇪 Georgia | +1.3 | 5.2 |

| 8 | 🇱🇹 Lithuania | +1.2 | 6.8 |

| 9 | 🇵🇭 Philippines | +1.2 | 6.0 |

| 10 | 🇹🇬 Togo | +1.2 | 4.2 |

| 11 | 🇳🇮 Nicaragua | +1.2 | 6.3 |

| 12 | 🇽🇰 Kosovo | +1.1 | 6.6 |

| 13 | 🇲🇳 Mongolia | +1.1 | 5.7 |

| 14 | 🇪🇪 Estonia | +1.1 | 6.4 |

| 15 | 🇭🇺 Hungary | +1.1 | 6.0 |

| 16 | 🇧🇦 Bosnia & Herzegovina | +1.0 | 5.9 |

| 17 | 🇲🇰 North Macedonia | +1.0 | 5.4 |

| 18 | 🇦🇲 Armenia | +1.0 | 5.5 |

| 19 | 🇺🇿 Uzbekistan | +1.0 | 6.2 |

| 20 | 🇰🇬 Kyrgyzstan | +1.0 | 5.7 |

| N/A | 🌍 World | +0.1 | 5.5 |

Since the first report, Western Europe has on average been happier than Eastern Europe. But as seen with these happiness gains, Eastern Europe is now seeing their happiness levels converge closer to their Western counterparts. In fact, when looking at those under the age of 30, the most recent happiness scores are nearly the same across the continent.

All in all, 20 countries have increased their happiness score by a full point or more since 2010, on the 0–10 scale.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)