Money

Mapped: Personal Finance Requirements, by State

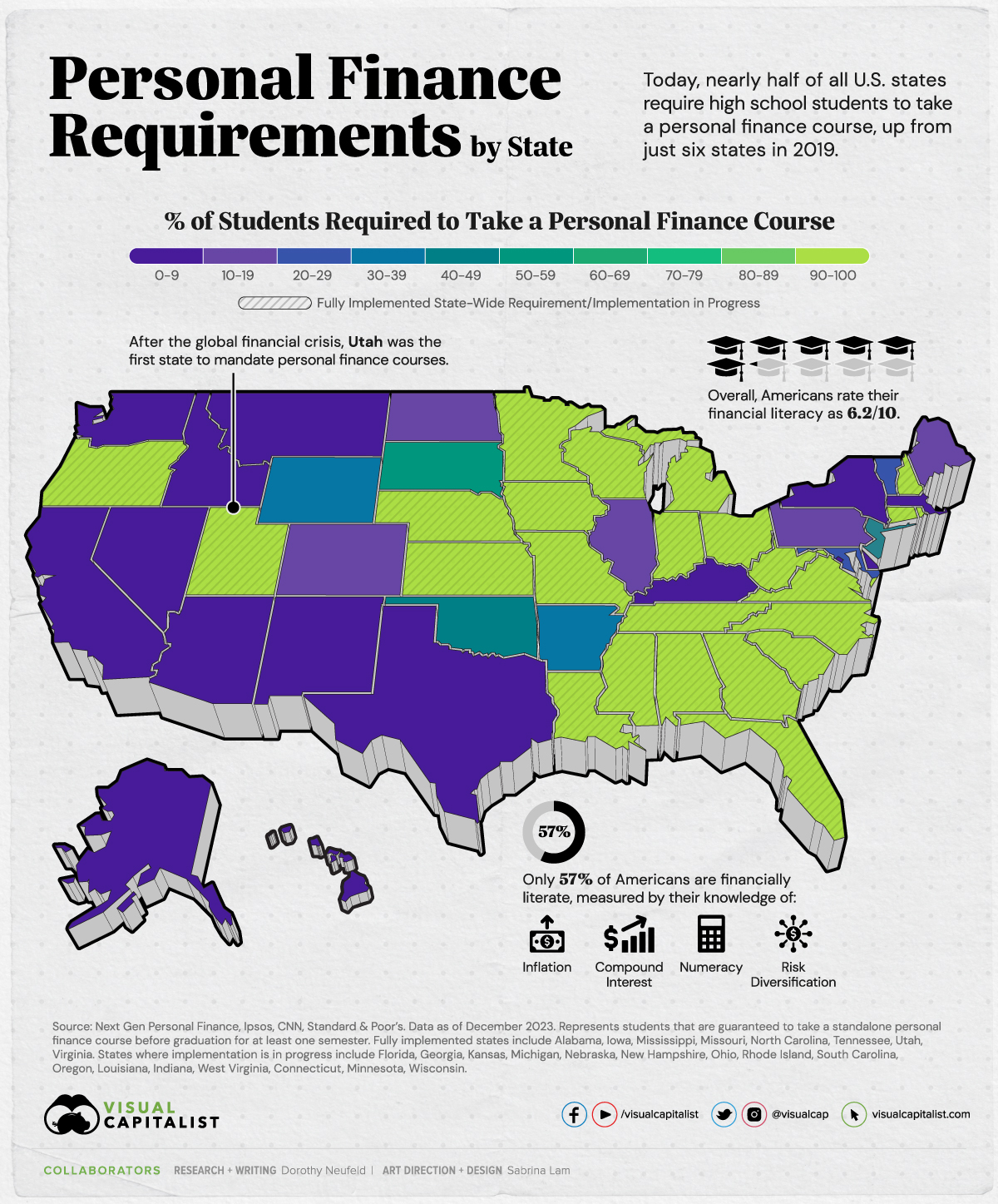

Personal Finance Requirements, by State

What happens when 600 kindergartners are given $50 to save for college?

In 2011, low-income students in San Francisco were given $50 to put in a bank account through a personal finance program that covered financial topics and encouraged families to save for college. By 2023, the average balance was $1,422, or 28 times the starting balance.

With soaring college costs and low financial literacy levels in the U.S., it highlights the role of financial education and how it can impact a person’s future. The above graphic shows personal finance course requirements by state in December 2023 based on data from Next Gen Personal Finance.

How Many Students Take a Personal Finance Course?

For many years, personal finance courses played a minor role in U.S. high schools.

While these courses were offered, often they had to compete with finite resources: schools must choose where classroom time is allocated.

It was not until 2008 that Utah became the first state to mandate high school students to take a personal finance course to graduate. By 2019, six states made this a requirement. Since then it has risen to 24 states as of this year, covering more than 50% of the country’s student population.

The table below shows the percent of high school students who must take a personal finance course over one semester in order to graduate, by state:

| U.S. State | % of Students Required to Take a Personal Finance Course |

|---|---|

| Alabama | 100% |

| Alaska | <1% |

| Arizona | 1% |

| Arkansas | 30% |

| California | <1% |

| Colorado | 13% |

| Connecticut | 100% |

| Delaware | 6% |

| Florida | 100% |

| Georgia | 100% |

| Hawaii | 0% |

| Idaho | 2% |

| Illinois | 14% |

| Indiana | 100% |

| Iowa | 97% |

| Kansas | 100% |

| Kentucky | 4% |

| Louisiana | 100% |

| Maine | 16% |

| Maryland | 27% |

| Massachusetts | 6% |

| Michigan | 100% |

| Minnesota | 100% |

| Mississippi | 99% |

| Missouri | 100% |

| Montana | 8% |

| Nebraska | 100% |

| Nevada | 3% |

| New Hampshire | 100% |

| New Jersey | 45% |

| New Mexico | <1% |

| New York | 3% |

| North Carolina | 95% |

| North Dakota | 12% |

| Ohio | 100% |

| Oklahoma | 43% |

| Oregon | 100% |

| Pennsylvania | 17% |

| Rhode Island | 100% |

| South Carolina | 100% |

| South Dakota | 57% |

| Tennessee | 100% |

| Texas | 3% |

| Utah | 100% |

| Vermont | 29% |

| Virginia | 100% |

| Washington | 2% |

| Washington D.C. | 0% |

| West Virginia | 100% |

| Wisconsin | 100% |

| Wyoming | 33% |

Fully implemented states include Alabama, Iowa, Mississippi, Missouri, North Carolina, Tennessee, Utah, Virginia. States where implementation is in progress include Florida, Georgia, Kansas, Michigan, Nebraska, New Hampshire, Ohio, Rhode Island, South Carolina, Oregon, Louisiana, Indiana, West Virginia, Connecticut, Minnesota, Wisconsin.

Wisconsin became the most recent state to implement this requirement as of December. Overall, eight states have fully implemented programs for high school students to take a personal finance course for graduation and 16 programs are currently in progress.

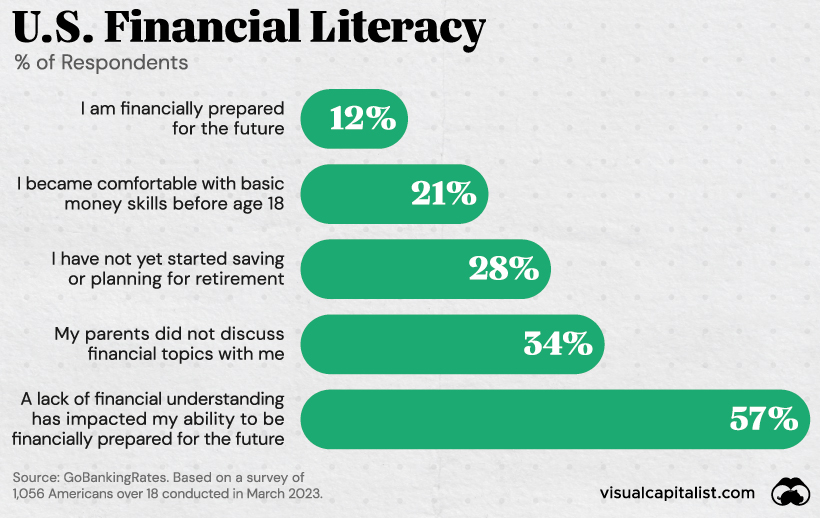

Financial Literacy: Where Do Americans Stand Today?

Roughly six in 10 of Americans are financially literate, measured by their knowledge of inflation, numeracy, compound interest, and risk diversification.

Separately, many Americans do not feel financially prepared for the future, and over a third of respondents did not discuss financial topics with their parents growing up.

We can see that gaps exist when it comes to financial knowledge, which can have consequences—especially for a person’s future financial stability. For many reasons, broadening the scope of financial education may be one way to encourage smarter financial decisions in terms of how a person saves and invests through their life.

Money

Charted: Which City Has the Most Billionaires in 2024?

Just two countries account for half of the top 20 cities with the most billionaires. And the majority of the other half are found in Asia.

Charted: Which Country Has the Most Billionaires in 2024?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Some cities seem to attract the rich. Take New York City for example, which has 340,000 high-net-worth residents with investable assets of more than $1 million.

But there’s a vast difference between being a millionaire and a billionaire. So where do the richest of them all live?

Using data from the Hurun Global Rich List 2024, we rank the top 20 cities with the highest number of billionaires in 2024.

A caveat to these rich lists: sources often vary on figures and exact rankings. For example, in last year’s reports, Forbes had New York as the city with the most billionaires, while the Hurun Global Rich List placed Beijing at the top spot.

Ranked: Top 20 Cities with the Most Billionaires in 2024

The Chinese economy’s doldrums over the course of the past year have affected its ultra-wealthy residents in key cities.

Beijing, the city with the most billionaires in 2023, has not only ceded its spot to New York, but has dropped to #4, overtaken by London and Mumbai.

| Rank | City | Billionaires | Rank Change YoY |

|---|---|---|---|

| 1 | 🇺🇸 New York | 119 | +1 |

| 2 | 🇬🇧 London | 97 | +3 |

| 3 | 🇮🇳 Mumbai | 92 | +4 |

| 4 | 🇨🇳 Beijing | 91 | -3 |

| 5 | 🇨🇳 Shanghai | 87 | -2 |

| 6 | 🇨🇳 Shenzhen | 84 | -2 |

| 7 | 🇭🇰 Hong Kong | 65 | -1 |

| 8 | 🇷🇺 Moscow | 59 | No Change |

| 9 | 🇮🇳 New Delhi | 57 | +6 |

| 10 | 🇺🇸 San Francisco | 52 | No Change |

| 11 | 🇹🇭 Bangkok | 49 | +2 |

| 12 | 🇹🇼 Taipei | 45 | +2 |

| 13 | 🇫🇷 Paris | 44 | -2 |

| 14 | 🇨🇳 Hangzhou | 43 | -5 |

| 15 | 🇸🇬 Singapore | 42 | New to Top 20 |

| 16 | 🇨🇳 Guangzhou | 39 | -4 |

| 17T | 🇮🇩 Jakarta | 37 | +1 |

| 17T | 🇧🇷 Sao Paulo | 37 | No Change |

| 19T | 🇺🇸 Los Angeles | 31 | No Change |

| 19T | 🇰🇷 Seoul | 31 | -3 |

In fact all Chinese cities on the top 20 list have lost billionaires between 2023–24. Consequently, they’ve all lost ranking spots as well, with Hangzhou seeing the biggest slide (-5) in the top 20.

Where China lost, all other Asian cities—except Seoul—in the top 20 have gained ranks. Indian cities lead the way, with New Delhi (+6) and Mumbai (+3) having climbed the most.

At a country level, China and the U.S combine to make up half of the cities in the top 20. They are also home to about half of the world’s 3,200 billionaire population.

In other news of note: Hurun officially counts Taylor Swift as a billionaire, estimating her net worth at $1.2 billion.

-

Misc1 week ago

Misc1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001