Money

Mapped: The Risk of Eviction and Foreclosure in U.S. States

Mapping the Risk of Eviction and Foreclosure in U.S. States

Alongside potential obstacles such as job loss, financial insecurity, and a subsequent inability to cover many upcoming bills, many Americans are now facing potential home loss as well.

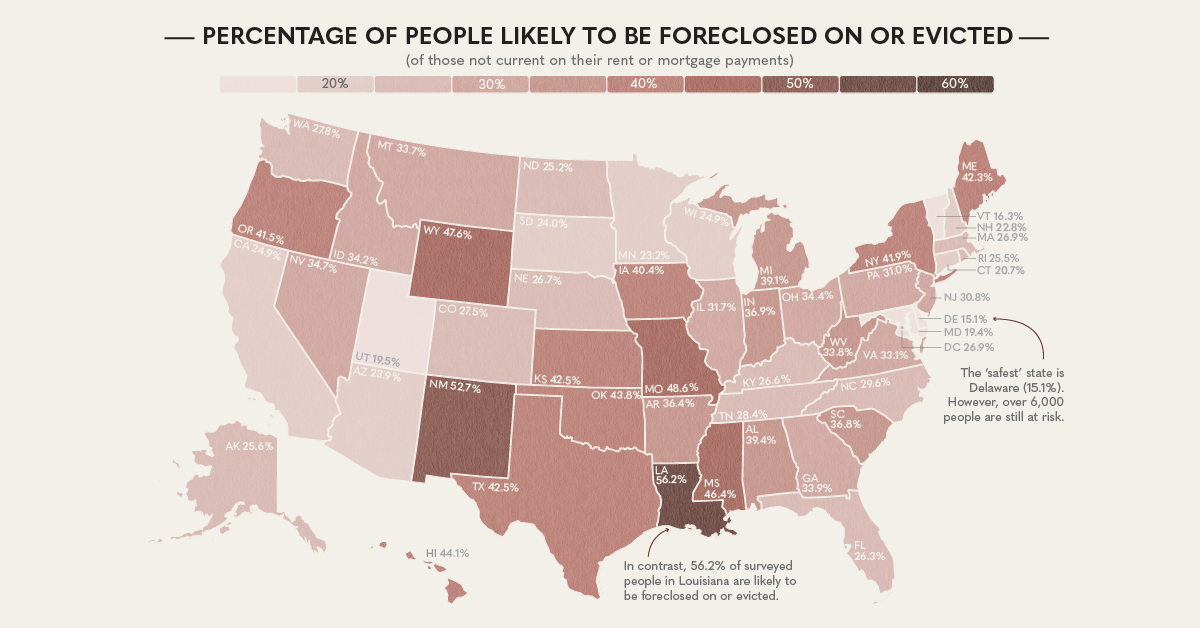

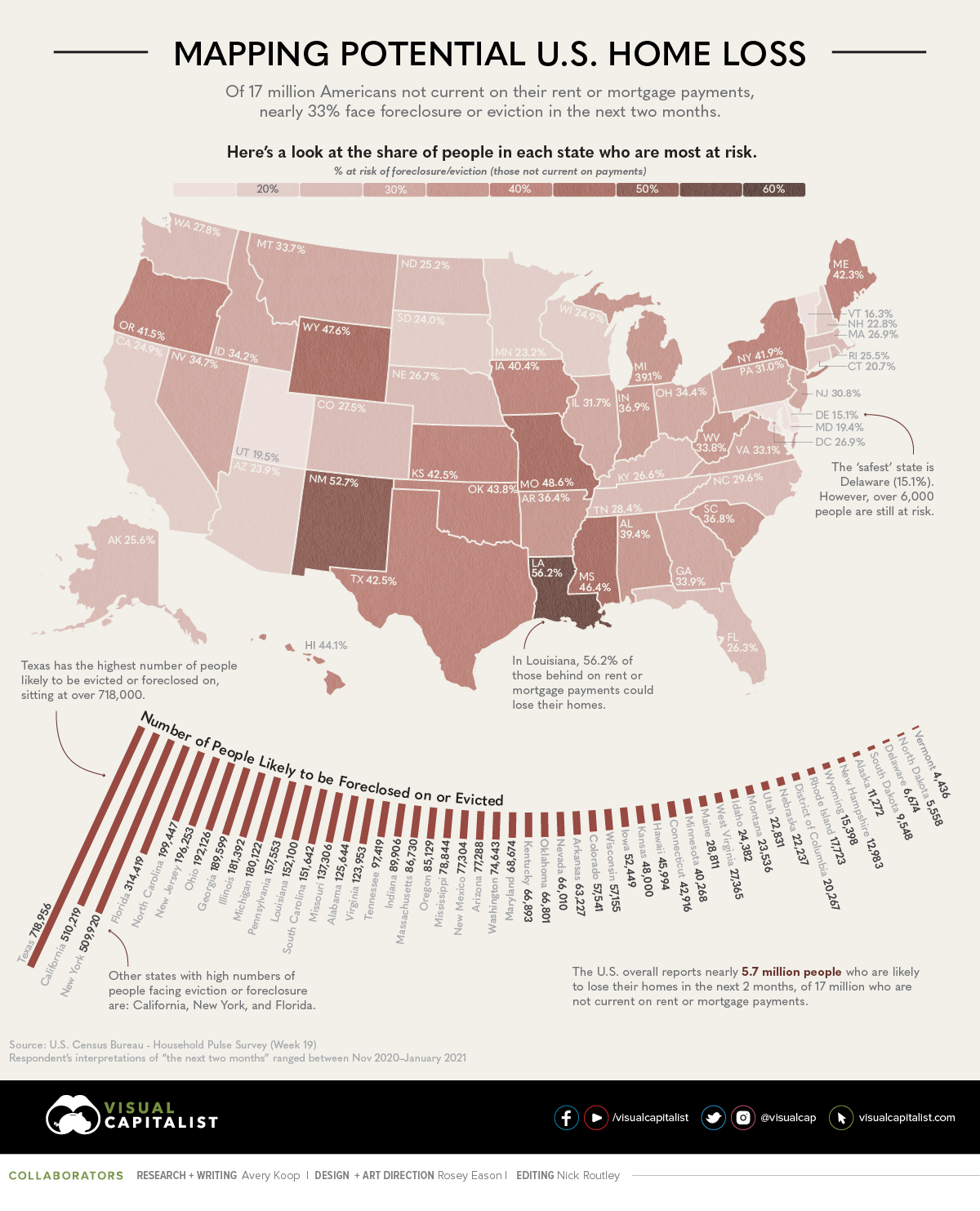

According to a recent survey by the U.S. Census Bureau, of the estimated 17 million adults who are not current on their rent or mortgage payments, a whopping 33% of them could be facing eviction or foreclosure in the “next two months”.

Note: While this survey was conducted Nov 11-23, 2020, respondents’ interpretations of “the next two months” ranged between Nov 2020–Jan 2021.

Millions Facing Home Loss

Although people across the country face similar risks, Texas stands out with an estimated 718,000 people facing foreclosures or eviction. In fact, more than 7.1 million people in the state may be expecting a loss of employment income in the coming four weeks.

Other states looking at high percentages of potential home loss include Louisiana, New Mexico, Mississippi, Wyoming, and Missouri.

To get a closer look, here are the top 10 metro areas with the highest percentages of people who will potentially be facing eviction or foreclosure:

| Rank | Area | Number | Percent |

|---|---|---|---|

| 1 | Houston-The Woodlands-Sugar Land, TX Metro Area | 265,454 | 47.6% |

| 2 | Miami-Fort Lauderdale-Pompano Beach, FL Metro Area | 147,830 | 34.1% |

| 3 | Atlanta-Sandy Springs-Alpharetta, GA Metro Area | 96,514 | 33.8% |

| 4 | Chicago-Naperville-Elgin, IL-IN-WI Metro Area | 184,381 | 33.3% |

| 5 | Dallas-Fort Worth-Arlington, TX Metro Area | 157,986 | 32.8% |

| 6 | Seattle-Tacoma-Bellevue, WA Metro Area | 52,959 | 32.5% |

| 7 | Detroit-Warren-Dearborn, MI Metro Area | 75,379 | 32.3% |

| 8 | New York-Newark-Jersey City, NY-NJ-PA Metro Area | 389,352 | 32.0% |

| 9 | San Francisco-Oakland-Berkeley, CA Metro Area | 61,647 | 31.1% |

| 10 | Phoenix-Mesa-Chandler, AZ Metro Area | 67,287 | 30.0% |

Note: The margin of error of the survey is higher in metro areas and smaller states.

Home for the Holidays?

On the other end of the spectrum, there are states that appear to have less need for concern, as the percentage of people likely to experience foreclosure or eviction in these places stands between 15% and 20%. However, this level of relative home security is the case for only Delaware, Vermont, Maryland, and Utah.

Everyone else is floating in a proverbial gray area, between a majority who may still be in their same home after Christmas, and those who may need to find a new place in the months following the holidays.

Even in the states with extremely low percentages like Delaware (15%), there are still thousands people who are highly likely to face the possibility of losing their home.

Going Forward

It goes without saying that with nearly 17 million Americans behind on mortgage and rent payments, there could be significant consequences down the road.

In an order issued by the CDC under the Public Health Service Act, it was stated that an eviction moratorium could help with the effectiveness of COVID-19 prevention measures like quarantining, social distancing, and self-isolation. However, while evictions were temporarily halted under this order on September 4th, the extent of this protection runs out on the last day of 2020.

President-elect Joe Biden expressed his desire for measures such as rent forgiveness back in March 2020, but it remains unclear what actions will be taken under the new administration when inauguration occurs on January 20th, 2021.

Money

Charted: Which City Has the Most Billionaires in 2024?

Just two countries account for half of the top 20 cities with the most billionaires. And the majority of the other half are found in Asia.

Charted: Which Country Has the Most Billionaires in 2024?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Some cities seem to attract the rich. Take New York City for example, which has 340,000 high-net-worth residents with investable assets of more than $1 million.

But there’s a vast difference between being a millionaire and a billionaire. So where do the richest of them all live?

Using data from the Hurun Global Rich List 2024, we rank the top 20 cities with the highest number of billionaires in 2024.

A caveat to these rich lists: sources often vary on figures and exact rankings. For example, in last year’s reports, Forbes had New York as the city with the most billionaires, while the Hurun Global Rich List placed Beijing at the top spot.

Ranked: Top 20 Cities with the Most Billionaires in 2024

The Chinese economy’s doldrums over the course of the past year have affected its ultra-wealthy residents in key cities.

Beijing, the city with the most billionaires in 2023, has not only ceded its spot to New York, but has dropped to #4, overtaken by London and Mumbai.

| Rank | City | Billionaires | Rank Change YoY |

|---|---|---|---|

| 1 | 🇺🇸 New York | 119 | +1 |

| 2 | 🇬🇧 London | 97 | +3 |

| 3 | 🇮🇳 Mumbai | 92 | +4 |

| 4 | 🇨🇳 Beijing | 91 | -3 |

| 5 | 🇨🇳 Shanghai | 87 | -2 |

| 6 | 🇨🇳 Shenzhen | 84 | -2 |

| 7 | 🇭🇰 Hong Kong | 65 | -1 |

| 8 | 🇷🇺 Moscow | 59 | No Change |

| 9 | 🇮🇳 New Delhi | 57 | +6 |

| 10 | 🇺🇸 San Francisco | 52 | No Change |

| 11 | 🇹🇭 Bangkok | 49 | +2 |

| 12 | 🇹🇼 Taipei | 45 | +2 |

| 13 | 🇫🇷 Paris | 44 | -2 |

| 14 | 🇨🇳 Hangzhou | 43 | -5 |

| 15 | 🇸🇬 Singapore | 42 | New to Top 20 |

| 16 | 🇨🇳 Guangzhou | 39 | -4 |

| 17T | 🇮🇩 Jakarta | 37 | +1 |

| 17T | 🇧🇷 Sao Paulo | 37 | No Change |

| 19T | 🇺🇸 Los Angeles | 31 | No Change |

| 19T | 🇰🇷 Seoul | 31 | -3 |

In fact all Chinese cities on the top 20 list have lost billionaires between 2023–24. Consequently, they’ve all lost ranking spots as well, with Hangzhou seeing the biggest slide (-5) in the top 20.

Where China lost, all other Asian cities—except Seoul—in the top 20 have gained ranks. Indian cities lead the way, with New Delhi (+6) and Mumbai (+3) having climbed the most.

At a country level, China and the U.S combine to make up half of the cities in the top 20. They are also home to about half of the world’s 3,200 billionaire population.

In other news of note: Hurun officially counts Taylor Swift as a billionaire, estimating her net worth at $1.2 billion.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees