Markets

Visualizing Major Layoffs At U.S. Corporations

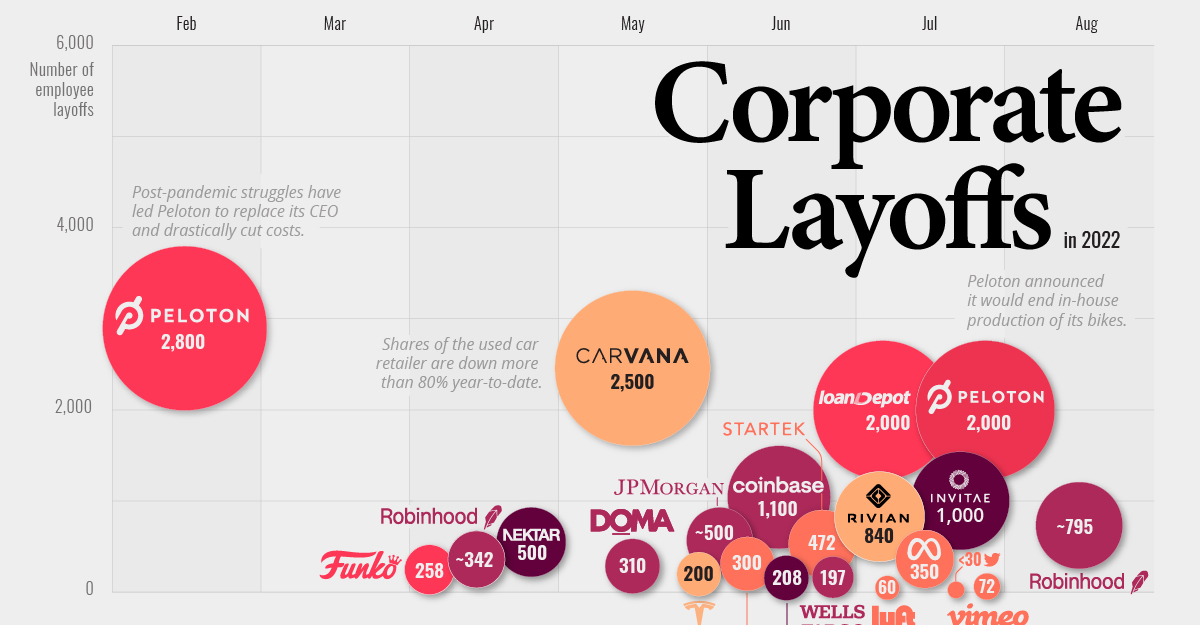

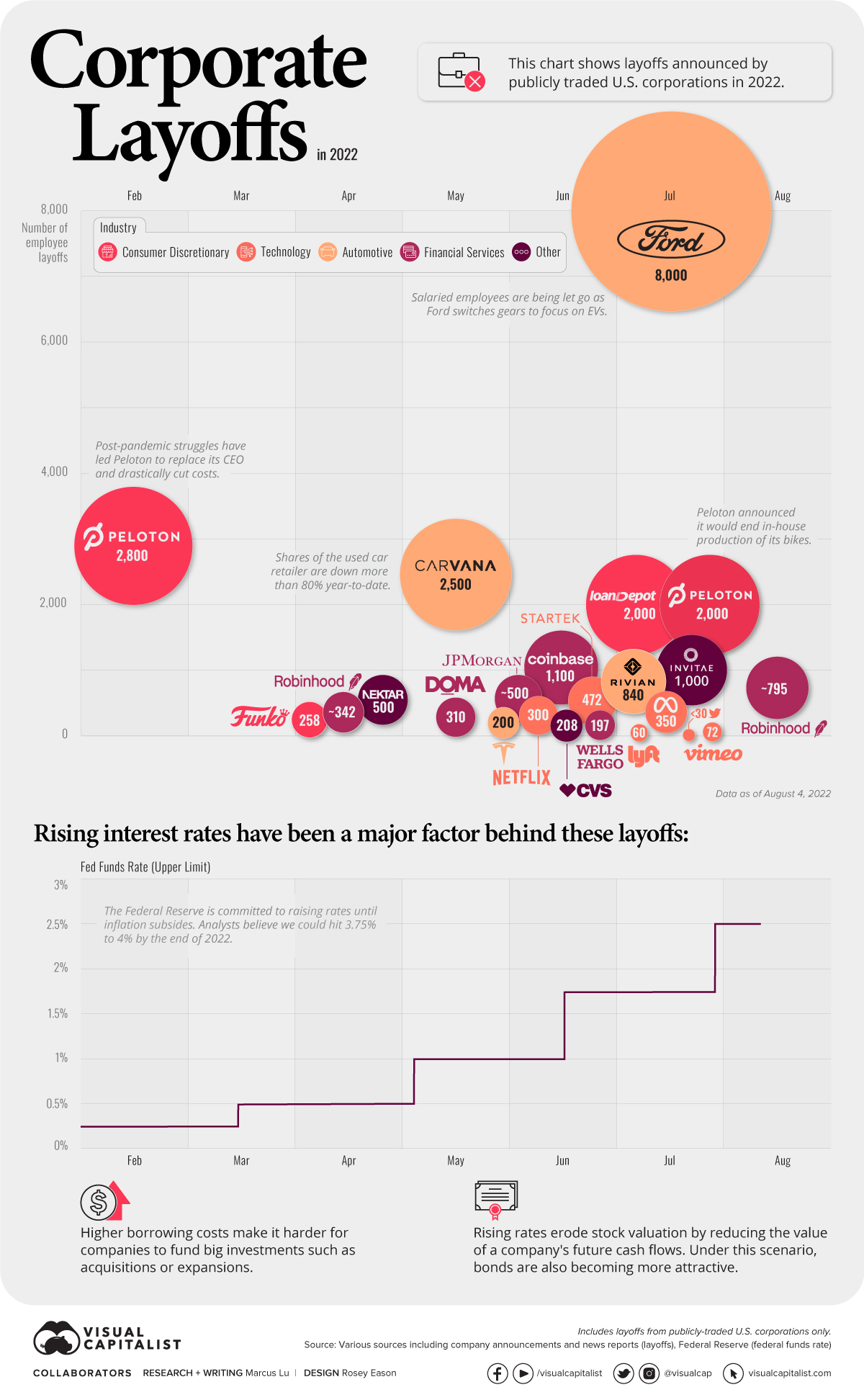

Visualizing Major Layoffs at U.S. Corporations

Hiring freezes and layoffs are becoming more common in 2022, as U.S. businesses look to slash costs ahead of a possible recession.

Understandably, this has a lot of people worried. In June 2022, Insight Global found that 78% of American workers fear they will lose their job in the next recession. Additionally, 56% said they aren’t financially prepared, and 54% said they would take a pay cut to avoid being laid off.

In this infographic, we’ve visualized major layoffs announced in 2022 by publicly-traded U.S. corporations.

Note: Due to gaps in reporting, as well as the very large number of U.S. corporations, this list may not be comprehensive.

An Emerging Trend

Layoffs have surged considerably since April of this year. See the table below for high-profile instances of mass layoffs.

| Company | Industry | Layoffs (#) | Month |

|---|---|---|---|

| Peloton | Consumer Discretionary | 2,800 | February |

| Funko | Consumer Discretionary | 258 | April |

| Robinhood | Financial Services | ~400 | April |

| Nektar Therapeutics | Biotechnology | 500 | April |

| Carvana | Automotive | 2,500 | May |

| Doma | Financial Services | 310 | May |

| JP Morgan Chase & Co. | Financial Services | ~500 | June |

| Tesla | Automotive | 200 | June |

| Coinbase | Financial Services | 1,100 | June |

| Netflix | Technology | 300 | June |

| CVS Health | Pharmaceutical | 208 | June |

| StartTek | Technology | 472 | June |

| Ford | Automotive | 8,000 | July |

| Rivian | Automotive | 840 | July |

| Peloton | Consumer Discretionary | 2,000 | July |

| LoanDepot | Financial Services | 2,000 | July |

| Invitae | Biotechnology | 1,000 | July |

| Lyft | Technology | 60 | July |

| Meta | Technology | 350 | July |

| Technology | <30 | July | |

| Vimeo | Technology | 72 | July |

| Robinhood | Financial Services | ~795 | August |

Here’s a brief rundown of these layoffs, sorted by industry.

Automotive

Ford has announced the biggest round of layoffs this year, totalling roughly 8,000 salaried employees. Many of these jobs are in Ford’s legacy combustion engine business. According to CEO Jim Farley, these cuts are necessary to fund the company’s transition to EVs.

We absolutely have too many people in some places, no doubt about it.

– Jim Farley, CEO, Ford

Speaking of EVs, Rivian laid off 840 employees in July, amounting to 6% of its total workforce. The EV startup pointed to inflation, rising interest rates, and increasing commodity prices as factors. The firm’s more established competitor, Tesla, cut 200 jobs from its autopilot division in the month prior.

Last but not least is online used car retailer, Carvana, which cut 2,500 jobs in May. The company experienced rapid growth during the pandemic, but has since fallen out of grace. Year-to-date, the company’s shares are down more than 80%.

Financial Services

Fearing an impending recession, Coinbase has shed 1,100 employees, or 18% of its total workforce. Interestingly, Coinbase does not have a physical headquarters, meaning the entire company operates remotely.

A recession could lead to another crypto winter, and could last for an extended period. In past crypto winters, trading revenue declined significantly.

Brian Armstrong, CEO, Coinbase

Around the same time, JPMorgan Chase & Co. announced it would fire hundreds of home-lending employees. While an exact number isn’t available, we’ve estimated this to be around 500 jobs, based on the original Bloomberg article. Wells Fargo, another major U.S. bank, has also cut 197 jobs from its home mortgage division.

The primary reason for these cuts is rising mortgage rates, which are negatively impacting the demand for homes.

Technology

Within tech, Meta and Twitter are two of the most high profile companies to begin making layoffs. In Meta’s case, 350 custodial staff have been let go due to reduced usage of the company’s offices.

Many more cuts are expected, however, as Facebook recently reported its first revenue decline in 10 years. CEO Mark Zuckerberg has made it clear he expects the company to do more with fewer resources, and managers have been encouraged to report “low performers” for “failing the company”.

Realistically, there are probably a bunch of people at the company who shouldn’t be here.

– Mark Zuckerberg, CEO, Meta

Also in July, Twitter laid off 30% of its talent acquisition team. An exact number was not available, but the team was estimated to have less than 100 employees. The company has also enacted a hiring freeze as it stumbles through a botched acquisition by Elon Musk.

More Layoffs to Come…

Layoffs are expected to continue throughout the rest of this year, as metrics like consumer sentiment enter a decline. Rising interest rates, which make it more expensive for businesses to borrow money, are also having a negative impact on growth.

In fact just a few days ago, trading platform Robinhood announced it was letting go 23% of its staff. After accounting for its previous layoffs in April (9% of the workforce), it’s fair to estimate that this latest round will impact nearly 800 people.

Economy

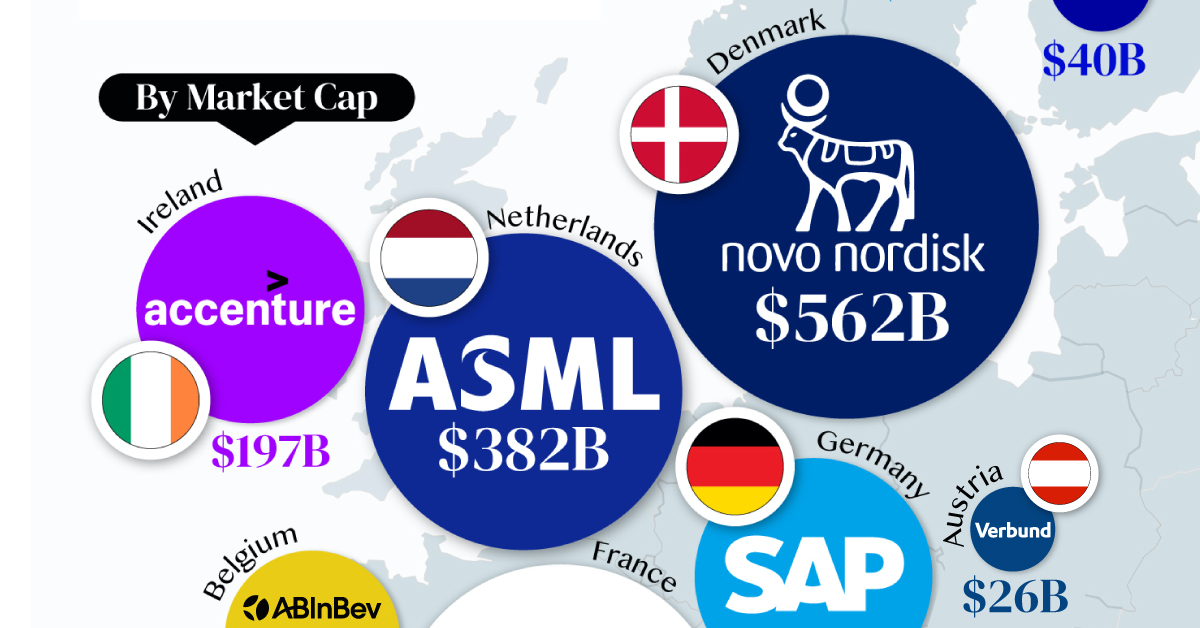

The Most Valuable Companies in Major EU Economies

From semiconductor equipment manufacturers to supercar makers, the EU’s most valuable companies run the gamut of industries.

Most Valuable Companies in the EU, by Country

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

In this graphic, we mapped out the most valuable corporations in 11 major EU economies, based on their market capitalizations as of April 15th, 2024. All figures are in USD, and were sourced from Companiesmarketcap.com.

Novo Nordisk is currently worth more than $550 billion, making it Europe’s most valuable company by a wide margin. The pharmaceutical giant specializes in diabetes and weight-loss drugs. Demand for two of them, Ozempic and Wegovy, has surged due to their weight-loss capabilities, even causing nationwide shortages in the United States.

The following table includes an expanded list of the most valuable publicly-traded company in larger EU economies. Many of these were not included in the graphic due to space limitations.

| Country | Company | Sector | Market Cap |

|---|---|---|---|

| 🇩🇰 Denmark | 💊 Novo Nordisk | Pharmaceuticals | $562B |

| 🇫🇷 France | 👜 LVMH | Luxury Goods | $422B |

| 🇳🇱 Netherlands | 🔧 ASML | Semiconductor Equipment | $382B |

| 🇩🇪 Germany | 💼 SAP | Enterprise Software | $214B |

| 🇮🇪 Ireland | 🖥️ Accenture | IT Services | $197B |

| 🇪🇸 Spain | 👗 Inditex | Retail | $147B |

| 🇧🇪 Belgium | 🍻 Anheuser-Busch InBev | Beverages | $116B |

| 🇸🇪 Sweden | 🛠️ Atlas Copco | Industrial Equipment | $80B |

| 🇮🇹 Italy | 🏎️ Ferrari | Automotive | $76B |

| 🇫🇮 Finland | 🏦 Nordea Bank | Banking | $40B |

| 🇦🇹 Austria | 🔌 Verbund AG | Energy | $26B |

| 🇱🇺 Luxembourg | 🏗️ Tenaris | Oil & Gas Equipment | $22B |

| 🇨🇿 Czech Republic | 💡 CEZ Group | Energy | $20B |

| 🇵🇱 Poland | ⛽ PKN Orlen | Energy | $20B |

| 🇵🇹 Portugal | 🔌 EDP Group | Energy | $16B |

| 🇬🇷 Greece | 🏦 Eurobank | Banking | $7B |

| 🇭🇺 Hungary | ⛽ MOL Group | Energy | $7B |

| 🇭🇷 Croatia | 🏦 Zagrebacka Banka | Banking | $6B |

| 🇷🇴 Romania | ⛽ Romgaz | Energy | $4B |

| 🇸🇮 Slovenia | 💊 Krka | Pharmaceuticals | $4B |

Note: Figures are rounded and last updated on April 15th, 2024. Countries with top publicly-traded companies worth under $4 billion are excluded.

Luxury supergiant LVMH—which owns brands like Tiffany, Christian Dior, and TAG Heuer to name a few—is Europe’s second largest company by market cap, at $420 billion.

Rounding out the top three is ASML, which produces equipment crucial to chip manufacturers, worth $380 billion.

When looking at the region, there is a vast disparity between EU member states and their most valuable companies.

For example, as mentioned earlier, Denmark’s Novo Nordisk and France’s LVMH are worth between $400-550 billion each. Meanwhile, some countries don’t even have a single publicly-listed company that is worth over $1 billion.

In fact, only 12 EU countries (less than half of the union) are home to the top 100 most valuable companies within the bloc. An additional four countries are represented if you look at the list of the top 200 companies.

-

Technology7 days ago

Technology7 days agoAll of the Grants Given by the U.S. CHIPS Act

-

Uranium2 weeks ago

Uranium2 weeks agoThe World’s Biggest Nuclear Energy Producers

-

Education2 weeks ago

Education2 weeks agoHow Hard Is It to Get Into an Ivy League School?

-

Debt2 weeks ago

Debt2 weeks agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Sports2 weeks ago

Sports2 weeks agoThe Highest Earning Athletes in Seven Professional Sports

-

Science2 weeks ago

Science2 weeks agoVisualizing the Average Lifespans of Mammals

-

Brands1 week ago

Brands1 week agoHow Tech Logos Have Evolved Over Time

-

Energy1 week ago

Energy1 week agoRanked: The Top 10 EV Battery Manufacturers in 2023