Markets

Interactive: A Dynamic Look At Rental Prices in the USA

The homeownership rate in the U.S. is at lows not seen since 1965 – and as a result, there are more renters in the housing market than ever before.

With rental prices across the country continuing to rise from this demand, there is one question on the minds of many Americans: how and where can dollars spent on housing be stretched the furthest?

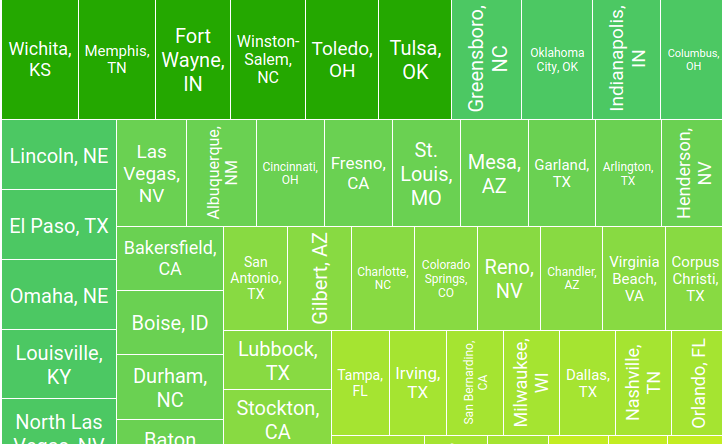

Housing market bloggers RentCafe have taken both of these key variables into account in the graphic below, which compares the square footage of an apartment with a fixed rent of $1,500 in the top 100 most populous U.S. metro areas.

Finding The Right Balance

Data like this helps to answer one of the most pressing problems that a prospective renter may have, which is finding the right balance in the trade-off between cost and size.

Cities like Cincinnati, Las Vegas, and St. Louis offer a benchmark for the American rental prices, as they have an average dollar-to-space ratio of 1:1.

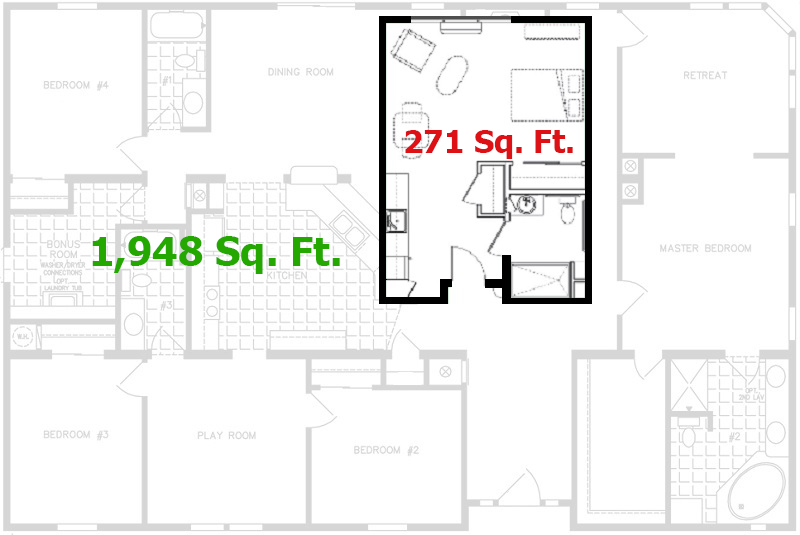

This kind of value can’t be found in most cities on the list, however. And in cities like San Francisco, Boston, and New York, the ratios get really out of whack. In Manhattan, $1,500 gets you just 271 square feet of space, which is the equivalent of $5.53 per square foot.

Space: The Rental Frontier

The disparity between these spatial arrangements is made clear in the graphic below. A fixed $1,500 budget would allow a renter to live in nearly 2,000 square feet of space in Wichita, KS, compared to the aforementioned “closet” in Manhattan:

Adjusting For Income

Not all renters’ budgets will be fixed at $1,500 per month, of course.

To address the wide variation in income and percentage of income that individual renters will be able to devote to their housing expenses, this calculator shows the equivalent square footage for any given monthly rent in a selection of the cities in the main graphic above.

Markets

The Best U.S. Companies to Work for According to LinkedIn

We visualized the results of a LinkedIn study on the best U.S. companies to work for in 2024.

The Best U.S. Companies to Work for According to LinkedIn

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

In this graphic, we list the 15 best U.S. companies to work for in 2024, according to LinkedIn data.

LinkedIn ranked companies based on eight pillars: ability to advance, skills growth, company stability, external opportunity, company affinity, gender diversity, educational background, and employee presence in the country.

To be eligible, companies must have had 5,000 or more global employees, with at least 500 in the country as of December 31, 2023.

Data and Highlights

Financial institutions dominate the ranking of the best U.S. companies to work for in 2024, with JP Morgan Chase & Co. ranking first.

| Rank | Company | Industry |

|---|---|---|

| 1 | JP Morgan Chase & Co. | Financial Services |

| 2 | Amazon | E-commerce |

| 3 | Wells Fargo | Financial Services |

| 4 | Deloitte | Professional Services |

| 5 | PwC | Professional Services |

| 6 | UnitedHealth Group | Healthcare |

| 7 | AT&T | Telecommunications |

| 8 | Verizon | Telecommunications |

| 9 | Moderna | Pharmaceuticals |

| 10 | Alphabet Inc. | Technology |

| 11 | General Motors | Automotive |

| 12 | Bank of America | Financial Services |

| 13 | Mastercard | Financial Services |

| 14 | Capital One | Financial Services |

| 15 | Northrop Grumman | Aerospace & Defense |

J.P. Morgan has a program that offers opportunities for candidates without a university degree. In fact, in 2022, 75% of job descriptions at the bank for experienced hires did not require a college degree.

Meanwhile, Deloitte and Amazon offer a variety of free training courses, including in AI.

Moderna includes in its employee package benefits to help avoid employee burnout — from subsidized commuter expenses and pop-up daycare centers, to wellness coaches.

Mastercard offers flexible work availability, with 11.5% remote and 89% hybrid options.

It’s also interesting to note that only Amazon and Alphabet made the cut from the ‘Magnificent Seven’ companies (Apple, Microsoft, Google parent Alphabet, Amazon, Nvidia, Meta Platforms, and Tesla).

See more about the best companies to work for in this infographic, which covers a separate ranking from Glassdoor.

-

Demographics7 days ago

Demographics7 days agoThe Countries That Have Become Sadder Since 2010

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023

-

Green2 weeks ago

Green2 weeks agoRanking the Top 15 Countries by Carbon Tax Revenue

-

Markets2 weeks ago

Markets2 weeks agoU.S. Debt Interest Payments Reach $1 Trillion

-

Mining2 weeks ago

Mining2 weeks agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Energy2 weeks ago

Energy2 weeks agoThe World’s Biggest Nuclear Energy Producers

-

Misc2 weeks ago

Misc2 weeks agoHow Hard Is It to Get Into an Ivy League School?

-

Debt2 weeks ago

Debt2 weeks agoHow Debt-to-GDP Ratios Have Changed Since 2000