How Precious Metals Royalty and Streaming Companies Create Value

The following content is sponsored by Empress Royalty.

Gold and Silver Royalty and Streaming Companies

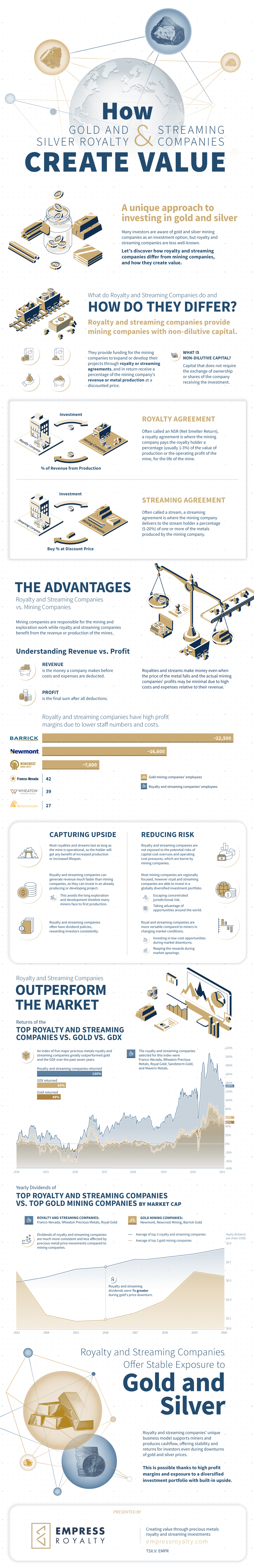

Investing in precious metals often seems like it boils down to either buying the physical gold or silver or investing in shares of specific mining companies, both with their own very distinct advantages and risks.

Rather than having to settle for the simplicity of bullion or extensive research in individual mining companies, precious metals royalty and streaming companies provide investors with exposure to a diversified portfolio of miners’ revenues and produced metals.

These companies are not operators of mines. Instead, they seek to find undiscovered value by financing and working directly with miners to forge agreements that provide their shareholders with steady exposure to precious metals production.

This infographic from Empress Royalty outlines exactly how gold and silver royalty and streaming companies operate, and how they mitigate risk and create value for their shareholders.

What Do Precious Metals Royalty and Streaming Companies Do?

Royalty and streaming companies are an important part of the mining industry’s financial ecosystem, as they provide capital to mine operators and explorers in exchange for a percentage of revenue or metals produced from the mine.

Mining companies receiving this investment are able to further develop or expand projects, providing greater returns for both their shareholders and the companies with royalties and stream agreements on the projects.

These agreements typically last for the life of a mine, providing steady cash flow to royalty and stream holders while cutting out various risks associated with mining companies and operations.

“What it takes in the royalty business is patience and cash.”

– Pierre Lassonde, co-founder of the first royalty and streaming company, Franco-Nevada

The Difference Between Royalty Agreements and Streams

Royalty agreements and streams have similarities in their structure, but ultimately have some key differences.

- Royalty agreements, also called net smelter return (NSRs), provide the royalty holder a percentage of the mine’s revenue from production, typically around 1-3%. There are also other kinds of royalty agreements like net profits interests (NPIs), where the royalty holder receives a percentage of the profits rather than the revenue.

- Streams provide the right to purchase a certain percent (typically 5-20%) of metal production directly from the mine. Typically, streams will have an already decided purchasing price for the metal, which is usually either a fixed dollar amount or a fixed percentage of the spot price.

Royalties are more common than streams as they provide cash directly to the royalty company rather than the option to buy the physical metal which then needs to be sold.

While royalty and streams differ in what is delivered, both kinds of agreements avoid operational costs as they receive cuts from the top line.

The Growing and Diverse Landscape of Royalty and Streaming

The niche sector of gold and silver royalties has changed greatly since the founding of the original royalty business, Franco-Nevada in 1980.

While still fairly small today, the subsector has grown to have more than 10 companies with a market cap of $100M USD each, with five surpassing the $1B mark.

Here are the top 10 royalty and streaming companies by market cap:

| Company | Market Capitalization (USD) | Forward Dividend Yield |

|---|---|---|

| Franco-Nevada | $21.6B | 0.91% |

| Wheaton Precious Metals | $17.8B | 1.20% |

| Royal Gold | $7.1B | 1.12% |

| Osisko Gold Royalties | $1.9B | 1.39% |

| Sandstorm Gold | $1.3B | 0.00% |

| Maverix Metals | $738.0M | 0.75% |

| Nomad Royalty | $488.6M | 1.82% |

| Metalla Royalty and Streaming | $368.3M | 0.37% |

| EMX Royalty Corporation | $308.0B | 0.00% |

| Abitibi Royalties | $237.9M | 0.78% |

Source: Yahoo Finance

While the three big names of Franco-Nevada, Wheaton Precious Metals, and Royal Gold tend to focus on larger and more secure ounce-producing agreements, the newer precious metals royalty companies start out by establishing a few cash-flowing agreements in their portfolio.

After this, they can begin targeting more speculative agreements with developing or exploration projects which are typically worth smaller dollar amounts and are slightly riskier or further from production, but have the potential of undiscovered upside.

Some royalty companies don’t even deal with mining companies at all, and focus exclusively on buying royalty and stream agreements held by third party companies or prospectors.

How These Companies Reduce Risk and Capture Upside

By avoiding many of the operational costs, royalty and streaming companies cut out a large amount of risk that is typically associated with mining investments.

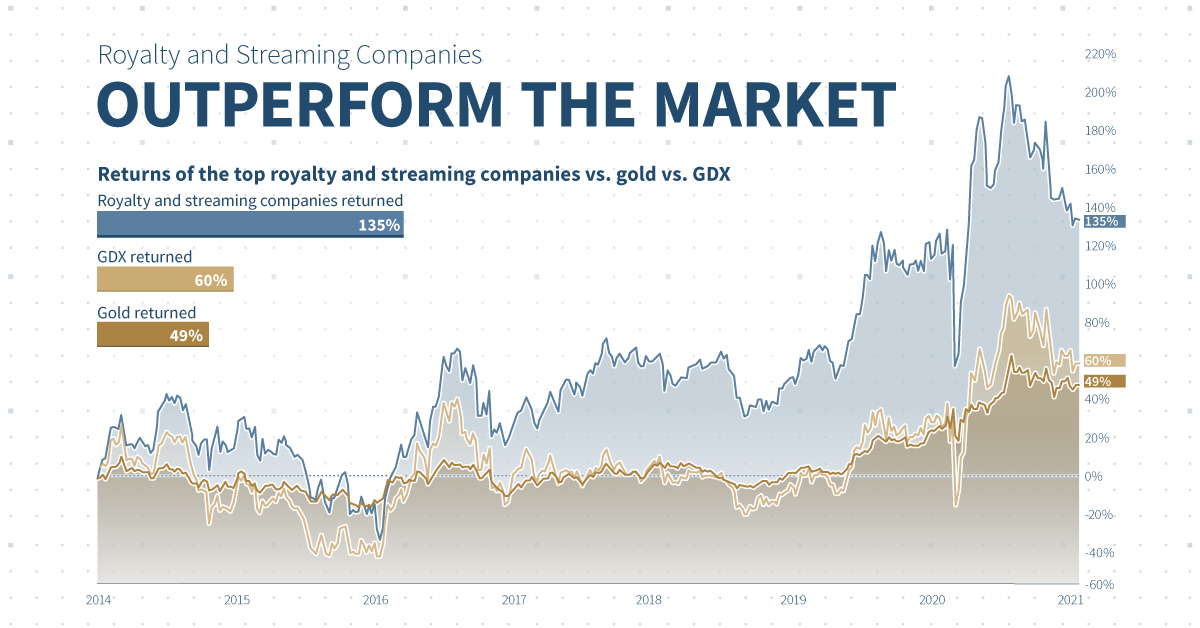

In precious metal bull markets, it’s typical to see mining company revenues rise alongside the prices of gold and silver.

While mining companies’ operational costs will also rise, royalty and stream holders simply reap the benefits of high margins as they sell their physical metals at higher prices, despite having acquired them at lower fixed prices according to their agreement.

Another key advantage royalty and streaming companies have is their ability to diversify their portfolios and be selective with their agreements. This allows them to escape concentrated jurisdictional or asset risk and make agreements with mines which are already producing or close to production.

Since royalties and streams tend to last as long as the associated mine is operational, the holders of these agreements also benefit from any increased production or lifespan.

Royalty and Streaming Companies: Stable Exposure to Metals

As precious metals royalty and streaming companies are able to carefully choose their agreements and are overall less exposed to price downturns, they provide investors with a more stable investment in gold and silver.

Royalty and streaming companies typically have dividend policies which ensure shareholders are consistently rewarded with rising dividends, while many gold and silver mining companies cut dividends aggressively during precious metal market downturns.

As they help finance new projects and expansions, royalty and streaming companies take advantage of high margins in a unique form of financial arbitrage while providing their shareholders with stable exposure to precious metals and mining operations.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.