Gold

Why Diversification Makes a Precious Metals Portfolio Stronger

Precious metals like gold, silver, and platinum have many things in common.

They tend to be heavy, durable, ductile, and malleable – all desirable traits for monetary metals. They also tend to be quite rare, which is part of the reason that investors have put trust in these assets as stores of value for hundreds of years.

Despite all these commonalities, the story of each individual metal is actually quite unique. Each metal is driven by its own set of supply and demand characteristics that are unique from the group. As a result, there is a significant amount of variance in the price patterns between each individual precious metal.

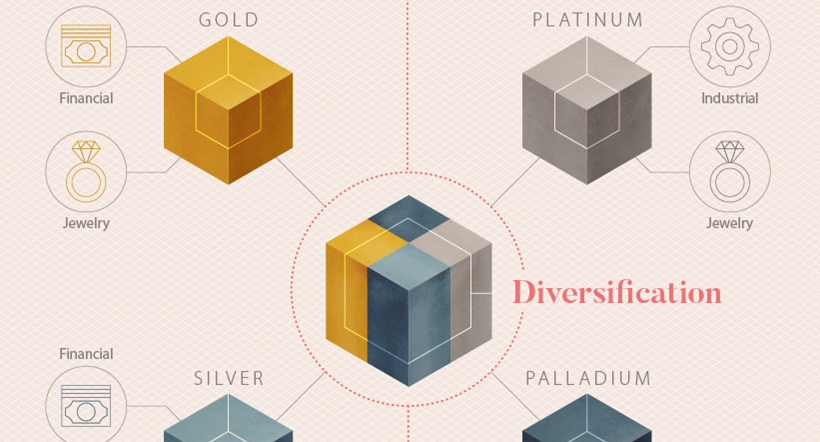

Precious Metals Diversification

Today’s infographic comes to us from Neptune-GBX and it showcases the story of each precious metal.

More importantly, it shows why owning them simultaneously is the only way to get exposure to the unique supply and demand drivers behind each of them in the context of the modern market.

The story of each individual precious metal is quite unique:

Gold

Investors and people buy gold bullion or jewelry as a store of value, and the gold price is sensitive to events in financial markets. Its main use is investment, and supply is diversified and global.

Silver

Silver is unique “hybrid” metal that is simultaneously driven by its investment and industrial uses. Its main uses are investment and industrial, and supply is diversified and global.

Platinum

Used in catalytic converters and for other industrial uses. Platinum demand also comes from jewelry and investment sectors. Platinum supply only comes from South Africa, Russia and Zimbabwe, giving it a unique set of supply characteristics.

Palladium

Palladium is a purer industrial metal than platinum, with 80% of demand coming from catalytic converters. It has similar supply issues to platinum.

Because each metal is different, when one increases in price, the others may or may not follow suit. This creates a problem and an opportunity for investors.

Why Diversification Matters

How do investors minimize the volatility of precious metals investments, while still maximizing returns?

It’s a risk management problem that portfolio managers have been dealing with for decades – and they’ve come up with a proven solution: diversification.

Diversification benefits:

- Reduces risk: All eggs aren’t in one basket

- Preserves capital: Protects against major declines in one asset

- Generates returns: Portfolio can grow in boom or bust

Since the four major precious metals are driven by individual demand and supply factors, diversification can allow you get exposure to the unique drivers behind each metal at the same time.

Mining

Gold vs. S&P 500: Which Has Grown More Over Five Years?

The price of gold has set record highs in 2024, but how has this precious metal performed relative to the S&P 500?

Gold vs. S&P 500: Which Has Grown More Over Five Years?

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Gold is considered a unique asset due to its enduring value, historical significance, and application in various technologies like computers, spacecraft, and communications equipment.

Commonly regarded as a “safe haven asset”, gold is something investors typically buy to protect themselves during periods of global uncertainty and economic decline.

It is for this reason that gold has performed rather strongly in recent years, and especially in 2024. Persistent inflation combined with multiple wars has driven up demand for gold, helping it set a new all-time high of over $2,400 per ounce.

To put this into perspective, we visualized the performance of gold alongside the S&P 500. See the table below for performance figures as of April 12, 2024.

| Asset/Index | 1 Yr (%) | 5 Yr (%) |

|---|---|---|

| 🏆 Gold | +16.35 | +81.65 |

| 💼 S&P 500 | +25.21 | +76.22 |

Over the five-year period, gold has climbed an impressive 81.65%, outpacing even the S&P 500.

Get Your Gold at Costco

Perhaps a sign of how high the demand for gold is becoming, wholesale giant Costco is reportedly selling up to $200 million worth of gold bars every month in the United States. The year prior, sales only amounted to $100 million per quarter.

Consumers aren’t the only ones buying gold, either. Central banks around the world have been accumulating gold in very large quantities, likely as a hedge against inflation.

According to the World Gold Council, these institutions bought 1,136 metric tons in 2022, marking the highest level since 1950. Figures for 2023 came in at 1,037 metric tons.

See More Graphics on Gold

If you’re fascinated by gold, be sure to check out more Visual Capitalist content including 200 Years of Global Gold Production, by Country or Ranked: The Largest Gold Reserves by Country.

-

Mining1 week ago

Mining1 week agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries