Technology

How Do Big Tech Giants Make Their Billions?

How Do Big Tech Giants Make Their Billions?

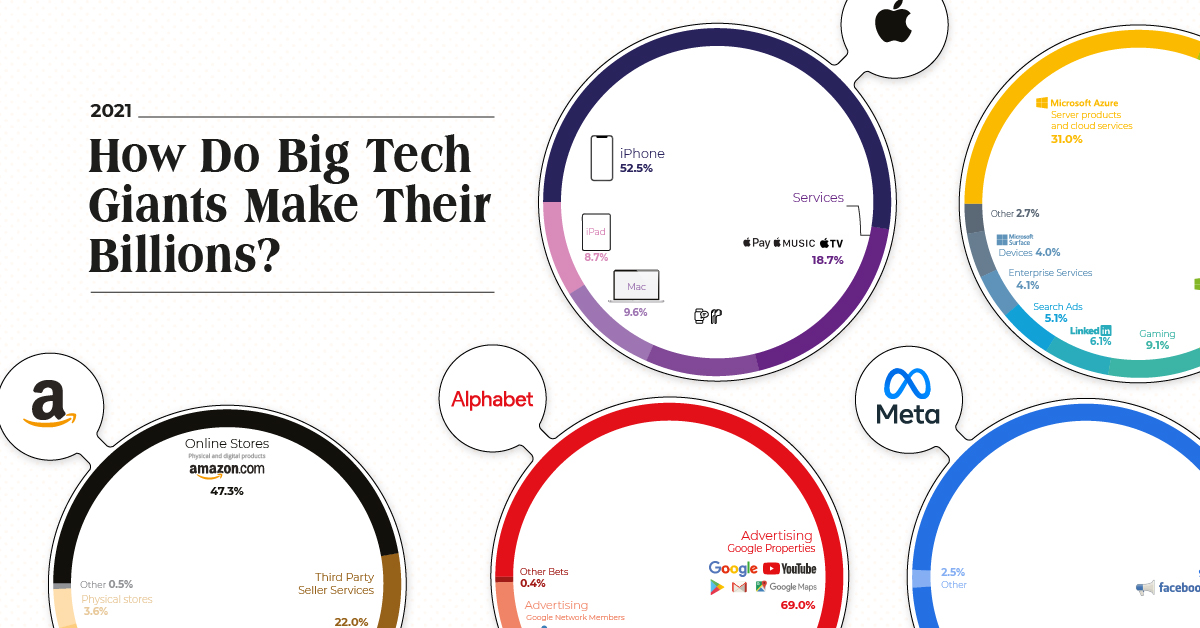

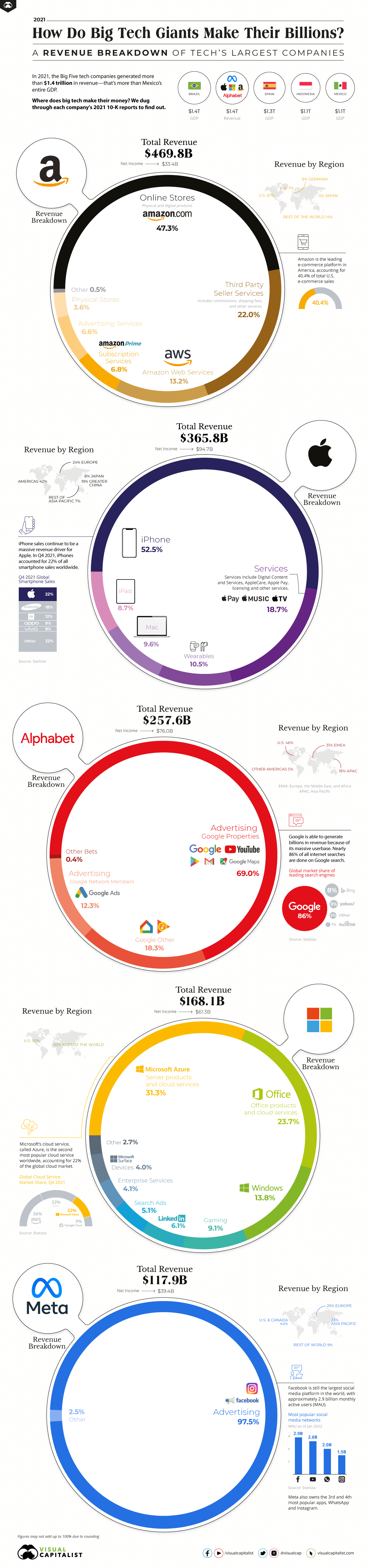

In 2021, the Big Five tech giants—Apple, Amazon, Google (Alphabet), Meta, and Microsoft—generated a combined $1.4 trillion in revenue.

What are the sources of this revenue, and how does it breakdown?

Below, we’ll dive into the main ways that these big tech giants generate revenue, and take a look at how much their revenues have increased in recent years.

Breaking Down Big Tech’s Revenue Streams

As we’ve mentioned in previous editions of this graphic, there are two main ways that big tech companies generate revenue:

- They either sell you a product

- Or sell you as the product to advertisers

Apple, Microsoft, and Amazon fall into the first category—like most traditional businesses, these companies offer customers a physical (or digital) product in exchange for money. More than half of Apple’s revenue comes from iPhone sales, Azure cloud services generate almost a third of Microsoft’s total, and Amazon’s online stores account for nearly 50% of the company’s revenue.

On the other hand, Meta and Alphabet do things a bit differently. Rather than selling an actual product, these two tech giants make most of their money by selling their audience’s attention. Nearly 98% of Meta’s revenue comes from Facebook ads, and 81% of Google’s revenue comes from advertising on various Google products.

However, despite their varying ways of generating sales, these companies all have one thing in common: revenues have soared in recent years.

The Pandemic Has Sped Up Growth

Amidst rising unemployment and pandemic-induced chaos, the Big Five still managed to see a significant revenue uptick.

In 2019 (pre-pandemic), big tech’s combined revenue grew by 12%. The following year, throughout the onset of the global pandemic and the various economic challenges that came with it, big tech still increased its combined revenue by 19%.

And in the 2021 fiscal year, big tech saw a 27% growth in combined revenue, year-over-year.

| Company | Revenue (FY 2020) | Revenue (FY 2021) | Growth (YoY) |

|---|---|---|---|

| Apple | $274.5 billion | $365.8 billion | 33% |

| Amazon | $386.1 billion | $469.8 billion | 22% |

| Alphabet | $182.5 billion | $257.6 billion | 41% |

| Microsoft | $143.1 billion | $168.1 billion | 17% |

| Meta | $86.0 billion | $117.9 billion | 37% |

| Combined | $1.1 trillion | $1.4 trillion | 27% |

How did these companies continue to thrive throughout economic turmoil and global chaos? It was made possible because the societal changes triggered by COVID-19 ended up driving demand for big tech’s products and services.

For example, lockdown restrictions forced people to shop online, causing e-commerce sales to escalate. Demand for laptops and cloud-based services grew as offices shut down and companies pivoted to fully remote workspaces.

Is Growth Here to Stay?

These days, COVID-19 restrictions have eased in most countries, and the world has slowly returned to normalcy.

But that doesn’t mean growth for big tech will stop. In fact, the pandemic-induced changes to our work and shopping habits will likely stick around, meaning the increased demand for big tech’s offerings could be here to stay.

Two-thirds of employees from a global survey said their company would likely make remote work a permanent option. And global e-commerce sales are expected to grow steadily over the next few years to reach $7 trillion by 2025.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001