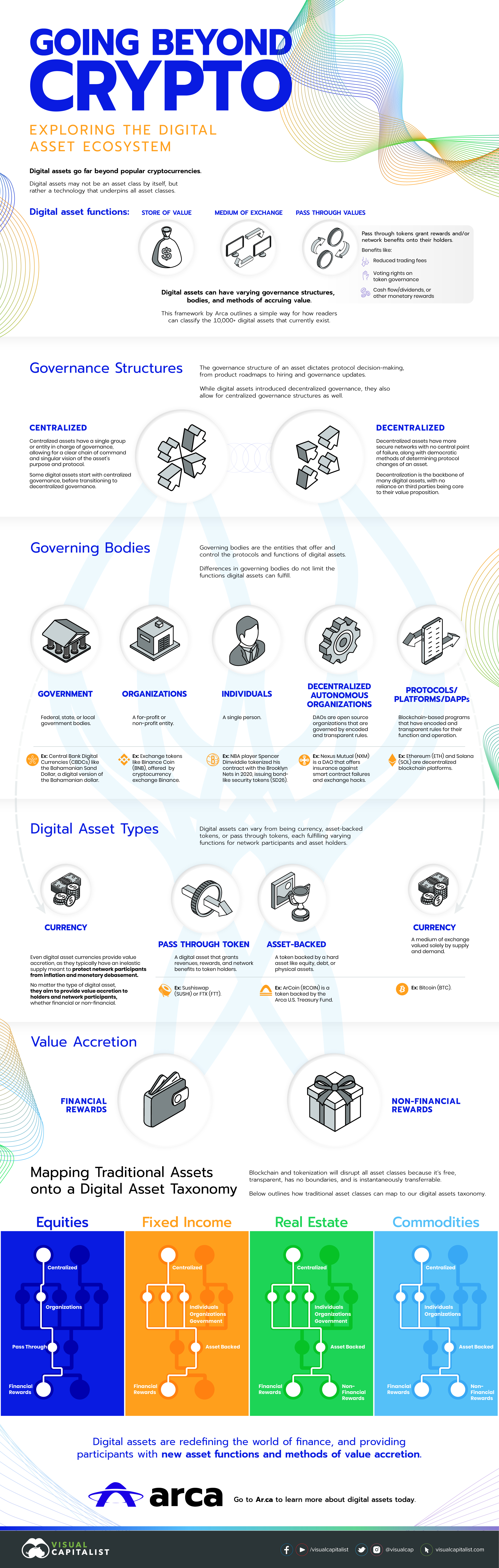

Going Beyond Crypto: Exploring the Digital Asset Ecosystem

The following content is sponsored by Arca.

Exploring the Digital Asset Ecosystem

The digital asset sector has undergone a rapid expansion over the past couple of years, growing in value and functionality.

Beyond the price growth of popular cryptocurrencies, digital assets are powering innovative applications that enable value transfer beyond just payments. From tokens that grant dividend-like revenue to holders, to tokens backed by other digital and physical assets, the digital asset ecosystem is redefining asset and financial structures before our very eyes.

This framework created by Arca explores and defines the state of the digital asset ecosystem, looking at how traditional assets might one day be integrated into this new taxonomy.

The Functions and Types of Digital Assets

Digital assets can be broken down into three different types of assets that fulfill three primary functions. The first two functions of digital assets, store of value and medium of exchange, are well established functions of digital and traditional assets.

However, a third functionality of being able to pass through values to holders has emerged, with benefits like discounted application fees, governance voting rights, and monetary rewards passed onto token holders.

These functions are fulfilled by three main types of digital assets:

- Currency: tokens that are a unit of account and medium of exchange

- Asset-backed tokens: tokens backed by hard assets like equity, debt, or physical assets

- Pass through tokens: tokens that grant revenues, rewards, and network benefits to holders

Many know of Bitcoin, the founding cryptocurrency that functions as a digital currency today. Along with this, tokens whose value is backed by other assets like Arca Lab’s ArCoin (Ticker: RCOIN) are also straightforward in nature and functionality.

Pass through tokens are where digital assets explore innovative concepts and structures unique to the blockchain networks that underpin the assets.

For example, cryptocurrency exchange FTX issued an exchange token (FTT) at launch, which provides holders with reduced trading fees on the platform. FTT holders can also stake, or lock up, their tokens to receive increased referral rebates, more votes in FTX polls, and more airdrop rewards (tokens exclusively given out to holders or stakers of another token).

Classifying Governance and Decentralization

Along with token types and their functionality, it’s important to understand the governing bodies and governance structures behind digital assets.

The governing body is the entity that issues and controls the function of a digital asset, ultimately defining the purpose and proposed value of a digital asset. These range from centralized governments and organizations, like the government of the Bahamas (issuer of the CBDC, the Bahamian Sand Dollar) to Decentralized Autonomous Organizations and blockchain protocols like Ethereum (ETH) and Solana (SOL).

| Governing Body | Governance Structure |

|---|---|

| Government | Centralized |

| Organizations | Centralized |

| Individuals | Centralized |

| Decentralized Autonomous Organizations (DAOs) | Decentralized |

| Protocols, Platforms, and Dapps | Typically decentralized |

Governance structures define the framework and procedures which decide and implement changes for a digital asset. These changes can be about anything, like the digital asset’s tokenomics, pass through values, or future development goals.

While some governing bodies like governments and organizations have centralized governance structures, centralization and decentralization isn’t all or nothing and can be seen as more of a spectrum.

Certain DAOs or protocols might have a core team of developers that propose certain features, which are then voted on and ultimately decided by the holders of the digital asset.

The Future of Traditional Assets in a Digital Framework

With an established taxonomy of digital assets, we can start to map out how traditional assets fit into this framework.

From tokenizing real estate and commodities for easier digital exchange and settlement to equity-like tokens issued by companies that provide holders with voting rights or non-financial rewards, digital assets will reshape the traditional asset structures of today.

By providing unbound and transparent asset structures, digital assets are providing people around the world with more freedom in storing, transferring, and accruing value.

Go to Ar.ca to learn more about digital assets today.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.