Technology

Visualizing the Current Landscape of the Fintech Industry

Visualizing the Current Landscape of the Fintech Industry

Since the introduction of the first credit card with a magnetic stripe in 1966, financial technology has come a long way. Silicon Valley may not have birthed the term “fintech”, but it has certainly helped catapult its applications into the mainstream.

Leveraging everything from basic apps to the blockchain, the changing dynamics of fintech are creating new investment opportunities everyday, growing its appetite with every new megadeal.

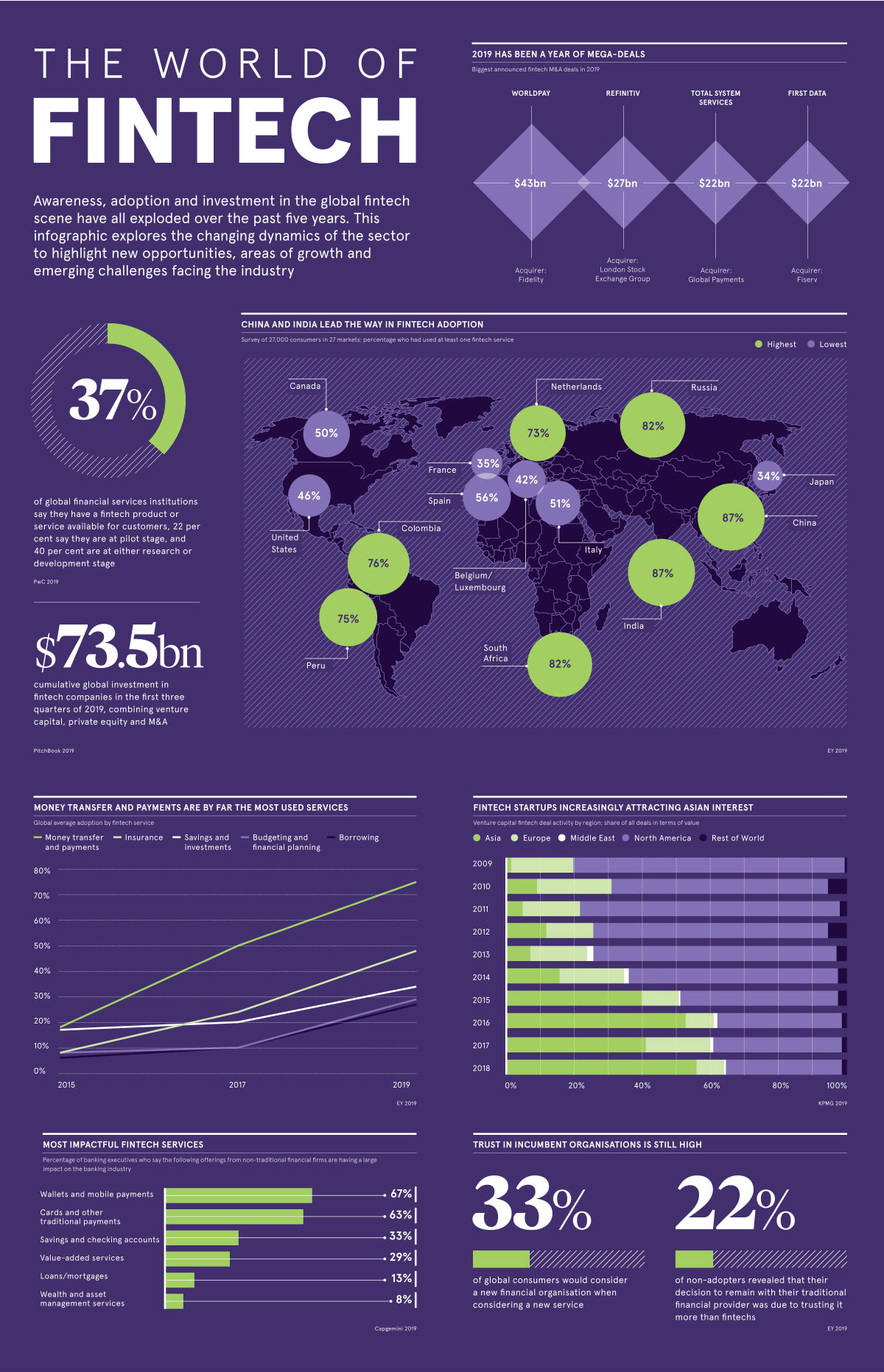

Today’s graphic from Raconteur highlights the global growth of the fintech industry, the services with the most staying power, and major M&A developments of the past year as traditional institutions scramble to deal with this digital disruption.

How Fintech Levels the Playing Field

Over the past five years, digitally-enabled financial technology services have delivered convenient and cheaper access to financial services to millions of consumers.

What draws consumers towards using fintech?

- Attractive rates and fees (27%)

- Easy access and account setup (20%)

- Variety of innovative products and services (18%)

- Better service quality and product features (12%)

This new implementation of technology is democratizing financial services for the masses, a strong contrast to accessing them through traditional brick-and-mortar institutions.

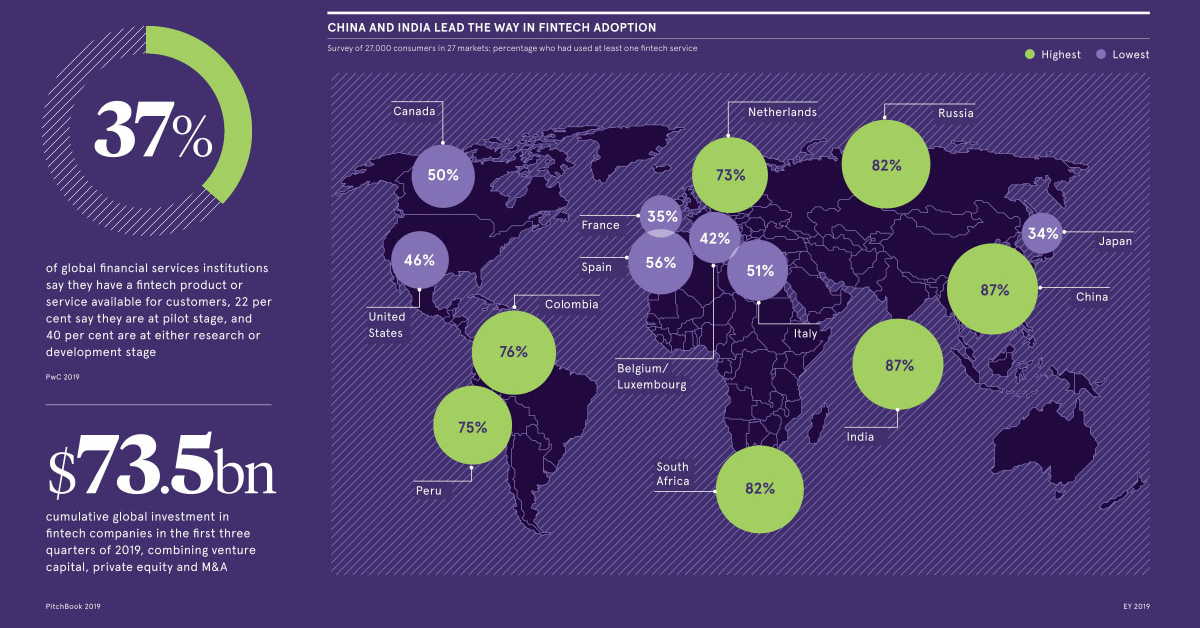

How Fintech Fares Across Borders

On average, 64% of the world’s digitally active population has used at least one fintech service. But China and India surpass this benchmark by a mile—in a survey of 27,000 consumers across 27 markets, both countries demonstrated a 87% fintech adoption rate.

Russia and South Africa are in close second, with 82% adoption respectively. On the other hand, France and Japan are tied at the low end of the spectrum with only 35% fintech adoption.

The trajectory of mobile payments and digital wallets in China can help put high Asian adoption rates in perspective. Thanks to services like Alipay and WeChat, 890 million unique mobile payment users are essentially transforming China from a cash economy to a digital one.

Which Services Have Caught Consumer Attention?

Just like “Googling” is synonymous with looking up information online, the term “Venmo-ing” has become an American verb for paying someone back via a digital wallet.

That’s why it’s no surprise that money transfer and payments are by far the most rapidly growing fintech services, shooting up from 18% to 75% global adoption in just four years. Here’s how global average adoption rates differ by fintech service, across time:

| Fintech Category | 2015 | 2017 | 2019 |

|---|---|---|---|

| 💸 Money transfer and payments | 18% | 50% | 75% |

| 💰 Savings and investments | 17% | 20% | 34% |

| 📋 Budgeting and financial planning | 8% | 10% | 29% |

| 🛡️ Insurance | 8% | 24% | 48% |

| 💳 Borrowing | 6% | 10% | 27% |

Source: EY Global Fintech Adoption Index 2019

Insurtech has steadily gained traction in the market. Digital insurance solutions provide personalized and on-demand coverage plans for clients, using bots and machine learning to assess risk levels. As a result, this sub-segment has been attracting large funding rounds due to the time—and money—it helps free up for firms.

According to CapGemini, incumbents in the financial industry see wallets and mobile payments from fintech providers as the most significant offerings impacting their companies. That may be why they’re resorting to big moves to protect their business.

Deals and More Deals

Major financial institutions made some serious plays in 2019, in the way of mergers and acquisitions of fintech companies:

- FIS bought the payments processing company Worldpay for $35 billion, valuing the company at $43 billion when debt is included. (Reuters)

- The London Stock Exchange Group plans to acquire financial markets data provider Refinitiv for $27 billion, in the hopes of rivaling Bloomberg. (Reuters)

- Global Payments bought the payments processing company Total System Services for $21.5 billion, planning to provide services to over 1,300 financial institutions. (Bloomberg)

- Fiserv acquired payments processing company First Data for $22 billion—the two companies combined are a backbone of Wall Street’s financial technology. (WSJ)

- Visa purchased the payments authentication company Plaid for $5.3 billion in January 2020, in hopes of strengthening its relations with financial institutions. (CNBC)

As billions of dollars exchange hands, it’s been noted that many of these plays were made by established incumbents to curb the threat posed by fintech startups.

At the same time, however, it’s also clear that traditional institutions want to tap into what fintech startups are doing right.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Energy1 week ago

Energy1 week agoThe World’s Biggest Nuclear Energy Producers

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024