Business

Ranked: Worst Companies for Employee Retention (U.S. and UK)

Editor’s Note: This graphic is being updated by the Creator to reflect the rebrand of Elevance Health from Anthem in 2022.

The Worst Companies for Employee Retention (U.S. and UK)

Employees consider various factors when committing to a company long term, including a positive work environment, fair compensation, job security, opportunities for professional growth, and resilience against disruptive changes in the economy or technology.

So, which companies have the worst employee retention?

To create these graphics, Resume.io analyzed LinkedIn data to identify large companies where employees have the shortest tenures in both the U.S. and the UK.

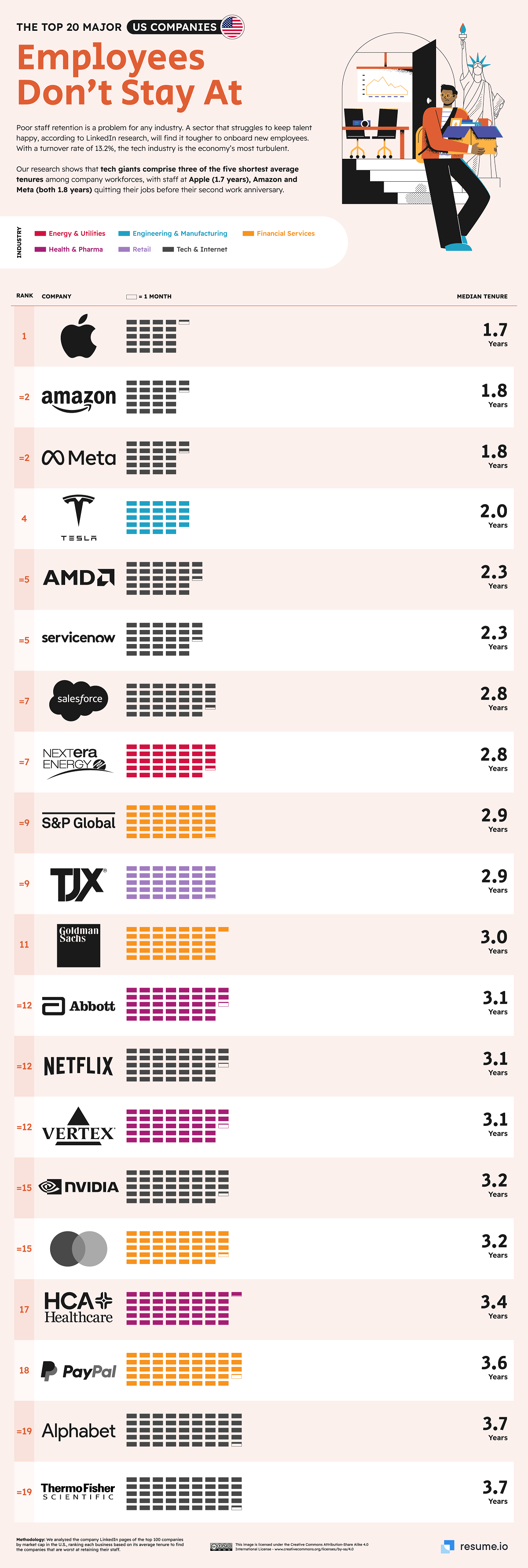

Tech Giants on Top of the List

Resume.io ranked the top 100 companies by market cap in the U.S. and UK based on their average employee tenure through an analysis of their LinkedIn pages.

With a turnover rate of 13.2%, the tech industry is the economy’s most turbulent.

Tech giants comprise three of the five shortest average tenures among company workforces. On average, staff at companies like Apple, Amazon, and Meta quit their jobs before the second year.

| Rank | Company | Median Tenure (years) |

|---|---|---|

| 1 | Apple | 1.7 |

| 2 | Amazon | 1.8 |

| 2 | Meta | 1.8 |

| 4 | Tesla | 2.0 |

| 5 | AMD | 2.3 |

| 5 | ServiceNow | 2.3 |

| 7 | Salesforce | 2.8 |

| 7 | NextEra Energy | 2.8 |

| 9 | S&P Global | 2.9 |

| 9 | TJX | 2.9 |

| 11 | Goldman Sachs | 3.0 |

| 12 | Abbott | 3.1 |

| 12 | Netflix | 3.1 |

| 12 | Vertex | 3.1 |

| 15 | Nvidia | 3.2 |

| 15 | Mastercard | 3.2 |

| 17 | HCA Healthcare | 3.4 |

| 18 | PayPal | 3.6 |

| 19 | Alphabet | 3.7 |

| 19 | Thermo Fisher Scientific | 3.7 |

Over the years, Apple and Meta have been seen as top companies to work with, with employees enthusiastically praising their cultures, values, benefits, and perks.

However, recent shifts, such as the return-to-office policies and lack of stability, have taken a toll on these companies.

Following the Covid-19 pandemic, Apple instituted a three-day-a-week in-office schedule in 2022. According to Tech.co, 67% of employees expressed dissatisfaction with the policy at that time.

Last year, Meta grabbed headlines by announcing the most significant tech layoff of the year, involving a 13% reduction in staff.

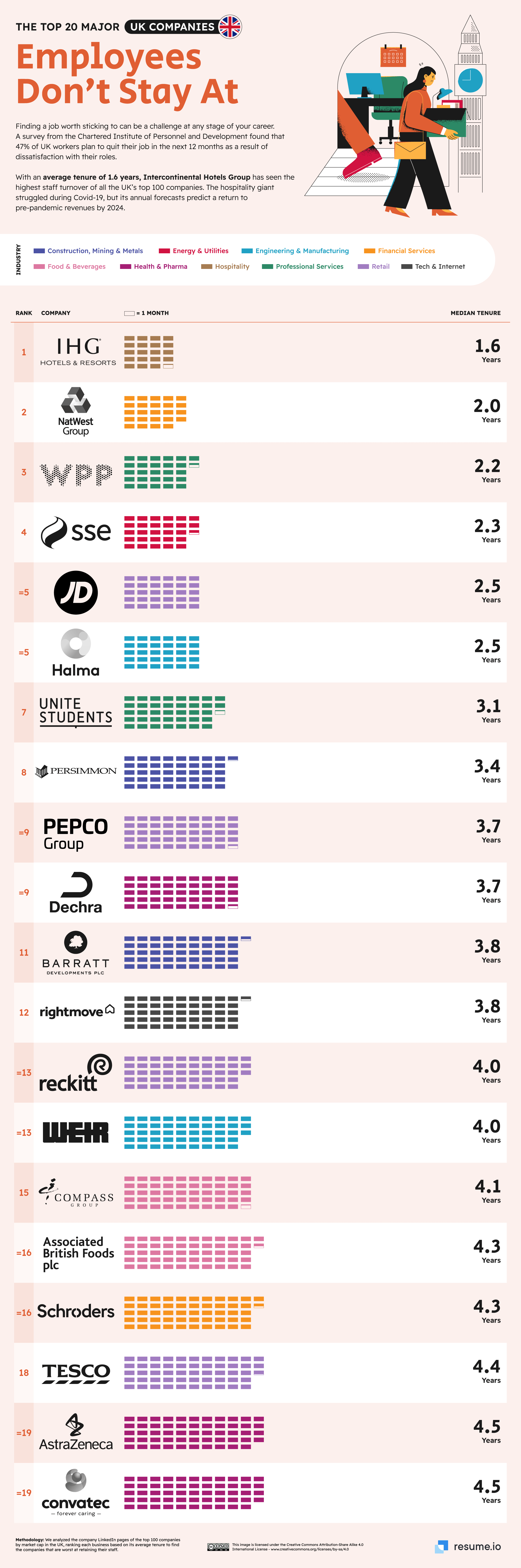

Cost of Living Weighs on UK Employee Retention

Retaining workers has also been a challenge for UK companies.

In fact, recent PwC research found that a fifth (21%) of UK workers are unsatisfied with their current jobs.

The list of worst companies for employee retention in the UK is led by British luxury hotel brand InterContinental Hotels & Resorts, which has a median tenure of 1.6 years.

At the top of the list are also British banking and insurance holding company NatWest Group plc and one of the world’s largest advertising companies, WPP.

Among the top complaints of UK workers are salary and benefits amid an increasingly challenging cost of living. Nearly half (47%) of UK employees have little to nothing left over for savings at the end of each month.

Editor’s Note: This article originally included Elevance Health, but due to the company’s 2022 rebrand, their employee tenures were not tracked consistently. It has since been updated.

This article was published as a part of Visual Capitalist's Creator Program, which features data-driven visuals from some of our favorite Creators around the world.

Brands

How Tech Logos Have Evolved Over Time

From complete overhauls to more subtle tweaks, these tech logos have had quite a journey. Featuring: Google, Apple, and more.

How Tech Logos Have Evolved Over Time

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

One would be hard-pressed to find a company that has never changed its logo. Granted, some brands—like Rolex, IBM, and Coca-Cola—tend to just have more minimalistic updates. But other companies undergo an entire identity change, thus necessitating a full overhaul.

In this graphic, we visualized the evolution of prominent tech companies’ logos over time. All of these brands ranked highly in a Q1 2024 YouGov study of America’s most famous tech brands. The logo changes are sourced from 1000logos.net.

How Many Times Has Google Changed Its Logo?

Google and Facebook share a 98% fame rating according to YouGov. But while Facebook’s rise was captured in The Social Network (2010), Google’s history tends to be a little less lionized in popular culture.

For example, Google was initially called “Backrub” because it analyzed “back links” to understand how important a website was. Since its founding, Google has undergone eight logo changes, finally settling on its current one in 2015.

| Company | Number of Logo Changes |

|---|---|

| 8 | |

| HP | 8 |

| Amazon | 6 |

| Microsoft | 6 |

| Samsung | 6 |

| Apple | 5* |

Note: *Includes color changes. Source: 1000Logos.net

Another fun origin story is Microsoft, which started off as Traf-O-Data, a traffic counter reading company that generated reports for traffic engineers. By 1975, the company was renamed. But it wasn’t until 2012 that Microsoft put the iconic Windows logo—still the most popular desktop operating system—alongside its name.

And then there’s Samsung, which started as a grocery trading store in 1938. Its pivot to electronics started in the 1970s with black and white television sets. For 55 years, the company kept some form of stars from its first logo, until 1993, when the iconic encircled blue Samsung logo debuted.

Finally, Apple’s first logo in 1976 featured Isaac Newton reading under a tree—moments before an apple fell on his head. Two years later, the iconic bitten apple logo would be designed at Steve Jobs’ behest, and it would take another two decades for it to go monochrome.

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001