Markets

The Hardest Hit Companies of the COVID-19 Downturn: The ‘BEACH’ Stocks

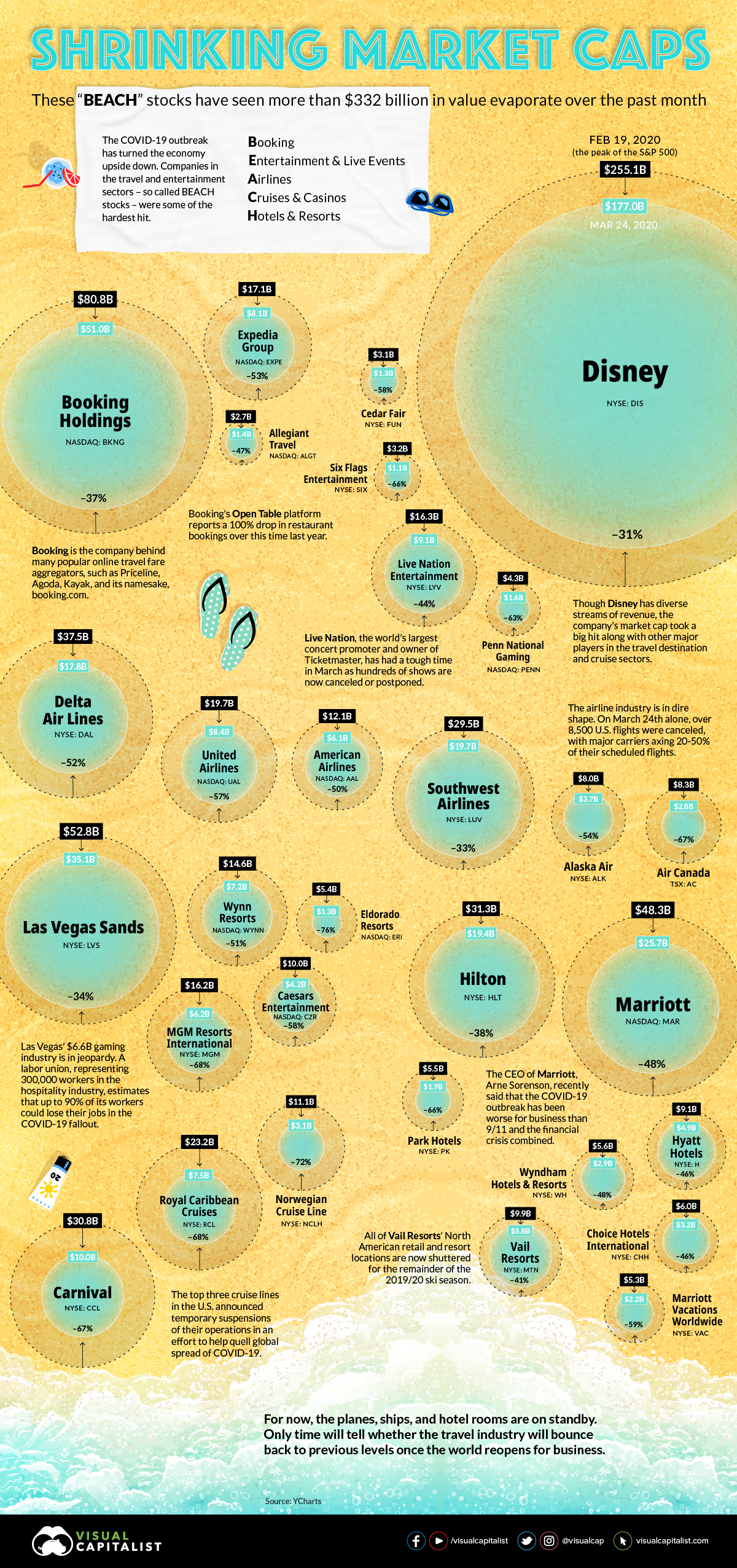

BEACH Stocks: $332B in Value Washed Away

The market’s latest storm has plunged the global travel industry into uncharted territory.

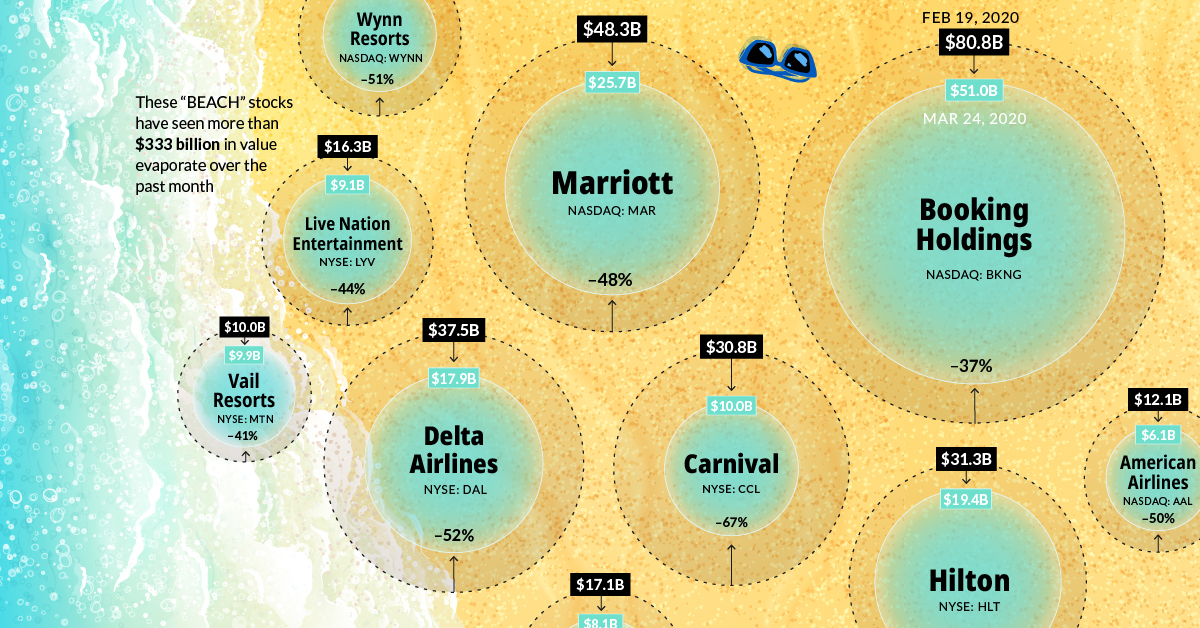

Since the S&P 500 market high on February 19, 2020, market capitalizations across BEACH industries—booking, entertainment, airlines, cruises, and hotels—have tumbled. The global airline industry alone has seen $157B wiped off valuations across 116 publicly traded airlines.

Investor confidence in cruise lines has also dropped. Between Carnival, Royal Caribbean, and Norwegian Cruise Line Holdings, over half of their market value has evaporated—equal to at least $42B in combined market capitalization.

Today’s infographic profiles the steep losses across BEACH companies. It looks at the ripple effects across individual companies and industries from the February 19 peak to date*.

*All numbers as of market close on March 24, 2020

Falling Off A Cliff

As the COVID-19 pandemic has spread to over 100 countries, many governments have implemented sweeping travel restrictions.

The impact across BEACH industries is far-reaching, with some valuations declining to nearly a quarter of their previous total.

| Company | Ticker | Category | Market Cap: 02/19/2020 | Market Cap: 03/24/2020 | % Change |

|---|---|---|---|---|---|

| Booking Holdings | BKNG | Booking | $80.8B | $51B | -37% |

| Expedia Group | EXPE | Booking | $17.1B | $8.1B | -53% |

| Allegiant Travel | ALGT | Booking | $2.7B | $1.4B | -47% |

| Live Nation | LYV | Entertainment & Live Events | $16.3B | $9.1B | -44% |

| Six Flags | SIX | Entertainment & Live Events | $3.2B | $1.1B | -66% |

| Cedar Fair | FUN | Entertainment & Live Events | $3.1B | $1.3B | -58% |

| The Walt Disney Co | DIS | Entertainment & Live Events | $255.1B | $177B | -31% |

| Penn National Gaming | PENN | Entertainment & Live Events | $4.3B | $1.6B | -63% |

| Delta Air Lines | DAL | Airlines | $37.5B | $17.8B | -52% |

| United Airlines | UAL | Airlines | $19.7B | $8.4B | -57% |

| American Airlines | AAL | Airlines | $12.1B | $6.1B | -50% |

| Southwest Airlines | LUV | Airlines | $29.5B | $19.7B | -33% |

| Alaska Air Group | ALK | Airlines | $8B | $3.7B | -54% |

| Air Canada (in USD) | AC | Airlines | $8.3B | $2.8B | -67% |

| Carnival | CCL | Cruise & Casino | $30.8B | $10B | -67% |

| Royal Caribbean Cruises | RCL | Cruise & Casino | $23.2B | $7.5B | -68% |

| Norwegian Cruise Lines | NCLH | Cruise & Casino | $11.1B | $3.1B | -72% |

| Las Vegas Sands | LVS | Cruise & Casino | $52.8B | $35.1B | -34% |

| MGM Resorts International | MGM | Cruise & Casino | $16.2B | $6.2B | -68% |

| Wynn Resorts | WYNN | Cruise & Casino | $14.6B | $7.2B | -51% |

| Caesars Entertainment | CZR | Cruise & Casino | $10B | $4.2B | -58% |

| Eldorado Resorts | ERI | Cruise & Casino | $5.4B | $1.3B | -76% |

| Marriott International | MAR | Hotels & Resorts | $48.3B | $25.7B | -48% |

| Hilton | HLT | Hotels & Resorts | $31.3B | $19.4B | -38% |

| Hyatt Hotels | H | Hotels & Resorts | $9.1B | $4.9B | -46% |

| Choice Hotels International | CHH | Hotels & Resorts | $6B | $3.2B | -46% |

| Wyndham Hotels & Resorts | WH | Hotels & Resorts | $5.6B | $2.9B | -48% |

| Park Hotels | PK | Hotels & Resorts | $5.5B | $1.9B | -66% |

| Vail Resorts | MTN | Hotels & Resorts | $9.98B | $5.8B | -41% |

| Marriott Vacations Worldwide | VAC | Hotels & Resorts | $5.3B | $2.2B | -59% |

For instance, the consequences on various travel bookings brands have been severe. Booking Holdings, the parent company to Booking.com, Priceline, Kayak and OpenTable, witnessed share price declines of over 35% since the peak.

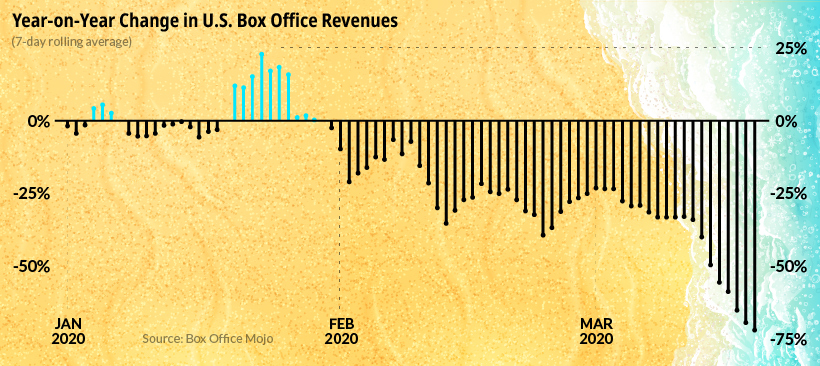

Empty Stadiums

Across the entertainment industry, ticket sales for concerts, movies, and other events are falling precipitously due to cancellations or postponements.

Upwards of $5B in global film industry losses could result from the COVID-19 pandemic.

Chilling footage of the Las Vegas strip, as well as other tourist epicenters around the world, shows deserted streets as visitors opt to stay home instead.

Bracing For Impact

Meanwhile, worldwide airline revenue is estimated to fall by as much as $113B in 2020.

In under two months, the share price of Delta Airlines has fallen over 50% as the company anticipates a capacity reduction of 40%, the largest in its history.

| Company | Ticker | Feb 19 2020 Share Price | Mar 24 2020 Share Price |

|---|---|---|---|

| Delta Air Lines | NYSE:DAL | $58.5 | $26.9 |

| United Airlines | NASDAQ:UAL | $79.4 | $33 |

| American Airlines | NASDAQ:AAL | $28.3 | $13.9 |

| Southwest Airlines | NYSE:LUV | $56.89 | $37.7 |

| Alaska Air Group | NYSE:ALK | $65.2 | $28.9 |

| Air Canada (in CAD) | TSX:AC | $45.3 | $15.1 |

The global airline industry—which employs over 10M people—supports $2.7T in global economic activity across an average of 12M passengers per day.

Aruba, Jamaica No More

As for the cruise line industry, global operations came to a 30-day standstill in mid-March. Over 800 COVID-19 cases and 10 deaths across three cruise ships have been discovered.

“COVID-19 on cruise ships poses a risk for rapid spread of disease, causing outbreaks in a vulnerable population, and aggressive efforts are required to contain spread.”

—CDC

Carnival, a Miami-based company, has witnessed its share price fall to around one third of its February 19 value. Similarly, Royal Caribbean Cruises, which has seen its market cap plummet almost 70%, announced that it will suspend trips until mid-May.

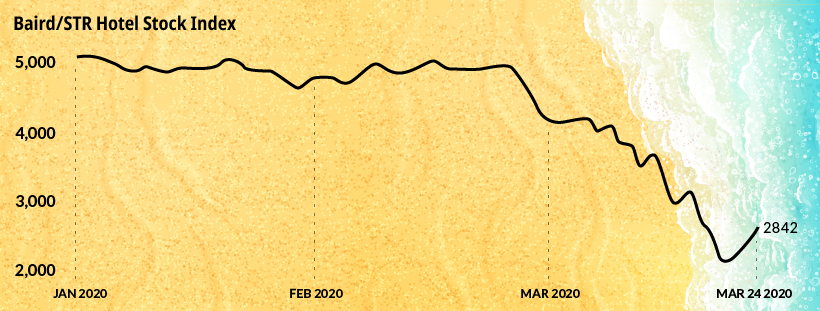

Occupancy Dilemma

As the hotel industry is impacted by the global outbreak, share prices have also realized a significant slump. In the U.S., an estimated $1.4B in revenue is vanishing each week. If occupancy levels fall by just 30% this year, the U.S. hotel industry could see approximately 4 million jobs wiped out.

The Baird/STR Hotel Stock Index, which serves as a benchmark for the sector’s overall health, has declined over 47% year-to-date.

Global Stimulus Response

A number of travel industries around the world are calling for stimulus packages.

On March 25, the U.S. Congress finalized a historic $2T deal, which includes $25B in grants for the airline industry. In the UK, officials are providing small businesses in hospitality and leisure grants that are worth up to $30,000 as part of its $400B bailout plan.

China, Germany, Italy, and Spain have outlined multibillion dollar proposals in response to COVID-19. Overall, at least eleven countries have announced stimulus plans along with the European Commission and the IMF.

When Will the Travel Wave Hit Again?

Amid the COVID-19 pandemic one thing is clear: the impact on the travel industry will have a marked effect on the broader economy.

Travel is closely linked with oil, as transportation accounts for over 60% of global demand. In Q2 2020, global oil consumption is projected to fall by 25M barrels per day.

Along with this, discretionary consumer spending makes up over one third of America’s GDP. The impact of the pandemic across this sector is expected to contribute to a 10% decline or more in U.S. GDP for the second quarter.

As conditions materially improve around the world—with China beginning to open up flights—positive signs are emerging from under the surface. Will BEACH industries quickly bounce back as infection rates drop, or will a slow and painful recovery unfold in the months ahead?

Economy

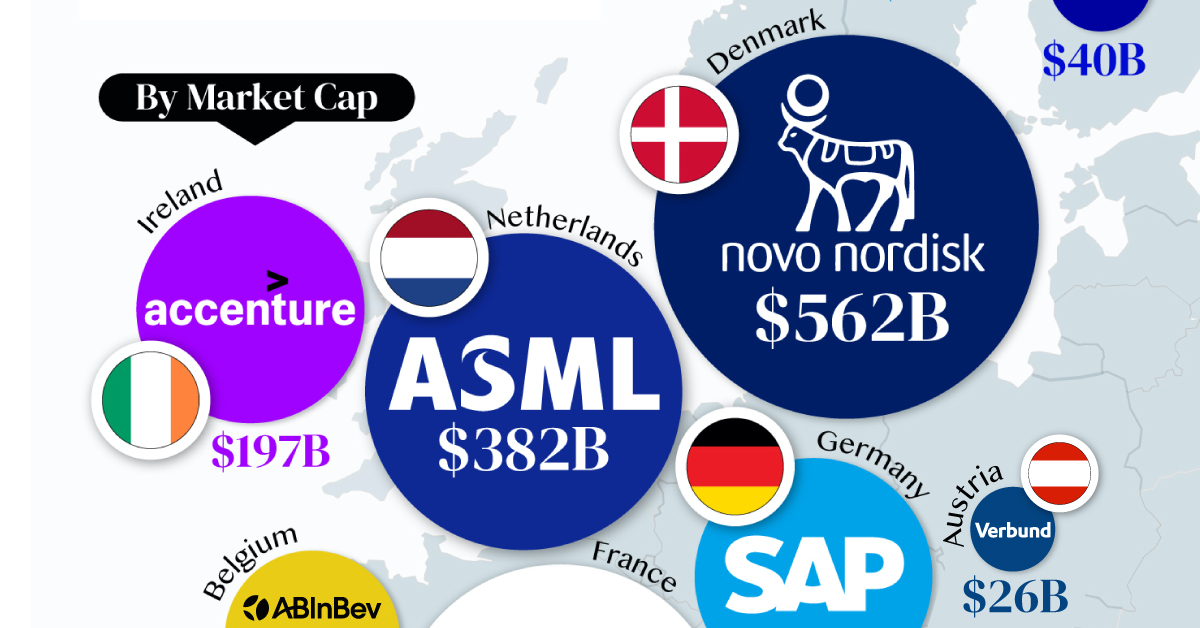

The Most Valuable Companies in Major EU Economies

From semiconductor equipment manufacturers to supercar makers, the EU’s most valuable companies run the gamut of industries.

Most Valuable Companies in the EU, by Country

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

In this graphic, we mapped out the most valuable corporations in 11 major EU economies, based on their market capitalizations as of April 15th, 2024. All figures are in USD, and were sourced from Companiesmarketcap.com.

Novo Nordisk is currently worth more than $550 billion, making it Europe’s most valuable company by a wide margin. The pharmaceutical giant specializes in diabetes and weight-loss drugs. Demand for two of them, Ozempic and Wegovy, has surged due to their weight-loss capabilities, even causing nationwide shortages in the United States.

The following table includes an expanded list of the most valuable publicly-traded company in larger EU economies. Many of these were not included in the graphic due to space limitations.

| Country | Company | Sector | Market Cap |

|---|---|---|---|

| 🇩🇰 Denmark | 💊 Novo Nordisk | Pharmaceuticals | $562B |

| 🇫🇷 France | 👜 LVMH | Luxury Goods | $422B |

| 🇳🇱 Netherlands | 🔧 ASML | Semiconductor Equipment | $382B |

| 🇩🇪 Germany | 💼 SAP | Enterprise Software | $214B |

| 🇮🇪 Ireland | 🖥️ Accenture | IT Services | $197B |

| 🇪🇸 Spain | 👗 Inditex | Retail | $147B |

| 🇧🇪 Belgium | 🍻 Anheuser-Busch InBev | Beverages | $116B |

| 🇸🇪 Sweden | 🛠️ Atlas Copco | Industrial Equipment | $80B |

| 🇮🇹 Italy | 🏎️ Ferrari | Automotive | $76B |

| 🇫🇮 Finland | 🏦 Nordea Bank | Banking | $40B |

| 🇦🇹 Austria | 🔌 Verbund AG | Energy | $26B |

| 🇱🇺 Luxembourg | 🏗️ Tenaris | Oil & Gas Equipment | $22B |

| 🇨🇿 Czech Republic | 💡 CEZ Group | Energy | $20B |

| 🇵🇱 Poland | ⛽ PKN Orlen | Energy | $20B |

| 🇵🇹 Portugal | 🔌 EDP Group | Energy | $16B |

| 🇬🇷 Greece | 🏦 Eurobank | Banking | $7B |

| 🇭🇺 Hungary | ⛽ MOL Group | Energy | $7B |

| 🇭🇷 Croatia | 🏦 Zagrebacka Banka | Banking | $6B |

| 🇷🇴 Romania | ⛽ Romgaz | Energy | $4B |

| 🇸🇮 Slovenia | 💊 Krka | Pharmaceuticals | $4B |

Note: Figures are rounded and last updated on April 15th, 2024. Countries with top publicly-traded companies worth under $4 billion are excluded.

Luxury supergiant LVMH—which owns brands like Tiffany, Christian Dior, and TAG Heuer to name a few—is Europe’s second largest company by market cap, at $420 billion.

Rounding out the top three is ASML, which produces equipment crucial to chip manufacturers, worth $380 billion.

When looking at the region, there is a vast disparity between EU member states and their most valuable companies.

For example, as mentioned earlier, Denmark’s Novo Nordisk and France’s LVMH are worth between $400-550 billion each. Meanwhile, some countries don’t even have a single publicly-listed company that is worth over $1 billion.

In fact, only 12 EU countries (less than half of the union) are home to the top 100 most valuable companies within the bloc. An additional four countries are represented if you look at the list of the top 200 companies.

-

Technology6 days ago

Technology6 days agoAll of the Grants Given by the U.S. CHIPS Act

-

Uranium2 weeks ago

Uranium2 weeks agoThe World’s Biggest Nuclear Energy Producers

-

Education2 weeks ago

Education2 weeks agoHow Hard Is It to Get Into an Ivy League School?

-

Debt2 weeks ago

Debt2 weeks agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Sports2 weeks ago

Sports2 weeks agoThe Highest Earning Athletes in Seven Professional Sports

-

Science2 weeks ago

Science2 weeks agoVisualizing the Average Lifespans of Mammals

-

Brands1 week ago

Brands1 week agoHow Tech Logos Have Evolved Over Time

-

Energy1 week ago

Energy1 week agoRanked: The Top 10 EV Battery Manufacturers in 2023

Can I share this graphic?

Can I share this graphic? When do I need a license?

When do I need a license? Interested in this piece?

Interested in this piece?