Misc

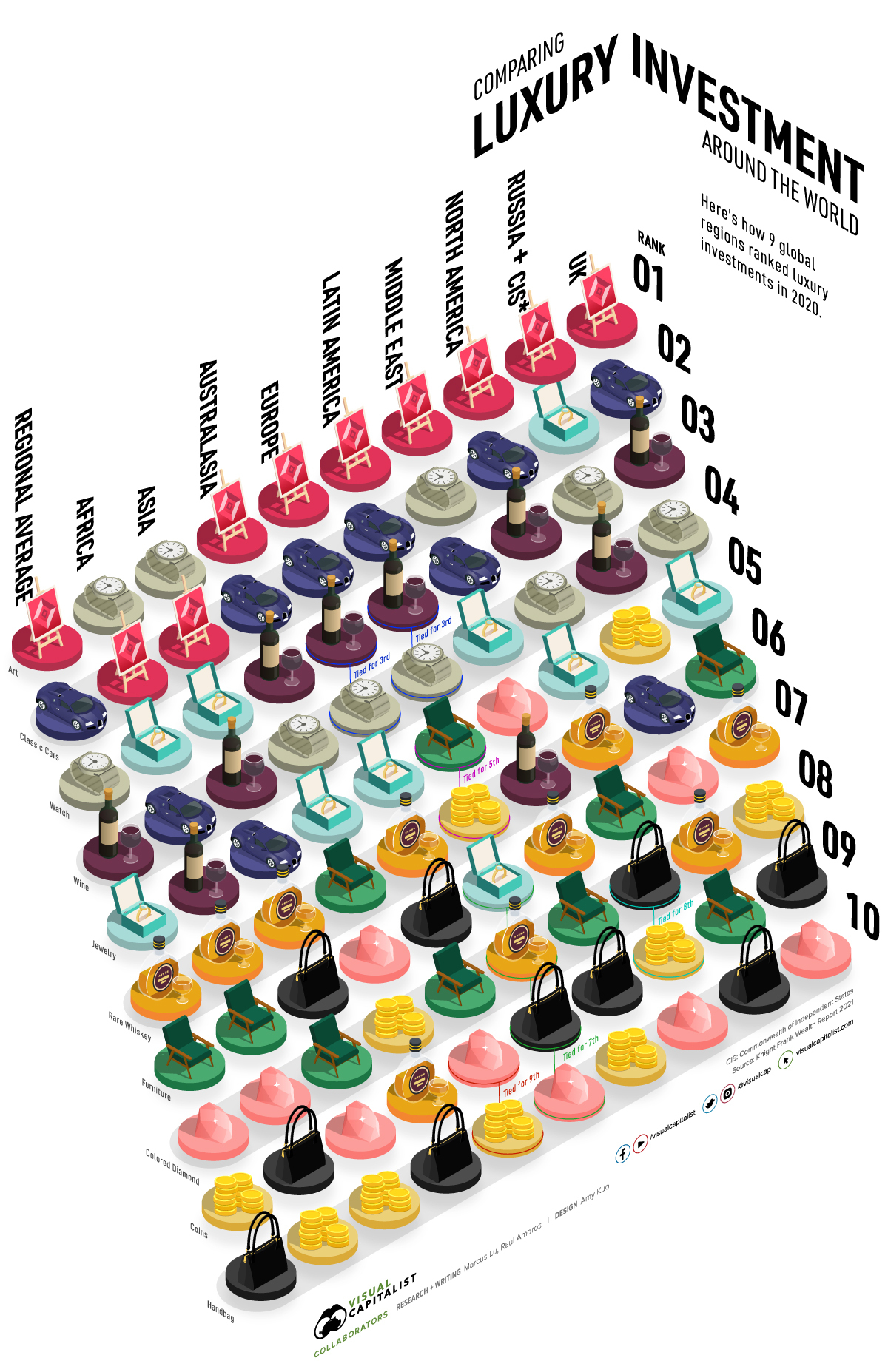

Comparing Luxury Investment Around the World

Comparing Luxury Investment Around the World

Do you enjoy the finer things in life? For many of the world’s wealthy individuals, acquiring luxury goods such as art, fine wine, and watches is a passion.

Unlike traditional investments in financial assets, luxury goods can be difficult to value if one does not have an appreciation for their form. A rare painting, for example, does not generate cash flows, meaning its value is truly in the eye of the beholder.

To gain some insight into the market for luxury goods, this infographic takes data from Knight Frank’s 2021 Wealth Report to compare the preferences of nine global regions.

Global Tastes in Luxury Goods

To rank the most popular luxury investments in 2020, Knight Frank surveyed over 600 private bankers, wealth advisors, and family offices. The following table summarizes their findings, as well as each category’s growth according to the Knight Frank Luxury Investment Index.

| Global Average Ranking | Category | 10-year growth in asset values (%) |

|---|---|---|

| 1 | Art | 71% |

| 2 | Classic cars | 193% |

| 3 | Watches | 89% |

| 4 | Wine | 127% |

| 5 | Jewelry | 67% |

| 6 | Rare whiskey | 478% |

| 7 | Furniture | 22% |

| 8 | Colored diamonds | 39% |

| 9 | Coins | 72% |

| 10 | Handbags | 108% |

Art was unmistakably the top category for 2020, ranking first in every geographic region except Africa and Asia, where it placed second instead. The global market for artwork was estimated to be worth $64 billion in 2019, and is often facilitated through auction houses such as Sotheby’s.

In terms of asset appreciation, rare whiskeys have climbed the most in value over the past 10 years. Connoisseurs of this spirit will be familiar with distilleries like The Macallan, whose rare bottles can sell for more than a million dollars.

Comparing Luxury Investment Between North America and Asia

Below, we’ve compared the rankings of Asia and North America to get a better idea of how preferences can vary.

The biggest differences here are watches, which ranked first in Asia but fourth in North America, and classic cars, which ranked second in North America but fifth in Asia. The remaining eight categories took similar spots across the two regions.

| Rank | Asia Popularity | North America Popularity |

|---|---|---|

| 1 | Watches | Art |

| 2 | Art | Classic cars |

| 3 | Jewelry | Wine |

| 4 | Wine | Watches |

| 5 | Classic cars | Jewelry |

| 6 | Rare whiskey | Rare whiskey |

| 7 | Handbags | Furniture |

| 8 | Furniture | Handbags |

| 9 | Colored diamonds | Coins (tied for 8th place) |

| 10 | Coins | Colored diamonds |

Asia’s stronger preference for watches was likely driven by Chinese consumers, who are now the biggest buyers of luxury watches globally. Demand throughout the COVID-19 pandemic proved resilient, with exports of Swiss watches to China increasing by 17.1% between January and November 2020.

Classic cars, on the other hand, may be more popular in North America due to the region’s longer automotive history. Two of America’s most iconic automakers, Ford and General Motors, have both been around for over a century!

The Biggest Sales of 2020

Here were some of the most extravagant and noteworthy luxury sales from 2020.

Art

Francis Bacon’s 1981 Triptych Inspired by the Oresteia of Aeschylus was sold by Sotheby’s for $84.6 million in June 2020. A triptych is an artwork that is divided into three sections but displayed as a single piece.

Other paintings by Francis Bacon have sold for even larger amounts. In 2013, Three Studies of Lucian Freud was sold by Christie’s auction house for $142 million.

Classic Cars

A 1932 Bugatti Type 55 Super Sport Roadster sold for $7.1 million in March 2020, making it one of the biggest classic car sales of the year.

Founded in 1909, Bugatti has produced some of the world’s most sought-after cars. The French brand was acquired by the Volkswagen Group in 1998, and since then, has released numerous special edition cars with price tags reaching well into the millions.

Handbags

An Hermès Himalaya Niloticus Crocodile Retourné Kelly 25 sold for $437,330 in November 2020, becoming the most expensive handbag ever sold at an auction. Founded in 1837, Hermès is commonly regarded as one of the world’s most prestigious makers of handbags.

COVID-19 Dampens Luxury Investment

When compared to 2019, total sales for Sotheby’s declined 16% in 2020, while Christie’s, another leading auction house, reported a 25% decline. Despite these decreases, executives remain optimistic.

“The art and luxury markets have proven to be incredibly resilient, and demand for quality across categories is unabated.”

– Charles Stewart, CEO, Sotheby’s

The industry has been largely successful in transitioning to online operations, with Sotheby’s reporting that 70% of its auctions in 2020 were held online, up from 30% in the previous year.

VC+

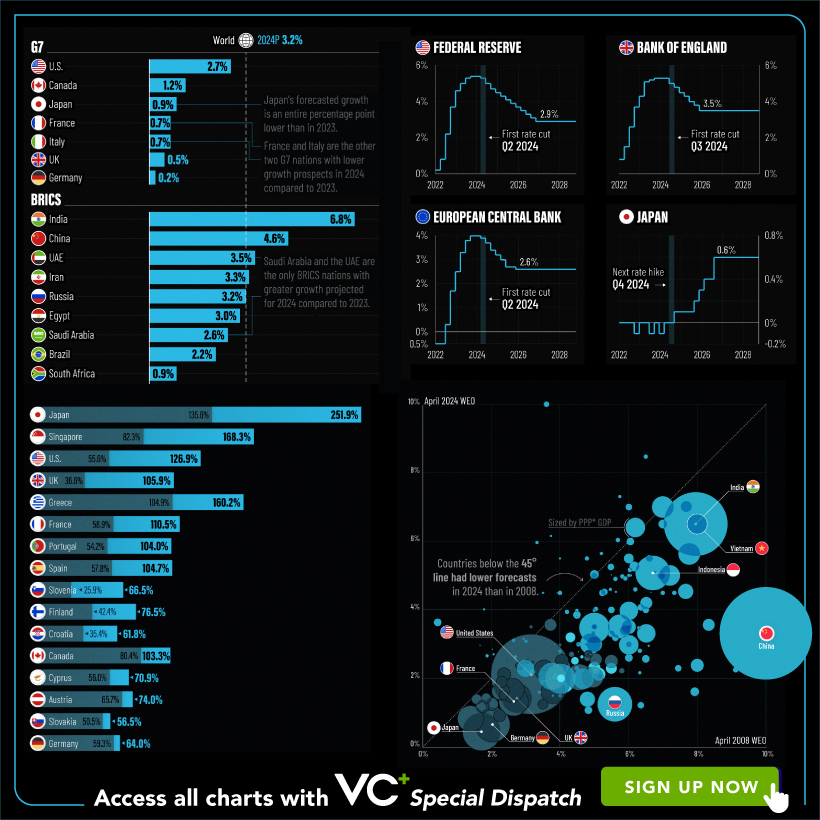

VC+: Get Our Key Takeaways From the IMF’s World Economic Outlook

A sneak preview of the exclusive VC+ Special Dispatch—your shortcut to understanding IMF’s World Economic Outlook report.

Have you read IMF’s latest World Economic Outlook yet? At a daunting 202 pages, we don’t blame you if it’s still on your to-do list.

But don’t worry, you don’t need to read the whole April release, because we’ve already done the hard work for you.

To save you time and effort, the Visual Capitalist team has compiled a visual analysis of everything you need to know from the report—and our VC+ Special Dispatch is available exclusively to VC+ members. All you need to do is log into the VC+ Archive.

If you’re not already subscribed to VC+, make sure you sign up now to access the full analysis of the IMF report, and more (we release similar deep dives every week).

For now, here’s what VC+ members get to see.

Your Shortcut to Understanding IMF’s World Economic Outlook

With long and short-term growth prospects declining for many countries around the world, this Special Dispatch offers a visual analysis of the key figures and takeaways from the IMF’s report including:

- The global decline in economic growth forecasts

- Real GDP growth and inflation forecasts for major nations in 2024

- When interest rate cuts will happen and interest rate forecasts

- How debt-to-GDP ratios have changed since 2000

- And much more!

Get the Full Breakdown in the Next VC+ Special Dispatch

VC+ members can access the full Special Dispatch by logging into the VC+ Archive, where you can also check out previous releases.

Make sure you join VC+ now to see exclusive charts and the full analysis of key takeaways from IMF’s World Economic Outlook.

Don’t miss out. Become a VC+ member today.

What You Get When You Become a VC+ Member

VC+ is Visual Capitalist’s premium subscription. As a member, you’ll get the following:

- Special Dispatches: Deep dive visual briefings on crucial reports and global trends

- Markets This Month: A snappy summary of the state of the markets and what to look out for

- The Trendline: Weekly curation of the best visualizations from across the globe

- Global Forecast Series: Our flagship annual report that covers everything you need to know related to the economy, markets, geopolitics, and the latest tech trends

- VC+ Archive: Hundreds of previously released VC+ briefings and reports that you’ve been missing out on, all in one dedicated hub

You can get all of the above, and more, by joining VC+ today.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees