Blockchain

Blockchain Governance: How Boundaries Can Help the Blockchain to Scale

How Boundaries Can Help the Blockchain to Scale

The blockchain offers a long overdue upgrade for our changing economy.

However, the world isn’t quite ready for broadscale blockchain adoption. The technology is still in its relative infancy, and to reach its true potential the blockchain must be able to successfully replace existing systems while also operating at meaningful scale.

Today’s infographic comes to us from eXeBlock Technology, and it explores how good blockchain governance can help solve the pressing challenges around blockchain adoption and implementation, including the ever-present issue of scalability.

So You Say You Want A Blockchain

While it’s relatively easy to implement a blockchain in an organization, it’s far more difficult to decide just how that network should operate. For a blockchain to generate and hold any real competitive advantage, there are a few key questions to consider:

Scalability

How big can you grow before sacrificing efficiency? As the blockchain grows, so do the number of nodes to process transactions. This creates a bottleneck and slows down the system.

Privacy

What are your privacy needs? The attraction of the blockchain lies in its ability to decentralize information and make it transparent, but this creates a challenge for corporations who use the blockchain to handle sensitive or proprietary information.

Interoperability

Will your blockchain play nicely with other blockchains? There are a number of blockchain configurations – and to date, no cross-industry standards. This means your blockchain might not collaborate smoothly with another blockchain, particularly if the security standards are mismatched.

How Can Blockchain Governance Help?

Blockchain governance is concerned with solving these problems by:

- Reducing scalability obstacles by finding ways for blockchains to reach consensus faster without sacrificing decentralization

- Providing a foundation for shared standards, so organizations can collaborate without risking the privacy of their data

- Providing a framework for adaptability – a playbook for the blockchain to rely on when inevitable problems and security issues crop up

Think of governance as a constitution to help the blockchain run smoothly: it improves efficiency, encourages collaboration, and outlines a course of action when the system falters.

Types of Blockchains

There are four different types of blockchains, each with unique characteristics:

Federated

- Operates under the leadership of a group, and access is limited to only members of the group

- Due to limited membership, they are faster, can scale higher, and offer more transaction privacy

Permissioned/private

- Access might be public or restricted, but only a few users are given permission to view and verify transactions

- Ideal for database management or auditing services, where data privacy is an issue

- Compliance can be automated, as the organization has control over the code

Permissionless/public

- Open-source and available to the public

- Transactions are transparent to anyone on the network with a block viewer, but anonymous.

- The ultimate democracy – this fully distributed ledger disrupts current business models by removing the middleman

- Minimal costs involved: no need to maintain servers or system admins

Hybrid

- A public blockchain, which hosts a private network with restricted participation

- The private network generates blocks of hashed data stored on the public blockchain, but without sacrificing data privacy

- Flexible control over what data is kept private and what is shared on the public ledger

- Hybrid blockchains offer the benefits of decentralisation and scalability, without requiring consensus from every single node on the network

Within each of these systems, blockchain governance outlines different standards for privacy and security. Governance determines how consensus is reached, and how many nodes are required. It establishes who has access to what information, and how that data is encrypted. Governance sets up the foundations for blockchains to scale according to the needs of the organization.

Blockchain governance exists to smooth the transition to widespread adoption, providing organizations with dynamic solutions to make their blockchain suit their needs without sacrificing the security of decentralization.

Green

The Carbon Emissions of Gold Mining

Gold has a long history as a precious metal, but just how many carbon emissions does mining it contribute to?

The Carbon Emissions of Gold Mining

As companies progress towards net-zero goals, decarbonizing all sectors, including mining, has become a vital need.

Gold has a long history as a valuable metal due to its rarity, durability, and universal acceptance as a store of value. However, traditional gold mining is a process that is taxing on the environment and a major contributor to the increasing carbon emissions in our atmosphere.

The above infographic from our sponsor Nature’s Vault provides an overview of the global carbon footprint of gold mining.

The Price of Gold

To understand more about the carbon emissions that gold mining contributes to, we need to understand the different scopes that all emissions fall under.

In the mining industry, these are divided into three scopes.

- Scope 1: These include direct emissions from operations.

- Scope 2: These are indirect emissions from power generation.

- Scope 3: These cover all other indirect emissions.

With this in mind, let’s break down annual emissions in CO2e tonnes using data from the World Gold Council as of 2019. Note that total emissions are rounded to the nearest 1,000.

| Scope | Type | CO2e tonnes |

|---|---|---|

| 1 | Mining, milling, concentrating and smelting | 45,490,000 |

| 2 | Electricity | 54,914,000 |

| 3 | Suppliers, goods, and services | 25,118,000 |

| 1,2,3 | Recycled Gold | 4,200 |

| 3 | Jewelry | 828,000 |

| 3 | Investment | 4,500 |

| 3 | Electronics | 168 |

| TOTAL | 126,359,000 |

Total annual emissions reach around 126,359,000 CO2e tonnes. To put this in perspective, that means that one year’s worth of gold mining is equivalent to burning nearly 300 million barrels of oil.

Gold in Nature’s Vault

A significant portion of gold’s downstream use is either for private investment or placed in banks. In other words, a large amount of gold is mined, milled, smelted, and transported only to be locked away again in a vault.

Nature’s Vault is decarbonizing the gold mining sector for both gold and impact investors by eliminating the most emission-intensive part of the mining process—mining itself.

By creating digital assets like the NaturesGold Token and the Pistol Lake NFT that monetize the preservation of gold in the ground, emissions and the environmental damage associated with gold mining are avoided.

How Does it Work?

Through the same forms of validation used in traditional mining by Canada’s National Instrument NI 43-101 and Australia’s Joint Ore Reserve Committee (JORC), Nature’s Vault first determines that there is gold in an ore body.

Then, using blockchain and asset fractionalization, the mineral rights and quantified in-ground gold associated with these mineral rights are tokenized.

This way, gold for investment can still be used without the emission-intensive process that goes into mining it. Therefore, these digital assets are an environmentally-friendly alternative to traditional gold investments.

Click here to learn more about gold in Nature’s Vault.

-

Green2 days ago

Green2 days agoThe Carbon Footprint of Major Travel Methods

Going on a cruise ship and flying domestically are the most carbon-intensive travel methods.

-

Green2 weeks ago

Green2 weeks agoRanking the Top 15 Countries by Carbon Tax Revenue

This graphic highlights France and Canada as the global leaders when it comes to generating carbon tax revenue.

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023

South Asian nations are the global hotspot for pollution. In this graphic, we rank the world’s most polluted countries according to IQAir.

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

One country is taking reforestation very seriously, registering more than 400,000 square km of forest growth in two decades.

-

Green3 weeks ago

Green3 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

The country with the most forest loss since 2001 lost as much forest cover as the next four countries combined.

-

Agriculture2 months ago

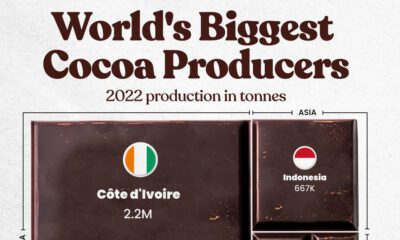

Agriculture2 months agoThe World’s Top Cocoa Producing Countries

Here are the largest cocoa producing countries globally—from Côte d’Ivoire to Brazil—as cocoa prices hit record highs.

-

Brands6 days ago

Brands6 days agoHow Tech Logos Have Evolved Over Time

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023

-

Green2 weeks ago

Green2 weeks agoRanking the Top 15 Countries by Carbon Tax Revenue