A Guide to Cannabis in the U.S.

A Guide to Cannabis in the U.S.

Providing an overview of the status of cannabis in the U.S. is challenging at best. On the federal level, things are fairly straight forward. Cannabis is federally illegal and has been for 88 years and counting. Getting down to the state level, however, changes things.

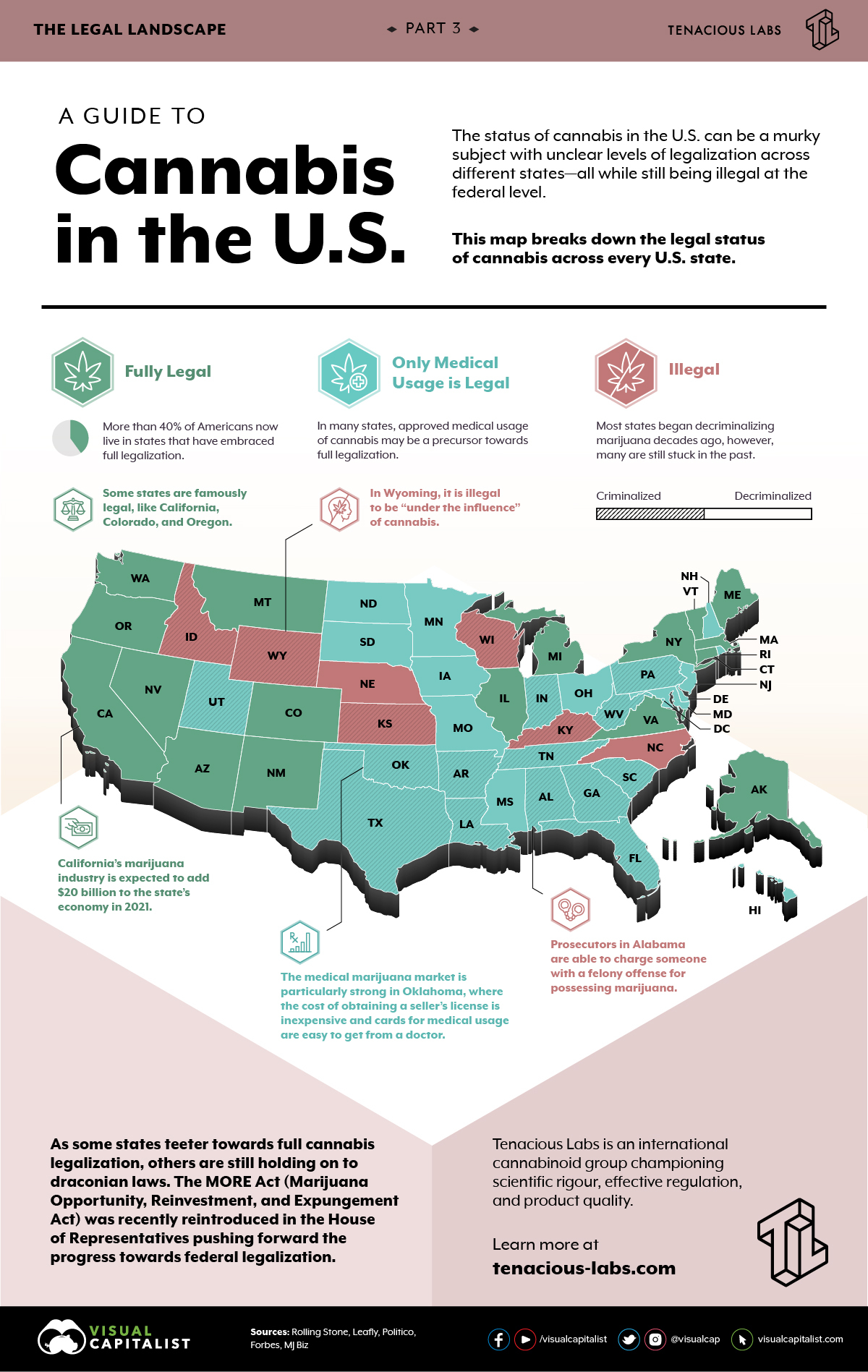

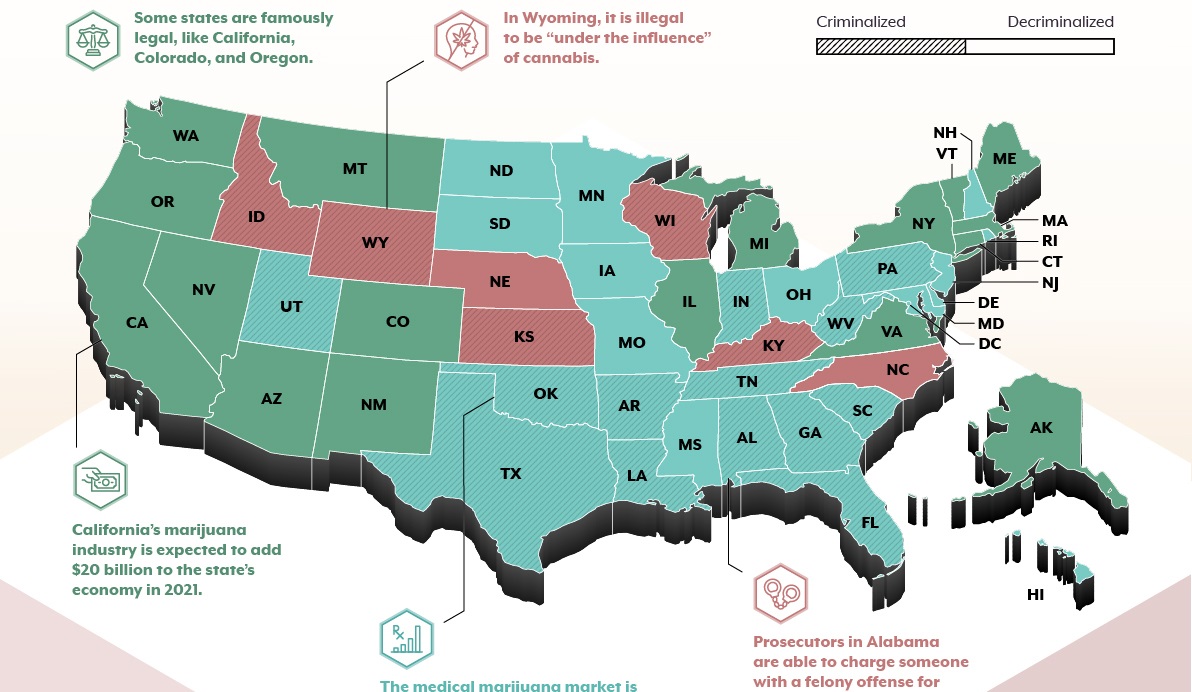

This map from Tenacious Labs breaks down the legal status of cannabis across every U.S. state, and details how lenient each one is when it comes to criminalization.

No Cannabis Allowed

Cannabis—the plant from which marijuana is made—is still considered a dangerous and criminal substance in many U.S. states. In fact, there are six states where cannabis is illegal, of which five are yet to decriminalize. This means an individual can be criminally prosecuted for possessing certain amounts.

| State | Legal Status | Decriminalized? |

|---|---|---|

| Wyoming | Illegal | No |

| Wisconsin | Illegal | No |

| Kentucky | Illegal | No |

| Kansas | Illegal | No |

| Idaho | Illegal | No |

| Nebraska | Illegal | Yes |

Most states began decriminalizing marijuana decades ago, but not all have chosen to partake in this trend. Prosecutors in Alabama for example are able to charge someone with a felony offense for possessing marijuana.

In most states where cannabis is illegal, it is not decriminalized. In particular, only one illegal state has decriminalized the substance—Nebraska.

Medical Use Only

In some U.S. states, approved medical usage of cannabis could be a precursor towards full legalization. Just as it was for states like California and Oregon. However, some states that allow medical usage have chosen not to decriminalize cannabis for recreational purposes.

| State | Legal Status | Decriminalized? |

|---|---|---|

| West Virginia | Medical | No |

| Utah | Medical | No |

| Rhode Island | Medical | Yes |

| Pennsylvania | Medical | No |

| Oklahoma | Medical | No |

| Ohio | Medical | Yes |

| North Dakota | Medical | Yes |

| New Hampshire | Medical | Yes |

| Missouri | Medical | Yes |

| Mississippi | Medical | Yes |

| Minnesota | Medical | Yes |

| Maryland | Medical | Yes |

| Louisiana | Medical | No |

| Iowa | Medical | No |

| Hawaii | Medical | Yes |

| Florida | Medical | No |

| Delaware | Medical | Yes |

| Arkansas | Medical | No |

| Tennessee | Medical | No |

| Texas | Medical | No |

| Alabama | Medical | No |

| Georgia | Medical | No |

| Indiana | Medical | No |

| North Carolina | Medical | Yes |

| South Carolina | Medical | No |

| South Dakota | Medical | No |

Many states have lists of qualifying conditions which allow a person to carry prescribed amounts of cannabis—often for ailments like glaucoma or cancer. States like Iowa allow cannabis to treat medical conditions, but only if it is CBD-based rather than THC-based.

Interestingly enough, all CBD-based cannabis products with THC levels less than or equal to 0.3% are fully legal on a federal level.

Cannabis Allowed

Some states are famously legal, like Colorado. The legalization of cannabis in Colorado, for example, has added numerous jobs, investments, and a new market to the economy—not to mention billions of dollars.

| State | Legal Status | Decriminalized? |

|---|---|---|

| Washington, DC | Adult use | Yes |

| Washington | Adult use | Yes |

| Virginia | Adult use | Yes |

| Vermont | Adult use | Yes |

| Oregon | Adult use | Yes |

| New York | Adult use | Yes |

| New Mexico | Adult use | Yes |

| New Jersey | Adult use | Yes |

| Nevada | Adult use | Yes |

| Montana | Adult use | Yes |

| Michigan | Adult use | Yes |

| Massachusetts | Adult use | Yes |

| Maine | Adult use | Yes |

| Illinois | Adult use | Yes |

| Colorado | Adult use | Yes |

| California | Adult use | Yes |

| Arizona | Adult use | Yes |

| Alaska | Adult use | Yes |

| Connecticut | Adult Use | Yes |

Overall, there are 18 states (and Washington D.C.) which have fully legalized cannabis—allowing both medical and recreational usage—and over 20 which have legalized cannabis for medical use only.

With the current Democratic government, federal legalization seems more likely. In fact, the MORE Act (Marijuana Opportunity, Reinvestment, and Expungement Act) was recently reintroduced in the House of Representatives pushing forward the progress for federal cannabis legalization in America.

In the next part of The Legal Landscape Series, we will take a deep dive into the evolution of cannabis markets.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology…

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.