A Bird’s Eye View of the World’s Largest Cannabis Markets

A Bird’s Eye View of the World’s Largest Cannabis Markets

North America and Europe are home to some of the world’s most famous cannabis cultures, such as California and Amsterdam.

However, even in these undoubtedly successful markets, cannabis legality varies by country—and as this graphic by Tenacious Labs explores, so does its subsequent market value.

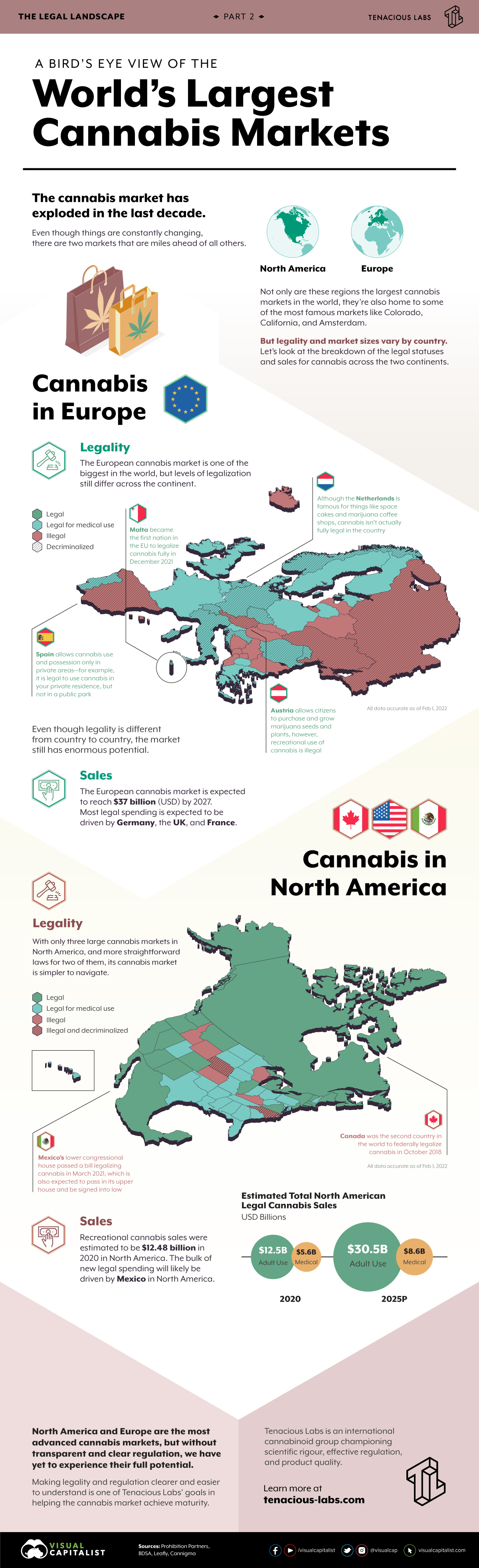

The European Cannabis Market

Although the European Union is one single economic market with agreed upon laws and regulations, individual countries still have their say on national laws. Looking at Europe as a region reshapes things again as countries like the UK are outside the EU—further muddying cannabis laws and regulation.

Here is an overview of cannabis’ legal status by European country:

| Country | Legal Status |

|---|---|

| 🇦🇱 Albania | Illegal |

| 🇦🇩 Andorra | Illegal |

| 🇦🇲 Armenia | Illegal |

| 🇦🇹 Austria | Illegal, decriminalized |

| 🇧🇾 Belarus | Illegal |

| 🇧🇦 Bosnia and Herzegovina | Illegal |

| 🇧🇪 Belgium | Legal for medical use |

| 🇧🇬 Bulgaria | Illegal |

| 🇨🇿 Czech Republic | Legal for medical use, decriminalized |

| 🇭🇷 Croatia | Legal for medical use, decriminalized |

| 🇩🇰 Denmark | Legal for medical use |

| 🇪🇪 Estonia | Legal for medical use |

| 🇫🇮 Finland | Legal for medical use |

| 🇫🇷 France | Legal for medical use |

| 🇬🇪 Georgia | Illegal |

| 🇩🇪 Germany | Legal for medical use, decriminalized |

| 🇬🇷 Greece | Legal for medical use |

| 🇭🇺 Hungary | Illegal |

| 🇮🇸 Iceland | Illegal |

| 🇮🇪 Ireland | Legal for medical use |

| 🇮🇹 Italy | Legal for medical use, decriminalized |

| 🇽🇰 Kosovo | Illegal |

| 🇱🇻 Latvia | Illegal |

| 🇱🇮 Liechtenstein | Illegal |

| 🇱🇹 Lithuania | Legal for medical use |

| 🇱🇺 Luxembourg | Legal for medical use, decriminalized |

| 🇲🇹 Malta | Legal |

| 🇲🇩 Moldova | Illegal, decriminalized |

| 🇲🇨 Monaco | Illegal |

| 🇲🇪 Montenegro | Illegal |

| 🇳🇱 Netherlands | Legal for medical use, decriminalized |

| 🇲🇰 North Macedonia | Legal for medical use |

| 🇳🇴 Norway | Legal for medical use, decriminalized |

| 🇵🇱 Poland | Legal for medical use |

| 🇵🇹 Portugal | Legal for medical use, decriminalized |

| 🇷🇴 Romania | Legal for medical use, decriminalized |

| 🇷🇺 Russia | Illegal, decriminalized |

| 🇸🇲 San Marino | Legal for medical use |

| 🇷🇸 Serbia | Illegal |

| 🇸🇰 Slovakia | Illegal |

| 🇸🇮 Slovenia | Legal for medical use |

| 🇪🇸 Spain | Illegal, decriminalized |

| 🇸🇪 Sweden | Legal for medical use |

| 🇨🇭 Switzerland | Legal for medical use, decriminalized |

| 🇺🇦 Ukraine | Illegal, decriminalized |

| 🇬🇧 United Kingdom | Legal for medical use |

Regardless, there is immense potential in the European cannabis market—it is expected to be worth $37 billion by 2027. The biggest markets driving this are Germany, the UK, and France.

As of December 2021, Malta became the first European country to fully legalize recreational cannabis. Three other countries have also started the process towards legalization, and a number of others are expected to fully legalize in the next few years, namely:

- Germany

- Luxembourg

- The Netherlands

- Spain

- Switzerland

On average, 1 in 10 Europeans use cannabis every year. With little legality for recreational cannabis, this high demand has to be met by the illegal market. As a result, yearly illicit cannabis market sales are estimated at around €11 billion (US$13 billion)—representing significant untapped potential.

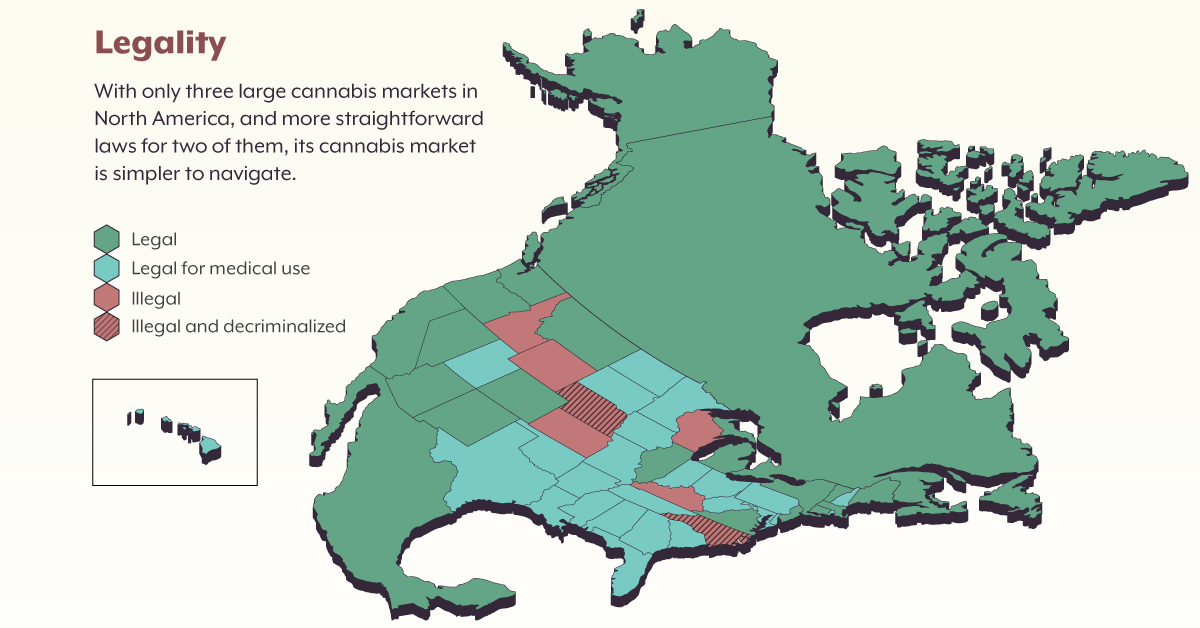

The North American Cannabis Market

The U.S., Canada, and Mexico make up the world’s largest continental cannabis market, worth $18.1 billion in 2020. In Canada, cannabis is federally legal, and Mexico will soon be in the same boat. The U.S., however, is a different story.

America’s stance on cannabis legality varies on a state-by-state basis. Federally, cannabis is illegal—listed as a Schedule I drug, alongside heroin. But individual states have their own laws, from states with fully legal recreational cannabis to medical usage only permitted, and full illegality.

| State | Status |

|---|---|

| Alabama | Legal for medical use |

| Alaska | Legal |

| Arizona | Legal |

| Arkansas | Legal for medical use |

| California | Legal |

| Colorado | Legal |

| Connecticut | Legal |

| Delaware | Legal for medical use |

| Florida | Legal for medical use |

| Georgia | Legal for medical use |

| Hawaii | Legal for medical use |

| Idaho | Illegal |

| Illinois | Legal |

| Indiana | Legal for medical use |

| Iowa | Legal for medical use |

| Kansas | Illegal |

| Kentucky | Illegal |

| Louisiana | Legal for medical use |

| Maine | Legal |

| Maryland | Legal for medical use |

| Massachusetts | Legal |

| Michigan | Legal |

| Minnesota | Legal for medical use |

| Mississippi | Legal for medical use |

| Missouri | Legal for medical use |

| Montana | Legal |

| Nebraska | Illegal, decriminalized |

| Nevada | Legal |

| New Hampshire | Legal for medical use |

| New Jersey | Legal |

| New Mexico | Legal |

| New York | Legal |

| North Carolina | Legal for medical use |

| North Dakota | Legal for medical use |

| Ohio | Legal for medical use |

| Oklahoma | Legal for medical use |

| Oregon | Legal |

| Pennsylvania | Legal for medical use |

| Rhode Island | Legal for medical use |

| South Carolina | Legal for medical use |

| South Dakota | Legal for medical use |

| Tennessee | Legal for medical use (Limited) |

| Texas | Legal for medical use (Limited) |

| Utah | Legal for medical use |

| Vermont | Legal |

| Virginia | Legal |

| Washington | Legal |

| Washington, DC | Legal |

| West Virginia | Legal for medical use |

| Wisconsin | Illegal |

| Wyoming | Illegal |

The U.S. has the biggest cannabis market potential in North America by far.

In states where cannabis has been fully legal for years—like Colorado—countless jobs and revenue have been added to the state’s economy and in such markets, regulation is pushing the industry towards maturity. In contrast, in states like Wyoming it is still illegal to be ‘under the influence’ of cannabis.

This stark contrast within one country hinders the market potential of the entire continent. However, the MORE (Marijuana Opportunity Reinvestment and Expungement) Act was recently reintroduced in the U.S.’ House of Representatives. If passed, it would remove cannabis from its classification as a Schedule I drug.

Cannabis Markets with Huge Potential

North America and Europe are the most advanced cannabis markets, but without transparent and clear regulation, we have yet to experience their full potential.

Treaties like USMCA in North America, and the economic union for most European countries, offer the chance for the world to benefit from the highly lucrative cannabis market.

In the next part of The Legal Landscape Series, we will take a deep dive into the cannabis market in the United States.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology…

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.