Technology

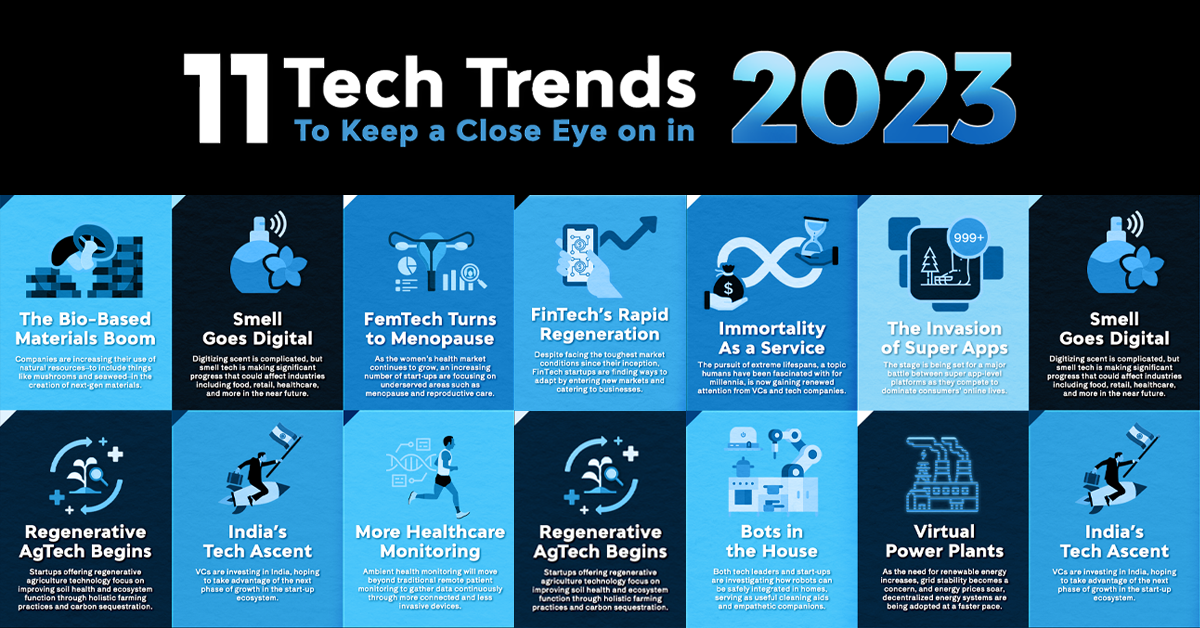

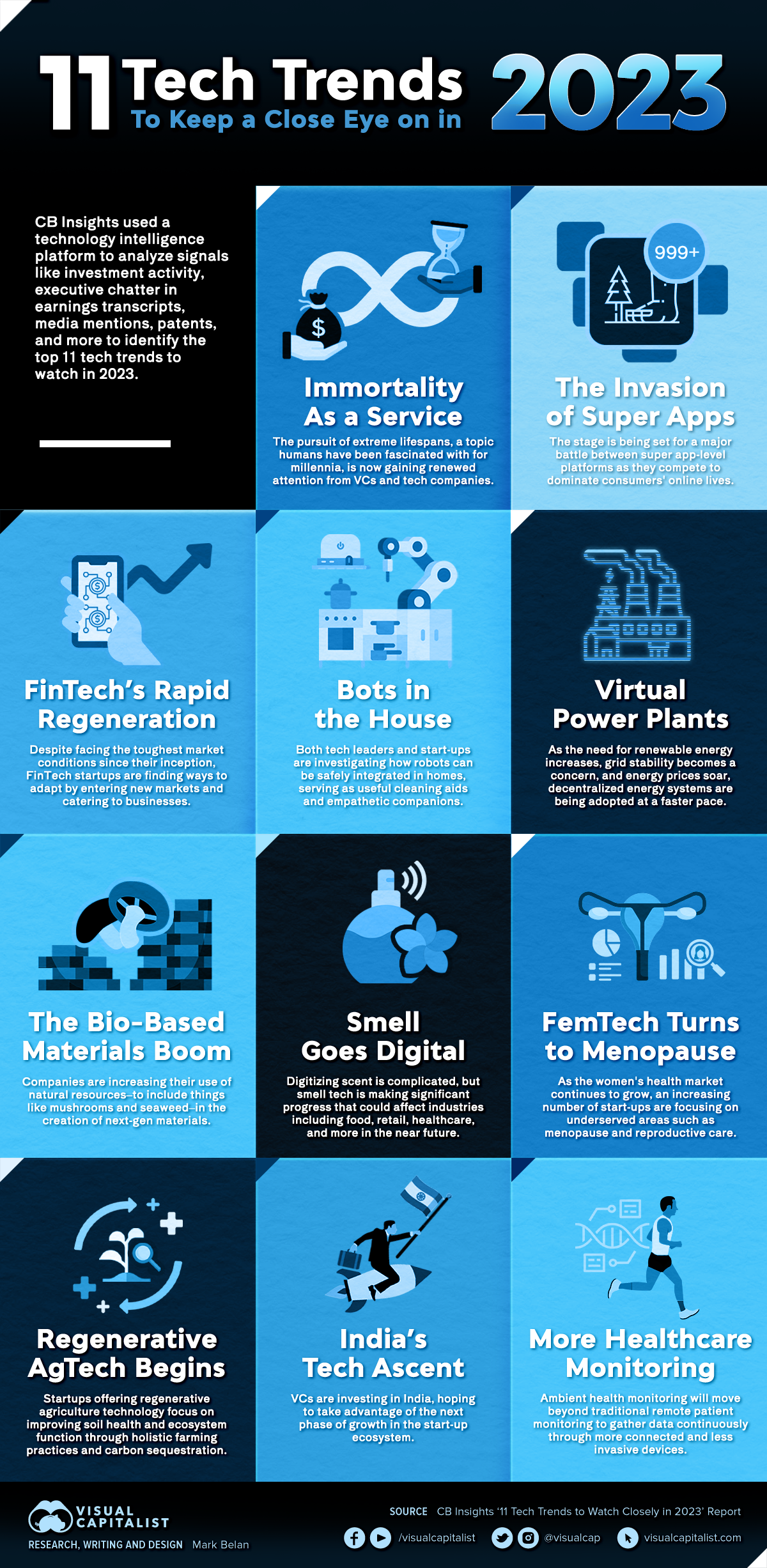

Infographic: 11 Tech Trends to Watch in 2023

Infographic: 11 Tech Trends to Watch in 2023

It can be tough to keep up with the rapid pace of innovation.

Each new year delivers the full spectrum of progress from game-changing breakthroughs to incremental advancements in a wide variety of fields.

In a noisy media landscape fueled by hype and speculation, it can be tough to know where true value is being created. The infographic above, which draws from CB Insights’ recent report on 11 Tech Trends To Watch Closely in 2023, helps narrow down some areas of focus:

- Immortality-as-a-service

- The secret invasion of super apps

- Fintech’s rapid regeneration

- Bots in the house

- Virtual power plants

- Healthcare’s invisibility trick

- Smell goes digital

- Femtech turns to menopause

- The bio-based materials boom

- India’s tech ascent

- Regenerative agtech takes root

The report draws information from earnings transcripts, media mentions, investment activity, patents, and more to arrive at the trends listed.

We’ll examine three of these trends below in a bit more detail.

Setting the Stage: Clash of the Super Apps

The concept of a super app—an all-in-one smartphone application that integrates a wide range of services—is far from new. In fact, for years now, WeChat has been the go-to app for many Chinese citizens to chat, order services, pay bills, and more.

A natural question comes to mind: why doesn’t an app like that exist in Western countries yet? Well, there are a couple of key reasons:

- Consumers and regulators alike are wary of providers holding so much personal information and power. In China, WeChat actually had government support, integrating public services into the app. As well, expectations of personal privacy are completely different in China than in Western countries

- Unlike China, which rapidly adopted digital payments, North America and Europe had preexisting near-ubiquitous financial networks in place. Super apps were a game changer for millions of unbanked consumers in China and beyond.

The situation is changing rapidly though, and 2023 could be the year that the foundations are laid for a clash of various Big Tech incarnations of the super app.

In late 2022, Microsoft was rumored to be building a super app using Bing as the foundation, and recent investment into ChatGPT adds fuel to that fire. Even Elon Musk hinted at his ambitions to turn Twitter into a one-stop-shop for just about everything.

There are still significant barriers to bundling a plethora of services into a single app, but that isn’t stopping companies from racing to be the one to do it. To the victor go the spoils.

The Resiliency of Life Extension

The concepts of immortality and age reversal have been a preoccupation of mankind since the dawn of time, so it stands to reason that technology that promises extra lifespan and quality of life continues to be compelling for individuals and investors alike.

Players in this space can approach life extension and anti-aging from a number of different angles, from supplements to tinkering at the cellular level.

Two high-profile examples in this space are Calico, which is a subsidiary of Alphabet, and the Jeff Bezos-backed Altos Labs. Other billionaires have expressed an interest in life extension as well, including Peter Thiel, who has definitive views on mortality.

I believe if we could enable people to live forever, we should do that. […] I think it is against human nature not to fight death. – Peter Thiel

In 2023, look for more investment and news from startups focused on gene therapy, genome analysis, regenerative medicine, or “longevity in a pill”.

Beyond Plastic: The Bio-Based Materials Boom

Public pressure is mounting for producers of consumer goods to change the way they manufacture their products.

The good news is that many of the largest producers of consumer packaged goods and apparel have some kind of plan in place to use more post-consumer recycled plastic in their products. The bad news is that not enough plastic is recycled globally for companies to source enough material to produce their products more sustainably. As a result, many companies are exploring the option of ditching plastic entirely.

For example, materials derived from seaweed are an active area of innovation right now. Mushrooms and algae are also commonly-used materials from nature that are being used to create biodegradable products. In one particularly interesting example, a company called MycoWorks recently began working with GM Ventures to explore the use of mycelium-based leather alternatives in GM’s vehicles.

While researchers and companies are just scratching the surface of what’s possible, consumers are likely to see more tangible examples of bio-based materials popping up in stores. After all, brands will be very eager to talk about their increasingly plastic-free product lines.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Environment2 weeks ago

Environment2 weeks agoTop Countries By Forest Growth Since 2001