Technology

10 Key Considerations Before a New Product Launch

If launching a new product was easy, then everyone would be doing it.

Instead, even as we’ve discovered in our planning for the launch of our new “coffee table” book of infographics, it requires an incredible combination of vision, deliberation, teamwork, and project management expertise to accomplish something that’s never been done before.

And even if you are lucky enough to nail many of those things, external factors can be just as deadly.

Getting a Launch Right

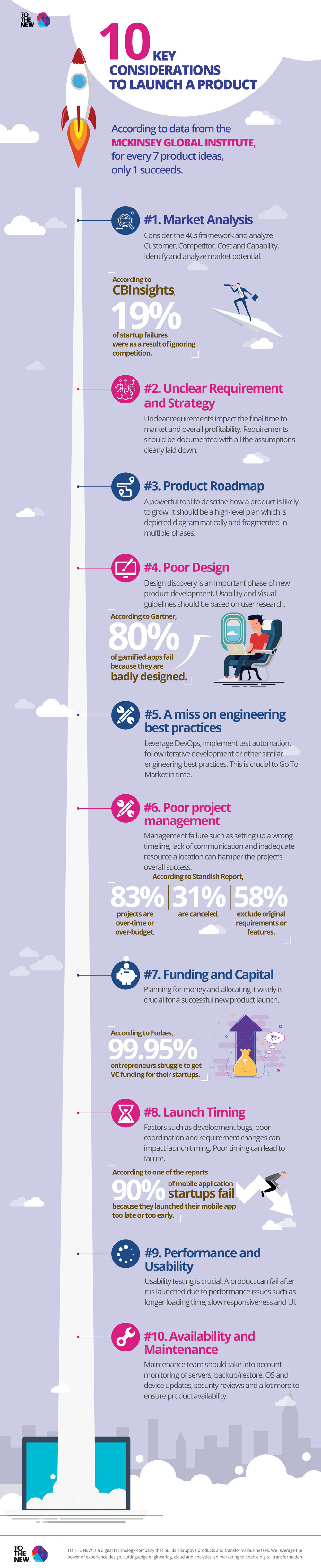

Today’s infographic comes from To The New, and it details 10 key points to consider before any new product launch. While it has a slant towards technology and startup products, many of the points are relevant for any new endeavor.

The fact is: launching a product can be ripe with pitfalls. Mckinsey says the chance of success for a new product is 14%.

That’s why preemptively addressing the most common slipups for new products can be an invaluable step for any prospective entrepreneur.

Ten Areas to Focus On

Here are 10 areas that experts say must be addressed to increase the odds of a successful product launch:

1. Market Analysis

According to CB Insights, 19% of startup failures were as a result of ignoring competition. Instead, the market potential must be properly analyzed and assessed to give a realistic perspective on a product launch.

2. Unclear Requirement and Strategy

If expectations for team members are unclear, then it will have a ripple effect. Product development will be delayed, and it could impact timing and profit potential.

3. Product Roadmap

This high-level plan keeps team members on the same page as product development and the launch are executed.

4. Poor Design

An easy thing to overlook – product design should be tested with extensive user research. Otherwise, users may not be aware of key features.

5. Engineering Best Practices

Following best practices for engineering helps to guarantee the product will be ready and glitch-free come launch time.

6. Poor Project Management

Unrealistic timelines, a lack of communication, and inadequate resource allocation can have a big impact on project success.

7. Funding and Capital

Getting the right amount of capital is key. Allocating it wisely to ensure project success is just as important.

8. Launch Timing

Poor timing can also lead to failure. As a result, project scheduling should be carefully planned and thought out, taking into account possible roadblocks or other adverse circumstances that could derail the plan.

9. Performance and Usability

For software or web-based products in particular: no one wants to deal with long loading times, slow responsiveness, or other usability issues. It’s best to clear these up before the product hits market.

10. Availability and Maintenance

If the product is connected to the web, the team needs to ensure that servers and security measures are taken to ensure uptime and availability.

A Final Note

Even the most powerful corporations are aware of the many potential pitfalls when launching a new product.

It’s why every CEO is so adamant that their organization maintains the focus on their core vision, competitive advantage, and current brand value proposition. If any new product does not fit all this criteria, it’s not worth the risk of the company being distracted. This is true for even the most resourceful and innovative corporations.

Luckily, and consequently, this conservatism that permeates big companies is exactly what opens up the tiny window for you to succeed with your next product launch!

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001