Technology

Map: Internet Censorship Around the World

In January 2011, Egyptian activists, inspired by a successful uprising in Tunisia, began organizing a demonstration using Facebook. In a matter of days, thousands of protesters – who learned about the event through the social media platform – gathered in Cairo’s Tahrir Square to protest the longstanding Mubarak regime.

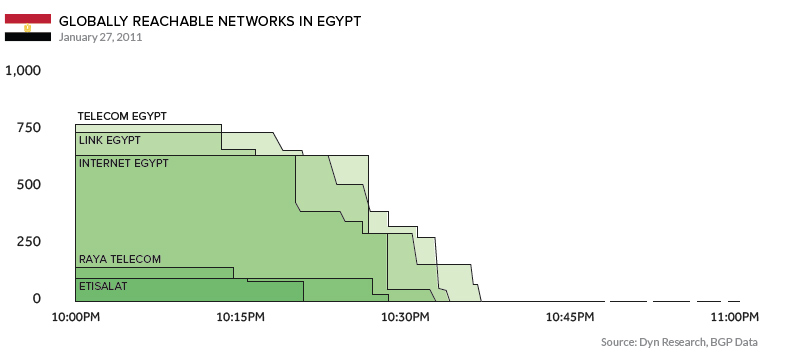

Then, in an attempt to quash civil unrest, the Egyptian government soon took the bold step of cutting off the country’s internet access. As the size of protests swelled from thousands to millions of people, the Mubarak regime quickly realized their mistake: never cut off a millennial’s internet access.

Mubarak was ultimately forced to resign after just 18 days of massive protests, but in that time Egypt’s Arab Spring demonstrated two major things: (1) the incredible organizing power of the internet, and (2) the how quickly a government could slam the door on the free flow of information.

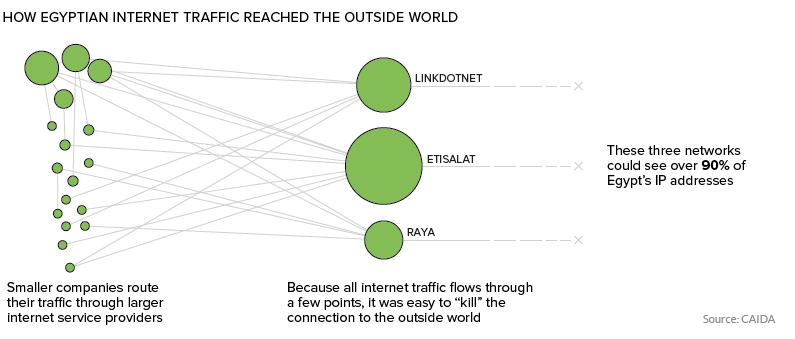

The Egyptian government was able to quickly and effectively shut down the chokepoints that connect its citizens to the outside world. Etisalat, for example, is a centrally located routing system that could see up to 58% of Egypt’s IP addresses.

In other words, Mubarak was essentially able to blockade every website in the world by making a few simple phone calls.

A New Era Of Internet Censorship

Egypt’s dramatic internet shutdown became a new template for other precarious regimes, but also sparked a broader global conversation around online censorship.

Today’s infographic comes to us from WhoIsHostingThis and it provides a detailed look at varying levels of internet censorship around the world today.

Internet users in North America and Europe enjoy relatively unfettered access to online content, while most countries in Asia, Africa, and the Middle East have some level of censorship. Torrenting is restricted in almost every country in the world, with a notable exception being Switzerland, where a laissez-faire approach is applied to downloading content for personal consumption.

It’s also worth noting that this map does not address government surveillance, which is ubiquitous even in countries with high levels of internet freedom.

The Anti-Information Age

If you want to liberate a country, give them the internet

–Wael Ghonim, Egyptian internet activist

Much of the world’s population accesses an internet that is at least partially censored. Countries have different motivations for restricting access and filtering content. Below are a few high-profile examples.

China

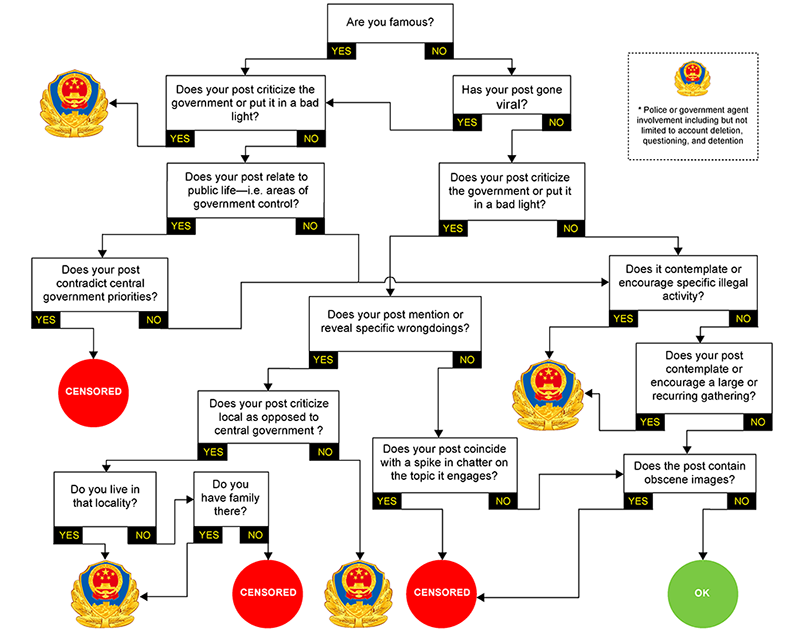

When most people think of internet censorship, China springs to mind. This makes sense as the country has a small army (upwards of 50,000 people) monitoring internet activity at all times. Also, much like Egypt, the government forces all online traffic through a mere three central routing systems. This makes it easy for censors to sift through all data entering and leaving the country.

China’s censorship apparatus is so advanced, it can take a very granular approach to repression and enforcement.

Turkey

The country’s swelling blacklist of 100,000 websites, coupled with harsh penalties for any whiff of anti-government sentiment, have created an extremely restrictive environment for Turkish internet users.

Ethiopia

In 2016, the government of Ethiopia blocked access to social networking sites to prevent cheating during the university entrance exam period.

North Korea

Unauthorized surfing of the internet is a dangerous activity in the Hermit Kingdom. The primary smartphones, tablets, operating systems, and browsers used in the country were all developed by the government, and content on the 5,000 or so accessible websites is tightly controlled.

Slipping Through the Firewall

Even when censoring measures are pervasive and effective, people continually find ways to slip between the cracks. For years, people have used proxy servers and virtual private networks (VPNs) to access content beyond their country’s censorship wall, but censors are getting better at discovering proxy servers and simply blocking them as they would any other site.

As a result, newer techniques are gaining popularity:

Steganography

Steganography is the science of hiding information. Basically, an innocuous file like an image can be stealthily encoded with information to evade detection by censors. Even changing a single pixel on a series of images can be used to relay a message, provided the recipient knows what to look for.

Refraction Networking

This circumvention tool uses partnerships with ISPs and other network operators to provide Internet freedom to users. Rather than trying to hide individual proxies, whole networks outside the censored country can become a conduit for the free flow of information.

Technology

Visualizing AI Patents by Country

See which countries have been granted the most AI patents each year, from 2012 to 2022.

Visualizing AI Patents by Country

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This infographic shows the number of AI-related patents granted each year from 2010 to 2022 (latest data available). These figures come from the Center for Security and Emerging Technology (CSET), accessed via Stanford University’s 2024 AI Index Report.

From this data, we can see that China first overtook the U.S. in 2013. Since then, the country has seen enormous growth in the number of AI patents granted each year.

| Year | China | EU and UK | U.S. | RoW | Global Total |

|---|---|---|---|---|---|

| 2010 | 307 | 137 | 984 | 571 | 1,999 |

| 2011 | 516 | 129 | 980 | 581 | 2,206 |

| 2012 | 926 | 112 | 950 | 660 | 2,648 |

| 2013 | 1,035 | 91 | 970 | 627 | 2,723 |

| 2014 | 1,278 | 97 | 1,078 | 667 | 3,120 |

| 2015 | 1,721 | 110 | 1,135 | 539 | 3,505 |

| 2016 | 1,621 | 128 | 1,298 | 714 | 3,761 |

| 2017 | 2,428 | 144 | 1,489 | 1,075 | 5,136 |

| 2018 | 4,741 | 155 | 1,674 | 1,574 | 8,144 |

| 2019 | 9,530 | 322 | 3,211 | 2,720 | 15,783 |

| 2020 | 13,071 | 406 | 5,441 | 4,455 | 23,373 |

| 2021 | 21,907 | 623 | 8,219 | 7,519 | 38,268 |

| 2022 | 35,315 | 1,173 | 12,077 | 13,699 | 62,264 |

In 2022, China was granted more patents than every other country combined.

While this suggests that the country is very active in researching the field of artificial intelligence, it doesn’t necessarily mean that China is the farthest in terms of capability.

Key Facts About AI Patents

According to CSET, AI patents relate to mathematical relationships and algorithms, which are considered abstract ideas under patent law. They can also have different meaning, depending on where they are filed.

In the U.S., AI patenting is concentrated amongst large companies including IBM, Microsoft, and Google. On the other hand, AI patenting in China is more distributed across government organizations, universities, and tech firms (e.g. Tencent).

In terms of focus area, China’s patents are typically related to computer vision, a field of AI that enables computers and systems to interpret visual data and inputs. Meanwhile America’s efforts are more evenly distributed across research fields.

Learn More About AI From Visual Capitalist

If you want to see more data visualizations on artificial intelligence, check out this graphic that shows which job departments will be impacted by AI the most.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023