Technology

The Changing Landscape of Business Risk

View a high resolution version of this graphic

The Changing Landscape of Business Risk

View the high resolution version of today’s graphic by clicking here.

In the modern era, the pace of business is fast – but the pace of technological change is even faster.

As a result, the landscape of business risks is constantly shifting and changing, and both entrepreneurs and investors need to be on top of the potential factors that could disrupt their chances of success. At the same time, they also need to be prepared to address and mitigate new risks as they crop up.

Today’s Biggest Risks

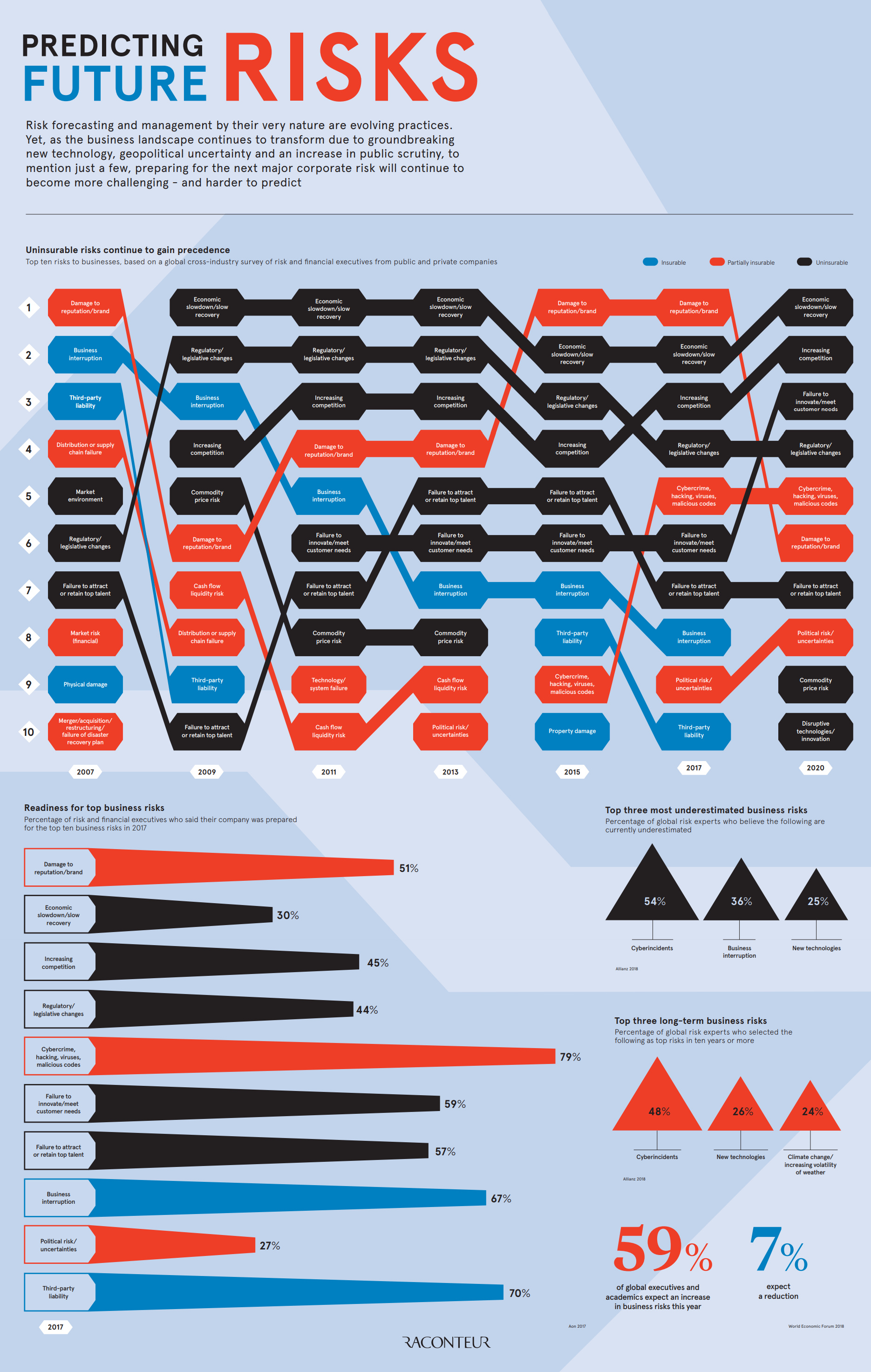

Today’s infographic comes to us from Raconteur, and it highlights the forces that have been shaping the business risk landscape – both today and as projected for the future.

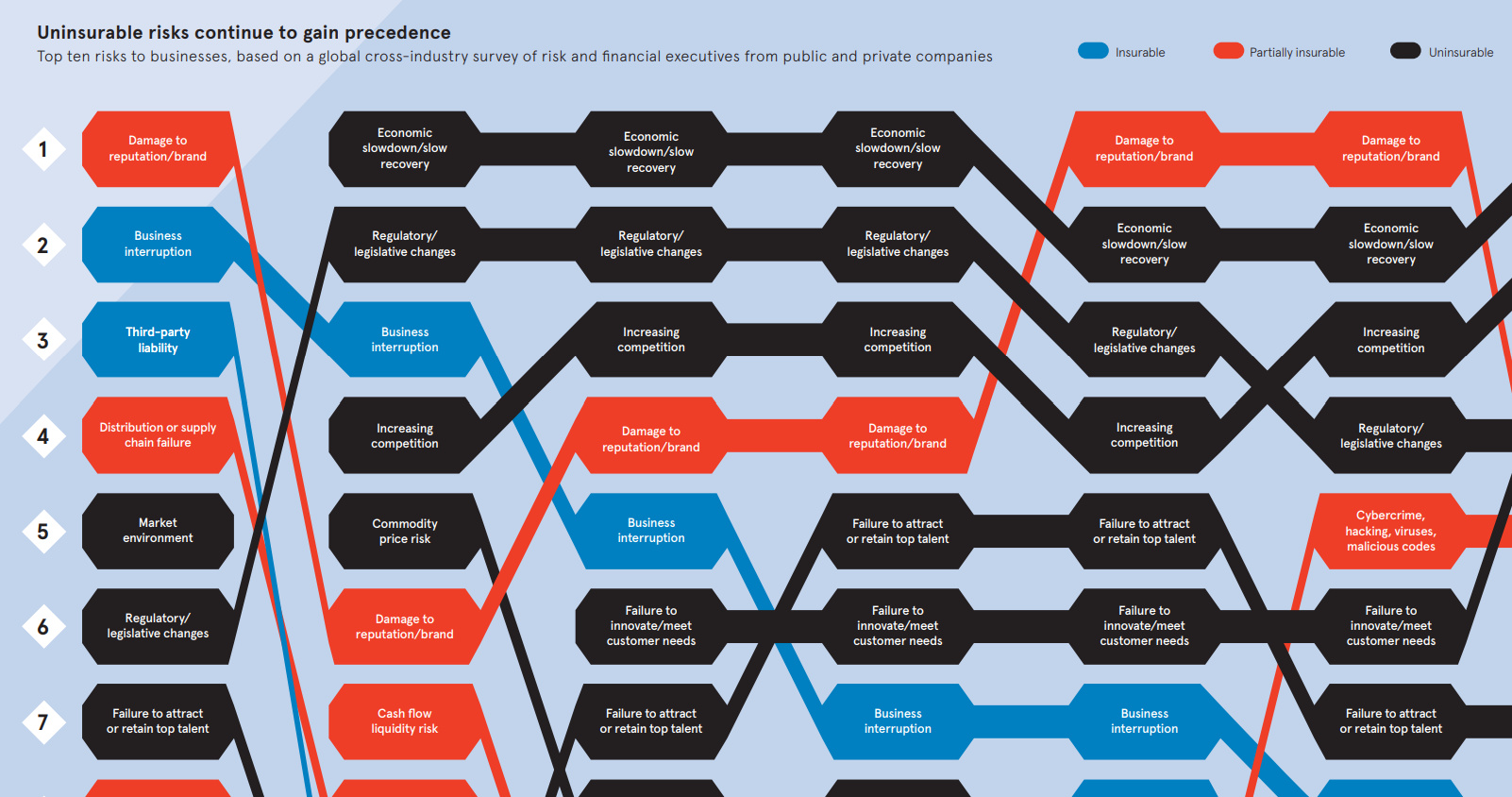

Using data from the 2017 Global Risk Management Survey done by insurance company Aon, it shows the top business risks according to 1,843 risk decision-makers from 33 industry sectors in over 60 countries.

Here were the top risks from 2017, as well as the corresponding portion of business leaders that said they were prepared for each risk:

| Rank (2017) | Business Risk | Readiness |

|---|---|---|

| #1 | Damage to reputation/brand | 51% |

| #2 | Economic slowdown/slow recovery | 30% |

| #3 | Increasing competition | 45% |

| #4 | Regulatory/legislative changes | 44% |

| #5 | Cybercrime, hacking, viruses, malicious codes | 79% |

| #6 | Failure to innovate/meet customer needs | 59% |

| #7 | Failure to attract or retain talent | 57% |

| #8 | Business interruption | 67% |

| #9 | Political risk/uncertainties | 27% |

| #10 | Third-party liability | 70% |

The insurer noted that many of these top business risks were uninsurable – and that in general, that such risks are continuing to gain precedence.

Future Business Risk

Interestingly, the survey also asked respondents to predict the risks in 2020 based on current trends and conditions.

Here is the same list, but for 2020, including the current ranks as well:

| Rank (2020) | Business Risk | Previous Rank (2017) |

|---|---|---|

| #1 | Economic slowdown/slow recovery | 2 |

| #2 | Increasing competition | 3 |

| #3 | Failure to innovate/meet customer needs | 6 |

| #4 | Regulatory/legislative changes | 4 |

| #5 | Cybercrime, hacking, viruses, malicious codes | 5 |

| #6 | Damage to reputation/brand | 1 |

| #7 | Failure to attract or retain talent | 7 |

| #8 | Political risk/uncertainties | 9 |

| #9 | Commodity price risk | n/a |

| #10 | Disruptive technologies/innovation | n/a |

Damage to risk/brand fell out of the top spot all the way to #6, and two new entrants appear for the first time: commodity price risk and disruptive technology/innovation.

Cybercrime Overconfidence

Raconteur’s infographic also points to the biggest long-term risks to business, and the risks that get the most underestimated. These both come from a 2018 report by German asset manager Allianz, which includes opinions from a selection of risk experts.

The Biggest Long Term Risks

1. Cyberincidents

2. New technologies

3. Climate change/increasing volatility of weather

The Most Underestimated Risks

1. Cyberincidents

2. Business interruption

3. New technologies

As you’ll notice, the risk of “cyberincidents” tops both lists.

This is particularly interesting, because in the previous survey of business leaders, the potential business risk of “cybercrime, hacking, viruses, and malicious codes” was the one that leaders said they were most prepared for, with a 79% readiness level.

Yet, cyberincidents – which have an estimated annual impact of $450 billion per year – are both the top long-term risk and the most underestimated risk according to risk experts in the Allianz report.

Could business leaders be overconfident about this kind of threat?

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Science1 week ago

Science1 week agoVisualizing the Average Lifespans of Mammals

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023

-

Green2 weeks ago

Green2 weeks agoRanking the Top 15 Countries by Carbon Tax Revenue