Technology

The Fastest Startups to Hit $1 Billion Valuations

For the founders coding in the trenches of Silicon Valley, achieving the status of a “unicorn” is still the Holy Grail. The term, which references the presumably rare and mythological uni-horned creature, is used to describe a tech startup that has hit a $1 billion valuation or more.

At the time the term was coined, unicorns were indeed rare. Aileen Lee’s data from 2003-2013 showed that just four unicorns were born a year, and that only 39 existed as of November 2013. However, while actual unicorns continue to be (very) difficult to find, the ones of the tech variety have been proliferating like bunnies.

By the count of VentureBeat, there are now 229 of them with a cumulative $1.3 trillion valuation.

The Unicorn Baby Boom

Fleximize recently created an interactive visualization that breaks down the fastest startups to reach a $1 billion valuation by geography, sector, year, and also the timeframe needed to reach the mark. We’ve pulled out the key visuals in this post, but we highly recommend viewing their interactive list which provides data on each company as well.

We’ll show the whole list of unicorns later in this article, but for now we will focus on the high level stuff: how many more unicorns are being born? Are startups achieving unicorn status faster than before?

Unicorn Births Per Year

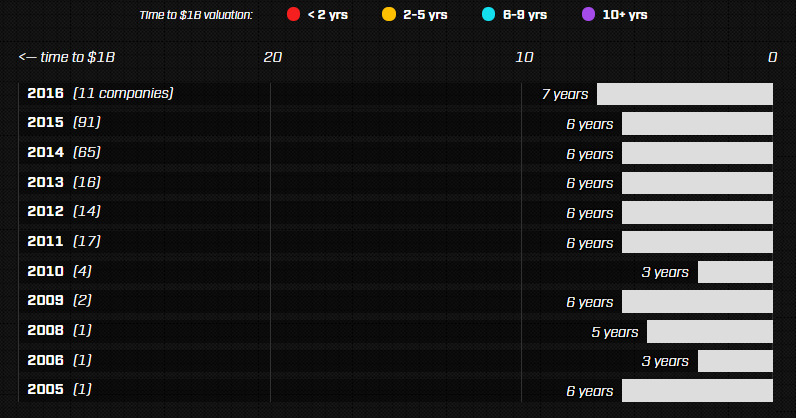

The above chart shows unicorn births each year from 2005 until today. There’s two important things to consider here:

Time to Achieve Unicorn Status: Despite the current froth in the venture capital market, it appears that the amount of time it takes to become a unicorn has remained relatively consistent. The average is around six years to go from the founding of the company to a $1 billion+ valuation.

More Unicorn Births: While it takes the same amount of time to become a unicorn, tech culture has become much more mainstream. Today, millions of startups are launched each year and 90% of them fail. However, the ones that get past the gauntlet raise billions of dollars from VCs.

According to the above chart, there were 65 new unicorns in 2014, and an additional 91 in 2015.

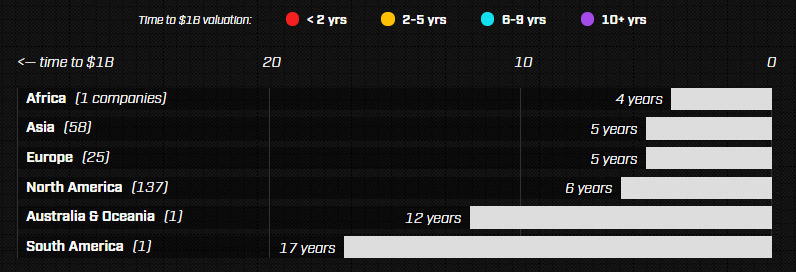

Unicorns by Birthplace

The majority of unicorns are still born in North America, which holds 61.4% of the population. However, Asia is rising fast with 58 unicorns (26.0%). It’s also worth noting that Asian unicorns spend a little less time in the womb, taking five years to be born. This is comparatively lower to the international average of six years.

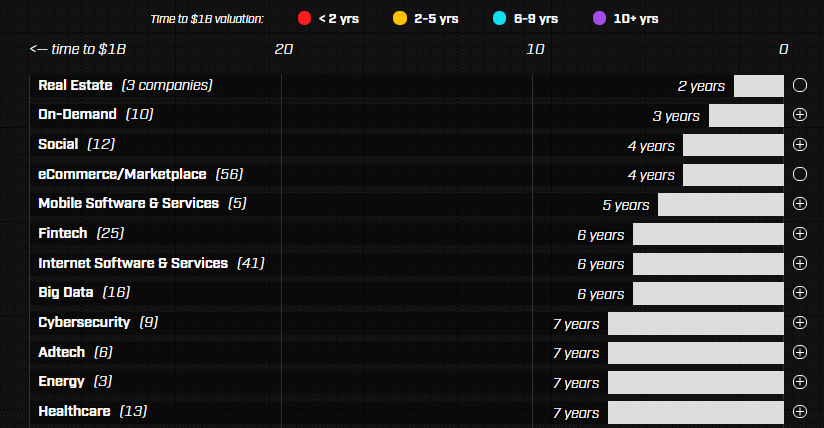

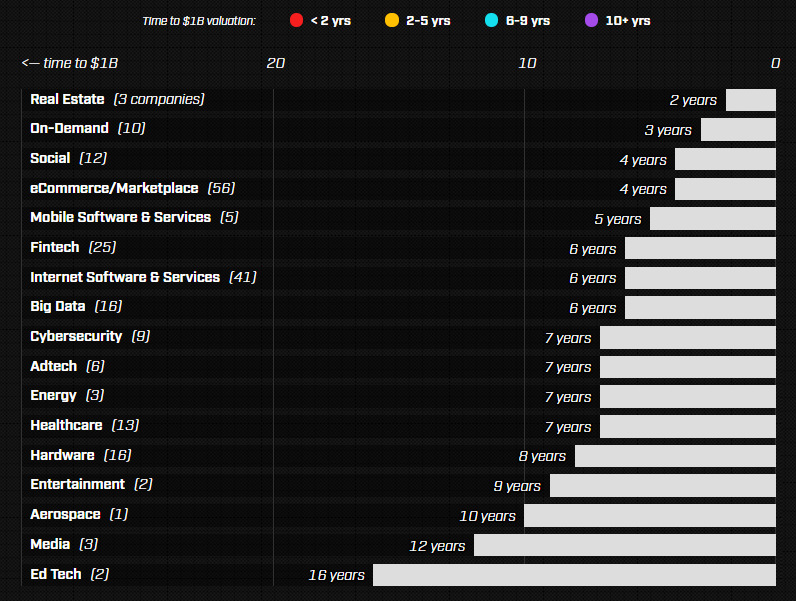

Unicorns by Profession

The unicorns that are born the fastest are ones focused on industries such as real estate, on-demand, social media, or e-commerce. These took four or less years on average.

Education tech and media companies took a long time to reach unicorn status – 16 years and 12 years respectively. That said, the dataset is quite small with only five companies in these categories combined.

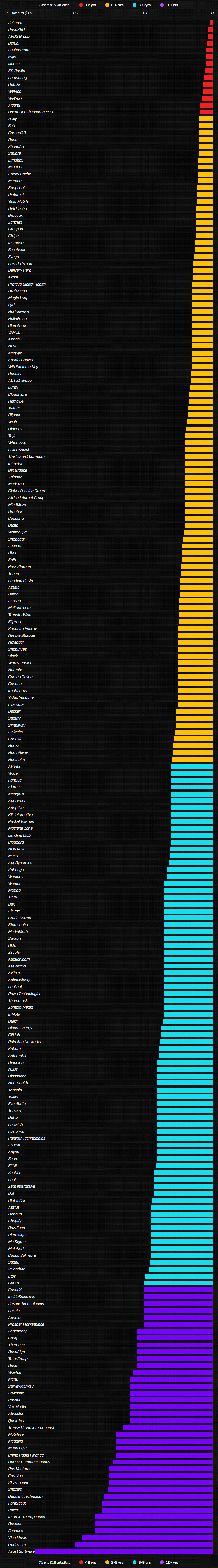

The Fastest Startups (The Whole List)

Below is the full list of companies valued at $1 billion or more.

The absolute fastest startup?

It’s Jet.com, an online retailer said to possibly rival Amazon, that uses real-time pricing algorithms to give consumers better deals. It hit a $1 billion valuation in just four months in 2015.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees