Technology

The Tech Giants Growing Behind China’s Great Firewall

The Tech Giants Growing Behind China’s Great Firewall

The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

Every day, your feeds are likely dominated by the latest news about Silicon Valley’s biggest tech giants.

Whether it’s Facebook’s newest algorithm changes, Amazon’s announcement to enter the healthcare market, a new acquisition by Alphabet, or the buzz about the latest iPhone – the big four tech giants in the U.S. are covered extensively by the media, and we’re all very familiar with what they do.

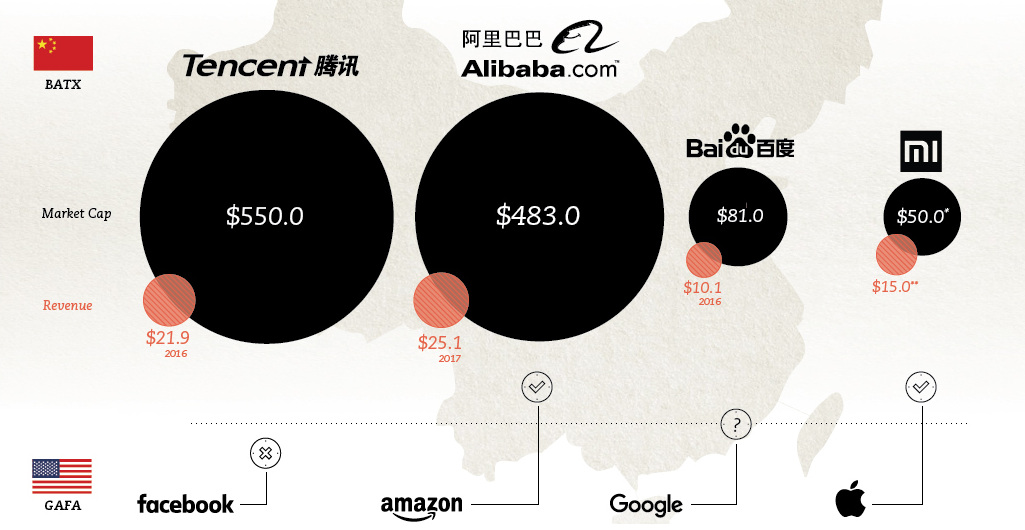

However, what is less commonly talked about is the alternate universe that exists on the other side of China’s Great Firewall. It’s there that four Chinese tech giants are taking advantage of a lack of foreign competition to post explosive growth numbers – some which compare favorably even to their American peers.

Bizarro World

Like the “Bizarro Jerry” episode of Seinfeld, the Chinese-based tech giants look recognizably familiar – but markedly different – to the ones we know so well.

Alibaba

Likely the best known of China’s tech giants, Alibaba is the dominant online retailer in the country. The company had revenues of $25.1 billion in 2017 and is seeing that revenue grow at impressive speeds. In its most recent quarterly results (Q3, 2017), the company noted a 56% jump in revenue.

Amazon’s tough sell: Amazon does exist in the Chinese market, but it just has trouble competing with Jack Ma’s creation. Amazon has less than a 1% share of the e-commerce space in China, after a decade of trying to get a foothold. Further, Alibaba also runs AliCloud, which provides direct competition to Amazon’s AWS.

Baidu

Baidu is the largest search engine in China and also a leading player in AI. It’s the most visited website in China, and ranks #4 globally. The company will announce 2017 annual results in the coming weeks, after reporting a 29% jump in revenue in Q3 2017.

Google’s searching for a way in: Google was blocked in China in 2010 after refusing to filter search requests. However, since then, the giant has been able to take very small steps in entering the Chinese market – even though its signature search engine is still blocked, Google now has at least three offices in the country.

Tencent

Tencent has recently been in the news for its rapidly surging stock. The company, which owns the dominant social platform in China (WeChat), is now valued at over $500 billion. For those keeping tabs, Facebook is currently worth $550 billion.

It’s complicated: Facebook remains blocked by China, meaning that Zuckerberg and company can’t take advantage of a 1 billion plus market of people with growing buying power. Even if it found its way in, there are multiple social platforms in China and competition would be stiff.

Xiaomi

Dubbed as “China’s Apple”, Xiaomi is one of the world’s most valuable private companies. Things have been hot and cold for the ambitious smartphone manufacturer, but recently reports have surfaced that Xiaomi will IPO in the second half of 2018 for upwards of $50 billion.

Apple’s shine has dulled: Apple’s entrance into the Chinese market was once described as a success, but recently competition from domestic manufacturers has derailed that claim.

Crossing Over

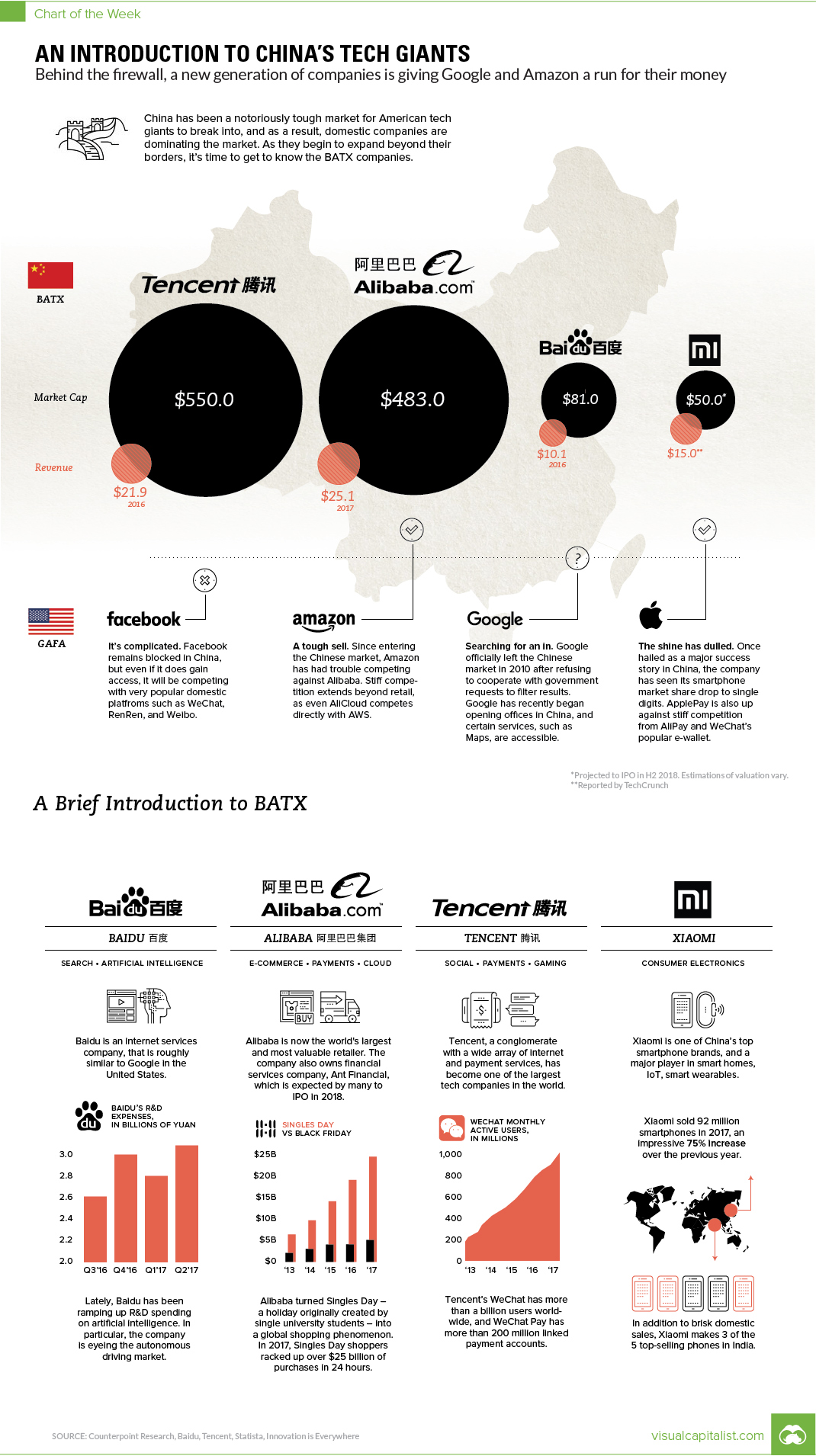

After a new round of financing, Bytedance – a Chinese company specializing in short-form video – surpassed Uber as the most valuable startup in the world, valued at $75 billion.

Unlike some of its peers, Bytedance has found success outside of China. Tik Tok, for example, has well over 300 million users world wide, and the company is making investments into other popular broadcasting platforms, such as Live.me.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Brands6 days ago

Brands6 days agoHow Tech Logos Have Evolved Over Time

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023

-

Green2 weeks ago

Green2 weeks agoRanking the Top 15 Countries by Carbon Tax Revenue