Technology

Chinese Brands are Shaking Up the $420B Smartphone Market

Smartphones are a ubiquitous part of modern life, and now nearly half of humanity is connected through such devices.

As a result, the stakes have never been higher in the ultra-competitive smartphone market. Every day, companies are duking it out for any sliver they can get of global smartphone sales, which now exceed $420 billion per year.

In rapidly growing markets like China and India, the competitive environments are even more interesting. Due to rising socioeconomic circumstances and falling price points on certain models, large segments of these populations are able to purchase these devices for the first time.

These big markets are in a constant state of flux – and it’s not unusual to see top competition to get unseated.

The Chinese Smartphone Market

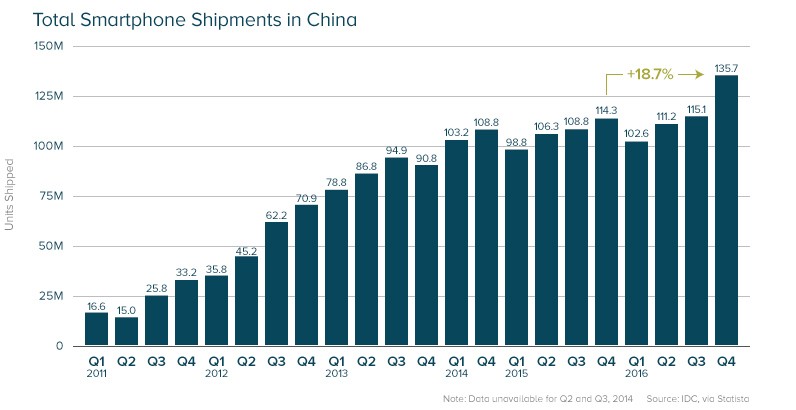

In the most recent quarter, Chinese smartphone shipments grew a staggering 18.7% to 135.7 million:

This rapid increase in sales comes at a time when domestic brands in China are starting to aggressively market their products.

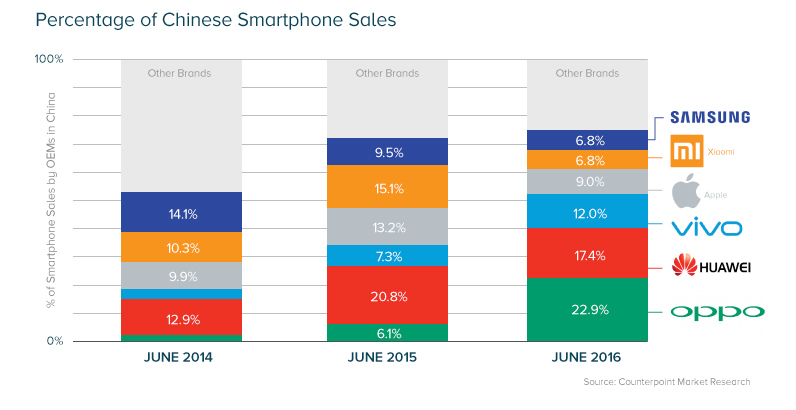

Oppo, a brand mostly unknown across the Pacific Ocean, has more than tripled market share over the last year to unseat the incumbent Huawei. This marks the first time that Oppo has been the most popular brand in the country.

Oppo has adopted a simple but effective strategy, going after the offline market which still contributes more than 70% of total sales in China. Aggressive marketing, promotions and sponsorships, greater offline retail penetration beyond tier-2 and tier-3 cities, better retail margins, dealer support and above all head-turning, innovative smartphone designs has helped Oppo drive its sales in the last eighteen months.

– Neil Shah, Counterpoint Research

iPhone Sales Dip

Apple fell in the rankings, as consumers wait for the release of the 10th anniversary iPhone. Notably, this year-over-year decline was the first for Apple since entering the Chinese market.

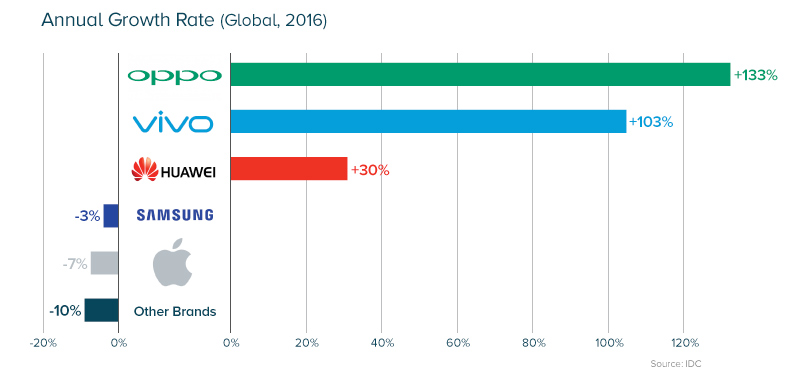

Because domestic companies have greater access to manufacturers, they are beginning to roll out new features (e.g. augmented reality, flexible screens) to compete with brands like Samsung and Apple in ways never seen before. Domestic Chinese brands are generating excitement for their products and that is translating into triple-digit growth numbers for companies like Oppo and Vivo.

One thing is for certain: competition will continue to be fierce in the world’s most populous country in 2017, and the success of domestic brands will continue to have growing implications for non-Chinese brands.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Brands6 days ago

Brands6 days agoHow Tech Logos Have Evolved Over Time

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023

-

Green2 weeks ago

Green2 weeks agoRanking the Top 15 Countries by Carbon Tax Revenue