Technology

Chart: Amazon’s Dominance in Ecommerce

This Chart Shows Amazon’s Dominance in Ecommerce

It’s no secret that Amazon is dominant in ecommerce.

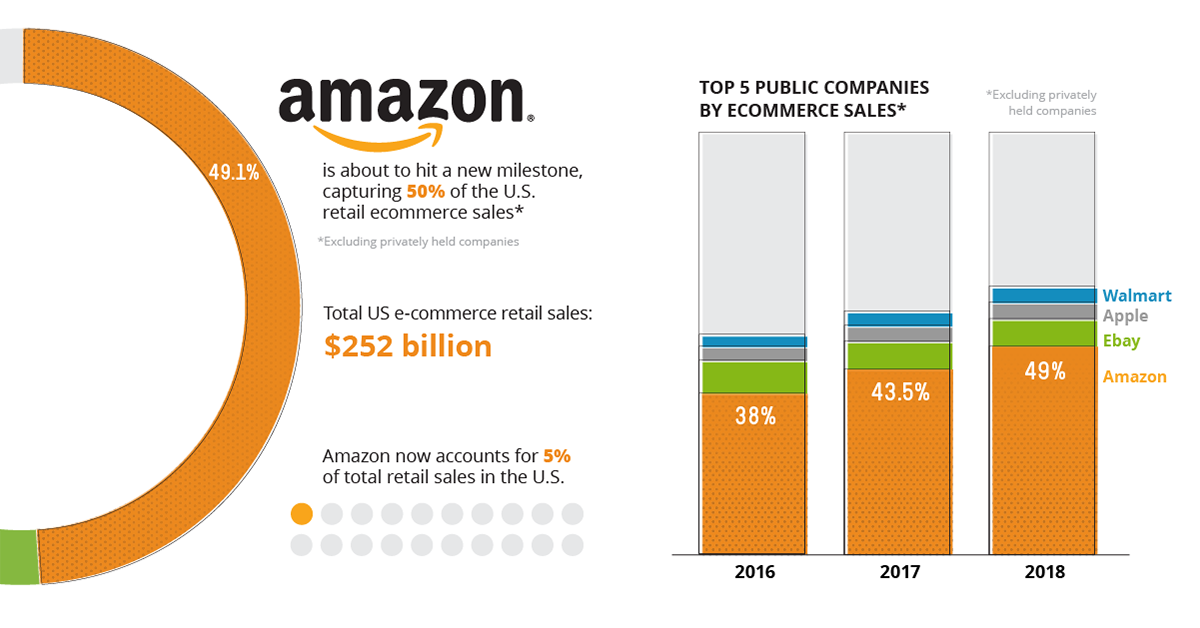

But despite this being common knowledge, the most recent data behind the explosion in Amazon’s market position is still stunning to behold: in the last two years, the already monstrous Amazon somehow was able to increase their share of the total U.S. ecommerce market from 38% to 49%.

Amazon holds almost half of the massive $252.7 billion market – that’s more than double the market share of the next nine companies (including eBay, Walmart, Best Buy, Apple, etc.) combined!

Leaders and Laggards

Capturing a 50% share of a coveted U.S. ecommerce market is impressive, especially considering Amazon is up against many formidable retailers:

| Rank | Company | Market Share (2018) |

|---|---|---|

| #1 | Amazon | 49.1% |

| #2 | eBay | 6.6% |

| #3 | Apple | 3.9% |

| #4 | Walmart | 3.7% |

| #5 | The Home Depot | 1.5% |

| #6 | Best Buy | 1.3% |

| #7 | Qurate Retail Group | 1.2% |

| #8 | Macy's | 1.2% |

| #9 | Costco | 1.2% |

| #10 | Wayfair | 1.1% |

Retailers like Walmart and Best Buy are collectively throwing billions of dollars to get a foothold online. The competition is certainly fierce, but Amazon has still been able to achieve astronomical growth:

| 2016 | 2017 | 2018 | |

|---|---|---|---|

| Amazon market share | 38.1% | 43.5% | 49.1% |

Will Amazon cap out at 50%, 60%, 70%, or beyond?

At this point no one can tell – but regardless of where the growth ends, such a level of dominance has never been achieved in the retail market like this before.

A Prime Driver

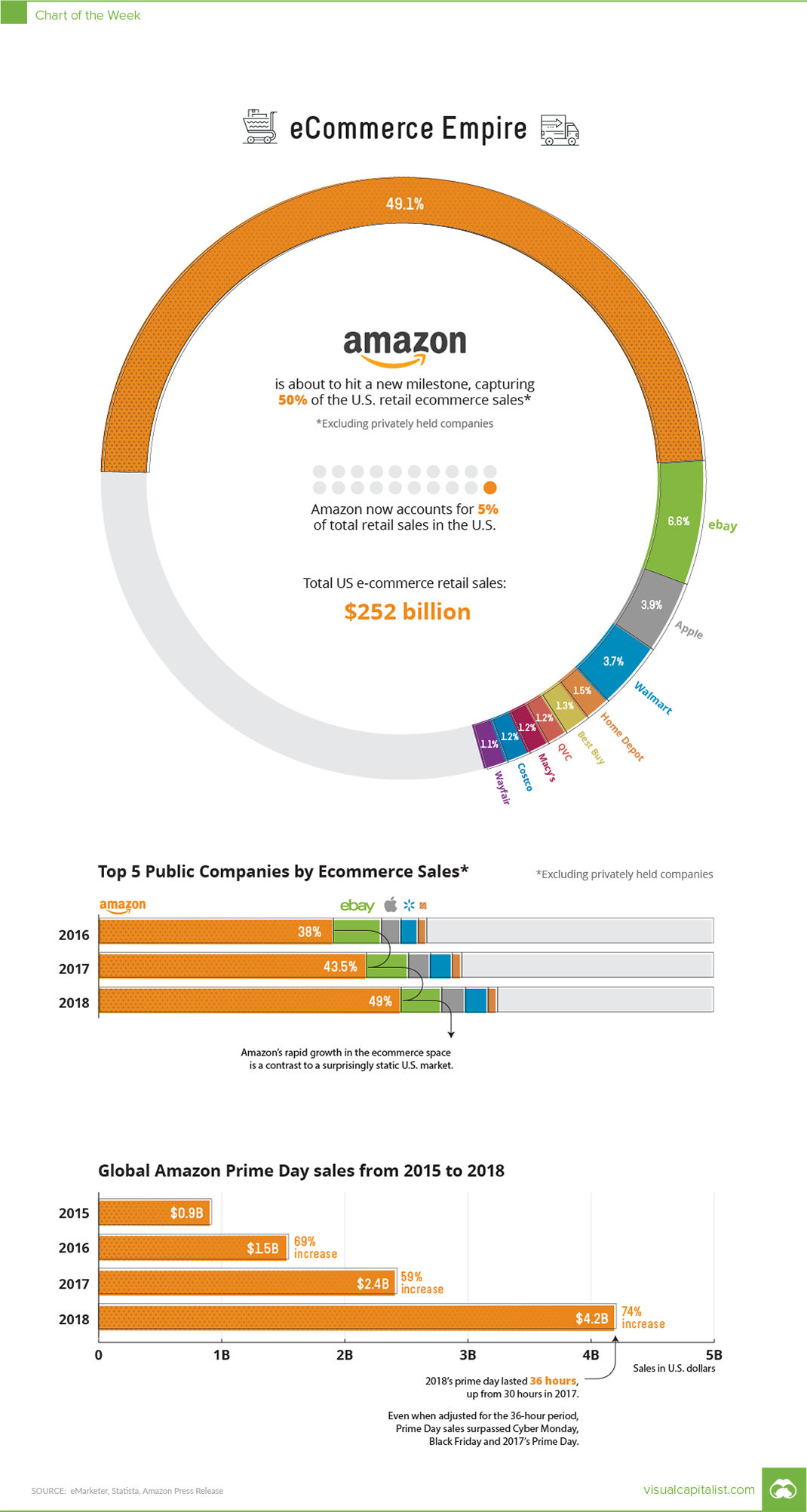

Although not as stunning as overall ecommerce market share, the company’s Prime Day numbers also illustrate the vast size and scale of the company.

The most recent rendition of the annual event in July 2018 raked in $4.2 billion of revenue in a 36-hour period, even though the company had well-publicized technical issues that cost the company $72 million.

| 2015 | 2016 | 2017 | 2018 | |

|---|---|---|---|---|

| Prime Day Sales | $0.9B | $1.5B | $2.4B | $4.2B |

The 2018 event brought a revenue increase of 74% – and Prime Day now generates more sales than Cyber Monday or Black Friday ecommerce sales.

There’s no doubt that the Jeff Bezos Empire is holding strong: with $900 billion in market capitalization, Amazon is now in the conversation to join Apple in hitting the $1 trillion milestone in the coming months.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees