Technology

Chart: Fintech Investment in 2016

Chart: Fintech Investment in 2016

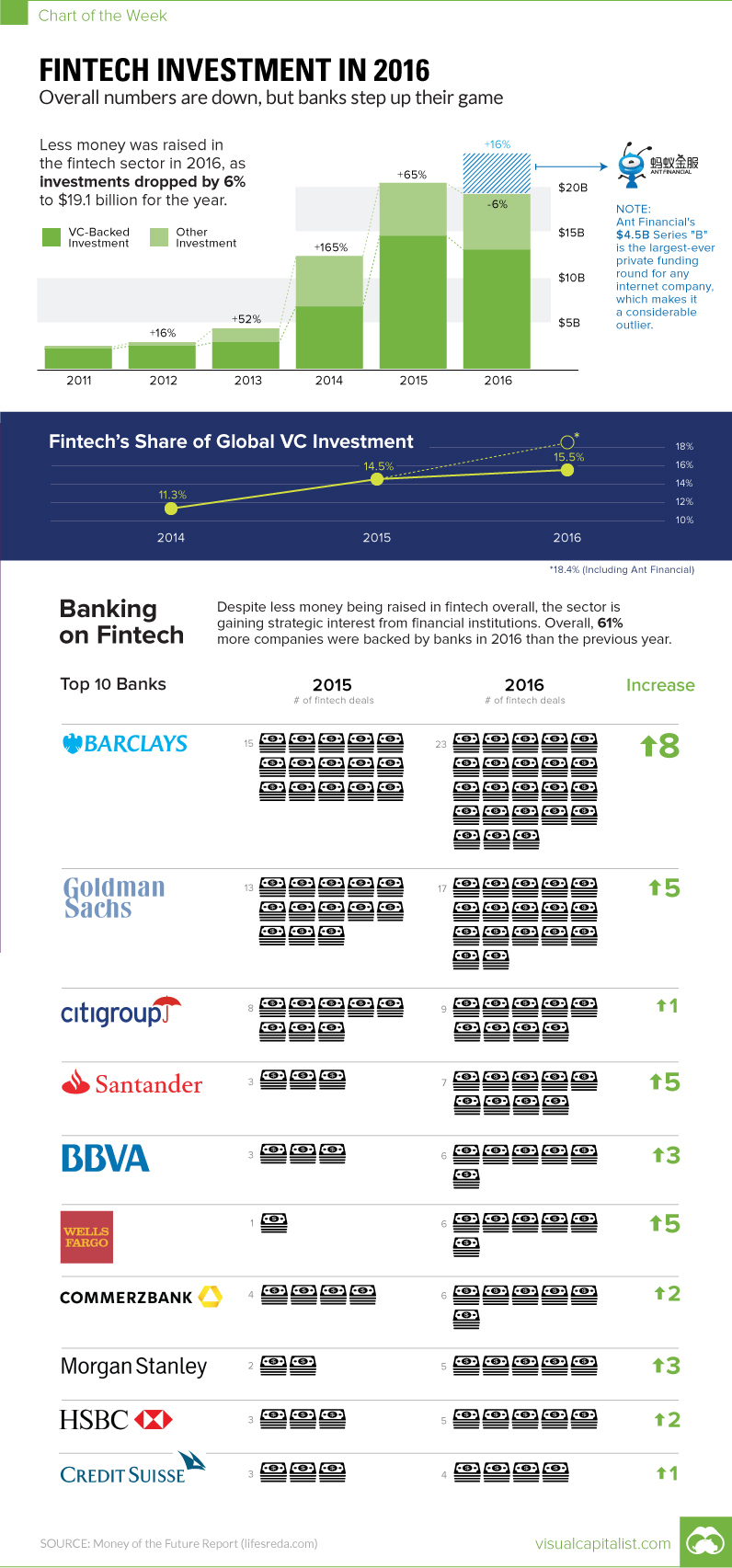

Overall numbers are down, but banks step up their game

The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

According to a new report by Singapore-based venture capital firm Life.SREDA, last year was a mixed bag for fintech.

On the one hand, the Money of the Future Report pegs 2016 as the first year to have an overall decrease in fintech funding after taking into account any outliers. By their calculations, dealflow slowed in the last couple of quarters of the year, while the amount of funding flowing into fintech fell 6% to $19.1 billion.

On the other hand, the one deal that was considered an outlier was a big one: Alibaba affiliate Ant Financial, the world’s second-largest unicorn (behind Uber), raised a Series B of $4.5 billion in early 2016. That’s the largest ever fundraising round for a private tech company.

Further, for the deals that were done in 2016, one could say there was an element of quality over quantity. Established financial institutions are no longer sitting on the sidelines for fintech – in fact, banks have increased the number of investments in VC-backed fintech companies by 61% since the previous year.

Who’s Banking on Fintech?

Some banks are more active than others.

JP Morgan, at one end of the spectrum, only booked three fintech deals last year, which is the same as they did for 2015.

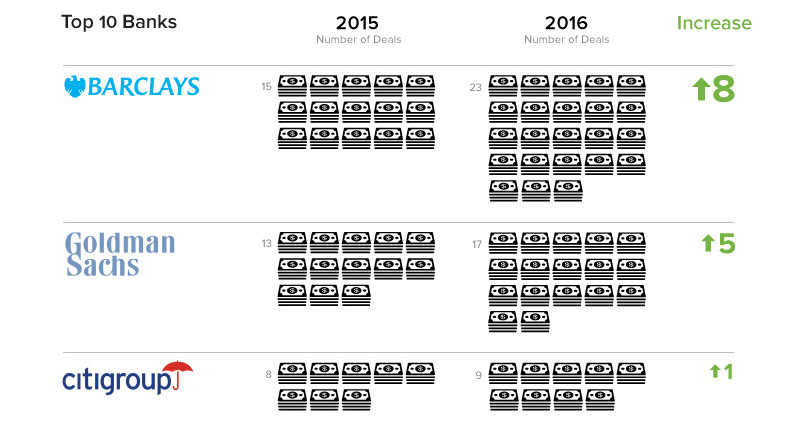

Companies like Barclays and Goldman Sachs have more of a shotgun approach: get in on as many fintech companies as possible. Barclays invested in 23 deals in 2016 for a 53% increase in activity, while Goldman got in on 17 deals for a 31% bump in activity.

Partnerships and product integrations, accelerators and innovative labs, direct investments and venture debts, corporate VCs and fund-of-fund investments — banks started to use all available mechanisms in order not too lose in the digital war with the new hungry players.

Even though Barclays and Goldman Sachs are both heavy investors in the space, each has a different rationale behind their tactics. Goldman Sachs invests in fintech startups solely with expectations of a financial return, while Barclays and banks such as BBVA are looking for more strategic investments that can also enhance their core businesses.

Regardless of the differing tactics and rationales, it looks like banks are officially in the tech game for good. The question is: can hulking, conservative institutions like banks be agile enough to make use of these upcoming investments – and will they pay off?

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Energy1 week ago

Energy1 week agoThe World’s Biggest Nuclear Energy Producers

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024