Technology

Under the Radar: Bank Executives Not Aware of Key Fintech Startups [Chart]

![Under the Radar: Bank Executives Not Aware of Key Fintech Startups [Chart]](https://www.visualcapitalist.com/wp-content/uploads/2015/10/fintech-startup-awareness-chart.jpg)

Flying Under The Radar

Bank Executives Not Aware of Key Fintech Startups

The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

Mid-afternoon single malt scotch. Summers in the Hamptons. Six-digit bills for yacht maintenance. If you thought bankers live in a bubble, you are correct. Today’s chart is even further evidence: banks are unaware of the very products and services that are vying to pull the rug from under them.

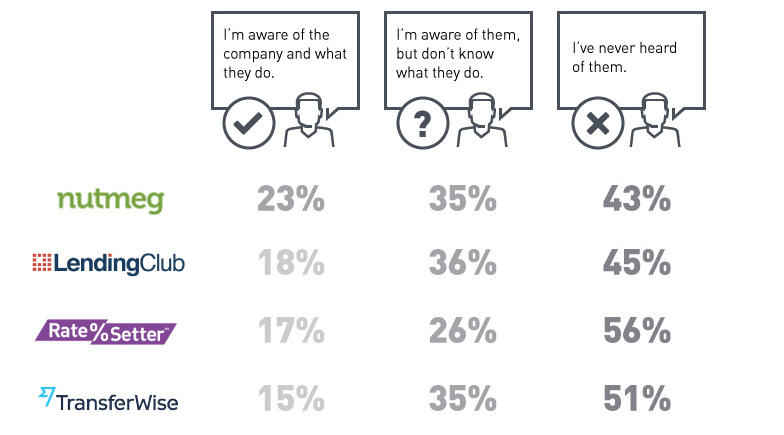

Fintech startups such as Square, The Lending Club, Nutmeg, and Betterment are taking the world by storm, but so far bank executives are unaware of their existence. A survey of 110 bank executives, ranging from directors to C-suite management, found that the majority of respondents do not know key fintech startups that are rapidly changing the banking landscape.

First, the benchmark: 92% of execs knew about Paypal, one of the first real fintech companies to exist. Paypal was started in 1998, IPO’d in 2002, and then was subsequently bought out by Ebay for $1.5 billion. Last year, the company moved $228 billion in 26 currencies across more than 190 nations.

Now, let’s take a look at some of the newcomers:

The Lending Club has a $5 billion market capitalization, after debuting on the NYSE after a widely celebrated IPO in December 2014. It raised $870 million in the IPO, yet only 18% of banking execs know about the company and what it does.

Square was co-founded in 2009 by Jack Dorsey, who was previously involved with starting a little-known company called Twitter. Square is an electronic payments service that was last valued at $6 billion in 2014, when it did its last raise of $150 million. Somehow only 15% of bank execs know about this company.

Nutmeg is the company that bank execs know the most about. About 23% of respondents know of the company. Nutmeg is an online wealth management platform from the UK that last raised $32 million in 2014 at an undisclosed valuation.

Betterment is another online financial adviser that was valued at between $400 million and $500 million in early 2015 with billions of assets under management. Roughly 73% of respondents had never heard of this fintech startup.

This reminds us of the early days of file-sharing and eventually music streaming services on the internet. Music labels, which are almost all but gone of the way of the dinosaur, fought with legal threats, lobbying, legislation, and lawyers rather than by way of innovation.

That may be the only way that the big banks can fight if it becomes too late.

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?