Technology

The Business of eSports

For decades, the world’s top athletes have competed in illustrious tournaments such as The Masters or the Tour de France.

People tune in from all over to see these athletes in peak form, and tournaments rake in cash from media rights, advertisements, sponsorships, merchandise, and also the live event itself. In turn, these competitions offer millions of dollars in prize pools for the participants.

But what if there was a new type of sport that upped the ante?

While sport purists might scoff at the idea of any type of competition involving video games – the numbers speak for themselves. The realm of eSports already has tournaments that pack stadiums, offering bigger prize pools than either the Tour de France or The Masters.

And soon, eSports will be a billion dollar business with a global audience of over 300 million fans.

The Booming Business of eSports

Today’s infographic comes to us from Moneypod, and it dives right into the interesting and possibly unfamiliar arena of eSports, which is seeing double-digit growth in all revenue categories from media rights to merchandise sales.

Gaming has always been popular, but the rise of eSports is something new.

The excitement around these competitions pairs the popularity of gaming with changing demographics, growing buying power for consumers in Asia (where the sport is the most popular), increased levels of connectivity, and new technological advancements.

Perhaps even more interesting is that the business of eSports is flourishing as a result – and with packed stadiums, deals with media giants like ESPN, double-digit revenue growth rates, and hundreds of millions of fans, it has been said that this is the year that eSports hits the mainstream.

Latest Market Projections

In the last few months, new market projections on the business of eSports have come out from NewZoo, a market intelligence company focused on games, eSports, and mobile.

Here are their latest projections for audience growth:

There are 215 million fans today, including 165 million hardcore enthusiasts. The majority of this group, about 53%, resides in the Asia-Pacific region.

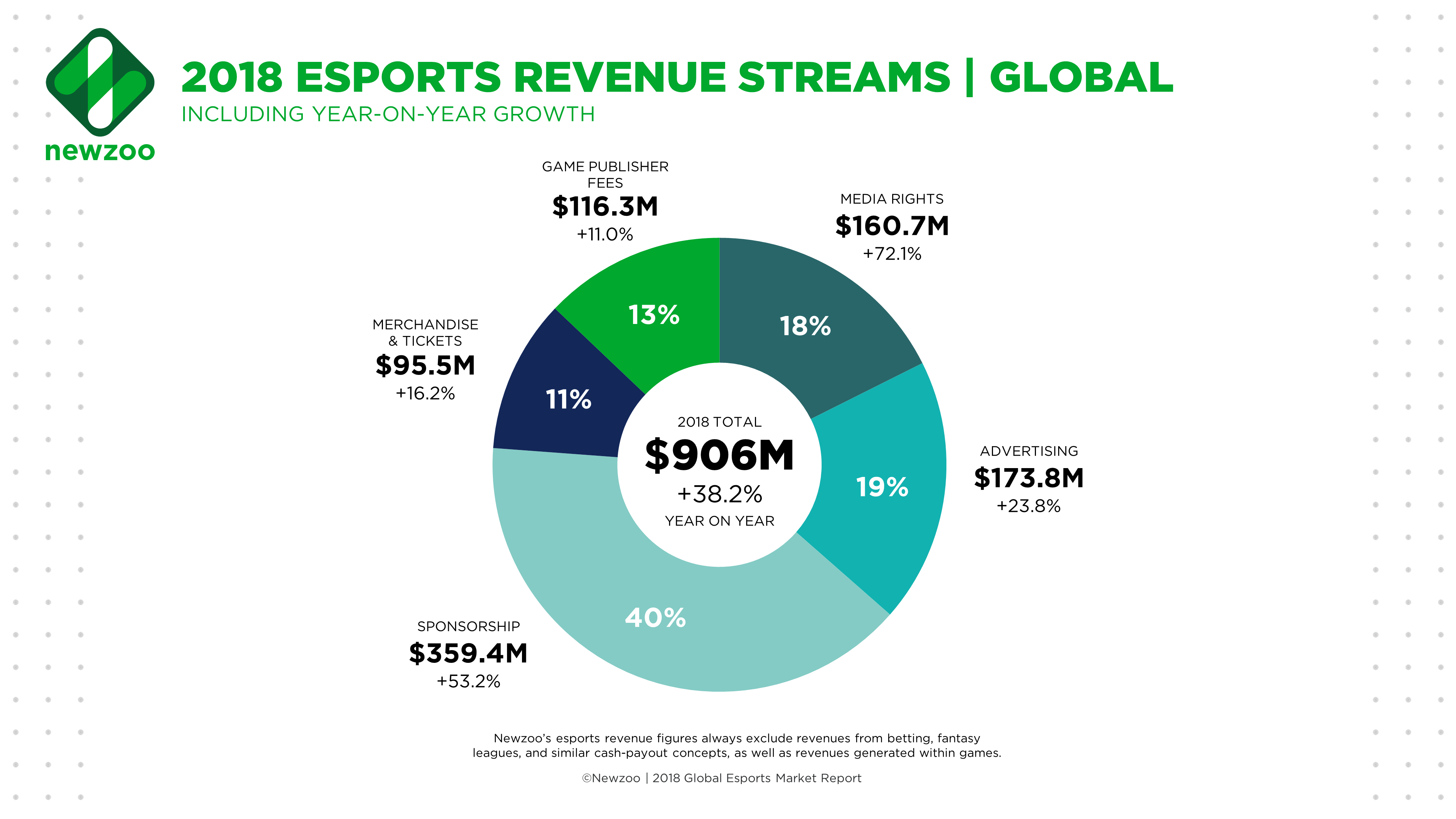

Lastly, here is a breakdown of projected revenue streams for 2018:

Impressively, media rights is the fastest growing segment at 72.1% growth. The sponsorship segment isn’t far behind at a 53.2% growth rate.

In total, the market is expected to be worth $906 million this year, a solid 38.2% higher than in 2017. This expansion is not expected to stop anytime soon, and in 2019 eSports will be a market in excess of $1 billion in size – a figure that will surely put this emerging space in an even bigger spotlight.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Culture7 days ago

Culture7 days agoThe World’s Top Media Franchises by All-Time Revenue

-

Science2 weeks ago

Science2 weeks agoVisualizing the Average Lifespans of Mammals

-

Brands2 weeks ago

Brands2 weeks agoHow Tech Logos Have Evolved Over Time

-

Energy2 weeks ago

Energy2 weeks agoRanked: The Top 10 EV Battery Manufacturers in 2023

-

Countries2 weeks ago

Countries2 weeks agoCountries With the Largest Happiness Gains Since 2010

-

Economy2 weeks ago

Economy2 weeks agoVC+: Get Our Key Takeaways From the IMF’s World Economic Outlook

-

Demographics2 weeks ago

Demographics2 weeks agoThe Countries That Have Become Sadder Since 2010

-

Money2 weeks ago

Money2 weeks agoCharted: Who Has Savings in This Economy?