Banks

The World’s Most Valuable Bank Brands

Visualizing The World’s Most Valuable Bank Brands

When most people think about brands, they often picture iconic consumer marks like Coca-Cola or Apple.

But in the realm of financial services, the importance of having a strong consumer brand is also rapidly growing. After all, with hundreds of new fintech entrants positioning themselves to be the “banks” of the future, it seems that brand awareness may be one of the major competitive advantages that incumbent banks can use to protect themselves.

Which financial institutions have the strongest brands, and which brands are the most valuable?

Valuable Bank Brands in 2019

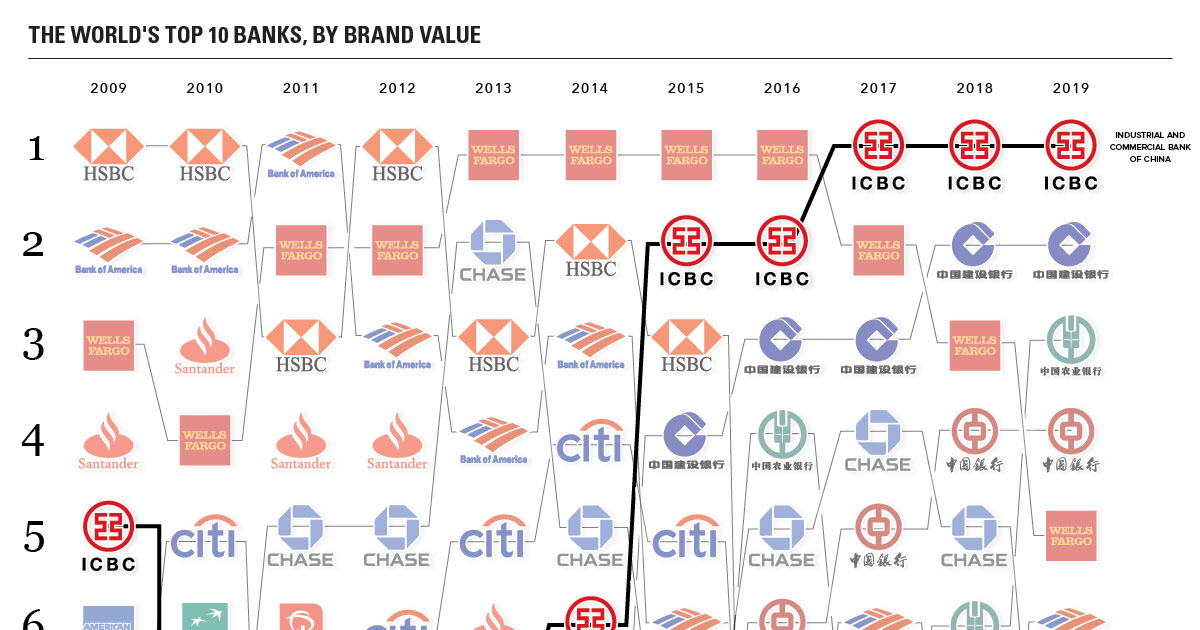

Today’s chart looks at the world’s most valuable bank brands, according to a recent report from Brand Finance.

It should be noted that brand value in this context is a measure of the “value of the trade mark and associated marketing IP within the branded business”. In other words, it’s measuring the value of intangible marketing assets, and not the overall worth of a business itself.

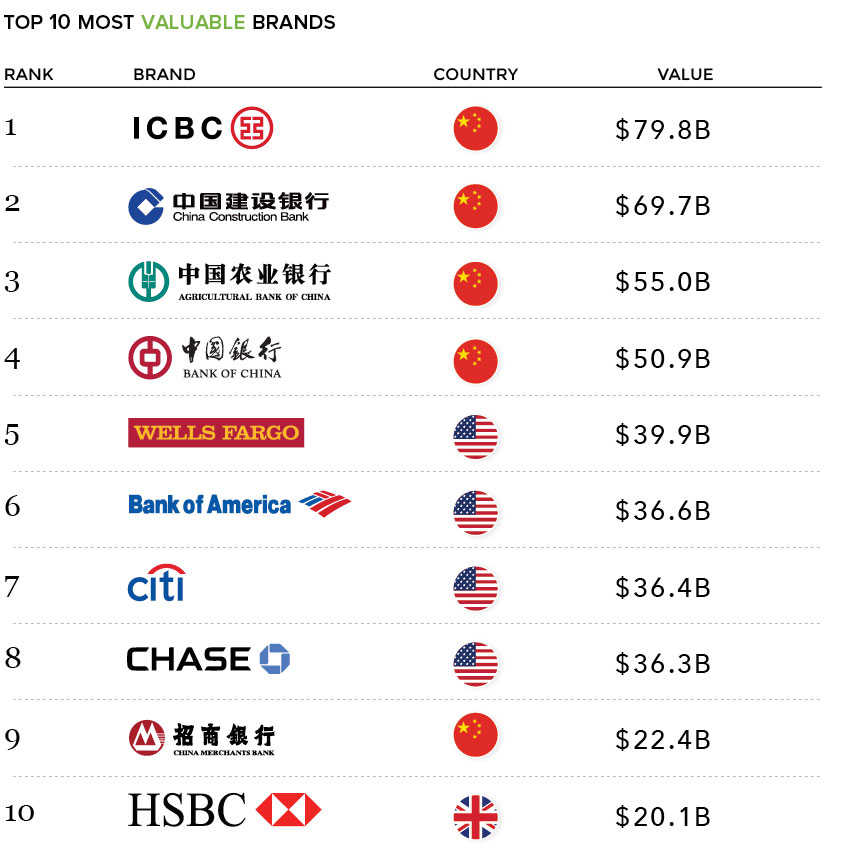

Here are the top bank brands by value in 2019:

For the third year in a row, the Industrial and Commercial Bank of China (ICBC) takes the top spot, with a brand value of $79.8 billion.

Wells Fargo is the top U.S. bank by brand value, coming in 5th place – however, the bank actually fell two spots from last year’s ranking while simultaneously losing 9% of its brand value. This is not surprising in light of the recent publicity challenges faced by the bank.

The Ascent of Chinese Banks

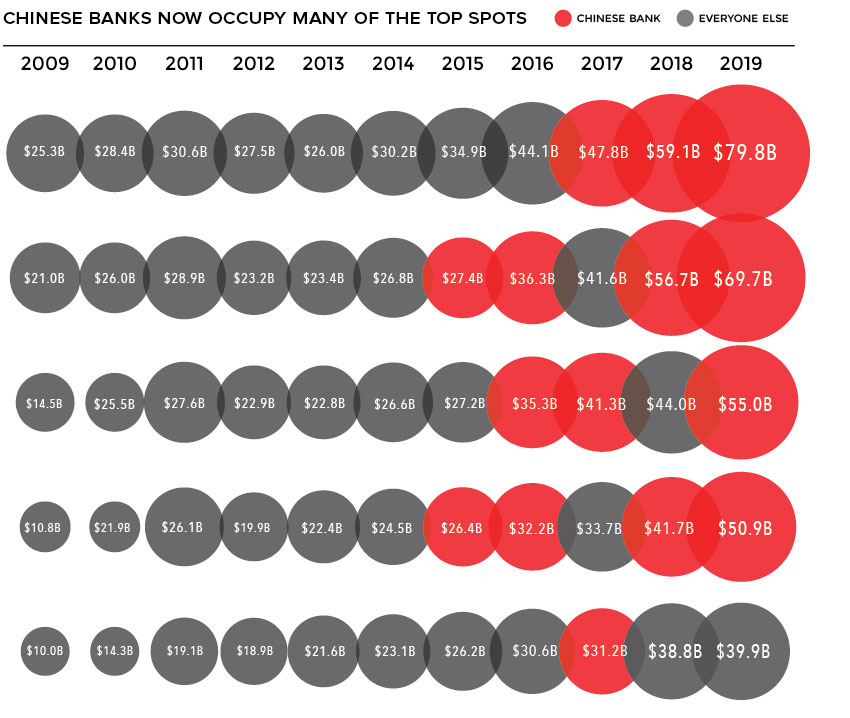

It’s also interesting to note that Chinese banks have taken all four of the top spots on the list, with ICBC, China Construction Bank, Agricultural Bank of China, and Bank of China having a combined brand value of over $250 billion.

Here’s a look at the ascent of Chinese banks over time:

In contrast, in the entire span of 2009-2014, there were zero Chinese banks that cracked the top five.

The Strongest Bank Brands

Finally, here is a look at the strongest bank brands.

It’s worth noting that in contrast to value, these are banks that have executed on their branding, marketing, and sales strategies to have brands that ultimately create a competitive advantage for their business.

Brand Finance measures brand strength by looking at a balanced scorecard of metrics evaluating marketing investment, stakeholder equity, and business performance.

For more insights, don’t forget to check out Brand Finance’s report.

Money

The World’s Top 50 Largest Banks by Consolidated Assets

How big are the world’s biggest banks? In this visualization, we show the top 50 banks by assets and headquarters location.

The World’s Top 50 Largest Banks by Consolidated Assets

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Banks are often among the biggest companies in the world.

In this graphic, we list the top 50 banks in the world by consolidated assets, based on a 2023 report from S&P Global Market Intelligence. The data represents each bank’s total assets for the most recent period available.

Chinese Banks Keep on Growing

According to S&P, the four largest Chinese banks grew their assets by 4.1% in 2022, reaching a combined total of $19.8 trillion.

In fact, Chinese banks already account for over a third of the assets held by the largest banks on the planet. Four of the 15 biggest companies in China are banks.

| Rank | Bank | Headquarters | Total Assets |

|---|---|---|---|

| 1 | Industrial and Commercial Bank of China | 🇨🇳 China | $5.7T |

| 2 | China Construction Bank Corp | 🇨🇳 China | $5.0T |

| 3 | Agricultural Bank of China | 🇨🇳 China | $4.9T |

| 4 | Bank of China | 🇨🇳 China | $4.2T |

| 5 | JPMorgan Chase & Co. | 🇺🇸 US | $3.7T |

| 6 | Bank of America | 🇺🇸 US | $3.1T |

| 7 | Mitsubishi UFJ Financial Group | 🇯🇵 Japan | $3.0T |

| 8 | HSBC Holdings | 🇬🇧 UK | $2.9T |

| 9 | BNP Paribas | 🇫🇷 France | $2.9T |

| 10 | Crédit Agricole Group | 🇫🇷 France | $2.5T |

| 11 | Citigroup | 🇺🇸 US | $2.4T |

| 12 | Postal Savings Bank of China | 🇨🇳 China | $2.0T |

| 13 | Sumitomo Mitsui Financial Group | 🇯🇵 Japan | $2.0T |

| 14 | Mizuho Financial Group | 🇯🇵 Japan | $1.9T |

| 15 | Bank of Communications | 🇨🇳 China | $1.9T |

| 16 | Wells Fargo & Co. | 🇺🇸 US | $1.9T |

| 17 | Banco Santander | 🇪🇸 Spain | $1.9T |

| 18 | Barclays PLC | 🇬🇧 UK | $1.8T |

| 19 | JAPAN POST BANK | 🇯🇵 Japan | $1.7T |

| 20 | UBS Group | 🇨🇭 Switzerland | $1.7T |

| 21 | Groupe BPCE | 🇫🇷 France | $1.6T |

| 22 | Société Générale | 🇫🇷 France | $1.6T |

| 23 | Royal Bank of Canada | 🇨🇦 Canada | $1.5T |

| 24 | The Toronto-Dominion Bank | 🇨🇦 Canada | $1.5T |

| 25 | China Merchants Bank | 🇨🇳 China | $1.5T |

| 26 | Goldman Sachs Group | 🇺🇸 US | $1.4T |

| 27 | Deutsche Bank | 🇩🇪 Germany | $1.4T |

| 28 | Industrial Bank | 🇨🇳 China | $1.3T |

| 29 | China CITIC Bank International | 🇨🇳 China | $1.2T |

| 30 | Shanghai Pudong Development Bank | 🇨🇳 China | $1.2T |

| 31 | Morgan Stanley | 🇺🇸 US | $1.2T |

| 32 | Crédit Mutuel | 🇫🇷 France | $1.2T |

| 33 | Lloyds Banking Group | 🇬🇧 UK | $1.1T |

| 34 | China Minsheng Banking | 🇨🇳 China | $1.1T |

| 35 | Intesa Sanpaolo | 🇮🇹 Italy | $1.0T |

| 36 | ING Groep | 🇳🇱 Netherlands | $1.0T |

| 37 | The Bank of Nova Scotia | 🇨🇦 Canada | $1.0T |

| 38 | UniCredit | 🇮🇹 Italy | $917B |

| 39 | China Everbright Bank | 🇨🇳 China | $913B |

| 40 | NatWest Group | 🇬🇧 UK | $868B |

| 41 | Bank of Montreal | 🇨🇦 Canada | $859B |

| 42 | Commonwealth Bank of Australia | 🇦🇺 Australia | $837B |

| 43 | Standard Chartered | 🇬🇧 UK | $820B |

| 44 | La Banque Postale | 🇫🇷 France | $797B |

| 45 | Ping An Bank | 🇨🇳 China | $772B |

| 46 | Banco Bilbao Vizcaya Argentaria | 🇪🇸 Spain | $762B |

| 47 | The Norinchukin Bank | 🇯🇵 Japan | $753B |

| 48 | State Bank of India | 🇮🇳 India | $695B |

| 49 | Canadian Imperial Bank of Commerce | 🇨🇦 Canada | $691B |

| 50 | National Australia Bank | 🇦🇺 Australia | $680B |

The Chinese financial market is followed by the American market on our list, with six U.S. banks combining for $13.7 trillion in assets.

The top 10 on the list include four Chinese banks, two American institutions, two French, one Japanese, and one British.

The biggest climber on our rank was Swiss UBS Group AG. The bank surged to 20th place from 34th in 2021. Its $1.6 trillion asset size has been adjusted to incorporate troubled Credit Suisse Group AG, which UBS agreed to take over in an emergency deal orchestrated by the Swiss authorities in March 2023.

Assets held by the 100 largest banks totaled $111.97 trillion in 2022, down 1.5% from $113.67 trillion a year earlier. Some of the reasons include high inflation, interest rate hikes, and the Russia-Ukraine war, which dampened global economic growth and investor sentiment.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees