Technology

What Would $5,000 Invested in Nvidia Be Worth Today?

![]() See this visualization first on the Voronoi app.

See this visualization first on the Voronoi app.

What Would $5,000 Invested in Nvidia Be Worth Today?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Investing in Nvidia has been highly lucrative, especially for investors who got in early.

As America’s largest chipmaker, its stock price has soared given its critical role in powering AI. Last year alone, its share price jumped 272%, vaulting it into becoming one of the world’s most valuable companies.

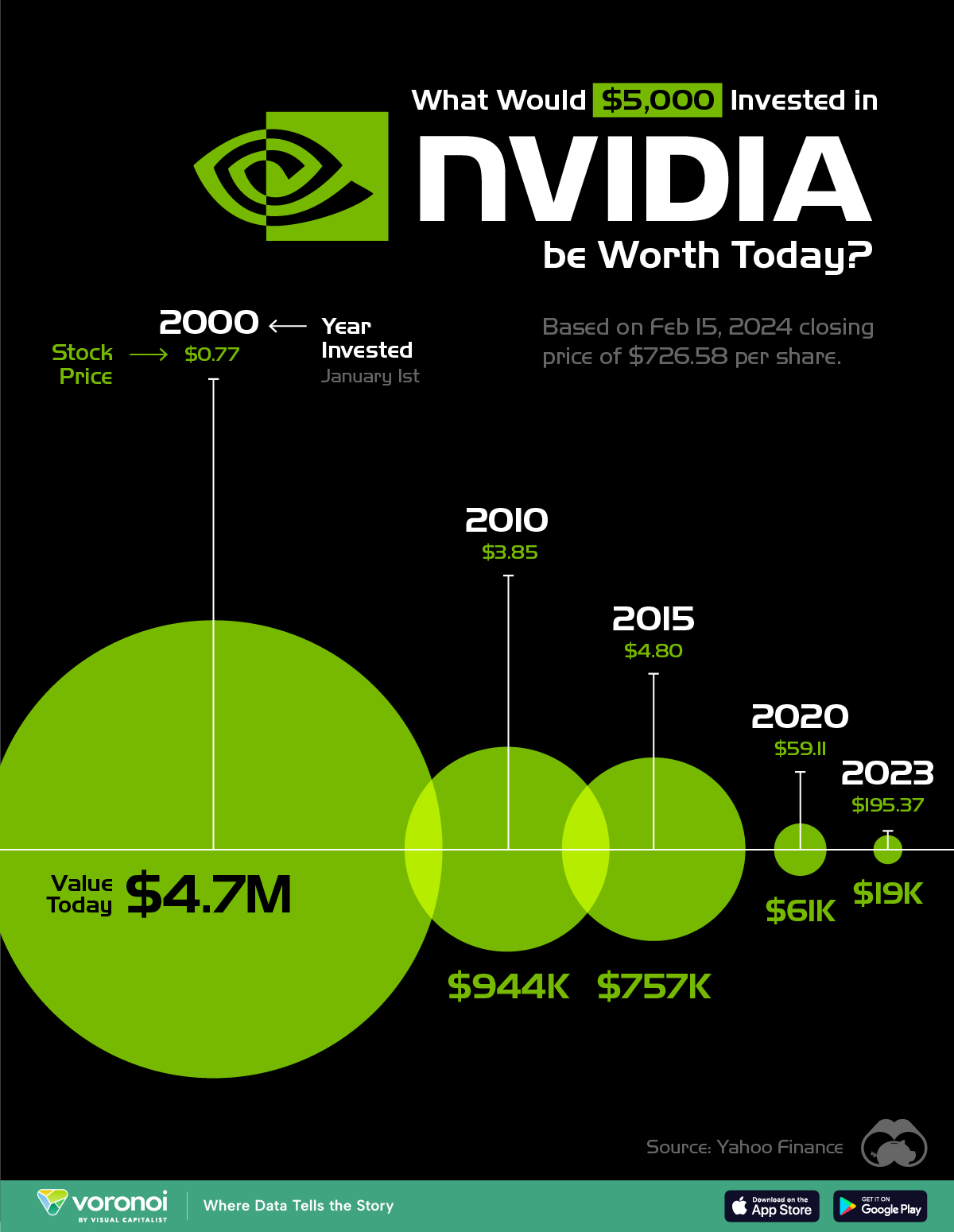

This graphic shows how much a $5,000 investment in Nvidia would have grown over time, based on data from Yahoo Finance.

Investing in Nvidia Before the AI Boom

Below, we show how much an investment in Nvidia would have increased in value over the last several decades:

| Year Invested (January 1st) | Stock Price | Starting Value | Value Today (as of Feb 15, 2024) |

|---|---|---|---|

| 2000 | $0.77 | $5,000 | $4,718,052 |

| 2010 | $3.85 | $5,000 | $943,610 |

| 2015 | $4.80 | $5,000 | $756,854 |

| 2020 | $59.11 | $5,000 | $61,460 |

| 2023 | $195.37 | $5,000 | $18,595 |

For those who bought in 2000, a $5,000 investment would be worth over $4.7 million today, with Nvidia’s stock price rising 94,261% over the time period.

At the time, Nvidia had just invented its graphics processing unit (GPU), which allowed computer graphics to render more seamlessly in video games and video editing. These high-performance units complete complex computing tasks, and Nvidia was creating leading technology at the time.

Over the last decade, Nvidia has increasingly focused on AI technology, with key developments launching as early as 2012. Yet it was not until 2020 when its share price really began to soar as the company’s end customer segments increasingly became data centers and cloud computing, alongside video games.

In fact, since 2020 alone, its share price has soared 1,129%—making a $5,000 investment worth twelve times as much today.

So far this year, its stock price shows no sign of stopping, driven by its outsized role in the AI chipmaking market. Roughly 70% of all chips are sold by Nvidia, outpacing key competitor AMD by a landslide.

The company’s Q4 revenues topped $22 billion, setting another historical record, amounting to a 265% year-over-year increase in revenues. In 2023, Nvidia sold 2.5 million chips with customers including OpenAI, Microsoft, Meta Platforms, and Alphabet. The price range for these chips can span anywhere from $16,000 to $100,000.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Science1 week ago

Science1 week agoVisualizing the Average Lifespans of Mammals

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023

-

Green2 weeks ago

Green2 weeks agoRanking the Top 15 Countries by Carbon Tax Revenue