Technology

Visualizing the Trillion-Fold Increase in Computing Power

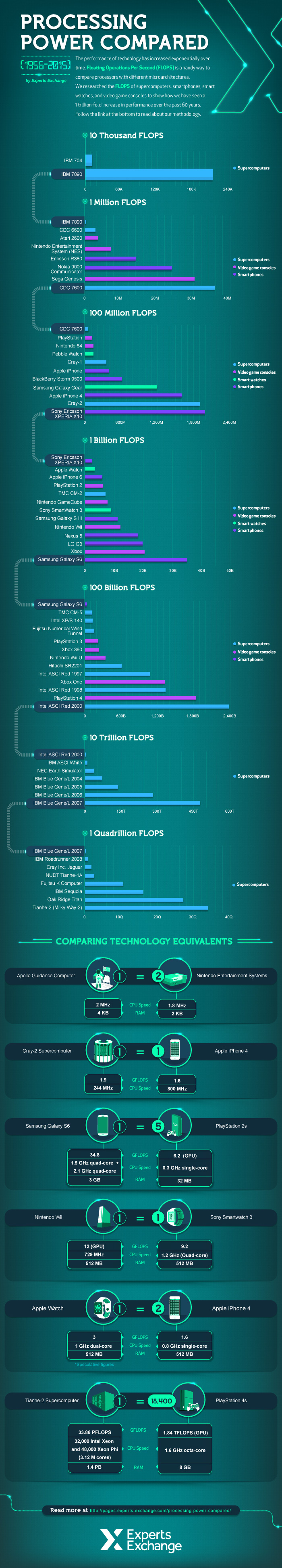

On July 20, 1969, millions of people received an inspirational jolt from watching two brave astronauts take humankind’s first steps on the moon. Rightly so, those astronauts, Neil Armstrong and Buzz Aldrin, are now household names to many – however, their Apollo Guidance Computer (AGC) remains the unsung hero that made their moon landing possible in the first place.

With processing power equivalent to a pair of Nintendo consoles, the AGC wasn’t flashy. But despite its technical limitations, the AGC functioned admirably as the interface for guidance, navigation, and control of the spacecraft to get humans to their first lunar destination.

To Infinity and Beyond?

If a pair of Nintendo consoles can get us to the moon, there’s no telling what the future may hold as computing power continues to grow.

Today’s infographic comes to us from Experts Exchange, and it visualizes the 1 trillion-fold increase in computing performance from 1956 to 2015.

The Incredible Shrinking Hard Disk

In the 1970s, data storage equipment was serious business. The IBM 305 RAMAC, for example, weighed a ton and measured 16 square feet. The RAMAC’s storage capacity? Just 5MB.

Thankfully, hard disks are no longer the size of filing cabinets. The animation below visualizes just how compact terabytes of storage have become.

Computing in the Real World

A relatable touchpoint for many people will be ever-changing graphics quality of video games.

The journey from Atari’s pixelated stick figures to today’s crisp, hyper-realistic graphics is a surprisingly good visual aid to help us understand increases in computing power over many years.

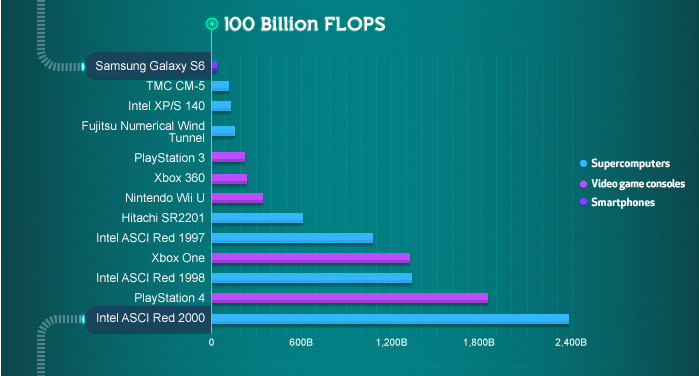

The journey from Pong to Call of Duty is inexorably linked to processing power. As the comprehensive list below demonstrates, modern gaming systems are so powerful that even the revolutionary Xbox 360 now looks quaint in comparison.

| YEAR | MFLOPS | CONSOLE |

|---|---|---|

| 1976 | 0 | Fairchild Channel F (Pong) |

| 1977 | 0 | Atari 2600 |

| 1983 | 0 | NES |

| 1986 | 0 | Atari 7800 |

| 1988 | 0 | Sega Genesis |

| 1990 | 0 | SNES |

| 1991 | 0 | Sega CD |

| 1994 | 0 | Sony PlayStation |

| 1994 | 0 | Sega Saturn |

| 1996 | 200 | Nintendo 64 |

| 2000 | 6,200 | Sony PlayStation 2 |

| 2005 | 240,000 | Xbox 360 |

| 2006 | 459,200 | Sony PlayStation 3 |

| 2013 | 1,228,800 | Xbox One |

| 2013 | 1,843,200 | Sony PlayStation 4 |

Our ExaFLOP Future

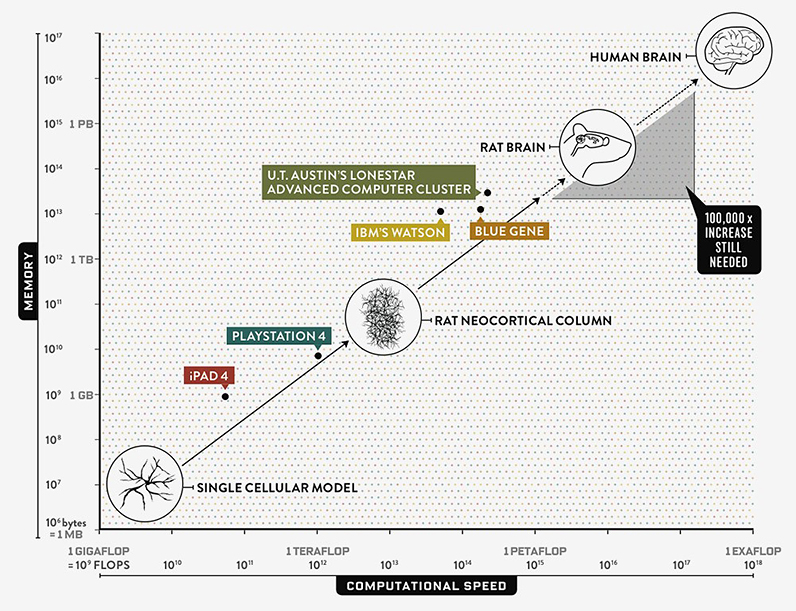

Though performance drivers are flattening out, supercomputing continues to hit new milestones. The next one on the list is exascale computing – and at that level, machines will be capable of a million-trillion calculations a second.

Why do we even need computers that powerful? For one, some of the biggest challenges facing humankind are extremely complicated, and we just don’t have the computing power to tackle them as effectively as we could. Two relevant examples are climate modeling and life sciences.

All these advances are pushing us closer to a major symbolic milestone: computers as powerful and complex as the human brain.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees