Technology

Ranked: The Top 100 Product Searches on Amazon

What Products are People Searching for on Amazon?

When it comes to searching for products online, a majority of U.S. shoppers go directly to Amazon. Thanks to this widespread use, product searches on Amazon provide interesting insights into current consumer behavior, including what shoppers have been focusing on in 2020.

Today’s chart uses data from Ahrefs to showcase Amazon’s top 100 U.S. product searches. We’ll also dive into the most popular categories, as well as top keyword searches on a global basis.

Top 100 Amazon Product Searches in the U.S.

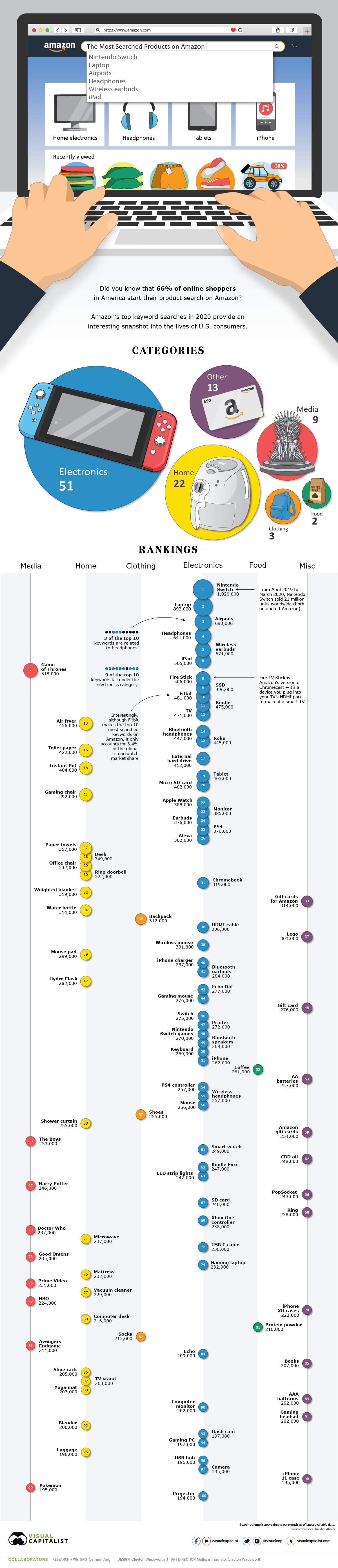

Out of the top 100 product searches on Amazon, over half are for electronics.

Nintendo Switch is the most searched product keyword, with approximately one million monthly searches. This makes sense, considering the console’s recent surge in popularity—in March 2020, U.S. sales of the Nintendo Switch more than doubled compared to a year prior.

Here’s a look at the full ranking of all product keywords, by monthly search volume:

| Rank | Keyword | Search Volume | Category |

|---|---|---|---|

| 1 | nintendo switch | 1,020,000 | Electronics |

| 2 | laptop | 892,000 | Electronics |

| 3 | airpods | 693,000 | Electronics |

| 4 | headphones | 641,000 | Electronics |

| 5 | wireless earbuds | 571,000 | Electronics |

| 6 | ipad | 565,000 | Electronics |

| 7 | game of thrones | 518,000 | Media |

| 8 | fire stick | 506,000 | Electronics |

| 9 | ssd | 496,000 | Electronics |

| 10 | fitbit | 481,000 | Electronics |

| 11 | kindle | 475,000 | Electronics |

| 12 | tv | 471,000 | Electronics |

| 13 | air fryer | 456,000 | Home |

| 14 | bluetooth headphones | 447,000 | Electronics |

| 15 | roku | 445,000 | Electronics |

| 16 | toilet paper | 422,000 | Home |

| 17 | external hard drive | 412,000 | Electronics |

| 18 | instant pot | 404,000 | Home |

| 19 | tablet | 403,000 | Electronics |

| 20 | micro sd card | 402,000 | Electronics |

| 21 | gaming chair | 392,000 | Home |

| 22 | apple watch | 388,000 | Electronics |

| 23 | monitor | 385,000 | Electronics |

| 24 | earbuds | 376,000 | Electronics |

| 25 | ps4 | 370,000 | Electronics |

| 26 | alexa | 362,000 | Electronics |

| 27 | paper towels | 357,000 | Home |

| 28 | desk | 349,000 | Home |

| 29 | office chair | 332,000 | Home |

| 30 | ring doorbell | 322,000 | Home |

| 31 | chromebook | 319,000 | Electronics |

| 32 | weighted blanket | 319,000 | Home |

| 33 | gift cards for amazon | 314,000 | Misc |

| 34 | water bottle | 314,000 | Home |

| 35 | backpack | 312,000 | Clothing |

| 36 | hdmi cable | 306,000 | Electronics |

| 37 | lego | 301,000 | Misc |

| 38 | wireless mouse | 301,000 | Electronics |

| 39 | mouse pad | 299,000 | Home |

| 40 | iphone charger | 287,000 | Electronics |

| 41 | bluetooth earbuds | 284,000 | Electronics |

| 42 | hydro flask | 282,000 | Home |

| 43 | echo dot | 277,000 | Electronics |

| 44 | gaming mouse | 276,000 | Electronics |

| 45 | gift card | 276,000 | Misc |

| 46 | switch | 275,000 | Electronics |

| 47 | printer | 272,000 | Electronics |

| 48 | nintendo switch games | 270,000 | Electronics |

| 49 | bluetooth speakers | 269,000 | Electronics |

| 50 | keyboard | 269,000 | Electronics |

| 51 | iphone | 262,000 | Electronics |

| 52 | coffee | 261,000 | Food |

| 53 | aa batteries | 257,000 | Misc |

| 54 | ps4 controller | 257,000 | Electronics |

| 55 | wireless headphones | 257,000 | Electronics |

| 56 | mouse | 256,000 | Electronics |

| 57 | shoes | 255,000 | Clothing |

| 58 | shower curtain | 255,000 | Home |

| 59 | amazon gift cards | 254,000 | Misc |

| 60 | the boys | 253,000 | Media |

| 61 | smart watch | 249,000 | Electronics |

| 62 | cbd oil | 248,000 | Misc |

| 63 | kindle fire | 247,000 | Electronics |

| 64 | led strip lights | 247,000 | Electronics |

| 65 | harry potter | 246,000 | Media |

| 66 | pop socket | 243,000 | Misc |

| 67 | sd card | 240,000 | Electronics |

| 68 | ring | 238,000 | Misc |

| 69 | xbox one controller | 238,000 | Electronics |

| 70 | doctor who | 237,000 | Media |

| 71 | microwave | 237,000 | Home |

| 72 | usb c cable | 236,000 | Electronics |

| 73 | good omens | 235,000 | Media |

| 74 | gaming laptop | 232,000 | Electronics |

| 75 | mattress | 232,000 | Home |

| 76 | prime video | 231,000 | Media |

| 77 | vacuum cleaner | 229,000 | Home |

| 78 | hbo | 224,000 | Media |

| 79 | iphone xr cases | 222,000 | Misc |

| 80 | computer desk | 216,000 | Home |

| 81 | protein powder | 216,000 | Food |

| 82 | socks | 213,000 | Clothing |

| 83 | avengers endgame | 211,000 | Media |

| 84 | echo | 209,000 | Electronics |

| 85 | books | 207,000 | Misc |

| 86 | shoe rack | 205,000 | Home |

| 87 | tv stand | 203,000 | Home |

| 88 | yoga mat | 203,000 | Home |

| 89 | aaa batteries | 202,000 | Misc |

| 90 | computer monitor | 202,000 | Electronics |

| 91 | gaming headset | 202,000 | Misc |

| 92 | blender | 200,000 | Home |

| 93 | dash cam | 197,000 | Electronics |

| 94 | gaming pc | 197,000 | Electronics |

| 95 | luggage | 196,000 | Home |

| 96 | usb hub | 196,000 | Electronics |

| 97 | camera | 195,000 | Electronics |

| 98 | iphone 11 case | 195,000 | Misc |

| 99 | pokemon | 195,000 | Media |

| 100 | projector | 194,000 | Electronics |

Two different Apple products make the top 10—Airpods and iPad. It’s interesting that Airpods and iPads have their own search term distinctive from their broader categories (wireless headphones and tablets), demonstrating Apple’s strong brand recognition in America.

Of course, Apple is also dominant in the personal tech market more broadly. For instance, iPhones make up 46% of the U.S. smartphone market by number of devices sold.

Top 100 Amazon Product Searches Globally

Like the U.S. top searches, Nintendo Switch comes in at number one worldwide, with over 2 million approximate monthly searches.

| Rank | Keyword | Search Volume | Category |

|---|---|---|---|

| 1 | nintendo switch | 2,520,000 | Electronics |

| 2 | laptop | 1,990,000 | Electronics |

| 3 | ssd | 1,780,000 | Electronics |

| 4 | kindle | 1,420,000 | Electronics |

| 5 | ps4 | 1,420,000 | Electronics |

| 6 | airpods | 1,350,000 | Electronics |

| 7 | ipad | 1,290,000 | Electronics |

| 8 | tablet | 1,150,000 | Electronics |

| 9 | iphone | 1,140,000 | Electronics |

| 10 | alexa | 1,120,000 | Electronics |

| 11 | headphones | 1,110,000 | Electronics |

| 12 | game of thrones | 1,040,000 | Media |

| 13 | lego | 1,020,000 | Misc |

| 14 | switch | 955,000 | Electronics |

| 15 | fitbit | 910,000 | Electronics |

| 16 | tv | 905,000 | Electronics |

| 17 | harry potter | 859,000 | Media |

| 18 | xiaomi | 836,000 | Electronics |

| 19 | monitor | 795,000 | Electronics |

| 20 | apple watch | 703,000 | Electronics |

| 21 | iphone 7 | 691,000 | Electronics |

| 22 | wireless earbuds | 687,000 | Electronics |

| 23 | iphone x | 670,000 | Electronics |

| 24 | fire stick | 664,000 | Electronics |

| 25 | bluetooth headphones | 655,000 | Electronics |

| 26 | samsung | 611,000 | Electronics |

| 27 | iphone 8 | 606,000 | Electronics |

| 28 | iphone xr | 606,000 | Electronics |

| 29 | mouse | 577,000 | Electronics |

| 30 | micro sd card | 576,000 | Electronics |

| 31 | gaming chair | 574,000 | Home |

| 32 | air fryer | 567,000 | Home |

| 33 | echo dot | 560,000 | Electronics |

| 34 | smart watch | 547,000 | Electronics |

| 35 | smartphone | 545,000 | Electronics |

| 36 | external hard drive | 526,000 | Electronics |

| 37 | instant pot | 516,000 | Home |

| 38 | roku | 514,000 | Electronics |

| 39 | star wars | 512,000 | Media |

| 40 | ps4 controller | 508,000 | Electronics |

| 41 | water bottle | 507,000 | Home |

| 42 | keyboard | 499,000 | Electronics |

| 43 | chromebook | 491,000 | Electronics |

| 44 | huawei | 490,000 | Electronics |

| 45 | gaming mouse | 484,000 | Electronics |

| 46 | pokemon | 483,000 | Media |

| 47 | shoes | 479,000 | Clothing |

| 48 | backpack | 473,000 | Clothing |

| 49 | playstation 4 | 472,000 | Electronics |

| 50 | earbuds | 471,000 | Electronics |

| 51 | echo | 467,000 | Electronics |

| 52 | toilet paper | 467,000 | Home |

| 53 | smartwatch | 461,000 | Electronics |

| 54 | notebook | 459,000 | Electronics |

| 55 | iphone 11 | 454,000 | Electronics |

| 56 | power bank | 454,000 | Electronics |

| 57 | xbox one | 452,000 | Electronics |

| 58 | wireless mouse | 450,000 | Electronics |

| 59 | gaming pc | 449,000 | Electronics |

| 60 | desk | 443,000 | Home |

| 61 | office chair | 442,000 | Home |

| 62 | mouse pad | 439,000 | Home |

| 63 | redmi note 7 | 433,000 | Electronics |

| 64 | printer | 431,000 | Electronics |

| 65 | chromecast | 430,000 | Electronics |

| 66 | gaming laptop | 429,000 | Electronics |

| 67 | hdmi cable | 422,000 | Electronics |

| 68 | earphones | 421,000 | Electronics |

| 69 | wireless headphones | 420,000 | Electronics |

| 70 | drone | 415,000 | Electronics |

| 71 | books | 408,000 | Misc |

| 72 | funko pop | 406,000 | Misc |

| 73 | nintendo switch games | 402,000 | Electronics |

| 74 | amazon | 400,000 | Misc |

| 75 | camera | 398,000 | Electronics |

| 76 | gift card | 396,000 | Misc |

| 77 | sd card | 396,000 | Electronics |

| 78 | xbox one controller | 392,000 | Electronics |

| 79 | ps4 games | 388,000 | Electronics |

| 80 | rtx 2060 | 387,000 | Electronics |

| 81 | laptops | 385,000 | Electronics |

| 82 | ring doorbell | 383,000 | Home |

| 83 | ipad pro | 381,000 | Electronics |

| 84 | ps4 pro | 378,000 | Electronics |

| 85 | gopro | 375,000 | Electronics |

| 86 | the boys | 375,000 | Media |

| 87 | bluetooth earbuds | 369,000 | Electronics |

| 88 | weighted blanket | 368,000 | Home |

| 89 | windows 10 | 368,000 | Electronics |

| 90 | paper towels | 367,000 | Home |

| 91 | avengers endgame | 366,000 | Media |

| 92 | lego star wars | 362,000 | Misc |

| 93 | xiaomi redmi note 7 | 362,000 | Electronics |

| 94 | microwave | 361,000 | Home |

| 95 | bluetooth speakers | 360,000 | Electronics |

| 96 | good omens | 357,000 | Media |

| 97 | coffee | 356,000 | Food |

| 98 | nike | 356,000 | Clothing |

| 99 | projector | 355,000 | Electronics |

| 100 | vans | 355,000 | Clothing |

Interestingly, three different Apple products appear in the top 10 global searches—Airpods, iPad, and iPhone. Additionally, a couple of older iPhone models make the overall ranking—iPhone 7 comes in at 21st place, and iPhone 8 takes the 28th spot.

On the U.S. list, these older iPhone models don’t even make the top 100.

Keyword Category Rankings

When it comes to top-ranking keywords, the electronics category appears to be the most important to Americans. Over half the U.S. top product searches fall under electronics, with the home category in second place.

Here’s a look at the full U.S. category breakdown:

Interestingly, when comparing the order of categories in the U.S versus worldwide, the sections remain mostly the same:

| Category | # of U.S. Keywords | # of Global Keywords |

|---|---|---|

| Electronics | 51 | 70 |

| Home | 22 | 12 |

| Media | 9 | 7 |

| Misc | 13 | 6 |

| Clothing | 3 | 4 |

| Food | 2 | 1 |

Like the U.S., electronics comes in at number one worldwide. However, it’s an even larger portion for the global ranking—70 keyword searches on the global list are for electronics.

The home category is more popular in the U.S. than across the globe, with 22 in the U.S. versus 12 worldwide. In America, air fryer is the most popular keyword search under this section—possibly because people were looking for a quick way to make their meals while they were busy playing Animal Crossing on their Switches.

The second most popular U.S. keyword under the home category is toilet paper. Considering the toilet paper shortages in the spring of 2020, this makes sense, as stores began limiting the number of rolls a person could purchase.

What Will 2021 Bring?

Based on the top 100 list, both globally and in the U.S., it’s clear that when searching on Amazon, a majority of consumers are looking for electronics.

However, the specific electronics they’re searching for (such as iPhones and Nintendo Switches), helps to provide some context around the products people are interested in, as well as the particular brands that are currently on everyone’s radar.

Will the Switch get switched out of the top spot in 2021? Because electronics tend to update so frequently, it’s very possible.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001