Business

Are You Suffering From Impostor Syndrome?

Are You Suffering From Impostor Syndrome?

If you have ever felt unworthy of your position at work, or felt uncomfortable about receiving praise from colleagues, then you’re not alone.

The psychological pattern of impostor syndrome is widespread, with the majority of people experiencing some form of it over the course of their careers.

Today’s infographic, from Resume.io, provides a useful guide to identifying the various manifestations of impostor syndrome, and how to potentially overcome it.

What is Impostor Syndrome?

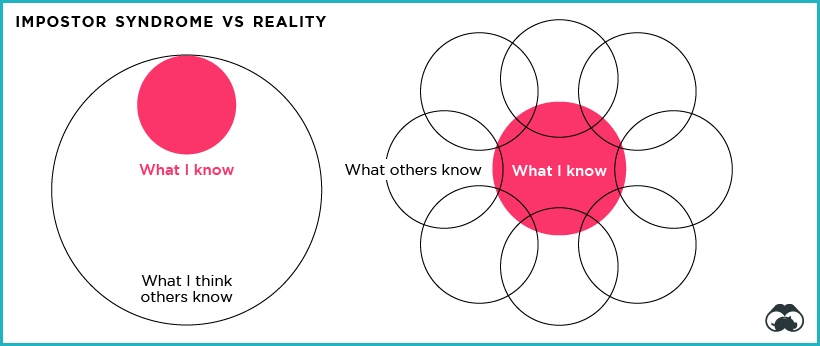

People suffering from impostor syndrome doubt their skills and accomplishments, live in fear of being exposed as not worthy of their position, and even downplay their success, attributing it all to luck or good fortune.

These feelings, which were first collectively known as “impostor phenomenon,” were introduced in a 1978 study of 150 highly successful women. Today, we have an even more nuanced view of how feelings of anxiety and inadequacy can afflict people in a professional setting.

Impostor Syndrome Archetypes

According to Dr. Valerie Young, a leading expert on the subject of impostor syndrome, these feelings of self doubt are not one-size-fits-all.

Here are the five different types of impostor syndrome:

| Number | Archetype | Description |

|---|---|---|

| #1 | Expert | You expect to know everything and feel ashamed when you don't. |

| #2 | Soloist | You believe work must be accomplished alone and refuse to take any credit if you received any kind of assistance. |

| #3 | Natural Genius | You tell yourself that everything must be handled with ease, otherwise it's not "natural talent". |

| #4 | Superperson | You feel you should be able to excel at every role you take on in your life. |

| #5 | Perfectionist | You set impossibly high standards for yourself and beat yourself up when you don't reach them. |

Understanding the different types of impostor syndrome is an important first step, as each manifestation requires a unique toolkit of solutions to help overcome this common psychological trap experienced by professionals.

Slaying Self Doubt

While impostor syndrome can afflict anyone, women have been shown to experience it more often – even once they have experienced high levels of success in their career.

A recent KPMG study of 750 high-performing executive women found that:

- 75% had experienced impostor syndrome at some point in their career

- 81% of these woman also believed they put more pressure on themselves than their male counterparts

Though progress has been made, lack of diversity at the C-suite level is still fueling some of these feelings. 32% of women identified with impostor syndrome because they did not know others in a similar place to them either personally or professionally.

When it came to combating feelings of self-doubt, many woman found support within their network and organizations:

- 72% said they looked to a mentor or trusted advisor for help and advice when the doubt creeps in

- 54% received support and guidance from performance managers

Actively creating a culture that supports honest conversations in the workplace is key to helping individuals slay professional self doubt.

Together, we have the opportunity to build corporate environments that foster a sense of belonging and lessen the experience of impostor syndrome for women in our workplaces.

– Laura Newinski, U.S. Deputy Chair and COO of KPMG

Technology

How Tech Logos Have Evolved Over Time

From complete overhauls to more subtle tweaks, these tech logos have had quite a journey. Featuring: Google, Apple, and more.

How Tech Logos Have Evolved Over Time

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

One would be hard-pressed to find a company that has never changed its logo. Granted, some brands—like Rolex, IBM, and Coca-Cola—tend to just have more minimalistic updates. But other companies undergo an entire identity change, thus necessitating a full overhaul.

In this graphic, we visualized the evolution of prominent tech companies’ logos over time. All of these brands ranked highly in a Q1 2024 YouGov study of America’s most famous tech brands. The logo changes are sourced from 1000logos.net.

How Many Times Has Google Changed Its Logo?

Google and Facebook share a 98% fame rating according to YouGov. But while Facebook’s rise was captured in The Social Network (2010), Google’s history tends to be a little less lionized in popular culture.

For example, Google was initially called “Backrub” because it analyzed “back links” to understand how important a website was. Since its founding, Google has undergone eight logo changes, finally settling on its current one in 2015.

| Company | Number of Logo Changes |

|---|---|

| 8 | |

| HP | 8 |

| Amazon | 6 |

| Microsoft | 6 |

| Samsung | 6 |

| Apple | 5* |

Note: *Includes color changes. Source: 1000Logos.net

Another fun origin story is Microsoft, which started off as Traf-O-Data, a traffic counter reading company that generated reports for traffic engineers. By 1975, the company was renamed. But it wasn’t until 2012 that Microsoft put the iconic Windows logo—still the most popular desktop operating system—alongside its name.

And then there’s Samsung, which started as a grocery trading store in 1938. Its pivot to electronics started in the 1970s with black and white television sets. For 55 years, the company kept some form of stars from its first logo, until 1993, when the iconic encircled blue Samsung logo debuted.

Finally, Apple’s first logo in 1976 featured Isaac Newton reading under a tree—moments before an apple fell on his head. Two years later, the iconic bitten apple logo would be designed at Steve Jobs’ behest, and it would take another two decades for it to go monochrome.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023