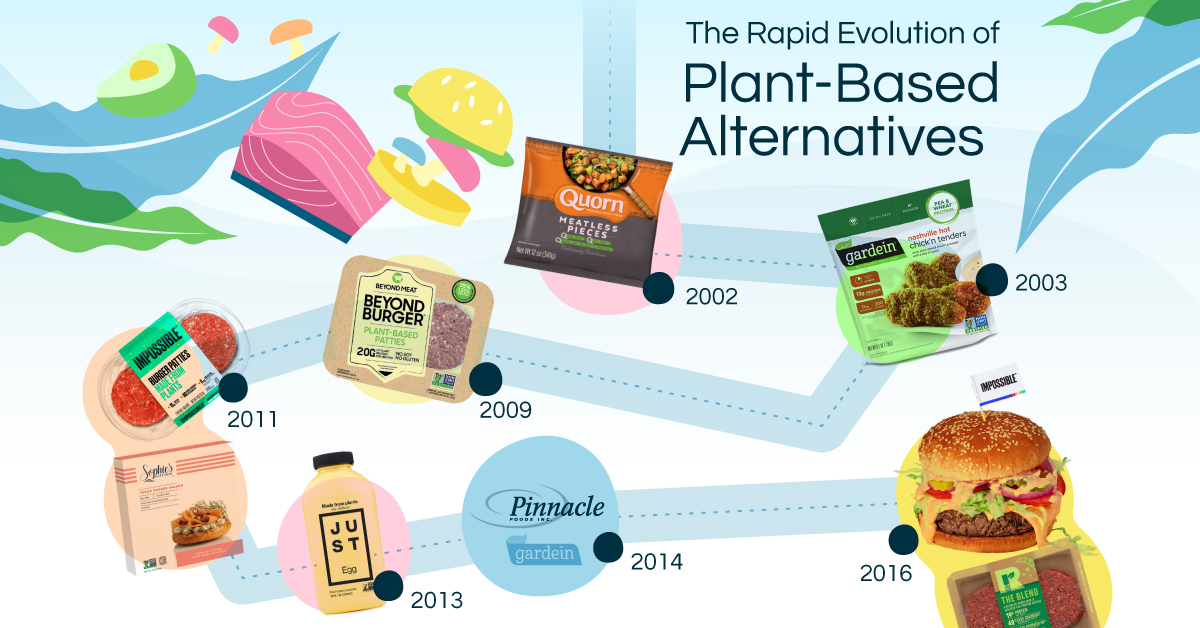

Timeline: The Rapid Evolution of Plant-Based Alternatives

The following content is sponsored by Billy Goat Brands (CSE: GOAT) (“GOAT”).

Timeline: The Rapid Evolution of Plant-Based Alternatives

From plant-based Chick’n Tenders to dairy-free Mylk, consumers are spoilt for choice when it comes to alternatives products on the market.

With an explosion of new options hitting shelves at lightning speed and consumers growing more knowledgeable of plant-based diets, a shift towards eating less meat is being felt across the globe. But how did this movement come to be?

The infographic above from Billy Goat Brands (CSE: GOAT) (“GOAT”) maps out the most notable milestones in the last two decades that have contributed to the evolution of this growing market. Let’s dive in.

Key Events

Although it may feel like we are undergoing a massive transformation when it comes to alternatives, vegetarianism is nothing new. In fact, meat alternatives like tofu have been around since as early as 200 BCE.

Since then, many cultures have made plants a staple in their diet and as of 2021, there was an estimated 79 million people in the world who eat strictly plant-based.

In the table below, we break down the milestones of note that contributed to the growing plant-based market over the last 20 years:

| Year | Key Event |

|---|---|

| 2002 | Quorn enters the North American market |

| 2003 | Plant-based food producer Gardein launches |

| 2009 | Beyond Meat is founded |

| 2011 | Impossible Foods is founded |

| 2011 | Sophie’s Kitchen—a plant-based seafood alternatives company—is founded |

| 2013 | The first plant-based egg substitute is created by San Francisco based startup JUST Egg |

| 2014 | Pinnacle Foods buys Gardein for $154 million |

| 2016 | Impossible Foods launches the Impossible Burger |

| 2016 | Tyson takes a 5% stake in Beyond Meat |

| 2017 | Nestlé acquires plant-based food producer Sweet Earth |

| 2018 | Conagra buys Pinnacle Foods for $10.9 billion |

| 2018 | “Bleeding” ingredient (Soy leghemoglobin) gets FDA approval |

| 2019 | Beyond Meat becomes the first plant-based manufacturer to go public |

| 2020 | Plant-based meat sales grew 152% compared to 2019 while plant-based dairy increased by 86% |

| 2020 | Cargill enters plant-based market |

| 2021 | Funding for alternative proteins increased to over $2 billion from just $271 million in 2020 |

| 2021 | Plant-based retailers become more prominent |

| 2021 | New report predicts plant-based food will reach $143 billion by 2030, and grow 100-fold to $1.4 trillion by 2050 |

Despite disruptions in the supply chain, 2020 proved to be a pivotal year for alternatives products moving into the mainstream with more people realizing the many benefits that come with a plant-based lifestyle.

U.S. retail sales in 2020 shot up by a whopping 27% as a result, reaching $7 billion according to the Good Food Institute.

The Benefits of Eating Plant-Based

Plant-based alternatives can provide the same, if not more nutrients and protein as meat and dairy products. In fact, there is a long list of reasons why you should eat plant-based, as many alternatives on the market have proven to:

- Contain lower saturated fats

- Help lower cholesterol

- Help lower cardiovascular risks

On top of the health benefits, plant-based alternatives have also been shown to be a better option for the planet:

- Reduce reliance on more resource-intensive production processes

- Produce lower GHG emissions

- Require less water and land use compared to conventional meat production

Ultimately, the reasons for reaching for healthy alternatives far outweigh the benefits of eating conventional meat products.

Investing in the Next Generation of Food

GOAT is a unique platform that gives investors access to a diverse selection of health-conscious, sustainability-focused and ESG-driven companies in the alternatives space including The Vegetarian Butcher.

As Canada’s one-stop shop for high quality plant-based alternatives, The Vegetarian Butcher has recently announced its ambitious plan to open a third brick and mortar store after just five years in business.

Will you invest in the future of food?

Learn more about GOAT by clicking this link.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.