Technology

Visualizing the Rise of the ICO

Visualizing the Rise of the ICO

If you ask any investor about Initial Public Offerings (IPOs), you’re not likely to get an extreme range of opinions.

That’s because IPOs have been around for centuries, they’re heavily regulated, and they usually are reserved for companies with impressive traction as they transition to the public market through a storied exchange like the NYSE or Nasdaq.

During times of extreme market froth, like the Dotcom bubble, a newly public company can be the subject of intense amounts of speculation. However, in relative terms, most IPOs are fairly benign.

Companies going public simply have a very abbreviated track record, which makes them difficult to value by the market.

Introducing the ICO

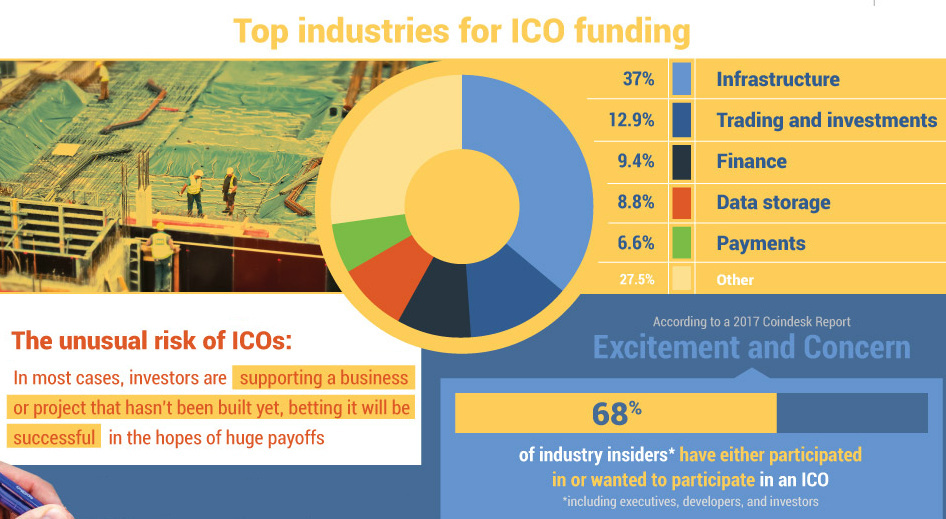

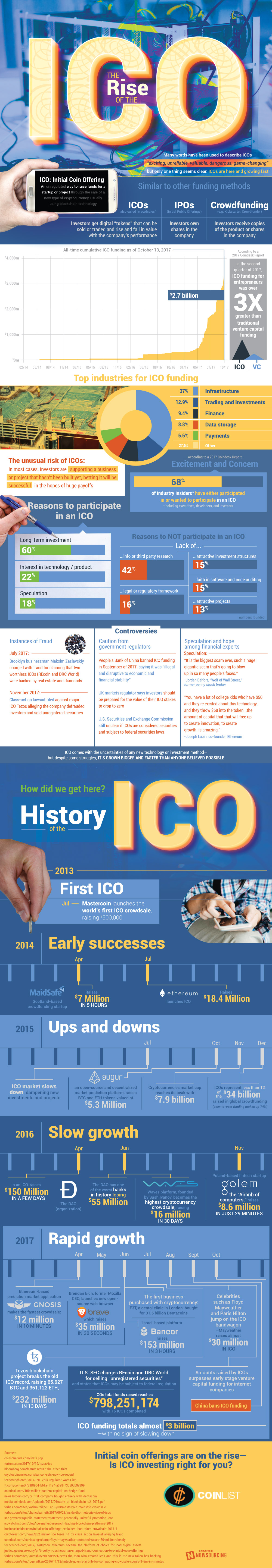

Today’s infographic comes to us from Coinlist, and it showcases the long-lost cousin of the IPO: the initial coin offering (ICO).

At the most basic level, an ICO is a crowdfunded offering of a newly issued cryptocurrency that can be used as a source of capital for startup companies. Investors buy these coins or tokens with legal tender or through the exchange of other cryptocurrencies such as Bitcoin or Ethereum.

And ICOs have taken off – see the incredible video on the explosion in ICOs for yourself.

ICO vs. IPO

Here are some major differences between ICOs and IPOs.

Risk

For a newly-listed public company, the market has limited information to assess – but usually the company has some known traction: sales, revenue, growth, etc. New listings can still be risky, but most still have some intrinsic value, even if that is just an asset at book value.

ICOs, on the other hand, are usually used to raise capital for a new idea or technology. Ethereum, which ICO’d in 2015, is a blockchain-based technology that focuses on enabling smart contracts and decentralized apps. While it wasn’t “proven” at the time of its ICO, Ethereum is now a wild success.

The only problem: not all new technologies or ideas are proven, and some will certainly crash and burn. Further, some will even be scams. Thus, the level of potential risk with ICOs cannot be understated.

Regulation

Newly-listed companies are highly regulated, for better or worse.

ICOs are not regulated, though the SEC has stated that it will treat ICOs as security offerings in some situations. Meanwhile, other countries like South Korea and China have banned ICOs altogether, at least temporarily.

Democratization

While early-stage venture capital and IPOs are traditionally much more difficult for the average person to get exposure to, anyone can buy into an ICO.

In this sense, the ICO offers something similar to crowdfunding: the ability for projects to raise money from a strong community of regular people. This community-based approach can also enable non-profit ventures to succeed.

A Full List of Pros/Cons

For a much more in-depth list of the pros and cons of ICOs, this article by Outlier Ventures provides some fantastic insights.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Science1 week ago

Science1 week agoVisualizing the Average Lifespans of Mammals

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023