How to Protect Your Business From Online Fraud

The following content is sponsored by Equifax.

How to Protect Your Business From Online Fraud

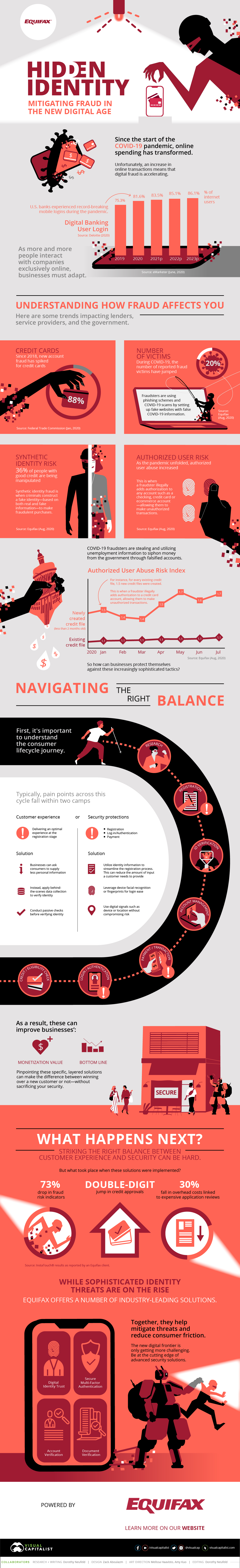

COVID-19 has created a watershed moment in the shift to digital, triggering a wave of online fraud in the process.

Direct messages can be accessed, and passwords changed—with critical infrastructure at stake. By way of social engineering, perpetrators exploit human weakness and vulnerabilities. It raises an unsettling prospect: as the world becomes increasingly digital, what does this mean for security?

Leveraging a rich dataset, this infographic from Equifax unearths several new trends in digital fraud, and shows how businesses can prevent online scams without impacting user experience.

Understanding How Online Fraud Affects You

Here are just a few of the trends impacting lenders, service providers, and the U.S. government.

Credit Cards

Credit card fraud is not a new phenomenon. The COVID-19 era, however, has accelerated it for both businesses and consumers. Credit card fraud on new accounts has spiked 88% since 2018, impacting roughly 250,000 U.S. individuals. This is where scammers use a stolen, synthetic identity to open a new account and maximize credit limits.

Meanwhile, consumers are turning to ecommerce experiences more so than ever before to purchase necessities, entertainment, and more. This means shopping with new vendors and making more card-not-present purchases.

With an increase in transactions comes an increase in chargebacks, either from friendly fraud or legitimate disputes. It’s something that hasn’t gone unnoticed: In fact, 40% of businesses have noticed an increase in chargebacks since January of 2020.

Number of Victims

Overall, the number of fraud victims has jumped 20% according to reported fraud victim alerts. In 2019, the most reported fraud alerts affected those aged between 60-69, with an average of $600 in losses.

| Age | Percentage of Losses | Median Loss | Total Losses |

|---|---|---|---|

| 19 and under | 3% | $200 | $14M |

| 20-29 | 13% | $448 | $124M |

| 30-39 | 16% | $379 | $168M |

| 40-49 | 15% | $410 | $178M |

| 50-59 | 16% | $500 | $186M |

| 60-69 | 20% | $600 | $223M |

| 70-79 | 12% | $800 | $150M |

| 80 and over | 5% | $1,600 | $72M |

| Total (across all age groups) | 100% | $448 | $1,115M |

*Based on 1,697,934 fraud reports in 2019, with 51% including age information

Source: Federal Trade Commission (Jan, 2020)

Now, fraudsters are using phishing schemes and COVID-19 scams by setting up fake websites with false COVID-19 information.

Synthetic Identity Risk

Often used in credit card fraud, synthetic identity theft happens when criminals construct a fake identity—based on both real and fake information—to make fraudulent purchases. Synthetic identity fraud can include account piggybacking, setting up a fake business, or teaming up with corrupt merchants. Scams that manipulate people with good credit have shot up 36% since 2018.

Authorized User Abuse

As the pandemic has unfolded, authorized user abuse has increased more than 20%.

Authorized user abuse occurs when low-risk primary card owners “rent” their tradelines with extensive credit histories, high credit limits and solid repayment profiles to others, often, knowingly, to fraudsters.

So how can businesses protect themselves against these increasingly sophisticated tactics?

Navigating the Right Balance

Preventing fraud is simple: stop accepting transactions or allowing new account creation. But, that stifles business growth. More friction isn’t the answer either. Businesses need to navigate the balance of delivering seamless experience and fraud prevention.

To improve online security for any business, it’s important to understand the consumer lifecycle journey. Typically, pain points across this cycle fall within two camps: customer experience or security protections.

| Type | Pain Point | Solution |

|---|---|---|

| Customer experience | Delivering an optimal experience | |

| Security | Registration | |

| Log-in or Authentication | ||

| Payment |

As a result, these can improve businesses’ monetization value and help the bottom line.

Pinpointing these specific, layered solutions can make the difference between winning over a new customer or not—without sacrificing your security.

Online Fraud: What Happens Next?

Still, striking the right balance between customer experience and security can be challenging.

But when these solutions are implemented, a 73% drop in fraud report incidents is reported by some users. Along with this, a double-digit jump in credit approvals takes place, while overhead costs linked to expensive application reviews sink 30%.

To mitigate threats and prevent consumer bottlenecks, businesses can apply solutions such as:

- Account verification

- Digital identity trust

- Document verification

- Multi-factor authentication

Further, businesses can look to establish the level of trust or risk at every interaction across the customer journey, from account creation and login to payment transaction.

High-trust interactions can move along a seamless, VIP experience, while riskier interactions can be dynamically challenged with friction. A vast identity trust network combined with adaptive AI helps businesses to make appropriate decisions at each interaction. This protects both the business and customer experience.

Combined, they provide the early warning technology that thwarts online fraud and digital attacks—with lasting implications for businesses in the COVID-19 digital era.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.