Technology

The Slowdown in Venture Capital Deals is a Cause for Concern

Last year, the market for venture capital soared to new heights. A record amount of money was raised, with global funding for VC-backed companies reaching $128.5 billion, a 44% jump from 2014.

However, this impressive annual data doesn’t show the whole picture. The fact of the matter is that the flow of venture capital deals peaked mid-year, and then began to disintegrate in the autumn.

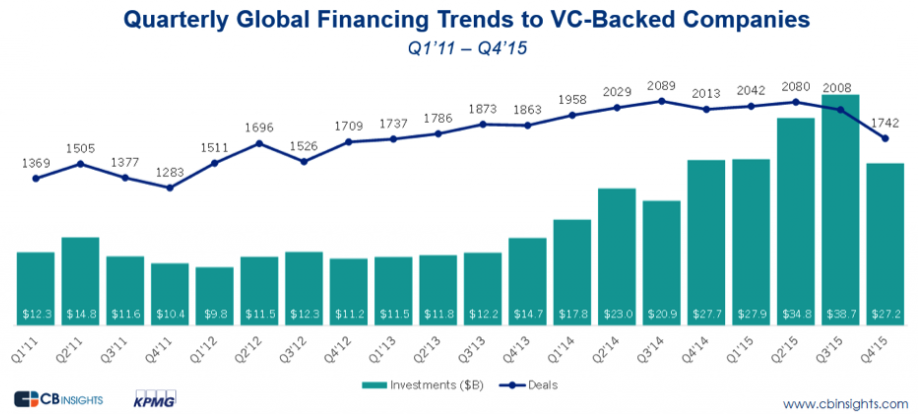

Here’s another look, this time with quarterly data from CB Insights:

The data for Q4 is a steep drop off in terms of deal-flow, and this number hasn’t been this low since Q1 of 2013. The better news is that a total of $27.2 billion was raised, which is more or less on par with previous quarters.

What’s Happening?

Venture capital stalwarts have noted that this lack of deals could be a blip on the radar.

“I’m not aware of any VC who pays attention to any quarter to quarter data at all,” Marc Andreessen, a prominent name in venture capital, noted in a Forbes piece.

That said, a sudden slowdown of this magnitude does raise questions. This is especially true given some of the market developments of 2015.

Firstly, this slowdown in venture capital deals has corresponded with the general anxiety and volatility occurring in public markets. Further, it’s also occurring on the heels of several less-than-stellar IPO performances and repeated calls of a tech valuation bubble. Lastly, while 2015 set records in terms of dollars spent in terms of funding, the amount of new capital raised by venture capital funds dipped significantly from 2014 levels.

This evidence would suggest that venture capital firms, as well as those that fund them, are becoming more discriminatory in how they spend their money.

Venture Capital in 2015: At a Glance

Where did venture capital money go to in 2015?

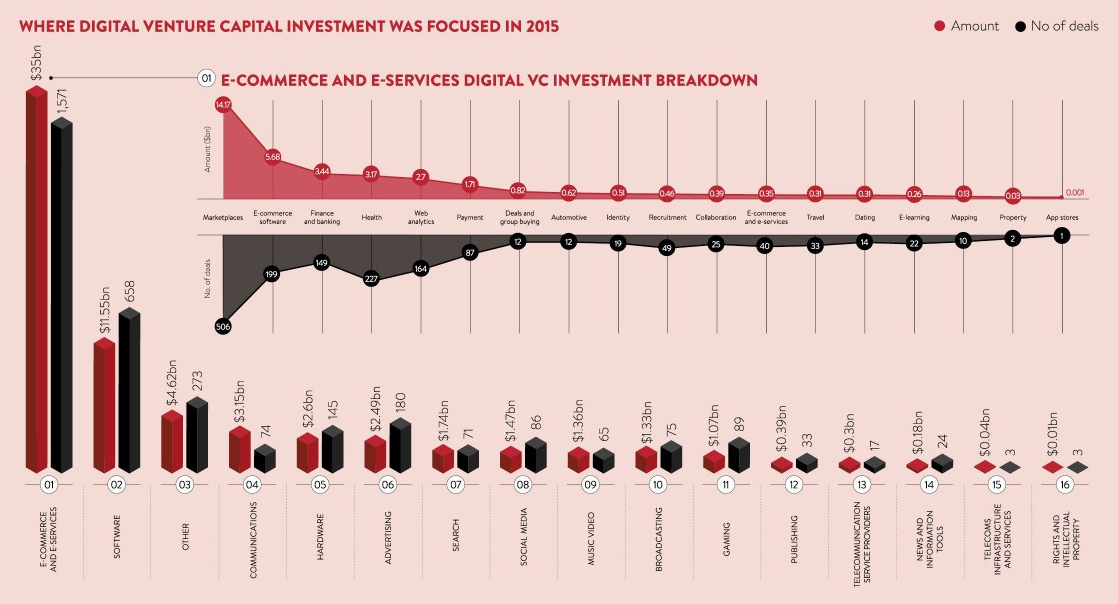

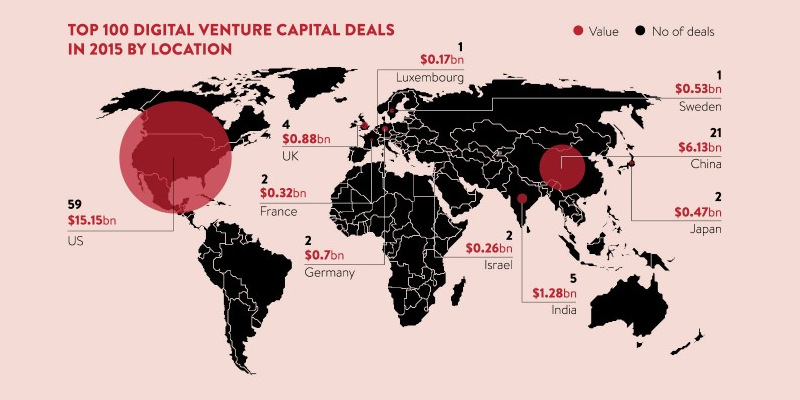

Here are some further charts from Raconteur that show the distribution behind the 100 biggest venture capital deals:

Top 100 Deals by Region

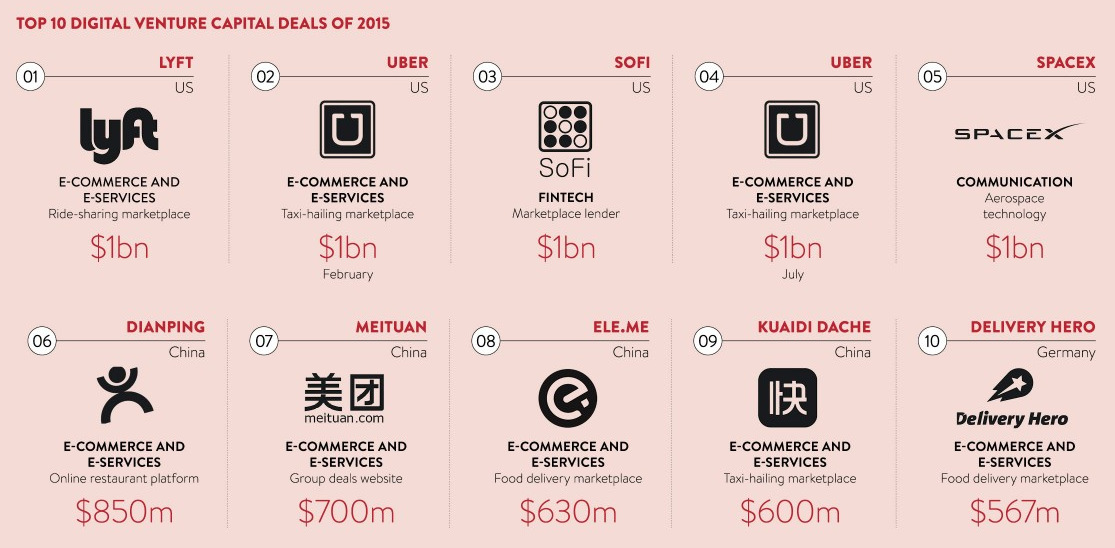

10 Largest Raises in Digital

Digital Deals by Sector

Click image to expand

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Energy1 week ago

Energy1 week agoThe World’s Biggest Nuclear Energy Producers

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024