Technology

The Rise of Regtech: How Software Can Help Cut Regulatory Risks

The Rise of Regtech

The volume of data produced by the financial industry today is massive. Leveraging this data to extract customer insights and prevent fraud requires analysis beyond the ability of any single team. Regulatory technology – or Regtech – is the branch of emerging technology rising to meet the challenge.

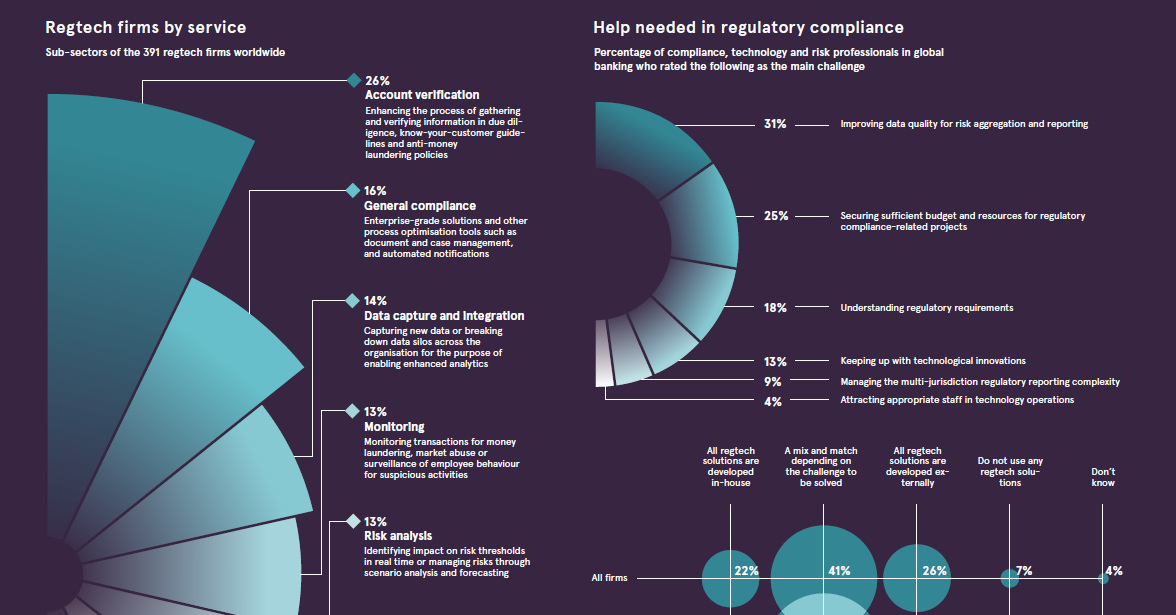

Today’s infographic from Raconteur offers a glimpse into the world of regtech, and how it can help financial services firms in finding efficient, cost-effective methods to comply with regulatory standards.

What is Regtech?

Following the financial crisis of 2008, the finance industry was hit with a number of new regulations designed to reduce risk and prevent fraud. Finance companies who fail to comply with these stringent regulations can face steep fines, but failing to find efficient ways to stay compliant can also impact the bottom line.

Regtech fills this gap with tech-driven solutions for financial companies to cut costs and streamline processes, while guarding against fraud and cybersecurity risks. They can remain compliant without sacrificing customer engagement, allowing them to continue to grow their businesses.

How does Regtech work?

Regtech solutions usually operate as cloud computing or software-as-a-service (SaaS) applications, offering companies a plug-and-play solution to their regulatory woes.

This process might look something like the following:

- A regtech tool monitors transactions taking place online in real-time

- This tool identifies issues or irregularities in the digital payment sphere

- Outliers are relayed immediately to a financial institution, so they can analyze the transaction and determine if it represents a fraudulent transaction

- This early-warning system allows institutions to identify potential threats at the outset, giving them valuable time to minimize risks associated with lost funds or data breaches

Emerging technologies like data analytics, artificial intelligence, and distributed ledgers fuel these regtech solutions, allowing them to collate relevant big data sets and analyze them using sophisticated algorithms.

How can Regtech work for me?

Not all regtech solutions are created equal – different software is coded to look for different things, so companies need to select the right suite of regtech solutions for their unique challenges.

Just a few of these options show the need for different applications:

- Account verification

These applications help companies gather information about customers to prevent fraudulent accounts. Examples include Trunomi, a company that manages consent for personal customer data; or PassFort, which automates the collection and storage of data for due diligence. - Monitoring

Companies like IdentityMind Global provide risk management for digital transactions. - Reporting

Companies like Suade help financial institutions to compile and submit required regulatory reports.

These examples are just the tip of the iceberg. As maintaining compliance grows in complexity, regulation technology will rise to meet the challenge, and so too the regtech budgets must grow to help companies keep up with demanding regulations.

The Costs of Regulation

Regtech funding has increased steadily over the past few years. 2017 saw more than $1 billion invested in the space – triple the investment from the preceding five years. However, 2018 promises to dwarf these figures, with more than half a billion dollars invested In the first quarter alone.

Perhaps the motivation for investors digging into regtech has something to do with the high costs of neglecting it. US Bancorp was forced to pay $613 million in penalties for their flawed anti-money-laundering scheme and violations of the Bank Secrecy Act, while Commonwealth Bank of Australia shelled out more than $500 million for similar penalties.

Financial regulations can make or break a finance firm – and given the rapidly increasing number of regtech providers entering the space, it seems there’s no shortage of solutions for forward-thinking firms.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Brands6 days ago

Brands6 days agoHow Tech Logos Have Evolved Over Time

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023

-

Green2 weeks ago

Green2 weeks agoRanking the Top 15 Countries by Carbon Tax Revenue