Technology

Patent Wars: Who is Winning the Battle for Tech Innovation Supremacy?

Patent Wars: The Battle for Tech Innovation

In the technology industry, the imperative to innovate is never-ending.

After all, the speed of technological change is exponential – and if a company like Microsoft or Google misses one important trend, it can drastically alter the direction of future prospects.

For the above reasons, both tech giants and unicorns are laser-focused on hiring the best engineering talent available, and deploying it to come up with the new innovations, business models, and game-changing products that they feel comfortable betting their futures on.

The Patent War Visualized

Today’s interactive visualization comes to us from The UK Domain, and it shows the amount of patents won by tech giants as well as unicorn startups.

Specifically, it pulls data from the U.S. Patent & Trademark Office, categorizing hundreds of thousands of patents by company, technology, and even CEO.

While the data is quite comprehensive, it’s also worth noting that recent years of data may be incomplete because there is up to an 18-month lag between patent registration and those patents becoming public.

Who’s Winning the Battle?

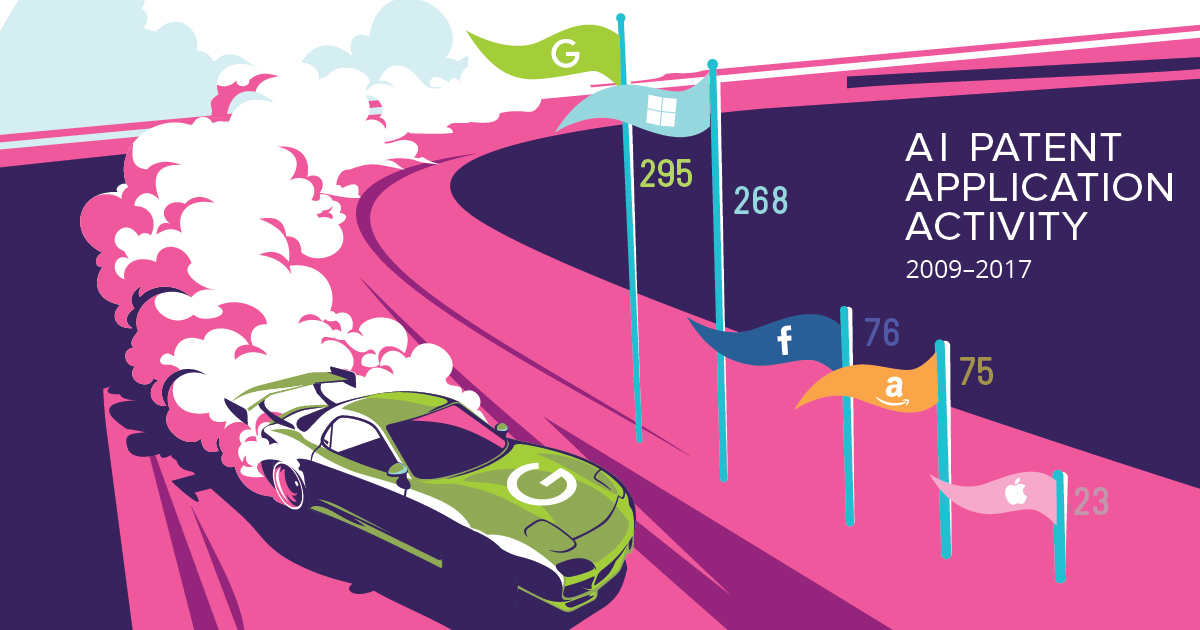

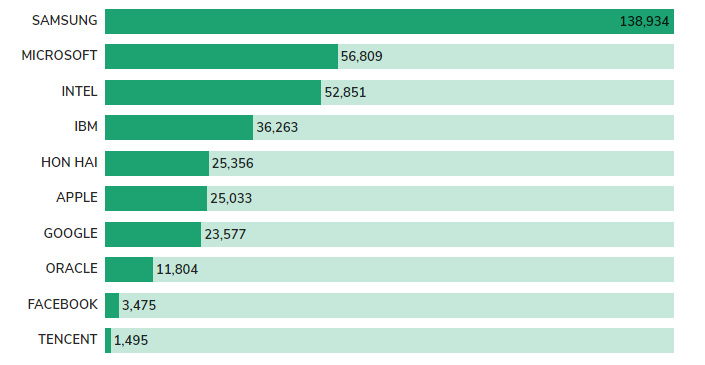

Here is a look solely at the quantity of patents awarded over recent years:

Interestingly, the list tends to skew towards companies with a hardware focus, even though many of their software counterparts are larger in terms of market capitalization.

For example, Samsung has 138,934 patents registered, which is more than Apple, Google, Facebook, Amazon, Uber, and Netflix combined.

Hon Hai Precision Industry Co. – better known as Foxconn – is also one of the highest-ranking companies on the list with 25,356 patents, about the same amount as its partner company Apple.

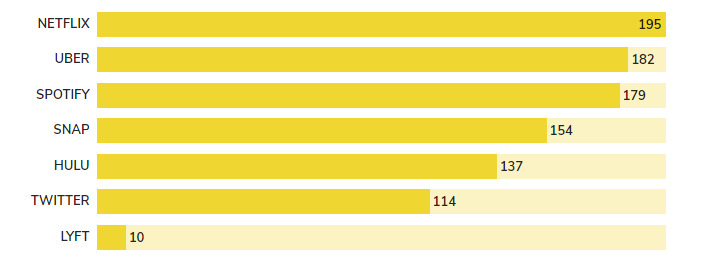

Unicorn Lightweights

Unicorns, which are startups valued at over $1 billion, also have a tough time competing with the tech giants on the patent front.

Note: it looks like the source has included both public and private companies on this “unicorn” list

Many unicorns are newer companies, which means that the 18-month lag in patents entering the public domain may have a considerable effect on totals.

Still, it’s amazing to see that companies like Uber and Lyft – two competitors that have confidentially filed to go public in 2019 – have fewer than 200 patents between them.

Even if you combine all patents by the companies on the above chart, it works out to roughly 1,000 registered patents. To put that in perspective, that’s not even equal to 1% of Samsung’s gigantic total.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Science1 week ago

Science1 week agoVisualizing the Average Lifespans of Mammals

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023

-

Green2 weeks ago

Green2 weeks agoRanking the Top 15 Countries by Carbon Tax Revenue