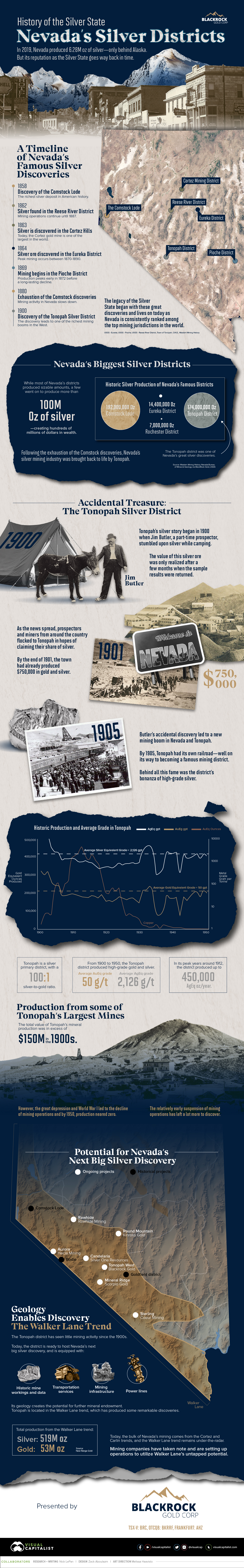

History of the Silver State: Nevada and its Silver Districts

The following content is sponsored by Blackrock Gold.

History of the Silver State: Nevada and its Silver Districts

Nevada and its silver districts built the western territory into a modern American state.

Today, the world best knows Nevada for its modern gold production—however, a new generation is rediscovering Nevada’s famous silver districts and their potential.

This infographic comes to us from Blackrock Gold and outlines the history of Nevada and its legendary silver districts.

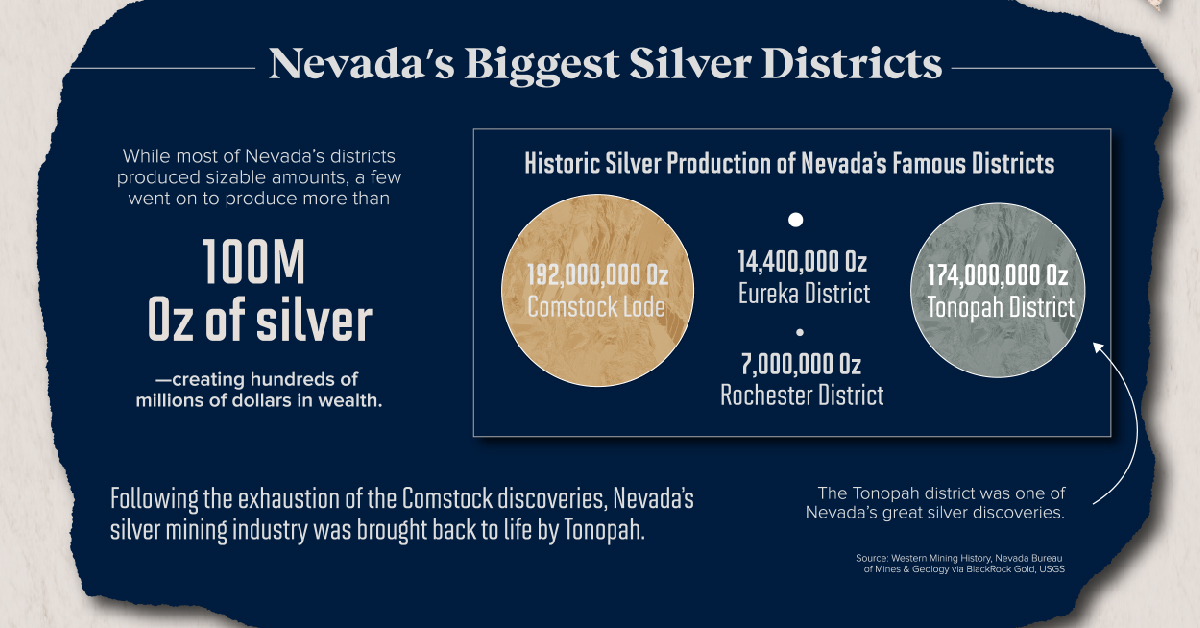

A Timeline of Nevada’s Famous Silver Districts

The Paiute, Shoshone, Quoeech, Washoe, and Walapai tribes populated the territory that is now the American state of Nevada before the Europeans arrived in the 18th century.

Nevada became part of the Spanish Empire as part of the greater province of New Spain, and then later Mexico after independence. As a result of the Mexican–American War and the Treaty of Guadalupe Hidalgo, Mexico permanently lost Alta California in 1848.

The United States continued to administer the area as a territory. As part of the Mexican Cession in 1848 and then the California Gold Rush, the state’s area was first part of the Utah Territory, then the Nevada Territory in 1861.

However, the great Comstock mining boom of 1859 in Virginia City consolidated the area as part of the United States. Silver discoveries and mining spurred development and statehood, all by uncovering the famous silver districts of Nevada.

An eccentric Canadian from Trenton, Ontario, Henry Comstock gave his last name to a discovery that launched mining in Nevada. In 1859, Comstock revealed his discovery and sparked a silver rush, sending thousands of prospectors into Nevada and becoming the genesis of Nevada’s mining industry.

Accidental Treasure: The Tonopah Silver District

Over time, miners exhausted the initial discoveries of silver until the Tonopah District in 1900 revived silver mining in the state.

As the legend goes, Jim Butler discovered the Tonopah district and its silver-rich ore. He went looking for a pack mule that wandered off in the night and sought shelter near a rock outcropping.

When Butler discovered the animal the next morning, he picked up a rock to throw at it in frustration and noticed the rock was heavy. He had stumbled upon the second-richest silver strike in all of Nevada’s history.

Silver production exploded in Tonopah and peaked at 450,000 ounces a year in 1915. However, between World War 1, the Great Depression, and World War 2, the country was exhausted of workers, and silver production tumbled by 1950.

The early suspension of mining in the region left it ripe for new exploration and discovery.

Unrealized Potential in Nevada for Silver Discovery

Today the bulk of the current mining in Nevada occurs along the Cortez and Carlin gold trends in the northeast. However the state’s earliest discoveries lie in what is known as the Walker Lane Trend that extends the entire western border of the state.

Several companies have taken note and are applying modern exploration to a neglected area for a new generation of silver discovery, and the Tonopah lies at the center of the Walker Lane Trend.

It is in the Tonopah Silver district where the past of Nevada lies—and the future will, too.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.