Stocks

The Most Shorted Stocks in the U.S. (Fall 2023)

The Most Shorted Stocks in the U.S. (Fall 2023)

Shorting a company involves borrowing its shares, selling them at current prices, and then buying them back in the future at a lower price. Essentially, short sellers are betting that the company will underperform in the future.

In this infographic, we list the 15 most shorted stocks in the U.S. during the fall of 2023, ranked by the value of their short interest, using data from FactSet.

Tesla: The Most Shorted Stock in 2023

This ranking is sorted by the dollar value of each firm’s short interest as of October 31, 2023.

Tesla holds the top position as the most shorted stock in 2023 so far. Of the 15 companies listed, seven rank among the top 50 largest companies in the world.

| Company | Short Interest Value (Oct. 2023) | Short Interest (% of float cap) |

|---|---|---|

| Tesla | $17B | 3% |

| RTX | $9B | 8% |

| Exxon Mobil | $8B | 2% |

| IBM | $4B | 3% |

| Charter Communications | $4B | 9% |

| Chevron | $4B | 1% |

| Airbnb | $3B | 7% |

| Blackstone | $3B | 5% |

| Applied Materials | $3B | 3% |

| Occidental Petroleum | $3B | 7% |

| Costco | $2B | 1% |

| Walmart | $2B | 1% |

| Lululemon Athletica | $2B | 5% |

| PepsiCo | $2B | 1% |

| Cisco Systems | $2B | 1% |

The EV maker’s shares are often volatile, which may explain the popularity of making short-term bets on the stock.

According to Cboe Global Markets, the biggest operator of options exchanges in the U.S., Tesla stock options are among the most heavily traded products on its platforms.

Another important factor to consider is the short interest’s percentage of the float cap. This percentage refers to the portion of the company’s publicly traded shares that have been shorted by investors, adding another layer of context to the ranking.

Charter Communications holds the highest percentage of float cap, with 9%. The mass media company, the second-largest cable operator in the U.S. by subscribers, recently agreed to pay $25 million to settle U.S. Securities and Exchange Commission charges related to stock buyback controls violations.

Markets

Visualizing the Biggest Companies on Major Stock Exchanges

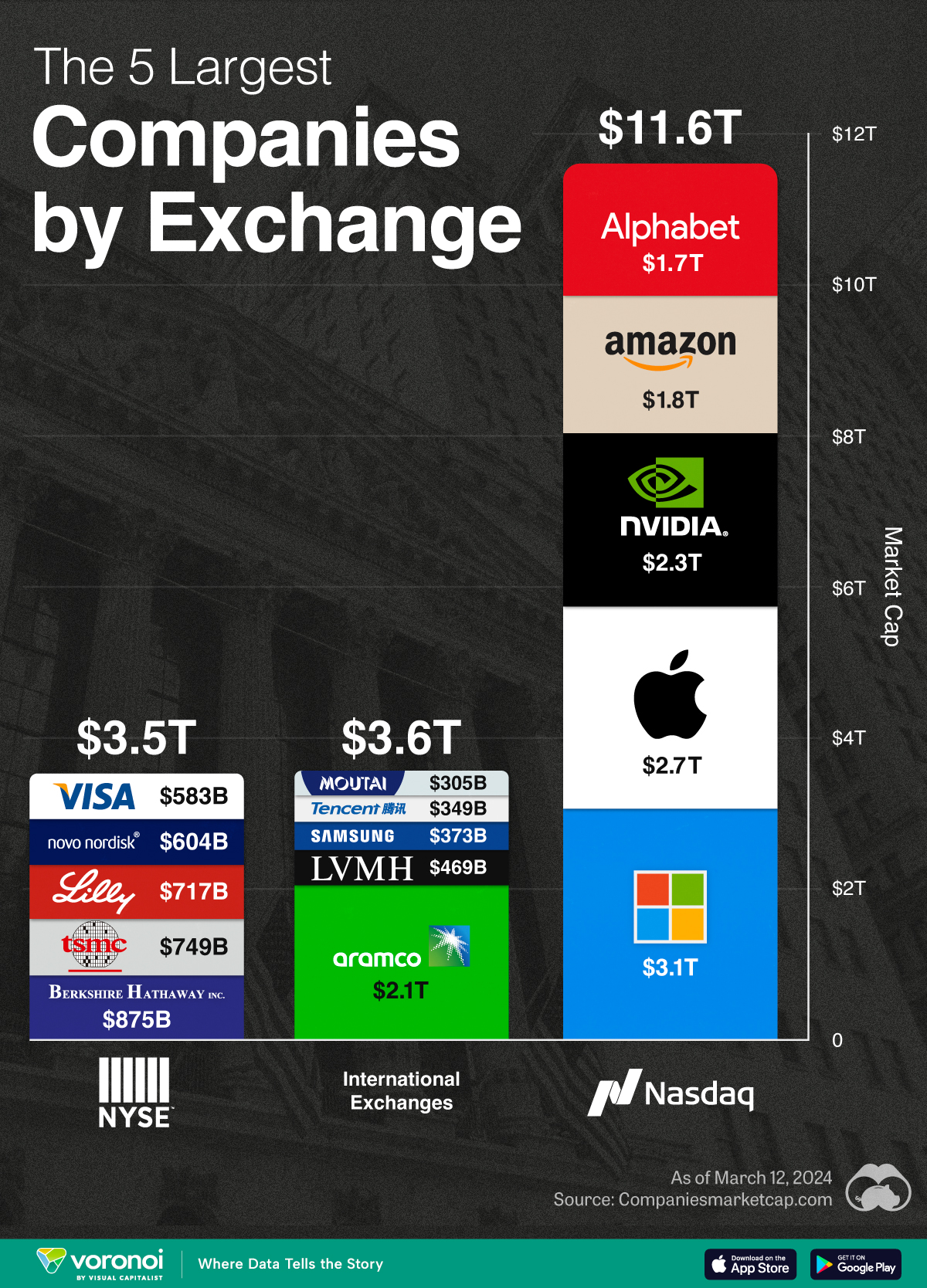

With trillion dollar valuations becoming more common, we’ve compared the five biggest companies by stock exchange.

Comparing the Top Five Companies on Major Stock Exchanges

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

With many companies nearing or surpassing the $1 trillion market capitalization milestone, we’ve put together a graphic that visualizes the five largest companies trading on the Nasdaq, New York Stock Exchange (NYSE), and international exchanges.

These figures come from Companiesmarketcap.com, and are as of March 12, 2024.

Biggest Companies on the Nasdaq

The Nasdaq is largely dominated by the tech industry, with all of its top five companies belonging to the Magnificent Seven group of U.S. tech stocks.

| Company | Market Cap (USD) |

|---|---|

| 🇺🇸 Microsoft | $3.1T |

| 🇺🇸 Apple | $2.7T |

| 🇺🇸 Nvidia | $2.3T |

| 🇺🇸 Amazon | $1.8T |

| $1.7T |

Altogether, these five companies have a combined market capitalization of nearly $12 trillion. To put this figure into context, the entire U.S. equity market is worth around $53 trillion.

Biggest Companies on the NYSE

The NYSE’s largest companies are more diversified, with a combination of tech, financial services, and healthcare names present. Among this list, Warren Buffett’s Berkshire Hathaway is the closest to becoming the next trillion dollar company.

| Company | Market Cap (USD) |

|---|---|

| 🇺🇸 Berkshire Hathaway | $875B |

| 🇹🇼 TSMC | $749B |

| 🇺🇸 Eli Lilly | $717B |

| 🇩🇰 Novo Nordisk | $604B |

| 🇺🇸 Visa | $583B |

Biggest Companies on International Exchanges

Saudi Aramco is the largest public company listed outside of the U.S., with a mammoth $2.1 trillion valuation.

| Company | Market Cap (USD) |

|---|---|

| 🇸🇦 Saudi Aramco | $2.1T |

| 🇫🇷 LVMH | $469B |

| 🇰🇷 Samsung | $373B |

| 🇨🇳 Tencent | $349B |

| 🇨🇳 Kweichow Moutai | $305B |

It should be noted, however, that the Saudi government directly owns 90% of the company, while another 8% is held by the country’s sovereign wealth fund.

This means that only 2% of shares are actually available to the public, prompting one Bloomberg columnist to call the firm’s valuation an “illusion”.

-

Science1 week ago

Science1 week agoVisualizing the Average Lifespans of Mammals

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023