Misc

This Fascinating City Within Hong Kong Was Lawless For Decades

View the full version of this graphic.

This Fascinating City Within Hong Kong was Lawless For Decades

There are very few places on Earth that remain ungoverned, and even the tiniest islands and city-states tend to have rules in place for things like taxation and citizenship.

Government control is an established reality for most of the world, but what would happen if a neighborhood in your city suddenly became a lawless free-for-all? What type of industries would emerge, and how would people cooperate within that environment to ensure basic services continued to operate?

One example from recent history sheds light on just how such a situation could work: Kowloon Walled City.

Kowloon Walled City

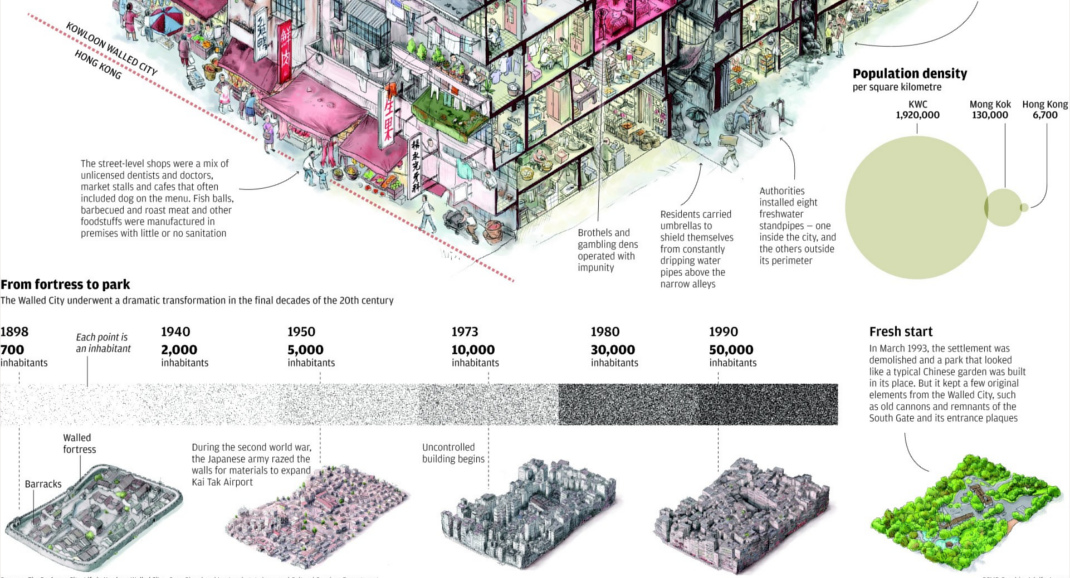

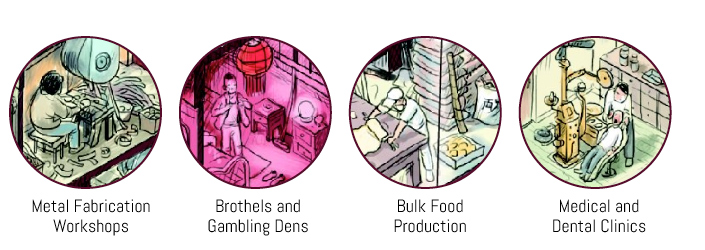

Today’s infographic is a fantastic editorial illustration from South China Morning Post from 2013 that takes a detailed look at the inner workings of Kowloon Walled City (KWC).

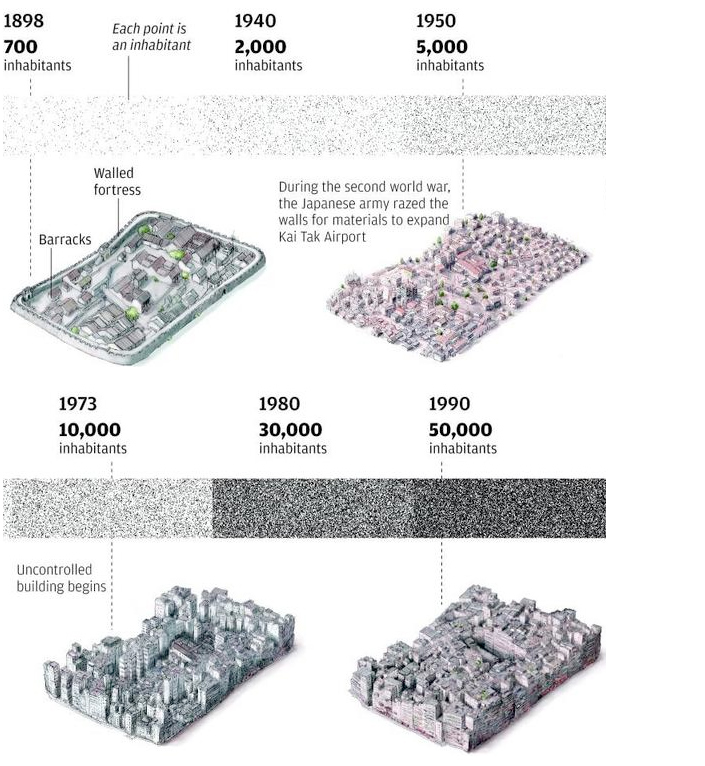

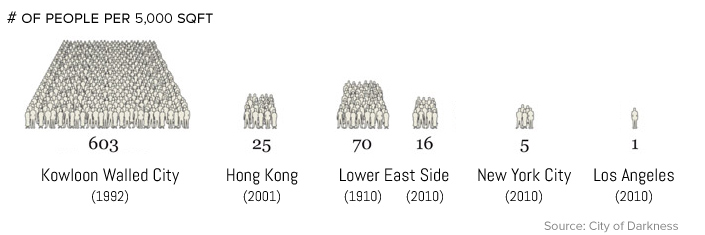

Often described as one of the most remarkable social anomalies in recent history, this bizarre enclave was more dense than any other urban area on the face of the planet.

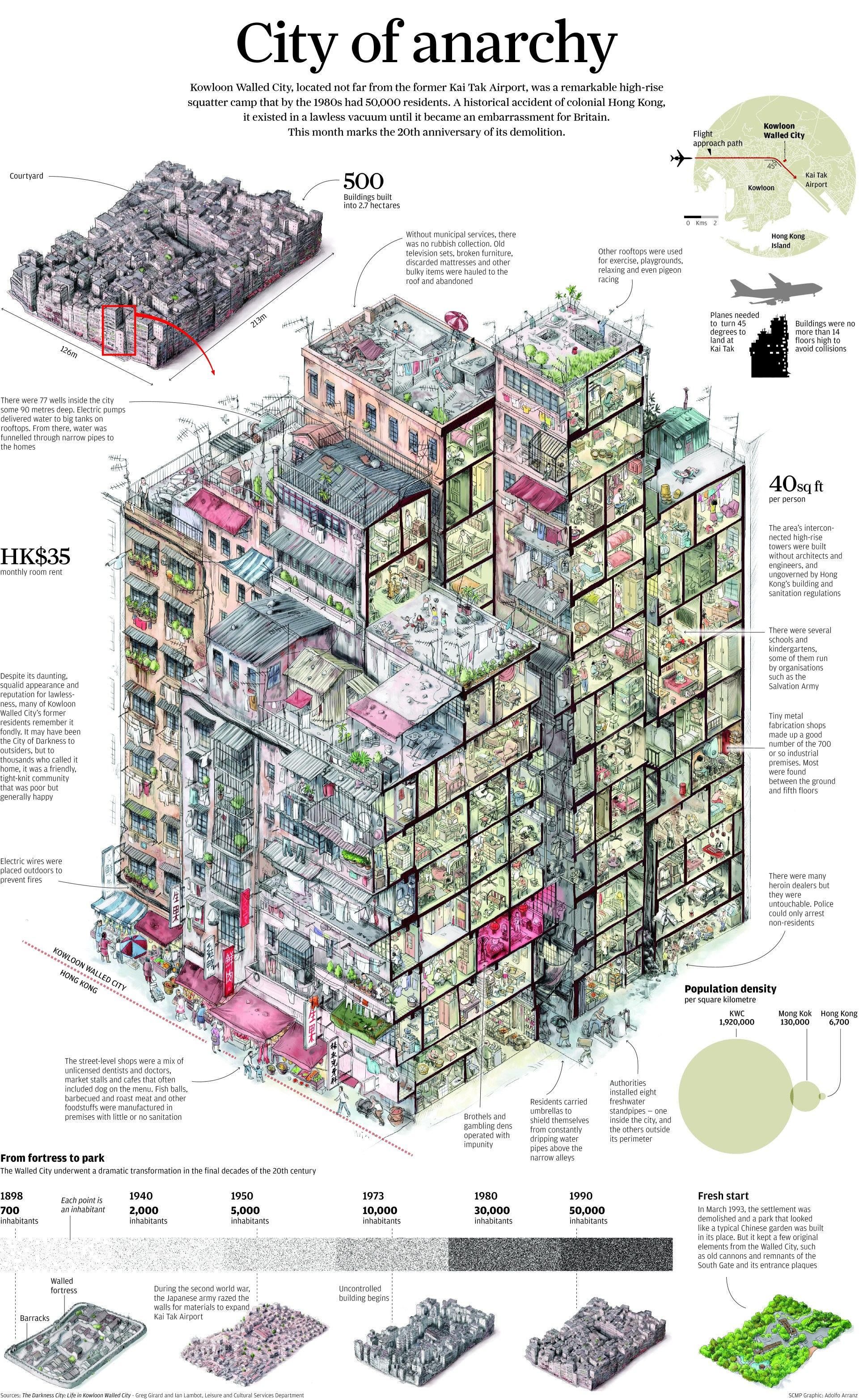

The story of the KWC site begins in the Song Dynasty (960-1297) when a small fort was constructed to house soldiers who helped safeguard the salt trade. In the latter half of the 19th century, the small fort was expanded into a full garrison town as the threat of a British invasion hung over China.

In 1898, the 99-year lease of Kowloon and the New Territories was established with one exception: the 2.7 hectare walled fortress. Because China never dropped its claim on the site and the British took a hands-off approach, the site became a sort of lawless enclave.

After WWII, squatters began to fill the site and more permanent structures followed. By 1950, the population had grown to 17,000, and by 1990 over 50,000 people lived within a property the size of two rugby fields.

From Squatter Camps to Functioning Neighborhood

There was a tendency to view KWC is an isolated bubble of vice within the city, but the sheer volume of business activity within the informal settlement shows that outside customers were more than happy to benefit from lower priced goods and services. This symbiosis has few parallels in modern history, and it makes KWC a fascinating situation to look back on.

KWC is best known as an enclave of criminal activity and illicit businesses such as brothels and gambling dens, but that only tells one side of the story. Despite the lack of space and formal links to utilities, the neighborhood was remarkably productive. In fact, KWC was often been described as Hong Kong’s shadow economy because the hundreds of tiny workshops and factories scattered throughout the site provided products for businesses across Hong Kong.

People moved to KWC for many reasons, including bankruptcy, poverty, or to avoid deportation. Others went there to take advantage of the lack of law enforcement and regulations.

One prominent example of skirting regulation was the high concentration of dental and medical practitioners operating within KWC. In addition to lower rents, doctors who immigrated to Hong Kong from China could avoid expensive licensing and retraining required by the colonial government. Industrial businesses were free to ignore fire, labor, and safety codes to produce goods at a lower cost, or to sell items that were considered taboo in the formal economy (e.g. restaurants serving dog meat).

Law and Order

Triads acted as a de facto city council by resolving civil conflicts, creating a volunteer fire brigade, and organizing garbage disposal. The tight-knit community within the settlement would also coordinate among themselves to conserve electricity and make repairs to shared infrastructure.

Despite the lack of formally recognized land ownership, people still bought and sold property within KWC. In one example, a construction company struck an exchange deal with the owner of a four-story building. The owner would retain a ground floor flat in a newly constructed thirteen-story building on the site.

The Bitter End

In 1993, after intense rounds of buy-out offers and forced relocations, Kowloon Walled City was demolished and converted into a park. Many of the businesses were forced to close forever as rents in the rest of Hong Kong were not affordable for most of the owners.

All this intensity of random human effort and activity, vice and sloth and industry, exempted from all the controls we take for granted, resulted in an environment as richly varied and as sensual as anything in the heart of the tropical rainforest. The only drawback is that it was obviously toxic.

– Greg Girard, author of City of Darkness

VC+

VC+: Get Our Key Takeaways From the IMF’s World Economic Outlook

A sneak preview of the exclusive VC+ Special Dispatch—your shortcut to understanding IMF’s World Economic Outlook report.

Have you read IMF’s latest World Economic Outlook yet? At a daunting 202 pages, we don’t blame you if it’s still on your to-do list.

But don’t worry, you don’t need to read the whole April release, because we’ve already done the hard work for you.

To save you time and effort, the Visual Capitalist team has compiled a visual analysis of everything you need to know from the report—and our VC+ Special Dispatch is available exclusively to VC+ members. All you need to do is log into the VC+ Archive.

If you’re not already subscribed to VC+, make sure you sign up now to access the full analysis of the IMF report, and more (we release similar deep dives every week).

For now, here’s what VC+ members get to see.

Your Shortcut to Understanding IMF’s World Economic Outlook

With long and short-term growth prospects declining for many countries around the world, this Special Dispatch offers a visual analysis of the key figures and takeaways from the IMF’s report including:

- The global decline in economic growth forecasts

- Real GDP growth and inflation forecasts for major nations in 2024

- When interest rate cuts will happen and interest rate forecasts

- How debt-to-GDP ratios have changed since 2000

- And much more!

Get the Full Breakdown in the Next VC+ Special Dispatch

VC+ members can access the full Special Dispatch by logging into the VC+ Archive, where you can also check out previous releases.

Make sure you join VC+ now to see exclusive charts and the full analysis of key takeaways from IMF’s World Economic Outlook.

Don’t miss out. Become a VC+ member today.

What You Get When You Become a VC+ Member

VC+ is Visual Capitalist’s premium subscription. As a member, you’ll get the following:

- Special Dispatches: Deep dive visual briefings on crucial reports and global trends

- Markets This Month: A snappy summary of the state of the markets and what to look out for

- The Trendline: Weekly curation of the best visualizations from across the globe

- Global Forecast Series: Our flagship annual report that covers everything you need to know related to the economy, markets, geopolitics, and the latest tech trends

- VC+ Archive: Hundreds of previously released VC+ briefings and reports that you’ve been missing out on, all in one dedicated hub

You can get all of the above, and more, by joining VC+ today.

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001