Everything You Need to Know on Carlin-Type Gold Deposits

The following content is sponsored by Nevada Exploration

Carlin-Type Gold Deposits: Everything You Need to Know

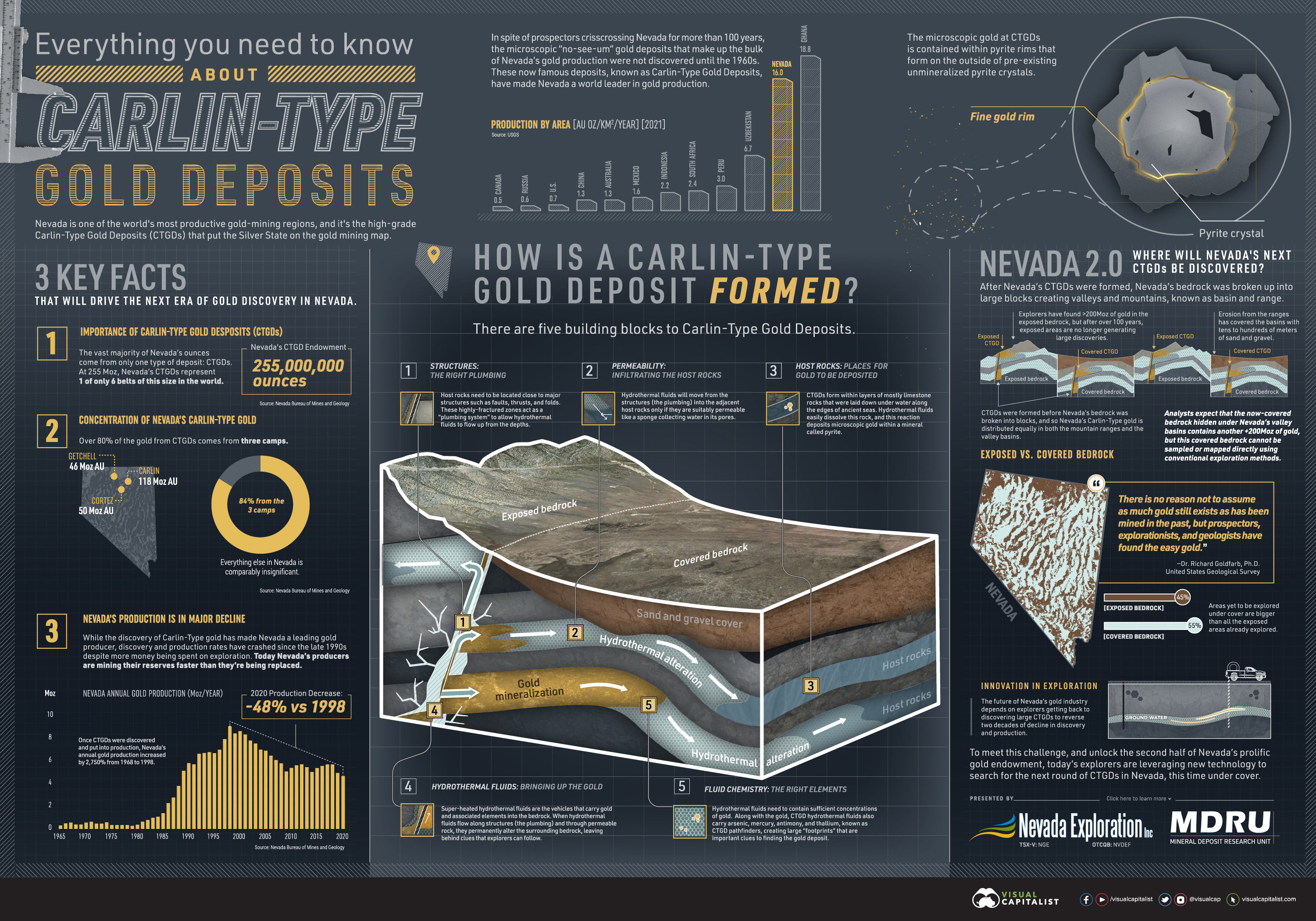

Nevada is one of the world’s most productive gold-mining regions, and it’s the high-grade Carlin-type gold deposits (CTGDs) that put the Silver State on the gold mining map.

Carlin-type gold deposits contain “invisible” or microscopic particles of gold that are deposited within a mineral called pyrite in sedimentary rocks. Needless to say, these deposits are named after the discovery of the Carlin Gold Deposit in 1961, which was the first of its kind.

Today, Carlin-type deposits make up the bulk of Nevada’s gold production. This infographic from our sponsor Nevada Exploration details everything you need to know about CTGDs.

The Building Blocks of Carlin-Type Gold Deposits

Nevada’s CTGDs contain 255 million ounces of gold, representing one of only six gold belts of this size in the world. Furthermore, 84% or 214 million ounces of Nevada’s CTGD gold is concentrated in just three camps:

- Carlin camp: 118 million ounces

- Cortez camp: 50 million ounces

- Getchell camp: 46 million ounces

So, just how are these massive deposits of invisible gold formed?

Building Block #1:

Structures

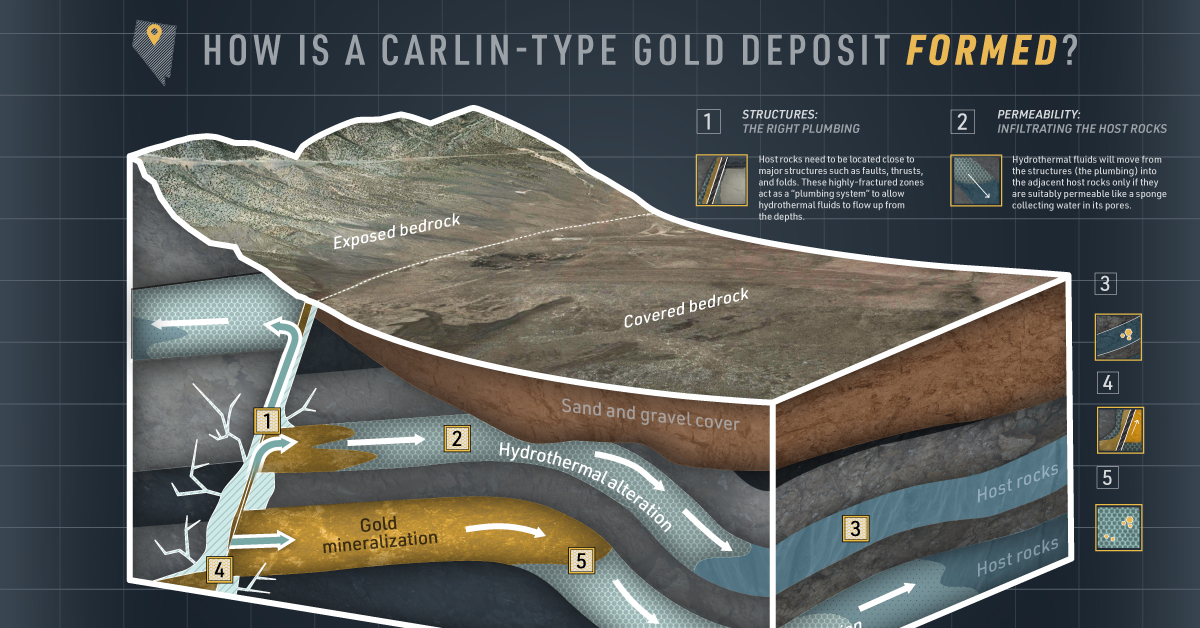

The rocks that host CTGDs are typically found close to major geological structures in the Earth’s crust. These structures include:

- Faults: A fracture or a zone of fracture between two rocks.

- Thrust faults: A fault across which older rocks are pushed above younger rocks.

- Folds: A wave-like structure that forms when rocks deform by bending.

These fractured zones act as a ‘plumbing system’ to allow mineral-rich hydrothermal fluids to flow up from the depths of the Earth’s crust.

Building Block #2:

Permeability

The host rocks of CTGDs need to be permeable enough for hydrothermal fluids to flow from the fractured structures (the plumbing) into the host rocks, where minerals will be eventually deposited.

Building Block #3:

Host Rocks

Host rocks are places for the gold to be deposited. CTGDs typically form within layers of limestone rocks that were laid down millions of years ago. When hot hydrothermal fluids hit these rocks, they dissolve easily, and this reaction deposits microscopic gold within the mineral called pyrite we mentioned earlier.

Building Block #4:

Hydrothermal Fluids

Hydrothermal fluids are super-heated water solutions that flow up from deep within the Earth’s crust. These are the vehicles that carry gold and other elements into the host rock, often leaving geological clues behind for explorers to follow.

Building Block #5:

Fluid Chemistry

Along with gold, CTGD hydrothermal fluids carry arsenic, mercury, antimony, and thallium, known as ‘CTGD pathfinders’. These create ‘footprints’ that are important clues to finding the gold. Additionally, hydrothermal fluids need to contain sufficient concentrations of gold for the deposit to be economically viable.

The discovery of CTGDs has made Nevada a leading gold producer globally. However, discovery and production rates have crashed since the late 1990s, despite more money being spent on exploration.

But if explorers look in the right places, there could be plenty of Carlin-type gold left to find.

Seeing Through the Cover: Nevada’s Next CTGDs

After the formation of CTGDs millions of years ago, Nevada’s bedrock was broken up into large blocks creating valleys and mountains, known as basin and range respectively.

Therefore, Nevada’s Carlin-type gold was distributed equally in both the mountain ranges and the valley basins. The deposits in the mountain ranges lay in exposed bedrock, making them easier to find. However, erosion from the ranges covered the valley basins with tens to hundreds of meters of sand and gravel.

The unexplored under cover bedrock area is bigger than the exposed areas already explored, and analysts expect that it contains over 200 million ounces of gold. But finding under cover gold will not be easy using conventional exploration methods. To meet this challenge and unlock the second half of Nevada’s gold endowment, explorers are leveraging new technology to search for hidden CTGDs.

Nevada Exploration is an early leader in applying new technology to uncover the second half of Carlin-type gold in Nevada.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.