Technology

The Dark Side of the Internet

The term Dark Web is evocative. It conjures up images of hitmen, illegal drugs, and pedophilia. One imagines a place where the dark side of human nature flourishes away from the eyes – and laws – of society at large.

Today’s infographic, from Cartwright King Solicitors, cuts through the mystique and provides an entertaining and practical overview of the Deep Web and the Dark Web.

Layers (Part 1)

Much like the ocean, the internet is divided into defined layers.

The internet most people are familiar with is called the Surface Web. Websites in this layer tend to be indexed by search engines and can be easily accessed using standard browsers. Believe it or not, this familiar part of the web only comprises less than 10% of the total data on the internet.

The next layer down, we encounter the largest portion on the internet – the Deep Web. Basically, this is the layer of the internet that is quasi-accessible and not indexed by search engines. It contains medical records, government documents, and other, mostly innocuous information that is password protected, encrypted, or simply not hyperlinked. To reach beyond this layer of the internet, users need to use Tor or a similar technology.

Layers (Part 2)

Tor, which stands for “The Onion Router”, is how the majority of people anonymously access the Dark Web. Tor directs internet traffic through complex layers of relays to conceal a user’s location and identity (hence the onion analogy).

In 2004, Tor was released as an open source software. This allowed the Dark Web to grow as people could anonymously access websites.

Since anonymity is sacrosanct in the deep reaches of the Internet, transactions are typically conducted using cryptocurrencies like Bitcoin or Ethereum. People making purchases in Dark Web markets are (understandably) concerned with privacy, so they often use a series of methods to transfer funds. Below is a common transaction flow on the Dark Web.

Tumblers are used as an extra step to ensure privacy. A conventional equivalent would be moving funds through banks located in countries with strict bank-secrecy laws (e.g. Cayman Islands, Panama).

What’s Going on Down There?

The concept of the Dark Web isn’t vastly different from the Surface Web. There are message boards (e.g. 8chan, nntpchan), places you can buy things (e.g. Alphabay, Hansa), and blogs (e.g. OnionNews, Deep Web Radio). The rules, or rather a lack thereof, is what makes the Dark Web unique.

Anything that is illegal to sell (or discuss) on the Surface Web is available in the Dark Web. Personal information, drugs, weapons, malware, DDoS attacks, hacking services, fake accounts for social media, and contract killing services are all available for sale.

The Dark Web is full of criminal activity, but it’s also place where dissidents and whistle-blowers can anonymously share information. In countries with restrictive internet surveillance, the Dark Web may be the only place to safely voice criticisms against government and other powerful entities.

Measuring in the Dark

Many .onion sites are only up temporarily, so determining the true size of the Dark Web is nearly impossible. That said, Intelliagg and Darksum recently attempted to map out the Tor-based Dark Web by using a script to crawl reachable sites. They found 29,532 websites; however, 54% of them disappeared during the course of their research. Another recent study found that 87% of Dark Web sites don’t link to any other sites.

It is more accurate to view the darkweb as a set of largely isolated dark silos.

– Graph Theoretic Properties of the Dark-web

Recent changes to Tor, such as 50-character hidden service URLs, have made the Dark Web an even more untraceable place, so we may never fully know what lies beneath the surface of the internet. Based on the parts we have seen, perhaps that’s for the best.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

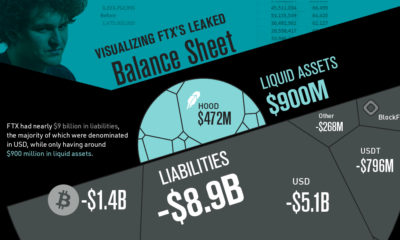

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees