Technology

Tracking Hacking: The World’s Biggest Data Breaches

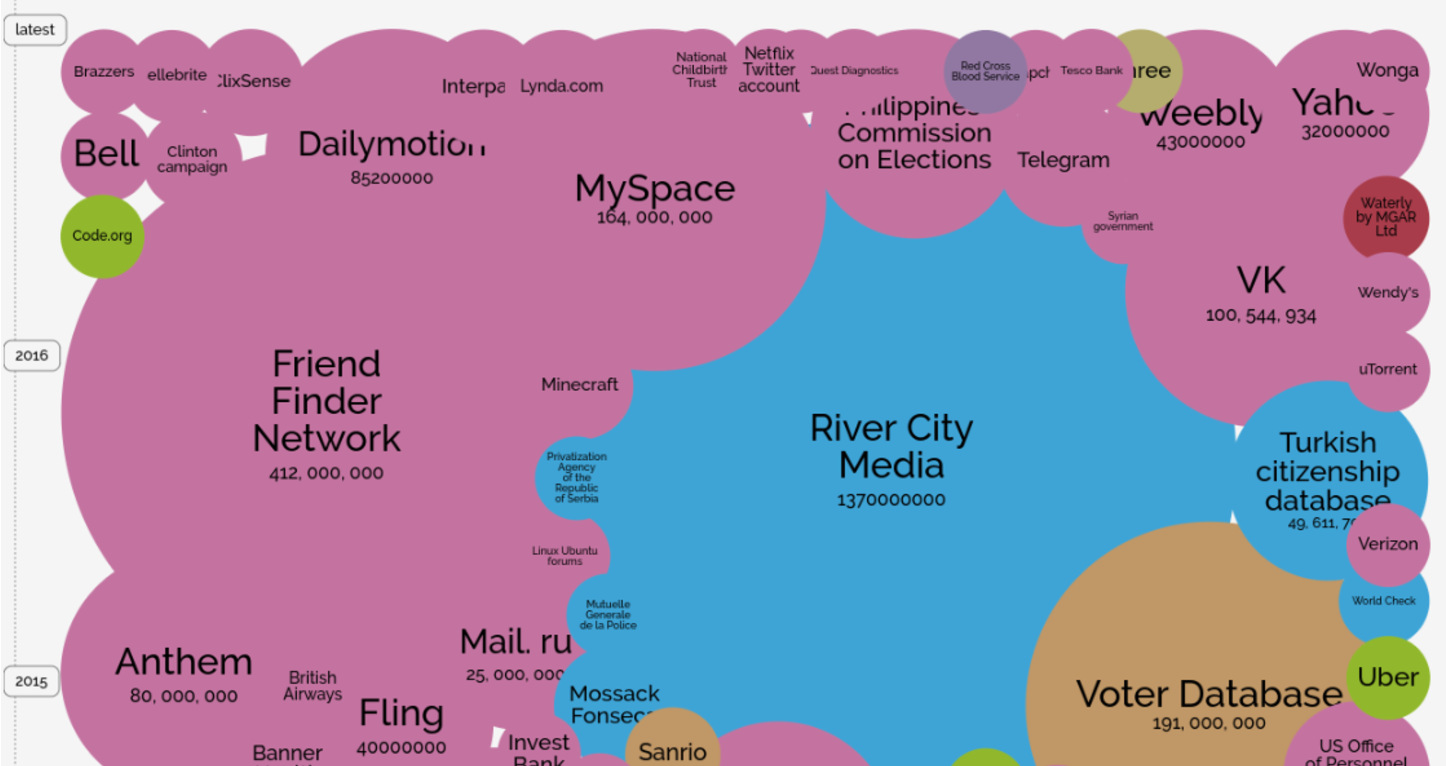

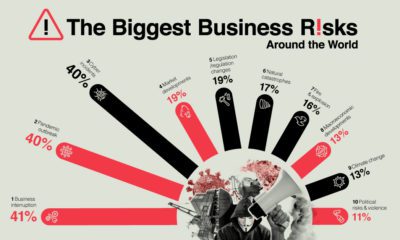

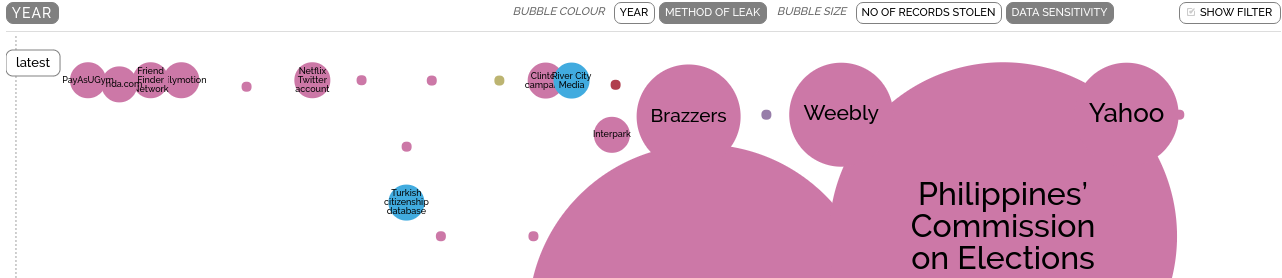

Each circle corresponds to the number of records lost per data breach. (Also: interactive version here)

<img src="https://www.visualcapitalist.com/wp-content/uploads/2017/05/bighackscrop.png" alt="History of Data Breaches"

Tracking Hacking: The World’s Biggest Data Breaches

This data visualization comes to us from Information is Beautiful. Go to their site to see the highly-recommended interactive format that visualizes the same data, while providing additional details on each specific hack.

The graphic above shows a timeline of some of the biggest data breaches on record. Each bubble represents the number of records lost in any given breach, with the most sensitive data clustered toward the right side.

Before 2009, the majority of data breaches were the fault of human errors like misplaced hard drives and stolen laptops, or the efforts of “inside men” looking to make a profit by selling data to the highest bidder. Since then, the volume of malicious hacking (shown in purple) has exploded relative to other forms of data loss.

From Millions to Billions

Increasingly sophisticated hacking has altered the scale of data loss by orders of magnitude. For example, an “inside job” breach at data broker Court Ventures was once one of the world’s largest single losses of records at 200 million.

However, it was eclipsed in size shortly thereafter by malicious hacks at Yahoo in 2013 and 2014 that compromised over 1.5 billion records, and now larger hacks are increasingly becoming the norm.

Small But Powerful

The problems caused by hacks, leaks and other data breaches are not just ones of scale. For example, the accidental 2016 leak of information from spam/email marketing service River City Media stands out at an alarming 1.37 billion records lost. However, sorting by data sensitivity paints a different picture. The River City leak – represented by the larger blue dot below – is surpassed in severity by hacks at Yahoo, at web design platform Weebly, and even at adult video provider Brazzers.

Much of the data lost in the River City hack was made up of long lists of consumer email addresses to be used for spam email distribution, while the other hacks listed compromised items like account passwords, banking information, addresses, phone numbers, or health records. While having your email address become the target for spam exploitation is a serious annoyance, the hacking of much more sensitive personal data has quickly become the norm.

The fact that more and more of our data is being stored “in the cloud” and among devices on the Internet of Things means that increasingly sensitive types of data are now more vulnerable than ever to being hacked. This looks to be even more cause for concern than the rapidly rising volume of records that have been exposed, whether intentionally or by accident.

Brands

How Tech Logos Have Evolved Over Time

From complete overhauls to more subtle tweaks, these tech logos have had quite a journey. Featuring: Google, Apple, and more.

How Tech Logos Have Evolved Over Time

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

One would be hard-pressed to find a company that has never changed its logo. Granted, some brands—like Rolex, IBM, and Coca-Cola—tend to just have more minimalistic updates. But other companies undergo an entire identity change, thus necessitating a full overhaul.

In this graphic, we visualized the evolution of prominent tech companies’ logos over time. All of these brands ranked highly in a Q1 2024 YouGov study of America’s most famous tech brands. The logo changes are sourced from 1000logos.net.

How Many Times Has Google Changed Its Logo?

Google and Facebook share a 98% fame rating according to YouGov. But while Facebook’s rise was captured in The Social Network (2010), Google’s history tends to be a little less lionized in popular culture.

For example, Google was initially called “Backrub” because it analyzed “back links” to understand how important a website was. Since its founding, Google has undergone eight logo changes, finally settling on its current one in 2015.

| Company | Number of Logo Changes |

|---|---|

| 8 | |

| HP | 8 |

| Amazon | 6 |

| Microsoft | 6 |

| Samsung | 6 |

| Apple | 5* |

Note: *Includes color changes. Source: 1000Logos.net

Another fun origin story is Microsoft, which started off as Traf-O-Data, a traffic counter reading company that generated reports for traffic engineers. By 1975, the company was renamed. But it wasn’t until 2012 that Microsoft put the iconic Windows logo—still the most popular desktop operating system—alongside its name.

And then there’s Samsung, which started as a grocery trading store in 1938. Its pivot to electronics started in the 1970s with black and white television sets. For 55 years, the company kept some form of stars from its first logo, until 1993, when the iconic encircled blue Samsung logo debuted.

Finally, Apple’s first logo in 1976 featured Isaac Newton reading under a tree—moments before an apple fell on his head. Two years later, the iconic bitten apple logo would be designed at Steve Jobs’ behest, and it would take another two decades for it to go monochrome.

-

Maps1 week ago

Maps1 week agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share